Introducing Coin Metrics' State of the Network: Issue 1

Wednesday, May 29, 2019

Introducing CM’s Weekly Newsletter

Dear crypto data enthusiasts,

We’re excited to launch “State of the Network”—CM’s weekly newsletter, bringing you an unbiased, focused view of the crypto market informed by our own network (on-chain) and aggregate market data. You can expect unique insight and recurring weekly data to help you stay informed.

The format and depth of data covered will be improving over the coming weeks so stay tuned! And of course, if you have any feedback or requests, don’t hesitate to let us know at info@coinmetrics.io.

Research Highlight: Ripple

Last week we published a report highlighting discrepancies in Ripple’s escrow reporting. Find the full report in the Coin Metrics blog. A quick summary below:

As part of Coin Metrics standard due diligence process when adding new assets/nodes to our Pro data services, we noticed an abnormality with Ripple’s escrow system reporting of XRP.

Key findings from our research include the following:

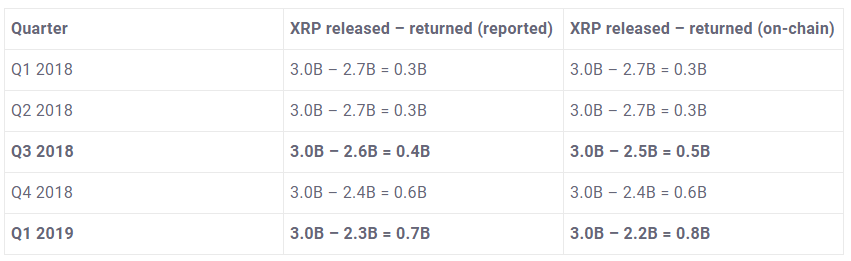

Two quarterly market reports under-reported the number of XRP released from escrow by a total of 200 million XRP ($84 million at current prices)

The “escrow queue” is implemented differently than announced, leading to a faster future release of escrowed funds compared to the announced schedule

Other party/parties, potentially associated with Ripple, have released 55 million XRP from an unknown escrow address not connected to the main Ripple escrow account”

Discrepancies such as this only become apparent through auditing and understanding on chain data.

Weekly Deep Dive

A visualization of trades on May 17, 2019

Abstract

On May 17, 2019, the crypto market experienced a sharp decline without any news-related catalyst. Bitcoin’s price decreased from $7,700 to $6,600 in the span of one hour. Similar to the market movement that occurred on April 2, 2019, Coin Metrics believes this movement was engineered to trigger a long squeeze through forced liquidations of long bitcoin futures positions, margin calls on long margin positions, and stop losses on spot markets.

Observations

Market conditions were ripe for a long squeeze:

Bitfinex’s bitcoin long-to-short ratio was at 1.4, indicating more margin long positions than short—the high-end of its recent historical range.

Bitmex’s funding rate on its bitcoin perpetual futures contract on the day prior was 0.07% indicating that Bitmex prices were trading at a premium to spot—again at the high-end of its recent historical range.

