State of Stablecoins: Sector Expansion & A Changing Interest-Rate Environment

Stablecoin growth, diversity in collateralization & implications of a changing interest-rate environment

Get the best data-driven crypto insights and analysis every week:

State of Stablecoins: Sector Expansion & A Changing Interest-Rate Environment

By: Tanay Ved

Key Takeaways:

Stablecoin flows have turned positive, pushing total supply above 160B towards record-highs. This suggests improving market liquidity and increased capital available for deployment in the crypto ecosystem.

The stablecoin landscape continues to expand in diversity, use cases, and risk profiles, from fiat-collateralized and crypto-backed to interest-bearing and protocol-native stablecoins.

With stablecoin collateral increasingly composed of U.S dollar equivalents and real-world assets (RWAs), changes in the interest rate environment could impact profitability and attractiveness of various stablecoins.

Introduction

In this issue of Coin Metrics’ State of the Network, we explore the diverse stablecoin landscape, focusing on peg mechanisms, approaches to collateral composition, and sources of yield amid a changing interest-rate environment.

Stablecoin Supply Pushes Towards New Highs

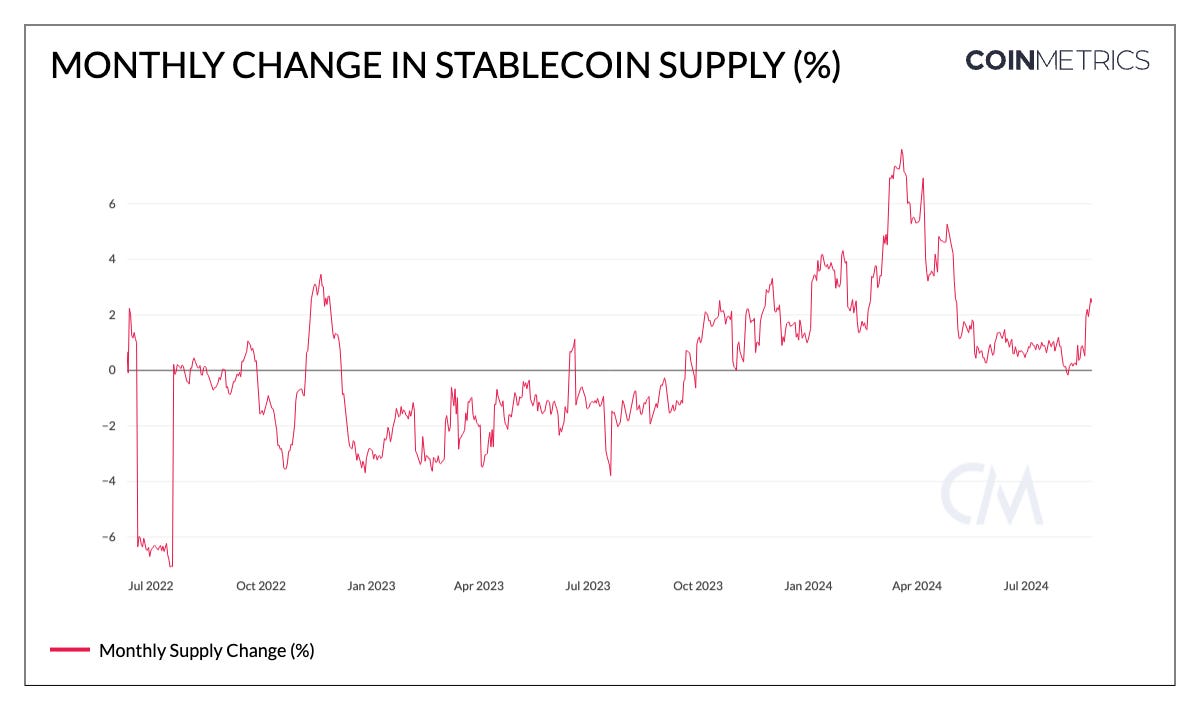

After a period of consolidation in Q2, aggregate stablecoin supply has trended positive in August—suggesting an environment with increased liquidity and potential for capital flows into the ecosystem. This is reflected in the chart below, illustrating the monthly change in stablecoin supply.

