Coin Metrics' State of the Network: Issue 60

Tuesday, July 21st, 2020

Get the best data-driven crypto insights and analysis every week:

Weekly Feature

Analyzing The Early Uses of Bitcoin

by Antoine Le Calvez and the Coin Metrics Team

Since its inception in 2009, Bitcoin triggered many discussions around its raison d’être. Conflicts between different points of view of what Bitcoin is and should be spanned years and tore many communities apart. Hasufly and Nic Carter cataloged the many different Bitcoin narratives in Visions of Bitcoin.

In this piece we aim for something a bit different than the usual discourse on this topic: instead of approaching Bitcoin as a political, philosophical or technical project and going top-down, we start by observing the history of what happened on-chain to gain insight into how Bitcoin’s usage has evolved over time.

Early Exchanges

Bitcoin launched in January 2009 to little fanfare. Before July 2010, it only saw a paltry eight thousand transactions (excluding protocol-mandated mining transactions). But then, within two weeks, Bitcoin did more transactions than it did in all its previous history.

This change is also visible when looking at a more subtle indicator: what was the precision of the amounts being sent? In that same period, the number of transactions specifying oddly precise amounts of bitcoin to be transferred increased dramatically.

A few events led to the sudden increase in Bitcoin usage in July 2010. First, Bitcoin had its Slashdot moment - the release of Bitcoin version 0.3 was picked up by the popular tech news outlet. A few days after, MtGox opened its doors to traders and users began using more decimals in their transactions to reflect the fact that they were transacting in Bitcoin, but with USD amounts.

As Bitcoin’s price increased in mid-2011, more and more outputs began using all the available decimals. What this tells us is that Bitcoin’s first growth spurt was directly related to the emergence of MtGox, the first marketplace allowing the exchange of BTC for US dollars.

SatoshiDice

The next interesting growth spurt comes from the rise of SatoshiDice in April 2012. It allowed users to bet bitcoin on the roll of a dice, with different odds, by just sending bitcoin to a specific address (for example, send 1 BTC and get 2x back with a 48% chance). Its key innovation was to use a provably fair protocol to show that it wasn’t defrauding its users with a bad random number generator.

In a matter of days after its launch, SatoshiDice grew to represent 40% of Bitcoin’s daily activity.

SatoshiDice represents a compelling argument for Bitcoin as a cheap and trustless payment network. Playing the same game with bank wires would not only be illegal, but also painfully slow. Its popularity died off due to many reasons, some regulatory (it had to ban US players), some business related as it changed ownership several times and some technical as raising transaction fees made using it less interesting to users.

Continue reading the full article…

Network Data Insights

Summary Metrics

Source: Coin Metrics Network Data Pro

On July 17th a Cloudflare outage briefly disrupted much of the internet. Although the major crypto networks were mostly unscathed, the outage led to a slight decrease in transactions likely due to popular wallets going down. Bitcoin (BTC) transactions were down 5% week-over-week as a result. But BTC transaction fees were up 54.5% week-over-week, signifying a surge in demand for block space despite the dip in transactions. Ethereum (ETH) transactions also dipped on July 17th, but they are still up week-over-week thanks to the continued rapid growth of decentralized finance (DeFi) applications.

Network Highlights

DeFi continues to push ETH fees higher. ETH median fees are approaching $0.40, which is the highest they’ve been since mid-2018. High fees are a mostly healthy sign - high fees typically signify high demand for block space, and create more revenue for the miners securing the network.

Source: Coin Metrics Network Data Pro

But high fees can also make it prohibitively expensive to send transactions, especially for use cases like gaming and collectibles that depend on large amounts of low cost transactions. Over the last week the amount of unique active ETH addresses decreased, despite an increase in transactions (7 day average).

Source: Coin Metrics Network Data Pro

Another sign of DeFi’s growth, the amount of ETH transferred by smart contracts is surging towards new all-time highs. There’s been an average of over 1M ETH transferred per day for most of July (7 day average).

Source: Coin Metrics Network Data Pro

DAI supply increased by over 40M since July 17th likely due to high demand for DAI within the DeFi ecosystem. For example, DAI currently has a 6.16% supply APY on Compound, about 4.5% higher than either USDC or USDT.

