Coin Metrics' State of the Network: Issue 69

Tuesday, September 22nd, 2020

Get the best data-driven crypto insights and analysis every week:

Weekly Feature

Bitcoin: A Novel Economic Institution

Below is an excerpt of a research report authored by ARK Invest and Coin Metrics. In Part 1 of this research, we described how we believe Bitcoin satisfies the four assurances that maximize the probability of a robust and predictable financial system. In Part 2, we explore bitcoin as an emerging asset. The following is an excerpt from Part 2 of the report.

Bitcoin’s Opportunity

With little more than a 10-year price history, bitcoin has been the best performing asset of the 21st century. Five years ago, a $10,000 investment in bitcoin would have delivered a 119% compound annual rate of return and would be worth roughly $500,000 today. In fact, during any yearly holding period since inception through September 1, 2020, bitcoin’s return has been positive, significantly so in most cases, as shown in Figure 2.

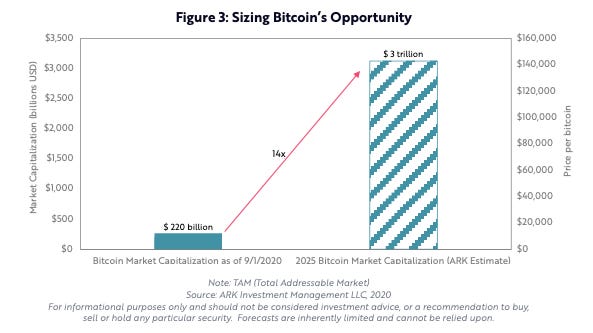

Despite its run, our analysis suggests bitcoin is early on its path to monetization, with substantial appreciation potential. In our view, Bitcoin’s $200 billion market capitalization - or network value - will scale more than an order of magnitude to the trillions during the next decade.

In the next section, we will discuss bitcoin’s largest market opportunities. Consistent with these opportunities, we estimate Bitcoin could reach a $3 trillion market cap by 2025.

Bitcoin As A Global Settlement Network

We believe Bitcoin could become a settlement system for banks and businesses. Unlike traditional settlement systems, the Bitcoin network is global, it cannot censor transactions, and its money cannot be inflated by institutions like central banks. Instead of facilitating a large volume of low- value transactions at point of sale, Bitcoin could evolve to handle large transactions between and among financial intermediaries. Today, most dollar-based international payments must settle through the Federal Reserve’s Real Time Gross Settlement (RTGS), or Fedwire.

Supporting both senders and receivers, the Bitcoin network obviates the need for counterparties to mediate and settle transactions and is capable of settling high value transactions irrevocably every few hours. It can facilitate 2,000 global settling transactions roughly every ten minutes from anywhere at any time. As noted in Economics of Bitcoin as a Settlement Network, the Bitcoin network could settle one transaction daily with every other bank in a global network of 850 banks. In the United States alone, deposits totaling $14.7 trillion generate $1.3 quadrillion in settlement volumes between and among banks each year. If it were to capture 10% of those settlement volumes at a similar deposit velocity, we believe the Bitcoin network would scale more than 7-fold from roughly $200 billion to $1.5 trillion in value, as shown below.

Bitcoin As Digital Gold

As part of the transition toward a digital economy, bitcoin could challenge gold as a global store of value. Economic history suggests that an asset accrues value as the demand for it increases relative to the supply. Demand is a function of an asset’s ability to serve the three roles of money: store of value, medium of exchange, and unit of account.

For thousands of years, the world has recognized gold as the most sustainable form of money. Through a process of natural selection, goods competed with each other for dominance until gold evolved as the global monetary standard. While gold has maintained its status as a store of value, its limitations to serve as a medium of exchange and unit of account began to surface in the 20th century.

Supporters often refer to bitcoin as digital gold because it improves upon many of physical gold’s characteristics. Not only is bitcoin scarce and durable, but it also is divisible, verifiable, portable, and transferable, all of which protect from the threat of centralization. According to our research, if it were to take 10% share of the physical gold market, bitcoin’s network value could increase nearly $1 trillion, as shown below, 5 times its $200 billion base today.

This is an excerpt of “Bitcoin: A Novel Economic Institution,” a research report authored by ARK Invest and Coin Metrics.Continue reading the full report here: Part 1 and Part 2.

Network Data Insights

Summary Metrics

Source: Coin Metrics Network Data Pro

Network metrics were slightly up this past week before Monday's decline. Ethereum (ETH) transaction fees are back on the rise following the surprise launch of Uniswap’s UNI token. ETH active addresses also rebounded thanks to UNI, after dropping to a 4-month low on September 11th. Bitcoin (BTC) daily active addresses also remained strong, averaging 978K over the past week.