Source: Coin Metrics Network Data Pro

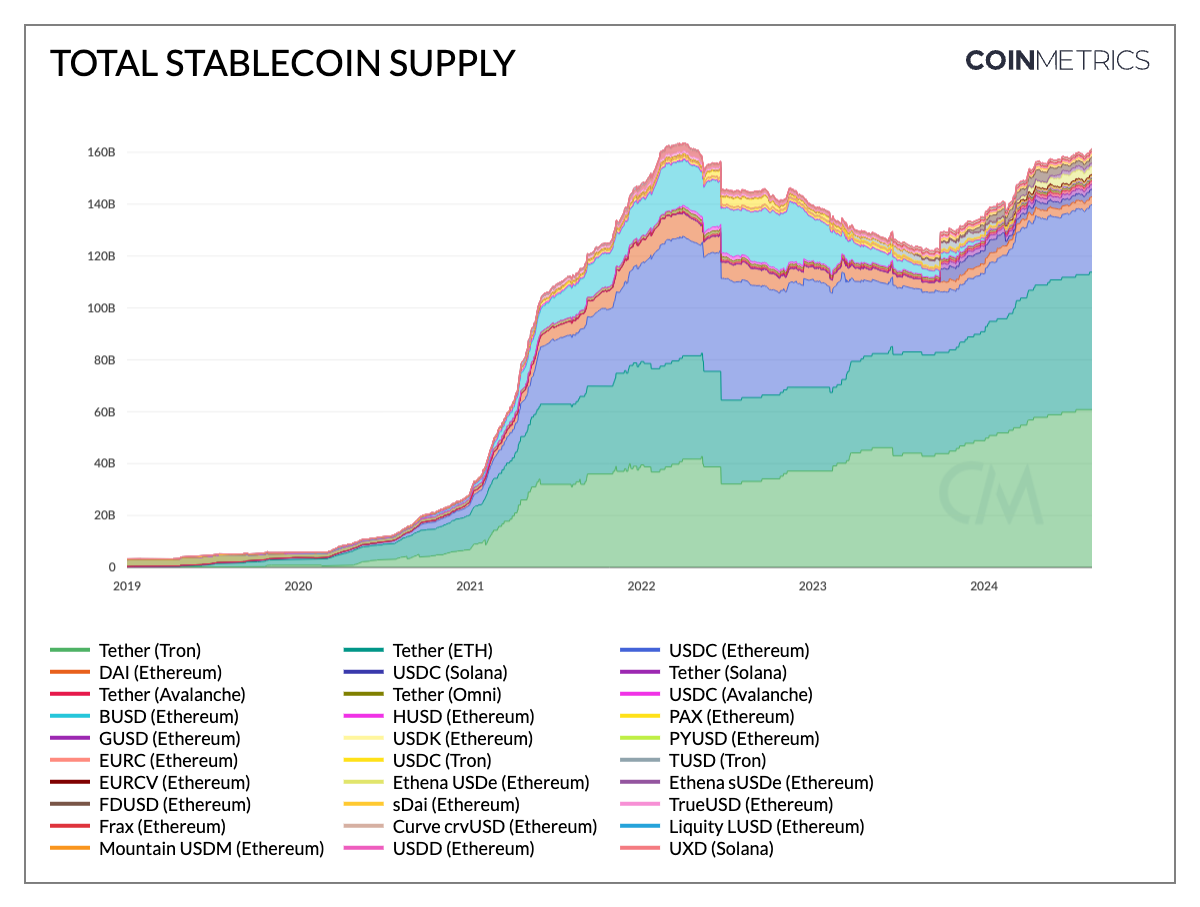

As a result, near 161B, the aggregate supply of stablecoins is once again approaching record-highs. Tether mantains a market share greater than 70%, with USDT on Ethereum (+28%) and Tron (+26%) growing over the year to a total supply of $119B across networks including Solana and Avalanche. Meanwhile, Circle’s USDC supply has grown to ~$34B as it proliferates across Solana and Ethereum layer-2’s like Base. While DAI has trended lower towards $3.1B, the tokenized version of DAI deposited into Maker’s Dai Savings Rate, sDAI (savings DAI), has grown to $1.34B.

Newer stablecoin entrants have also gained traction: First Digital USD (FDUSD) on Ethereum grew by 56% in August to reach $3.07B, while Ethena’s USDe ($2.96B) and sUSDe ($1.16B) hit a combined total of $4.12B. Notably, PayPal’s PYUSD has seen rapid growth on Solana, surpassing its Ethereum supply of $364M to reach a $1B total.