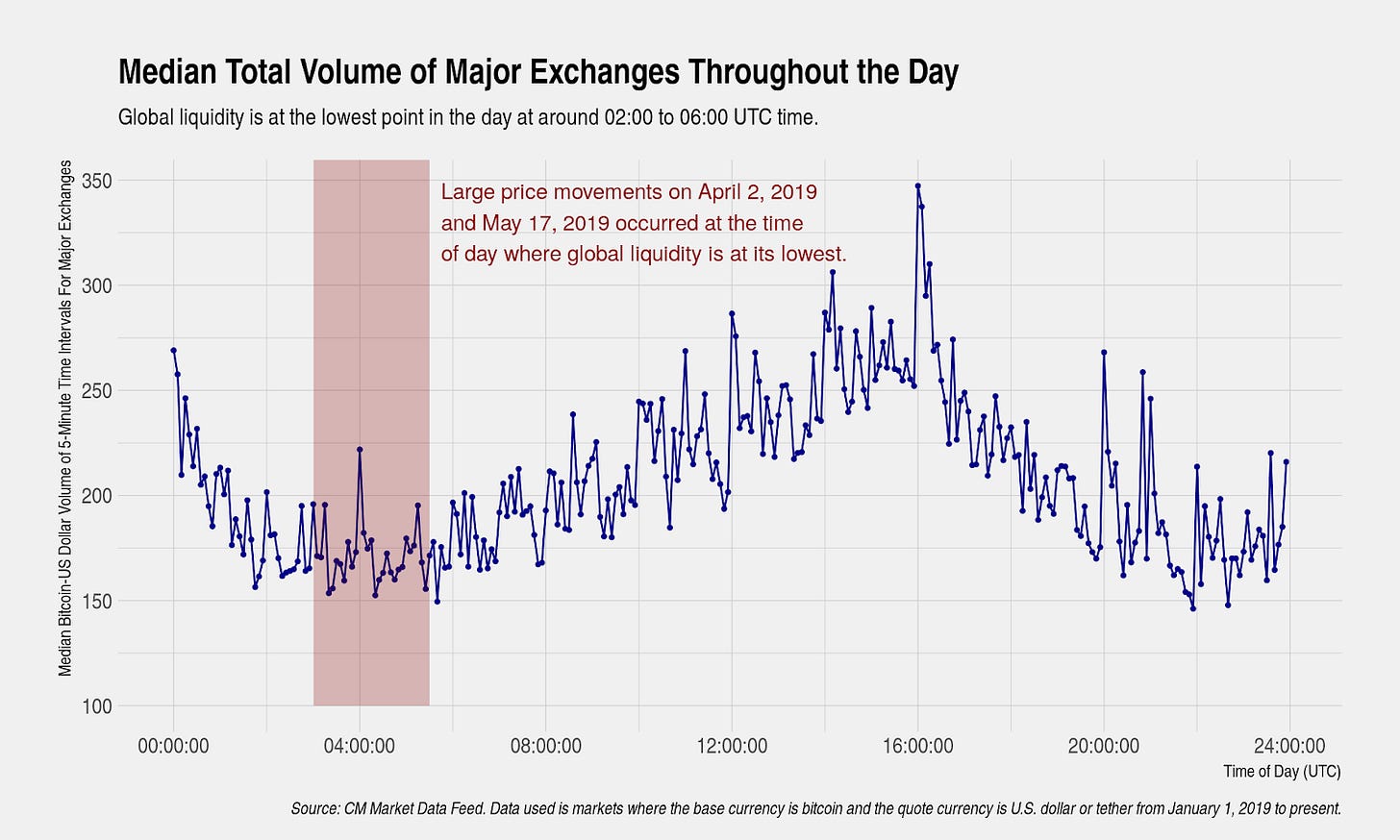

Finally, the move happened at 03:00 UTC, typically the point of lowest liquidity during a typical day (see Timing section below)

Focused selling was observed on Bitstamp’s BTC-US Dollar market resulting in a sharp divergence in Bitstamp’s price relative to other major exchanges. Bitstamp was likely targeted because, at the time, it was one of two constituent markets used in the calculation of Bitmex’s bitcoin index. Five days after this movement, Bitmex subsequently added Kraken as a third constituent market, likely in response to this engineered market movement.

Timing

The large price movements on April 2, 2019 and May 17, 2019 both occurred between 03:00 UTC and 05:00 UTC, the time of day where global liquidity is typically at its lowest. This time period coincides with the time when most of the global population is asleep and not at work. The timing of the market movement on May 17, 2019 and the absence of any news-driven catalyst indicate that this market movement was engineered to trigger a squeeze.

Trades Across Exchanges

Some selling was first observed on Bitfinex at approximately 03:00 UTC followed shortly by sustained heavy selling on Bitstamp. The selling on Bitstamp was executed in a way to maximize price impact and a $300 discount was observed on Bitstamp compared to other major exchanges. As the bid side of the order book was wiped completely clean on Bitstamp, a short and volatile period of price discovery followed. Large buying on Binance appears to have stemmed the decline. During this time of market stress, tether-quoted markets temporarily sold for a premium to dollar-quoted markets and none of the bitcoin-tether markets dipped below $7,000. (Tip: zoom in on your browser for greater resolution.)

Here is a closer look at Bitstamp.

Conclusion

In the long-term, crypto prices are driven by market cycles and fundamentals. However, in the short-term, engineered price movements designed to trigger squeezes have been observed from time-to-time. This might be driven by a few factors:

The ability to easily access leverage and the outsized impact of futures markets (particularly Bitmex) incentivize traders to engineer price movements.

The fragmented, 24/7 nature of crypto markets results in an easier ability to have market impact when buying or selling large positions.

This recent market movement is perhaps the clearest indication that these price movements are engineered due to the timing and focused nature of the selling and because the selling was observed on Bitstamp, one of two constituent exchanges for Bitmex’s bitcoin index. Bitmex subsequently added Kraken as a third constituent exchange.

Network Data Insights

Summary Metrics

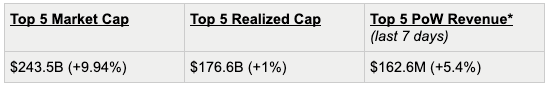

Top 5

* Ignores Ripple which is not a PoW chain

Network Highlights

Someone made an expensive mistake sending litecoin, paying a 200 LTC transaction fee. For comparison, that’s 13x the usual fees paid over a full day.

Source: Coin Metrics, Network Data Pro

BCH experienced an intentional reorganization to recover funds accidentally sent to SegWit addresses. This appears to have resulted in a deliberate and coordinated 2-block reorganization. This adds to the debate surrounding intentional reorganizations on Bitcoin that was sparked following a Binance hack which led Binance’s CEO to consider, but ultimately decide against, an intentional reorganization to recover the lost funds.

Illustration of the Bitcoin Cash network splits on 15 May 2019

Source: The Bitcoin Cash Hardfork – Three Interrelated Incidents, BitMex

Market Data Insights

The market has experienced a sharp and broad-based recovery over the past month. Most major assets are up at least 50% and high correlation in returns between assets are observed in the short-term. Bitcoin Cash SV is the biggest mover in the subset of major assets below with a one-month return of 122%.

The short-term moves mask a broader and long-term phenomenon of large dispersion in returns among assets. As an illustration, Binance Coin has returned 164% over the past year while ZCash has lost 66% of its value. Only a handful of assets have a positive return over the past year: Bitcoin, Litecoin, and Binance Coin.

Examining the rolling drawdown paints a similar picture. Certain assets, particularly ZCash, Ripple, Dash, Bitcoin Cash, and Stellar are still far from reaching their all-time highs.

Several interesting narratives can be drawn from the above data:

Litecoin has performed well during this market cycle and is one of the few major assets with a positive yearly return. A factor in its strong performance may be market participants pricing in its second block reward halving in August 2019.

ZCash is the worst performer in this sample. It also happens to have the highest issuance rates with an annualized inflation in excess of 50% over the past year, likely leading to large selling pressure by miners. By contrast, Bitcoin’s annualized inflation is less than 4%.

Subscribe and Past Issues

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.