Source: Coin Metrics Network Data Pro

Market Data Insights

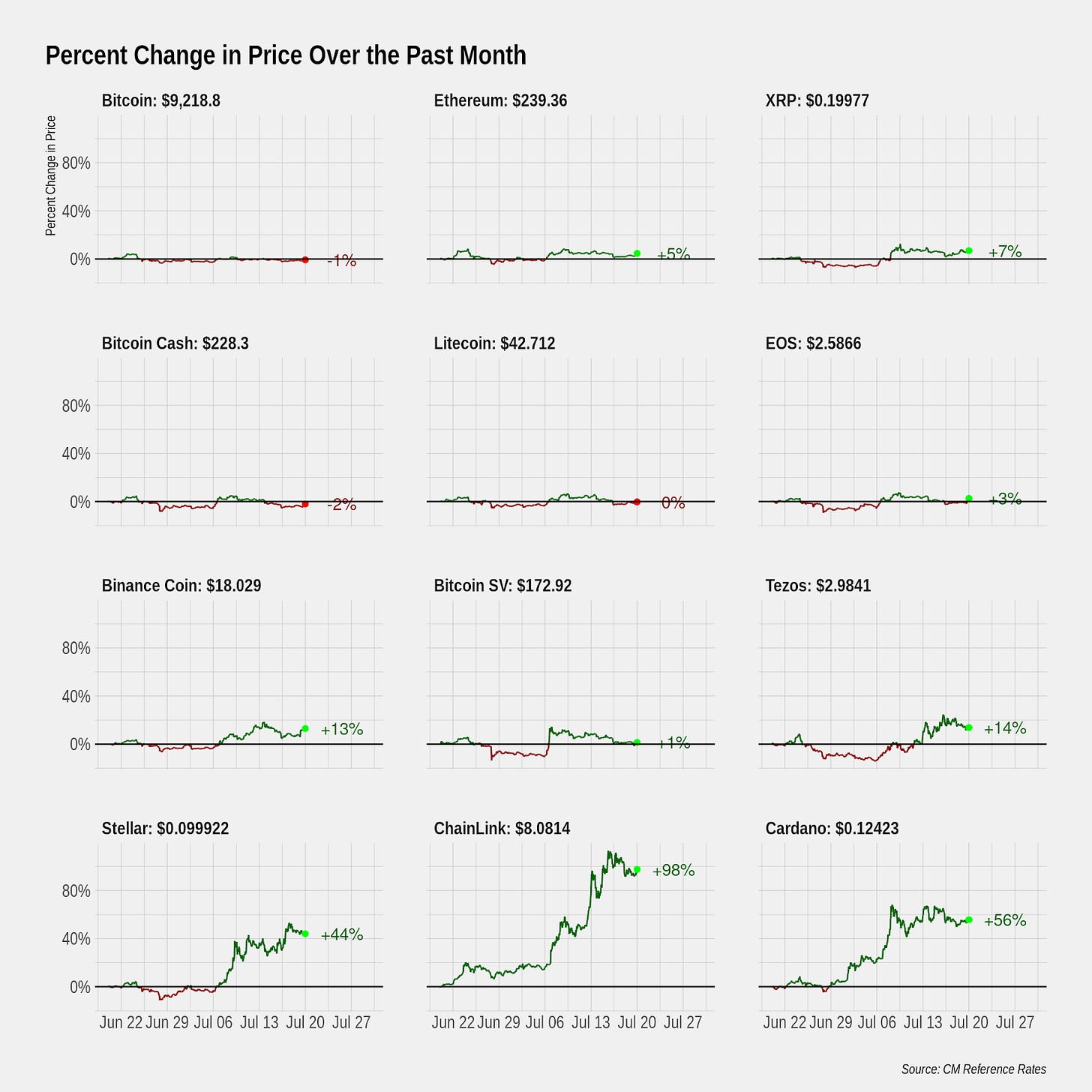

It was a relatively sleepy week for the markets, with one big exception: ChainLink. ChainLink continues to defy gravity and pushed through to a new all-time high price this week of $8.80. This is happening on the continued tail of a euphoric period of momentum for altcoins.

Source: Coin Metrics Reference Rates

ChainLink has continued to increase its market share of spot volume as well, now making up roughly 9% of the rolling 7 day average.

Volatility continued to drift lower for all the major assets and the long volatility trade continued to get crushed. We reported on this trend back in June as holding below these levels for less than 20 days in a majority of cases. We are now at day 41.

CM Bletchley Indexes (CMBI) Insights

Most CMBI and Bletchley Indexes finished the week slightly down, excluding the Bletchley 40 (small-cap), which significantly outperformed the rest of the indexes, returning 7.1%.

The CMBI Bitcoin Index was down 0.4%, continuing its streak of weekly performance in the ±3% range for the 7th straight week.

The strong performance of small-cap assets relative to the rest of the market can be witnessed in the returns of the Bletchley Total Even Index. This index is composed of the 70 constituent markets included in the B10, B20 and B40, weighting each constituent equally (1.43%). The result is much greater exposure to small-cap assets (57.1%) than its market cap weighted peer, which allocated Bitcoin a 65% weighting and small-caps collectively only 1.6%.

For further detail on the performance of the CMBI Bitcoin Index and CMBI Ethereum Index, please check out the CMBI Single Asset Index Factsheet.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Coin Metrics is pleased to announce the release of a new Network Data Visualization offering. Come check it out at https://network-charts.coinmetrics.io

As always, if you have any feedback or requests, don’t hesitate to reach out at info@coinmetrics.io.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.