Coin Metrics’ State of the Network: Issue 201

A data-driven overview of the events from Q1, 2023

Get the best data-driven crypto insights and analysis every week:

State of the Network’s Q1 2023 Wrap-Up

By Kyle Waters & Matías Andrade

In this special edition of State of the Network, we take a data-driven look at the most important events that impacted the digital assets industry from the first quarter of 2023.

Market Bounceback

After an arduous slide downward in 2022, the crypto asset markets roared back in Q1 ‘23, with bitcoin (BTC) rising near $30,000 and finishing the quarter up 72%. The digital asset market comeback was accompanied alongside a broader risk-on attitude in the markets, with the 2022 distaste for tech sharply reversing into a 17% return of the NASDAQ in Q1.

All sectors of the digital assets industry accelerated; using Coin Metrics’ datonomy, we can see that each of the CMBI Total Market Series indices had a strong finish this quarter, with the Information Technology (CMBIITE) index leading the way—up over 100% year-to-date.

Source: Coin Metrics Total Market Series

Across the universe of crypto assets in datonomy, the market capitalization of the digital assets ecosystem creeped back up over one trillion dollars, to the highest level since summer 2022. When combined together, the two largest assets in the ecosystem—BTC and ETH—passed back over $700B in total market capitalization.

Sources: Coin Metrics datonomy, Coin Metrics Network Data

Although BTC, ETH, and many smaller-cap assets in particular remain well below their 2021 highs, the uptick in the market valuations of these assets has come alongside an intriguing shift in market behavior.

Although stocks also rebounded in Q1, BTC started detaching a bit from the equity markets as evidenced by a decrease in the correlation between BTC and the S&P 500 index.

Source: Coin Metrics Correlation Chart

On its own, a more independent return profile may just seem like a win for practitioners of modern portfolio theory seeking diversification. Amid the backdrop of banking sector distress not witnessed since 2008, markets in Q1 appeared to vindicate BTC’s original raison d'être as an alternative financial asset born from the ashes of the great financial crisis. Indeed, some have suggested that BTC data is beginning to show potentially bullish foundations.