Source: Coin Metrics Network Data Pro

Competing For Adoption

Diversity in Collateralization

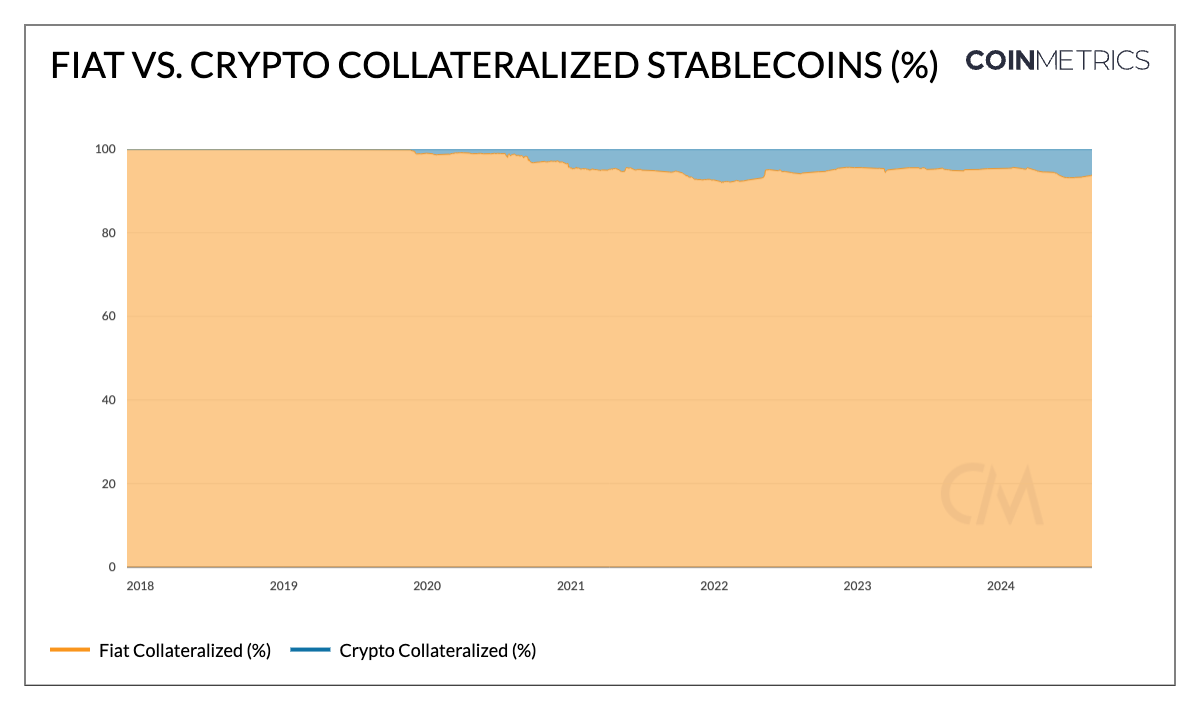

To improve utility as a store of value, a variety of asset composition or collateralization approaches have arisen in the stablecoin ecosystem, influencing the risk profile, operational characteristics and regulatory outlook of these products. More than 90% of outstanding stablecoin supply consists of those collateralized by fiat currencies, such as Circle’s USDC, Tether’s USDT and PayPal’s PYUSD, backed by the US Dollar and cash-equivalents assets, tying their stability to the traditional financial system.

Others, like MakerDAO’s DAI and sDAI, provide an alternative to traditional units of account, backed by a portfolio of crypto-assets and real-world assets (RWAs) like private credit loans or treasuries. 45% of Dai is backed by crypto-assets, while 40% is collateralized by RWAs.

