Coin Metrics' State of the Network: Issue 31

Tuesday, December 24th, 2019

Weekly Feature

Revisiting the Block Reward Halving Theory

by Kevin Lu and the Coin Metrics Team

The upcoming block reward halving for Bitcoin, anticipated in May 2020, has already given rise to intense discussion about its potential impact. Several theories have been advanced to study supply-side dynamics surrounding halvings and its eventual impact (or lack thereof) on cryptoasset prices. But up to this point, the short history and infrequent nature of block reward halvings have prevented us from drawing strong conclusions.

In this article, we evaluate commonly proposed theories surrounding block reward halvings through the lens of the most recent instance: Litecoin’s halving that occurred in August 2019.

History of Block Reward Halvings

As a byproduct of mining, proof-of-work networks distribute new coins into circulation through block rewards. Block reward halvings are a common characteristic built into the protocol of Bitcoin-derivative proof-of-work coins as a means to gradually reduce the supply issuance. Other proof-of-work coins adjust issuance every block and/or do not have halving-induced supply shocks.

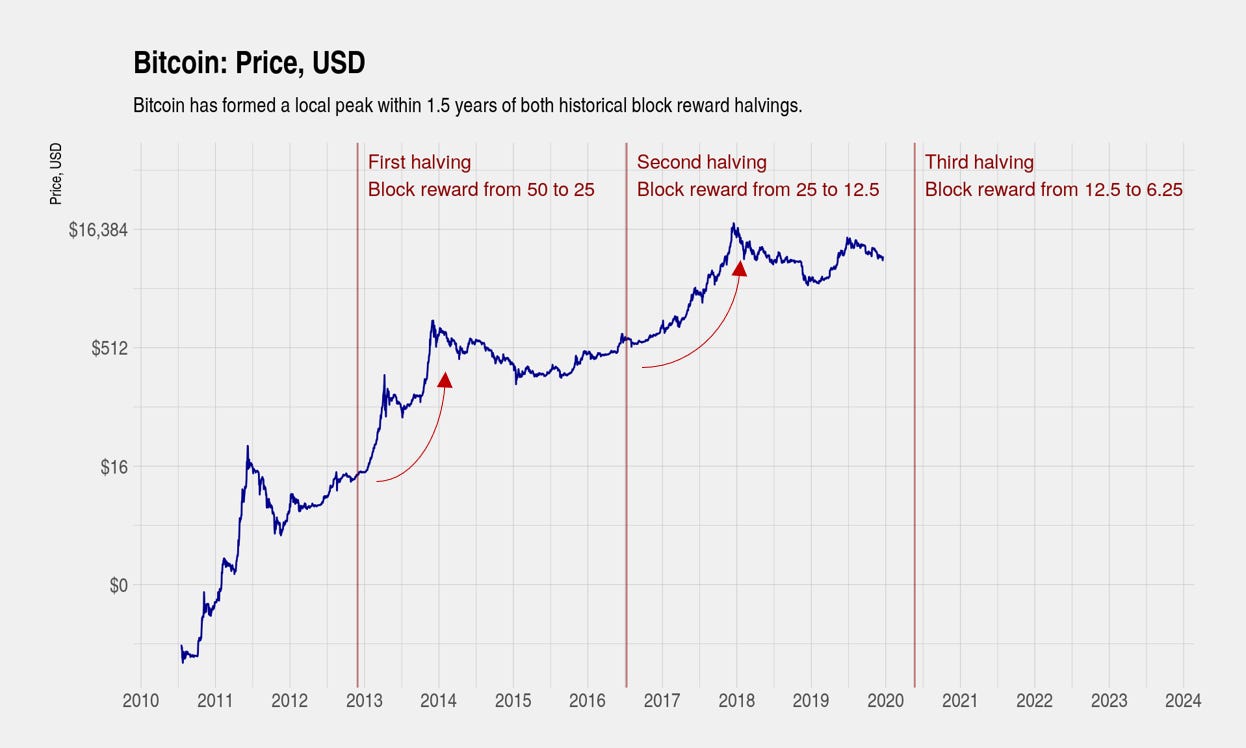

Bitcoin has experienced two block reward halvings and Ethereum has similarly experienced two block reward reductions. While Bitcoin halvings are mandated by the protocol, Ethereum has a less transparent issuance model. There has, however, been broad consensus for the Ethereum block reward to trend downward over time and for eventual issuance to be maintained at a low level as the network shifts to a proof-of-stake model.