Stablecoin Market Shake-Up

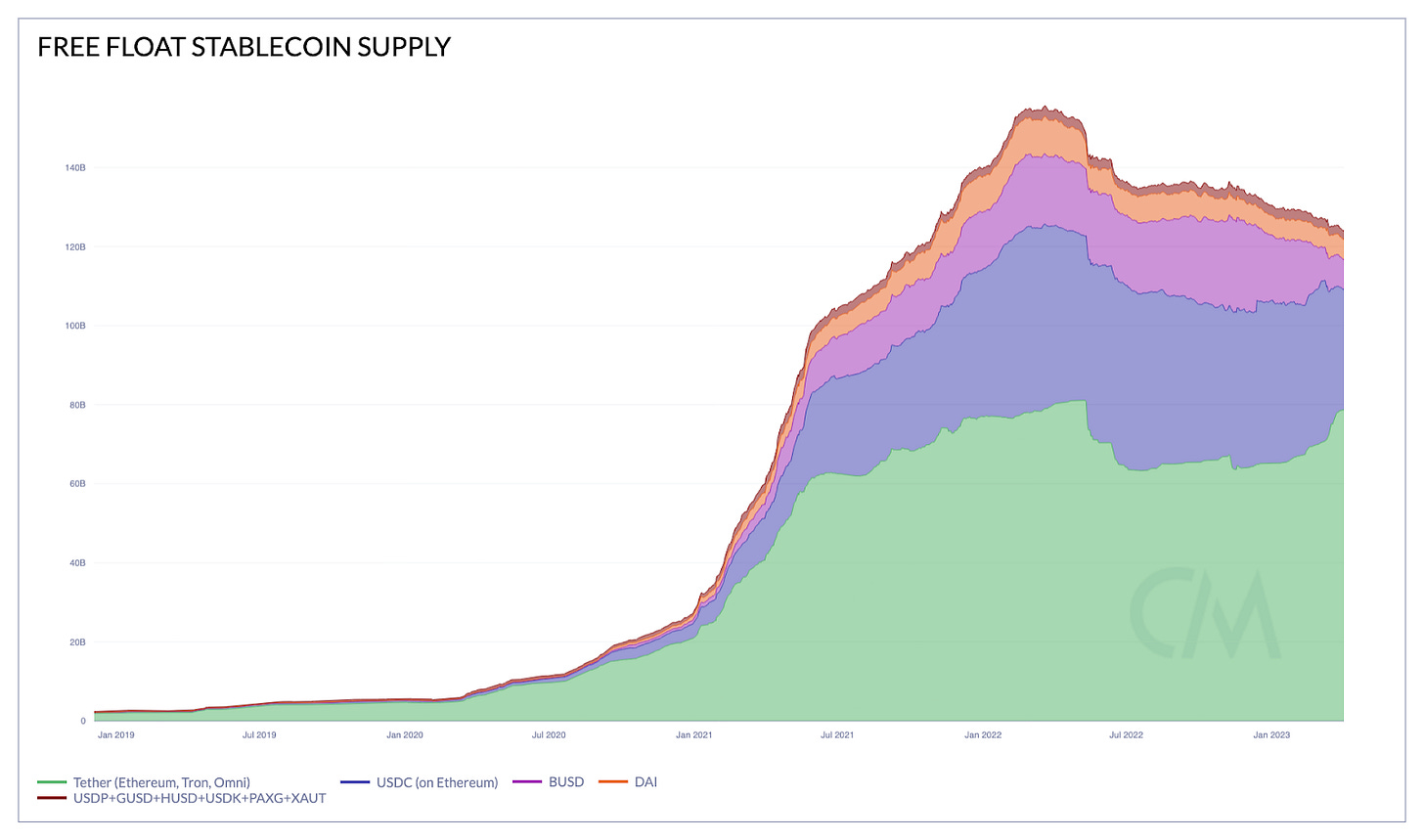

Stablecoins have quickly become an integral part of the digital assets ecosystem over the last few years, permeating across the entire crypto-economy, financial institutions, and even garnering the attention of the President’s Working Group on Financial Markets and highest-ranking regulators and policymakers in the United States, European Union, and elsewhere.

Q1 was an important quarter for the $120B stablecoin market. Although total supply only contracted about $8B or 5%, significant market events prompted large movements within the stablecoin ecosystem.

Source: Coin Metrics Network Data

The first major event came on February 13th, with the stablecoin operator and infrastructure company Paxos announcing that it planned to halt the minting of Binance USD (BUSD), a branded stablecoin affiliated with the largest crypto exchange by spot volume. The plans came alongside an announcement from Paxos that it had received a Wells Notice from the U.S. Securities and Exchange Commission stating the SEC was considering action alleging that BUSD is a security.

With a cloud of regulatory uncertainty, the circulating supply of BUSD quickly collapsed falling in half from $16B to $8B at the end of the quarter.

Source: Coin Metrics Formula Builder

Then, the sudden shut down of tech and start-up friendly Silicon Valley Bank (SVB) in early March sent a large shock to the second largest stablecoin, USDC. Although the run on SVB was an unexpected disruption across many dimensions and to a wide range of industries, for crypto market participations, the most immediate impact came in the form of the de-pegging of USDC. USDC was caught up in the mess due to immediate uncertainty surrounding the $3.3B which Circle (USDC’s parent company) was custodying at SVB. The price of USDC reached as low as ¢88 on the dollar on March 11th before rebounding with an assurance from the FDIC, US Treasury, and Federal Reserve that all depositors would be fully protected.

The brief bout of chaos had a large impact on the second largest stablecoin by market cap, with over $35B worth of USDC moving around on Ethereum on March 11th alone, an all-time record. The supply of USDC quickly fell by around $10B on Ethereum, falling from $40B to $30B. Meanwhile, the supply of the largest stablecoin by market cap and long-time market incumbent, Tether, rose around $7B across Tron and Ethereum.