Source: Coin Metrics Network Data Pro

Alternative Units of Account

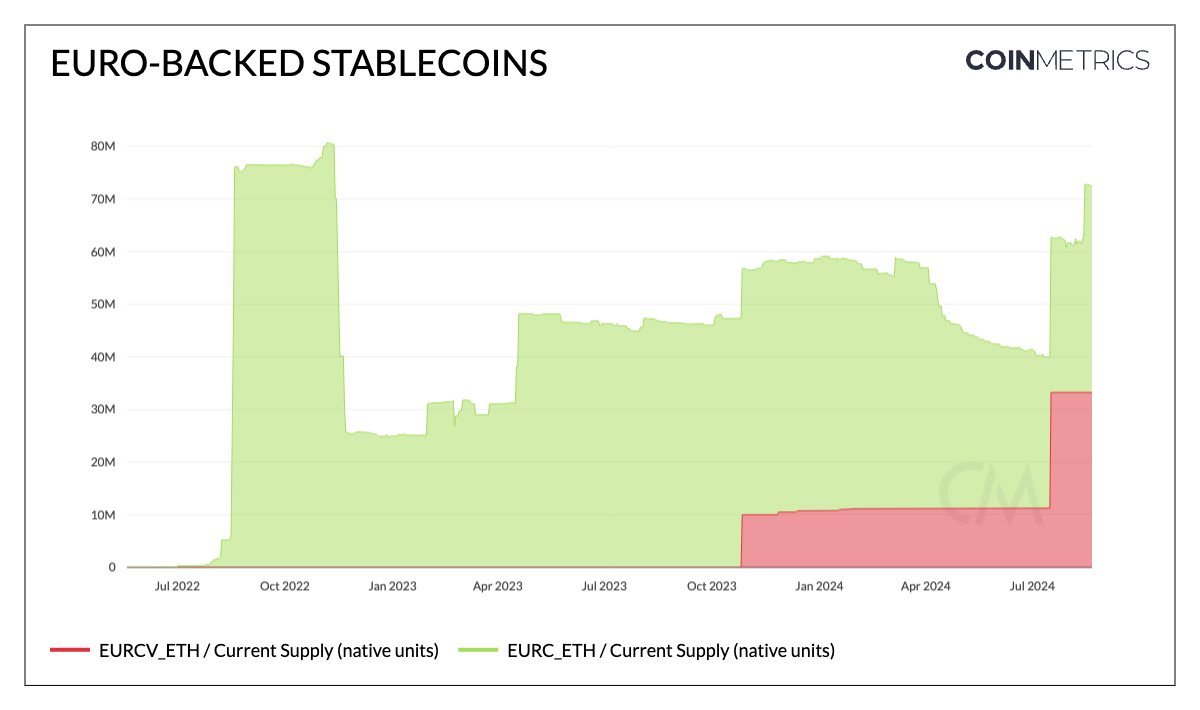

As a result of the US Dollar’s status as the global reserve currency and ubiquitous demand in emerging markets, the supply of USD-pegged stablecoins far exceeds alternative units of account. However, not all stablecoins are pegged to the U.S. dollar. With the European Union’s progress on regulating digital assets through Markets in Cryptoassets (MiCA) Regulations, Euro-backed stablecoins have seen a boost in adoption. With a current supply of ~40M, Circle’s EURC is the only Euro-pegged stablecoin compliant to MiCA regulations. As more institutions deploy alternative pegged assets such as Société Générale’s EURCV wholesale stablecoin, alternative pegs may enable forex markets to expand leveraging on-chain infrastructure.

As different jurisdictions develop their regulatory frameworks for digital assets, stablecoins pegged to local currencies can facilitate transactions for individuals and businesses within and across regional economies, while complying with regulatory requirements.

