Coin Metrics' State of the Network: Issue 68

Tuesday, September 15th, 2020

Get the best data-driven crypto insights and analysis every week:

Weekly Feature

Measuring Bitcoin’s Decentralization

By Karim Helmy and the Coin Metrics Team

The following is an excerpt from a full-length report, which has been truncated due to space limitations. Read the full report here.

Over the last eleven years, Bitcoin has managed to function relatively seamlessly in the face of a large number of threats, largely due to its lack of a single controlling entity. This trait, known as decentralization, encompasses a large number of loosely-coupled characteristics. Some of these traits are difficult to describe and measure, but others lend themselves well to direct analysis.

One directly observable feature is the dispersion of funds across addresses. The distribution of wealth is a critical factor in any economy, roughly coinciding to the distribution of economic influence. For cryptoassets, which often grant large token allocations to the founding team, it’s also a severely underexplored one.

Another characteristic, the distribution of hashpower, is arguably even more important. Bitcoin relies on decentralization at this level in order to meet its goals of sustaining a secure, censorship-resistant payments and savings system.

Bitcoin is also highly exposed to the market share distribution of exchanges, which exercise an outsized influence on the network’s economy. The distribution of volume on fiat-quoted spot pairs is particularly important, since these represent on- and off-ramps to and from the world at large.

In this week’s feature, we’ll quantify Bitcoin’s decentralization along these three verticals and track how it’s progressed over time.

Dispersion

The presence of whales, or users with large quantities of funds held in the asset, is a concern for the viability of many cryptocurrencies. A particularly unequal distribution of funds could grant a small set of users significant influence over the direction of an asset’s markets and protocol development and call into question the asset’s viability as a store of value or medium of exchange.

Since Bitcoin balances are easily auditable, dispersion can be assessed with on-chain data. Because funds held by custodians in omnibus accounts cannot be attributed to their owner and address reuse is generally discouraged, these estimates are imperfect. However, the degree of transparency afforded is still unprecedented when compared to the legacy financial system.

Bitcoin still has whales, but since the network’s inception, its supply has become more evenly distributed, with smaller accounts comprising an increasing proportion of the aggregate supply.

Source: Coin Metrics Network Data Pro

In addition to controlling an increasing proportion of supply, addresses with smaller balances continue to represent the majority of accounts. In the face of a fluctuating dollar-denominated price, most addresses still control less than $100 worth of Bitcoin.

Mining

In addition to on-chain dispersion and activity, Bitcoin’s effective decentralization depends on the distribution of computational power, or hashpower, among miners.

Bitcoin relies on miners to secure the network and add new blocks to the blockchain. These miners compete to find the next block by computing a large number of energy-intensive hashes, and often aggregate into loose coalitions known as mining pools.