Source: Coin Metrics Formula Builder

Despite Tether’s long history of clashes with regulators and concerns with transparency at times, some market participants appeared to rotate into Tether in the immediate wake of the SVB crisis. While it is tough to pinpoint the exact flows, Tether has long been a favored stablecoin of offshore exchanges for liquidity and reportedly popular as a dollar-denominated asset in countries currently facing high-inflation rates.

However, despite the recent supply contraction, USDC remains a strong winner in the DeFi market, with a total of $13B worth of USDC still locked in Ethereum smart contracts, compared to Tether’s $5B. With a group of blue chip partners, including BNY Mellon and BlackRock, commitments to transparency, and continued onshore engagement in the U.S., Circle hopes to win back market share in 2023. We will have to wait and see if this recent rotation is temporary or if it will endure the test of time.

Exchanges Face Regulatory Scrutiny

The quarter was also marked by a series of new regulatory actions in the U.S. against crypto exchanges. In early February, Kraken settled with the SEC and agreed to pay $30M and end staking services for U.S. clients. This was a big development for the growing business of staking-as-a-service following Ethereum’s move to proof-of-stake last September, via The Merge.

This was followed-up in March with two high-profile developments. First, the publicly-traded U.S. crypto exchange Coinbase (COIN) announced on March 22nd that it had received a Wells Notice from the SEC stating that the U.S. regulator had made a “preliminary determination to recommend that the SEC file an enforcement action against the Company,” and that Coinbase believed the potential enforcement actions would relate to “aspects of the Company’s spot market, staking service Coinbase Earn, Coinbase Prime and Coinbase Wallet”. Then, on March 27th, the Commodities Futures Trading Commission (CFTC) filed a civil enforcement action against the international exchange Binance and its CEO Changpeng Zhao (who often goes by just “CZ”), for purportedly “failing to diligently supervise Binance’s activities” as well as a slew of other charges.

While the two developments are starkly different in their nature, they touch two major players in the digital assets industry—the largest U.S.-based exchange and largest international exchange by spot volume. In the last week Binance has averaged daily spot trading volume of $9.5B while Coinbase spot volume (plotted on the right-hand axis below) averaged $1.1B per day last week.

Source: Coin Metrics Market Data Feed

Conclusion

Q1 was an important one for the digital assets ecosystem across multiple facets. Although some participants are undoubtedly feeling the weight of regulatory uncertainty, the beginning of high-profile cases may help finally accelerate needed clarity in the industry. Meanwhile, a narrative of digital-bearer assets, which can be self-custodied by all in a variety of ways, is a pleasant chord compared to the instabilities observed in traditional finance during the quarter.

Lest the news overshadow it, the quarter was also filled with important innovation. The rise of ordinals and inscriptions provided a new bid for Bitcoin block space, the layer-2 (L2) network Arbitrum surpassed L1 Ethereum in the number of transactions per day while also launching its ARB token via an airdrop, and after completing testing in Q1 Ethereum is poised to complete its next upgrade on April 12th.

Q2 is shaping up to be filled with fundamental questions about the digital assets industry, arriving fittingly at a time when participants are revisiting the very motivations underpinning the desire for decentralized finance and digital currency.