Source: Coin Metrics Network Data Pro

Decentralized Finance (DeFi) Utility & Expansion

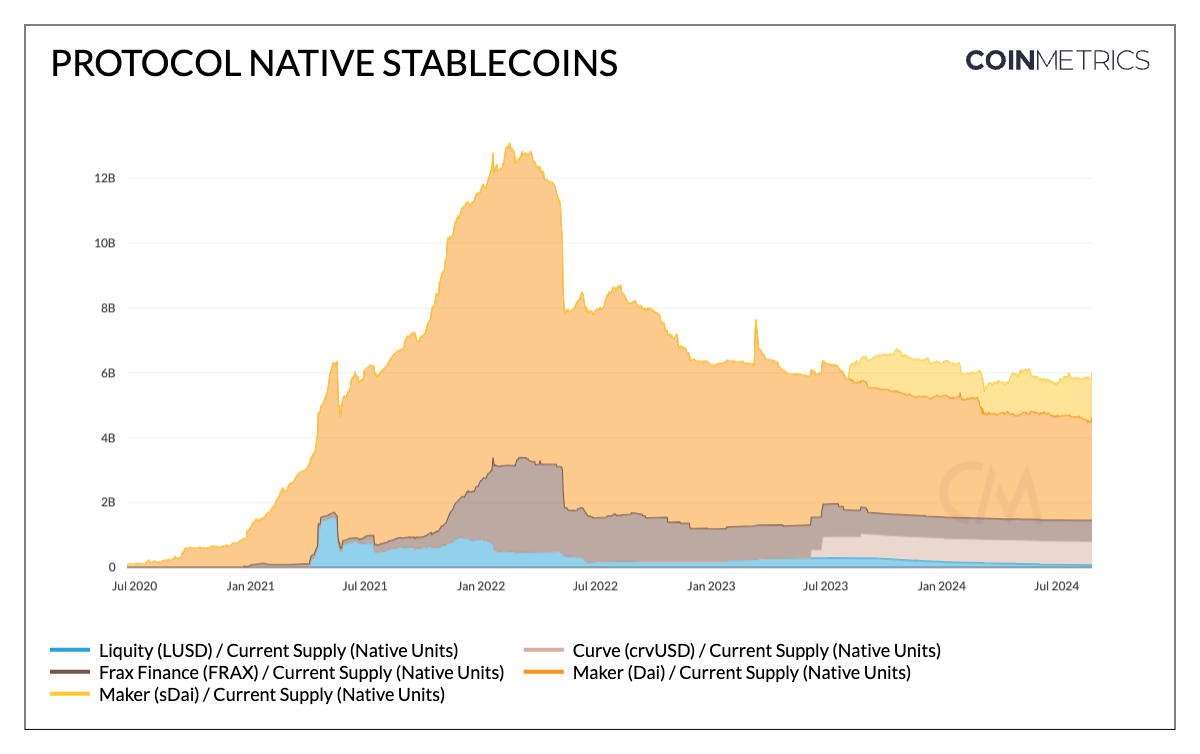

Stablecoins have become synergistic to the business models and functionality of decentralized finance (DeFi) protocols. Following Maker's success with DAI, many DeFi protocols have launched their own native stablecoins tailored to their ecosystems. Money market protocols like Aave (GHO), DEXs like Curve Finance (crvUSD) and collateralized-debt protocols (CDPs) like Maker & SparkLend (DAI) and Liquity (LUSD) feature native stablecoins, with mechanisms for maintaining price stability and aiding operations within their respective ecosystems.

They facilitate a wide range of financial services like payments, borrowing, trading, liquidity provision and yield strategies. A significant portion of traditional stablecoin supply also resides in Ethereum smart contracts: 27% of USDC, 20% of USDT, and notably, over 50% of PYUSD —serving as stable collateral on lending protocols and quote pairs on decentralized exchanges (DEXs). Furthermore, with the proliferation of tokenized treasuries and real-world assets (RWAs) like BlackRock’s BUIDL and Mountain Protocols USDM, DeFi protocols are beginning to incorporate traditional financial assets into their ecosystems, bridging the gap between DeFi and TradFi.