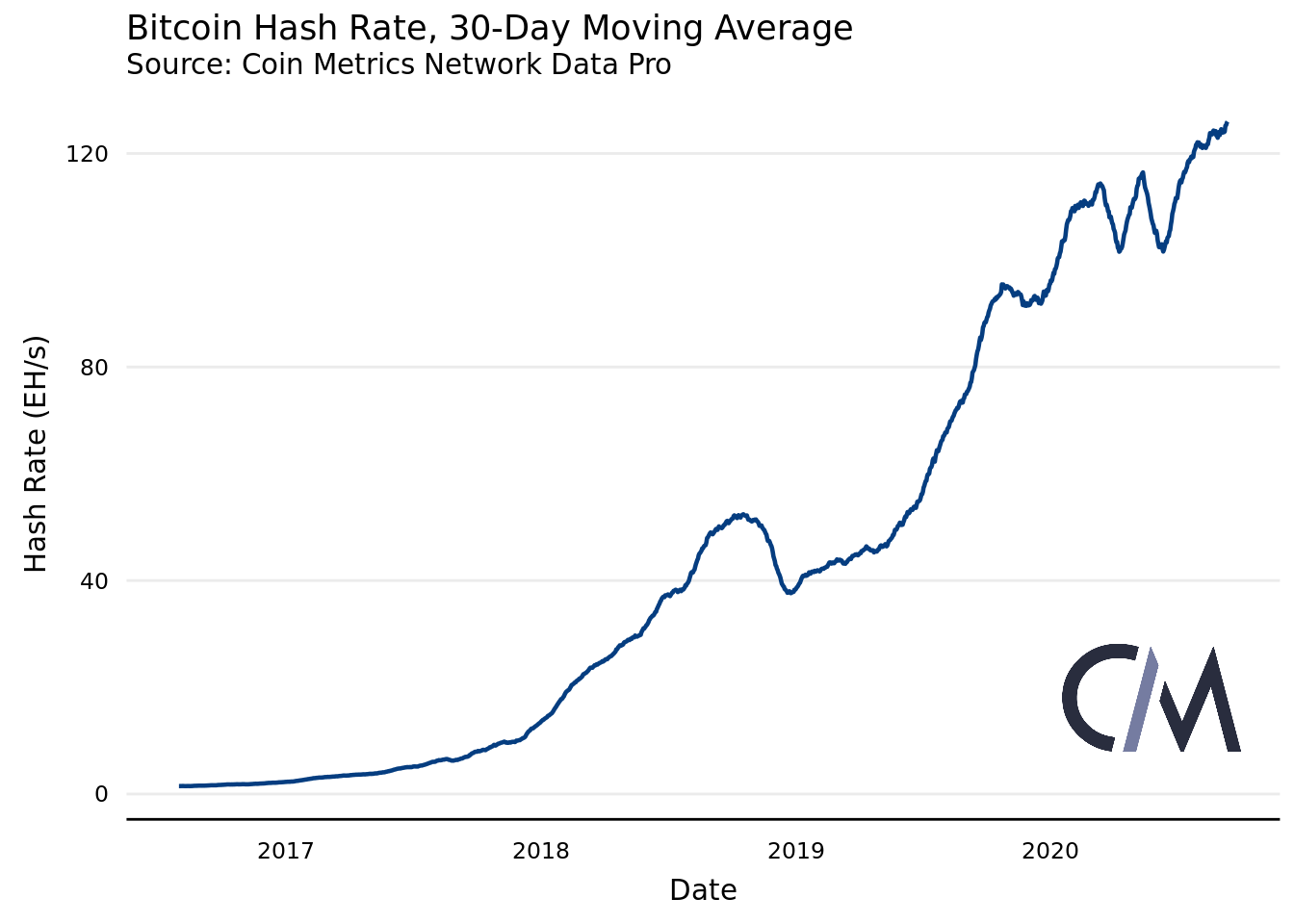

The amount of hashpower securing the Bitcoin network has generally grown exponentially throughout the network’s history.

Source: Coin Metrics Network Data Pro

In addition to the amount of raw hashpower securing the network, the distribution of hashpower is also important. A malicious actor who controls more than half of the network’s hashpower could 51%-attack the network and perform a double-spend, and an attacker with considerably less resources could censor transactions through feather forks.

An attacker would need to double-spend a large amount of money in order to make a 51%-attack profitable. In majority-hashpower ASIC-mined coins like Bitcoin, which require significant capital expenditure by miners, it would be difficult for a rational miner to perform a 51% attack, though these attacks are made somewhat more feasible by the presence of hashpower marketplaces.

Today, Bitcoin’s mining industry is competitive. The plot below, which is subject to a degree of survivorship bias, shows mining to be a thriving, distributed ecosystem.

Continue reading Measuring Bitcoin’s Decentralization...

Network Data Insights

Summary Metrics

Source: Coin Metrics Network Data Pro

Network metrics were mostly down this past week as Bitcoin (BTC) and Ethereum (ETH) market caps tumbled over the first half of the week. ETH had bigger downturns in most categories as DeFi enthusiasm temporarily waned following the latest food related controversy. ETH active addresses dropped to about 356K on September 11th, which is the lowest daily total since May.

Network Highlights

USDC supply has nearly doubled since the beginning of August. It took almost two years for USDC supply to go from zero to 1 billion. It only took about two months to go from 1 billion to 2 billion.

Source: Coin Metrics Network Data Charts

Tether supply exploded after the March 12th market crash. But since July, USDC supply has been growing at a faster rate. Fueled by the rapid rise of decentralized finance (DeFi), USDC is increasingly being used in liquidity pools on Uniswap and Curve Finance. Uniswap clone SushiSwap has also added to USDC’s rise, as USDC is one of the main underlying tokens that is staked to earn SUSHI. USDC’s lead has grown in September, as USDC supply issuance continues to accelerate. The following chart shows growth since March 1st.

Source: Coin Metrics Formula Builder

Tether still has a large lead in terms of total supply. As of September 13th, the total supply of Tether is approaching 15 billion, compared to about 3 billion for all other stablecoins combined. But USDC’s sudden surge might finally start to threaten Tether’s market dominance. Tether’s share of the total stablecoin supply peaked at about 87% on August 10th. Since then, it has dropped down to about 83%, its lowest level since April.

Source: Coin Metrics Formula Builder

USDC’s median transfer value has also started to rise in August and September. DAI’s median transfer value has risen as well compared to Paxos (PAX) and Ethereum-issued Tether (USDT_ETH). This is also likely a result of DeFi, as USDC and DAI are increasingly used for staking.

Source: Coin Metrics Network Data Charts

Market Data Insights

As the summer of DeFi rages on price action around Bitcoin has been relatively subdued. Realized volatility remains around 50%. This is interesting because in the past when Bitcoin broke out of this range into more volatile trading this measure reached levels over 100%. However, this past breakout did not reach nearly as elevated levels with the rolling 30 day average not surpassing the 60% mark. This is potentially due to a reduction in leveraged Bitcoin positions relative to the market size or a growing efficiency in the price action of the markets.

Source: Coin Metrics Market Data Feed

Another sign of growing efficiencies in the market is the reduction of offset seen between the market value of Tether and the U.S. Dollar. This chart below shows a rolling 30 day average price of Tether since 2018. You can observe that in 2018 and 2019 there were periods with large differences between the two and that this offset has been reduced over time.

Source: Coin Metrics Market Data Feed

CM Bletchley Indexes (CMBI) Insights

This week, CMBI Indexes recovered a fraction of last week’s market wash, all closing the week in the green. After last week’s big move, most indexes experienced a reduction in volatility this week, trading within a relatively tight range. The CMBI Bitcoin Index only finished slightly up, closing at $10,302.48 (up 0.4%), whilst the CMBI Ethereum Index performed slightly better closing at $362.63 (up 2.4%).

As has been a trend through most of Q3, the small cap (Bletchley 40) and mid cap (Bletchley 20) indexes were the best performers of the week.

The CMBI Bitcoin Hash Rate Index continues to reach new weekly highs, closing the week at 142,275 Petahashes per second, up 13%. This led to miners doing an observed 81,057 Zettahashes over the last week, 10.5% more than expected based on the previous week’s performance.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

We’re excited to announce the new Coin Metrics mobile app. View real-time cryptoasset pricing and relevant on-chain data in a single app! Download for free here: https://coinmetrics.io/mobile-app/

As always, if you have any feedback or requests, don’t hesitate to reach out at info@coinmetrics.io.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.