Network Highlights

ETH daily transaction count hit a new all-time high of 1.41M on September 17th, following the launch of Uniswap’s UNI token the previous day.

Source: Coin Metrics Network Data Charts

The amount of transactions sent to Ethereum smart contracts also hit a new all-time high of 915.56K on September 17th as users sent transactions to Uniswap contracts to claim and trade UNI tokens. Transactions sent to contracts have surged since July, as decentralized finance (DeFi) has taken over Ethereum activity. This signals that Ethereum is being used more and more as a smart contracts platform as DeFi continues to evolve.

The following chart shows the daily amount of transactions sent to contracts vs non-contract addresses, smoothed using a 7-day rolling average.

Source: Coin Metrics Network Data Formula Builder

Similarly, the amount of ETH transferred by smart contracts (non-adjusted) shot up to a new all-time high of $3.07B on September 17th. The following chart is smoothed using a 7-day rolling average.

Source: Coin Metrics Network Data Charts

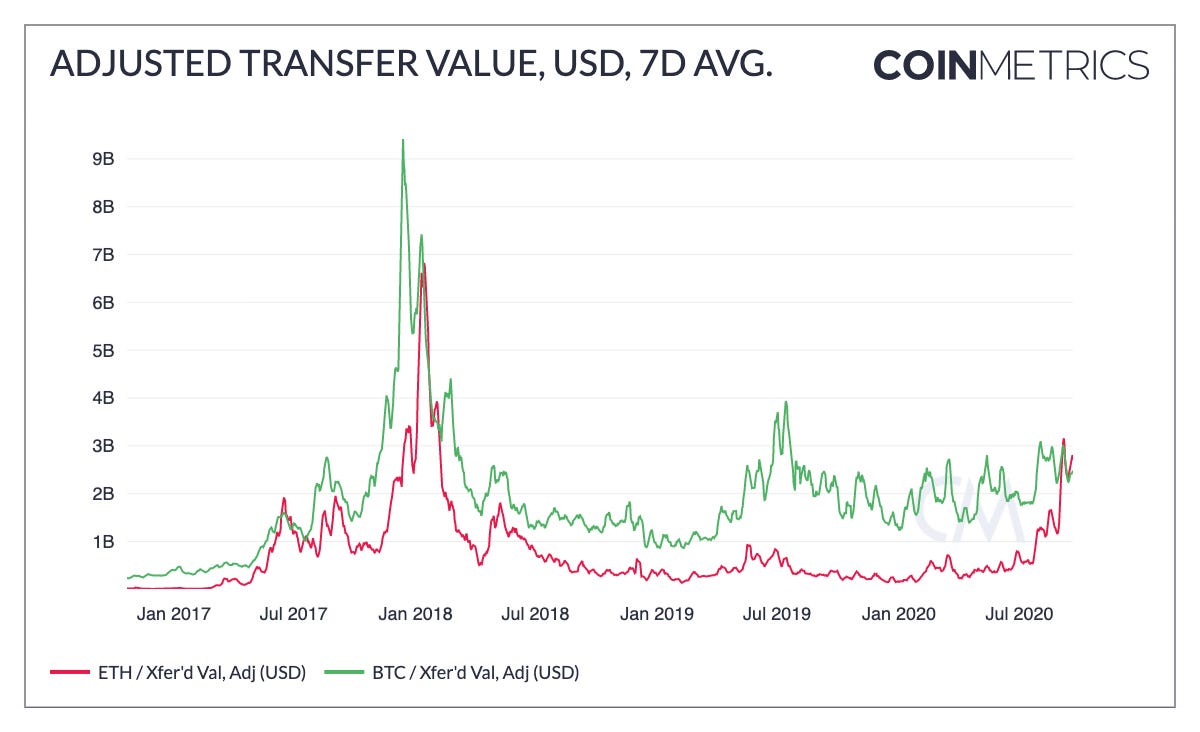

As a result, the overall amount of ETH transferred has climbed to its highest levels since January 2018. ETH’s adjusted transfer value 7-day average passed BTC’s on September 6th. ETH has increased its lead following UNI’s launch.

Source: Coin Metrics Network Data Charts

Market Data Insights

Volatility has returned to ETH following the recent selloff and last week's UNI debut. This is significant because it follows a period of sustained levels of low volatility not seen since mid-2019. This increase in volatility precedes some significant events, namely the launch of the first phase of ETH 2.0 and, more urgently, the September 25th options expiration.

Source: Coin Metrics Market Data Feed

The options for ETH expiring on Friday make up almost $450m in open interest. This will be the largest expiration date for Ethereum for the options exchange Deribit, currently the largest venue (by open interest) offering these contracts. This event will likely add additional volatility to price action throughout the week, as traders look to hedge exposure on these positions, work out of them, or possibly take action in the spot market in anticipation.