Source: Coin Metrics Network Data Pro

Product Market Fit: Tether on Tron

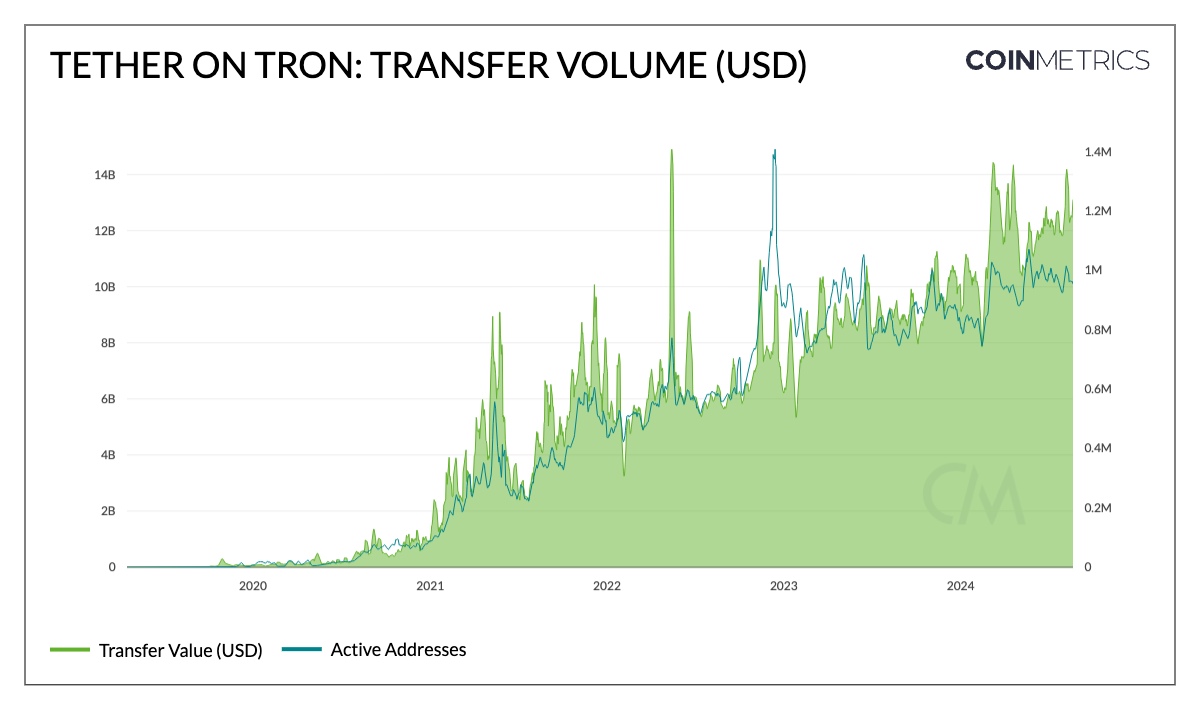

Tether (USDT) on the Tron network is a prime example of a stablecoin that has established a product-market fit. It has displayed strong adoption and usage as a medium of exchange and store of value across a range of metrics. Not only does it boast the largest current supply of 118B with ~61B on Tron and ~53B on Ethereum (in addition to Solana & Avalanche), but records the highest transfer volumes and counts relative to other stablecoins. Tether’s (adjusted) transfer volume on Tron is nearing a record $14B, with close to 1M active addresses.

This usage is propelled by a combination of Tron's low transaction fees, enabling lower value payments and remittances with low median transfer sizes and USDTs deep liquidity across exchanges, facilitating transactional activities as a quote-asset. Therefore, it provides the means to protect savings, seek economic stability and democratizes access to banking infrastructure, enabling peer-to-peer transactions of various purposes—especially in emerging markets.

Source: Coin Metrics Network Data Pro

Low fees on networks like Solana and Ethereum layer-2s, combined with the distribution of businesses like Coinbase and easier onboarding through smart-wallets or point of sale systems, offer an opportunity for stablecoins to establish a strong base across these networks and around the globe.