Network Data Insights

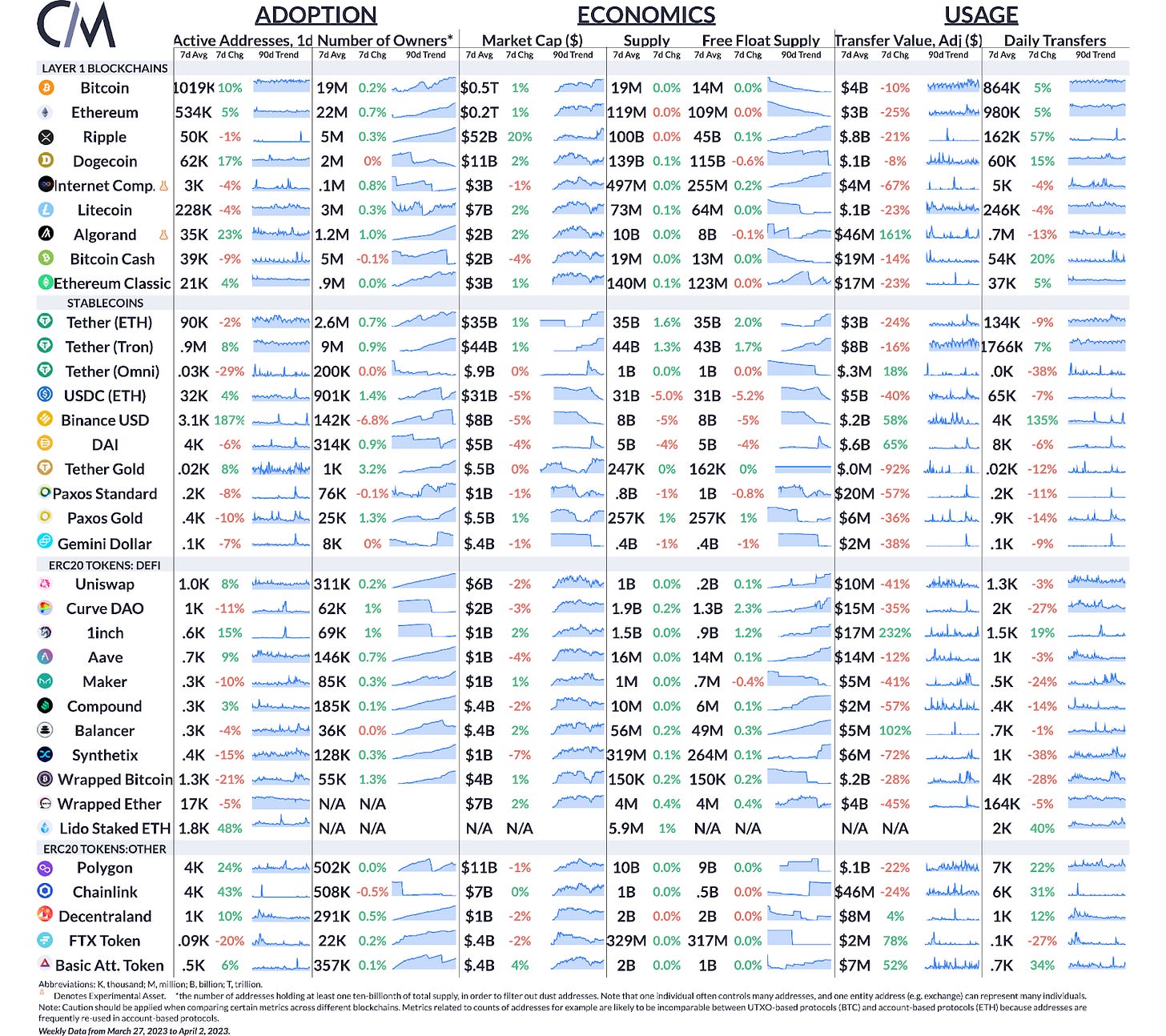

Summary Metrics

Source: Coin Metrics Network Data Pro

Network activity is ramping up as digital assets catch a bid this week. Active addresses rose 10% and 5% across Bitcoin and Ethereum networks, respectively, as price volatility increased, with BTC hovering around $27,700 and ETH around $1,770.

Coin Metrics Updates from Q1 2023

Some highlights from the Coin Metrics research team in Q1, 2023:

We added a new DEX digest page and fee market page to Coin Metrics’ State of the Market

We released a report What is MEV Anyway? providing an overview of Maximal Extractable Value (MEV), an existential threat facing all blockchains.

We wrote a report on Coin Metrics pricing data for institutional investors.

We released a report diving into the mechanics of a UniswapV2 swap. Throughout the report, mathematics, Solidity code, and on-chain transactions are used for clear explanation of the topic.

We walked through Version 2.0 of our Trusted Exchange Framework in this report.

We encourage readers to explore “Metrix”—a generative art project from cryptothematic data visualist Takens Theorem. Metrix uses the Coin Metrics community API to turn on-chain Bitcoin data into generative artworks inscribed on the Bitcoin blockchain itself!

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.