The few historical instances of block reward reductions have been associated with increases in price in Bitcoin and Ethereum within the first 1.5 years of the halving. For this reason, an upcoming block reward reduction is often cited as a reason to be bullish about an asset’s future price appreciation.

Litecoin was initially launched in October 2011 as a fork of Bitcoin. The Litecoin issuance model is similar to Bitcoin's except that blocks are produced every 2.5 minutes, and the total supply of Litecoin will eventually be capped at 84 million. Block rewards are halved every four years, assuming that blocks are produced on average every 2.5 minutes.

Litecoin experienced its first block reward halving in August 2015 when the block reward halved from 50 LTC to 25 LTC. The second halving occurred in August 2019 when the block reward halved from 25 LTC to 12.5 LTC.

Theory: Block Reward Halvings are Priced In

There is intense discussion regarding whether block reward halvings are priced in. In one camp, proponents of the efficient market hypothesis (EMH) state that block reward halvings are mandated in the protocol and are well-known to all market participants far in advance. Since all information regarding halvings is already known, any impact that halvings have on supply-side dynamics or price should be fully reflected in the cryptoasset’s price. Furthermore, demand should not change since the issuance rate schedule and final supply are already known. Indeed, for Litecoin, the approximate dates of each of the halvings that have occurred (and all future halvings) were known when the protocol was launched in October 2011.

Detractors of this theory state that not all market participants are aware of the existence or significance of halvings and will still act on this phenomenon when discussion increases as the halving date nears. While this may be true, this is not incompatible with the theory that halvings are priced in. The EMH does not require all market participants or even a majority of market participants to be aware of information for prices to fully reflect that information. In fact, all that is required is the existence of a small fraction of market participants who control enough capital and act upon this information to force prices to react.

Detractors of this theory also point to empirical evidence which shows that historical halvings have been associated with positive returns, arguing that the historical halvings were not priced in, and the trend is likely to continue. This argument deserves further consideration. Here, we propose an alternative theory which attempts to reconcile the arguments made by both sides.

On one hand, empirical evidence supports a narrow interpretation of the efficient market hypothesis -- at the instant that a halving occurs, there is no immediate reaction in the price, either up or down, as no new information has been revealed. On the other hand, halvings can still impact prices over a period of several months to years, not because new information is revealed, but because market participants understand the impact of a reduction in miner-led selling (discussed more fully below) and anticipate actions by other traders in a reflexive, game theory-like manner.

Litecoin’s price performance this year supports the theory that market participants anticipate halvings and act on halvings by bidding prices up in advance. Among major cryptoassets, Litecoin experienced one of the strongest price appreciations this year, increasing in price by 350% between January 2019 and July 2019. Over the same time period, this performance was second only to Binance Coin and far outpaced the gains seen in Bitcoin, Ethereum, XRP, and Bitcoin Cash.

While all information regarding halvings is widely known, the evidence suggests that market participants still act upon halvings in part because of a strong narrative that halvings are positive for prices. Even if no logical cause-and-effect relationship exists between halvings and prices, the narrative (or belief that others will act on this narrative) can cause a self-fulfilling increase in prices as market participants attempt to enter positions in advance of other market participants doing the same thing.

In Litecoin’s case, this game theory-like “anticipation trade” caused prices to run up and sell-off in advance of the halving as market participants attempted to time their entries and exits while anticipating the actions of others. Poor performance of Litecoin’s price after the halving could be explained by a continuation of traders unwinding their positions, although Litecoin’s year-to-date performance is still among the strongest of the major cryptoassets.