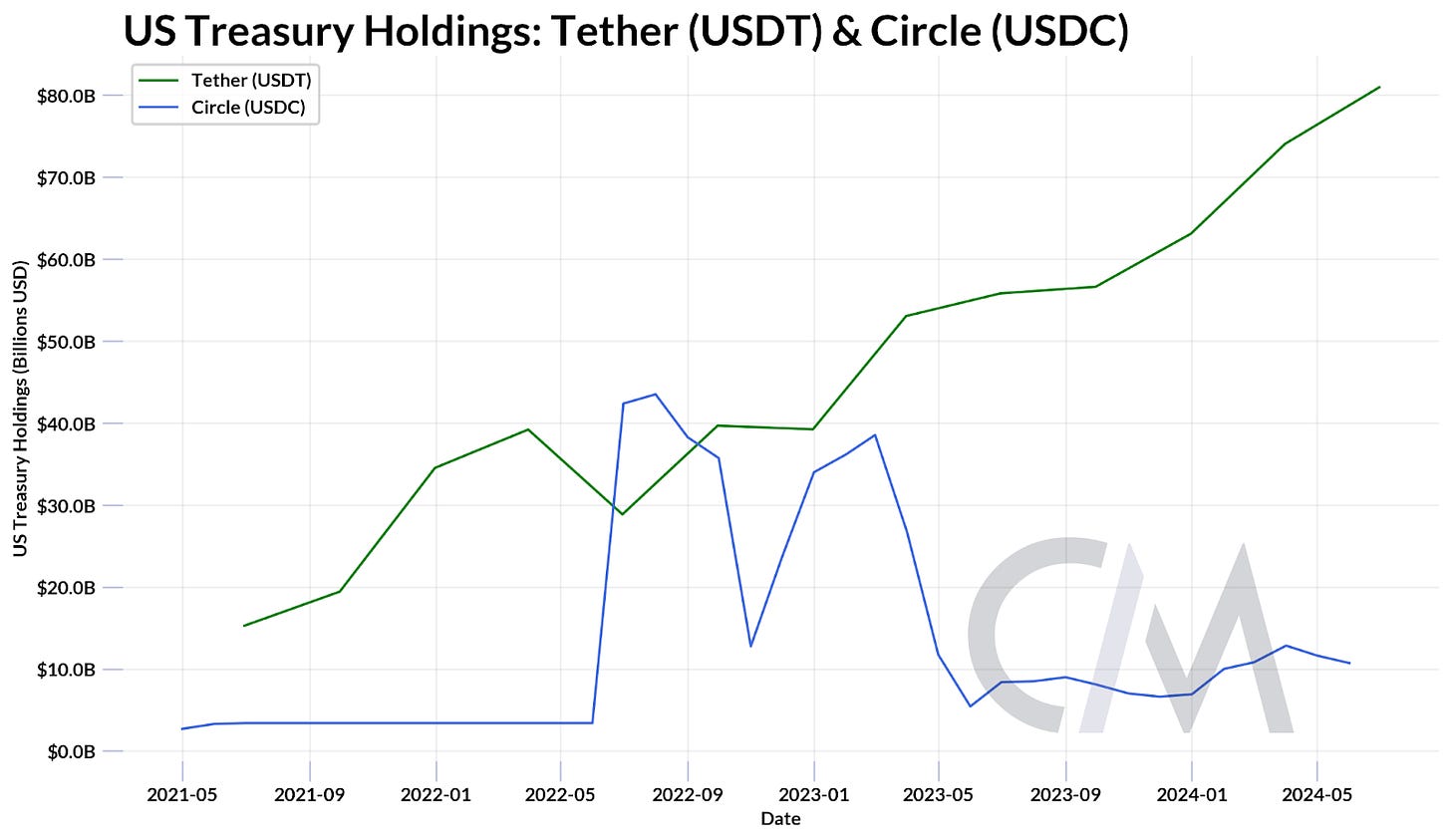

Stablecoins In A Changing Interest-Rate Environment

Stablecoins are primarily collateralized by U.S Dollars or equivalents like cash or treasury bills. Most traditional stablecoins (e.g., USDT, USDC, PYUSD) retain interest earned on their collateral rather than passing it to token-holders. Tether's Q2 attestation exemplifies this, reporting $5.4B in profits partly from direct and indirect ownership of U.S. Treasury holdings, which reached a new high of $97.6B. This brought their exposure to treasuries above Germany, the United Arab Emirates, and Australia—ranking 18th out of countries holding U.S debt.

Source: Tether & Circle Attestations

Where Does the Yield Come From?