CM Bletchley Indexes (CMBI) Insights

CMBI and Bletchley Indexes had a mixed week, with the large cap assets performing best. In particular the CMBI Bitcoin Index had a strong showing and closed the week up 5.6%, at $10,879.71. The CMBI Ethereum Index also finished the week up 2.4%, at $371.44. The performance of these two indexes carried through to the positive performance of the Bletchley 10, which finished the week up 2.5%, despite many of the other assets experiencing losses for the week.

The mid and small cap indexes experienced the worst of the market sentiment this week, with the Bletchley 20 and Bletchley 40 closing down 5.7% and 7.8% respectively. This performance comes after several weeks of these indexes outperforming the large cap cryptoassets.

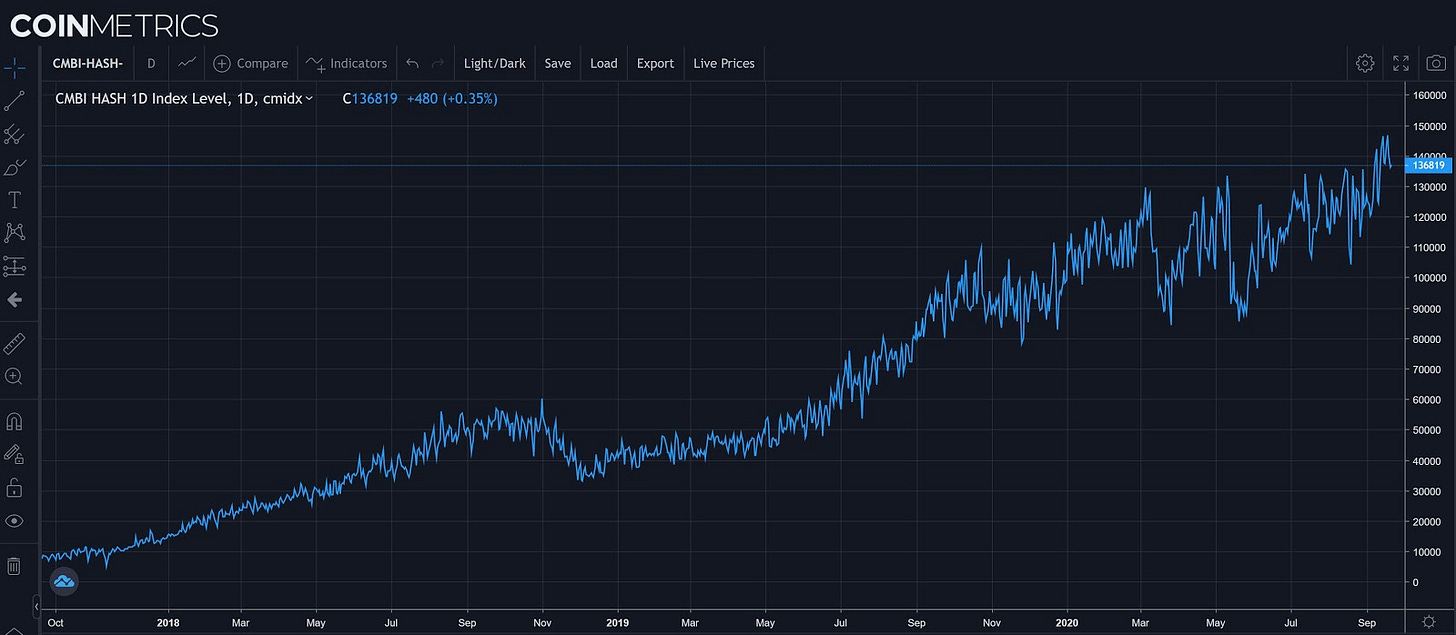

During the week the CMBI Bitcoin Hash Rate Index yet again experienced all time high levels, peaking at 151,760 petahashes on Friday. The sustained high levels of hash rate can be evidenced through the CMBI Bitcoin Observed Work Index, whose weekly levels indicate that 85,506 zettahashes were conducted by miners during the week (up 14.3% from 2 weeks ago). These record levels of hash rate resulted in Bitcoin’s difficulty increasing 11.35% on Sunday.

More performance information can be found here:

CMBI Bitcoin Index and CMBI Ethereum Index can be found in the August CMBI Single Asset Index Factsheet.

CMBI Mining Indexes can be found in the July CMBI Mining Index Factsheet.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

We’re excited to announce the new Coin Metrics mobile app. View real-time cryptoasset pricing and relevant on-chain data in a single app! Download for free here: https://coinmetrics.io/mobile-app/

As always, if you have any feedback or requests, don’t hesitate to reach out at info@coinmetrics.io.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.