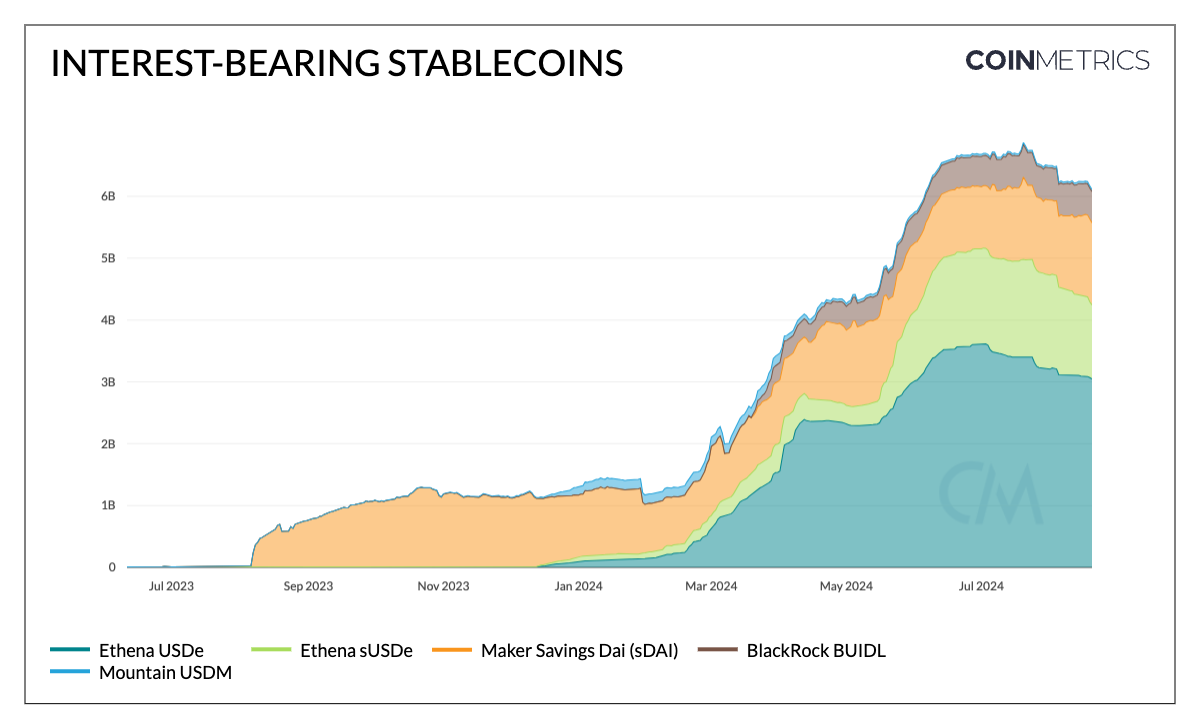

However, the post-2021 rise in federal funds and global interest rates introduced an opportunity cost for pure U.S. dollar exposure. This sparked the emergence of interest-bearing stablecoins, collateralized by short-term U.S. treasury bills, money market instruments, and other real-world assets (RWAs), which passed yield to holders.

Mountain Protocol's USDM, for instance, derives its yield from a reserve composition of treasury bills, accruing interest through a rebasing mechanism. Maker protocol's savings DAI (sDAI), takes another approach, accumulating interest from DAI deposited in the DAI Savings Rate (DSR). This yield originates from a basket of real-world assets (RWAs), crypto-assets, and excess reserves backing DAI, implemented through an ERC-4626 vault standard. These products essentially function as crypto savings accounts.

The integration of RWAs with public blockchains has also paved the way for institutional-grade offerings like BlackRock's BUIDL, a tokenized money market fund issued by Securitize that utilizes a USDC redemption fund to provide a continuous, 24/7 offramp into stablecoins. While tokenized treasury products rely on such off-chain sources of yield, others like Ethena’s USDe generates yield through a basis trade involving delta-neutral hedging (long position in staked ETH or other collateral and a corresponding short position in perpetual futures contracts.)

Source: Coin Metrics Network Data Pro

However, Federal Reserve Chair Jerome Powell's suggestion of interest rate cuts at the 2024 Jackson Hole symposium raises questions about stablecoins in a low interest-rate environment. While fiat collateralized stablecoin issuers may see reduced profitability due to the interest-rate sensitivity of their business models and yield-bearing stablecoins might lose some of their appeal due to diminishing returns, a risk-on environment could bring new capital inflows to the crypto ecosystem. This influx, driven by investors seeking to capitalize on lower borrowing costs and higher asset valuations, could potentially offset these effects through increased demand for stablecoins as a medium of exchange.

Conclusion

The recent growth in stablecoin supply, pushing towards new highs, signals increasing liquidity and capital availability in the crypto ecosystem. As the landscape continues to evolve, we're witnessing stablecoins optimizing for different use cases and risk profiles with diverse collateralization methods from RWAs to crypto-assets and innovative approaches like the tokenized basis trade. As we look ahead, navigating regulatory hurdles and a low interest-rate environment introduces both opportunities and challenges, potentially reshaping business models, user preferences and the overall competitive landscape of this burgeoning sector.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Be sure to check out our catalog of Research on Stablecoins, and our Stablecoin Dashboard for more

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

Subscribe and Past Issues

As always, if you have any feedback or requests please let us know here.

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.