Theory: Reduction in Miner-Led Selling Pressure

The protocols of major proof-of-work coins adjust the difficulty of the proof-of-work calculation regularly to ensure that blocks are produced at regular intervals. Mining represents a near perfectly competitive industry that constantly seeks a steady state where miner revenue is only slightly above miner costs. When the state is far from this equilibrium, miners will either enter or exit the industry until the equilibrium is achieved.

Miners earn revenue in the form of native units of the cryptoasset they are mining, while their variable costs (primarily in the form of electricity) must be paid in fiat currency. This, combined with the fact that miners must, in the long-run, operate at a profitability level that is only slightly above breakeven, means that they represent the single largest cohort of natural, consistent sellers. According to this theory, miner-led selling pressure is likely significant, small perturbations in the amount they sell can have an impact on prices, and a halving of this selling flow may eventually have a large impact on prices.

To illustrate, Litecoin’s annualized supply issuance since the halving has been running at around 4%. At current prices, this means that miner revenue denominated in U.S. dollar terms is roughly $100 million per year. Under the theory that miners must sell nearly all of their holdings for fiat, this is equivalent to nearly $300,000 in natural selling pressure every day over the course of an entire year.

Immediately prior to the halving, these figures were doubled -- issuance was running at 8% and daily selling pressure was $600,000. Such a drastic reduction in compelled selling pressure should be supportive to prices going forward. Importantly, this reduction in selling flow occurs regardless of the degree to which the halving was priced in or anticipated by market participants.

Detractors of this theory point to the relatively small amount of volume that can be attributed to miners compared to all trading volume that occurs within exchanges or on-chain. Indeed, compared to these much bigger figures, miners appear insignificant. Although data is not readily available on capital inflows and outflows into a cryptoasset, it is likely that the majority of trading that occurs within exchanges and on-chain do not represent a net inflow or outflow of fiat. Under this perspective, miner-led selling pressure may represent a large amount of net capital outflow of a cryptoasset.

The Current State of Litecoin

Although still one of the strongest performers this year, Litecoin’s performance after the halving has been quite negative, perhaps reflecting an unwinding of the “anticipation trade”. Any positive price pressure as a result of a halving of miner-led selling flow has yet to occur or has been overshadowed by the unwinding of the anticipation trade.

The halving of the block reward combined with the decline in prices have caused a sharp decline in mining difficulty. Current difficulty is approaching two year lows and have already exceeded the lows during the depths of the market-wide sell-off in December 2018.

Looking at the one-month change in mining difficulty reveals that after the halving, difficulty declined at the fastest pace ever. Litecoin mining is clearly in a state where a significant number of miners are operating with a loss and/or less cost-efficient miners are exiting the industry.

Inventory management of miners is not a well-studied topic since access to this information is not available, but it stands to reason that each miner makes their own decision on how much of their block rewards to sell for fiat and when to sell it. Since miner variable costs are relatively constant in fiat terms, during periods of rising crypto prices, miners are required to sell less of their block rewards to cover their expenses. On the other hand, when crypto prices are falling, they are required to sell more. Under this theory, miners have a procyclical effect on the market, in that they further exacerbates price increases during periods of increase and vice versa.

During periods of capitulation, miner-led selling flow is likely to be high. Miners may play games of chicken in which miners that are barely profitable are attempting to hold on, perhaps even willing to temporarily operate at a loss, until less cost-efficient miners exit the industry. Miners may even be willing to sell block rewards earned in prior periods that they kept on their balance sheet to be used in an attempt to outlast other miners.

Although this has not yet occurred, Litecoin difficulty will likely eventually stabilize as all unprofitable miners exit the network. The culling of inefficient miners combined with the halving of the block reward should eventually result in a significant reduction in miner-led selling flow and could be supportive of prices going forward.

Coin Metrics is actively researching miner flows by tracking the movement of block rewards from miners to other entities in the ecosystem. We hope to publish more information on this topic as our understanding grows.

Current market value to realized value (MVRV), calculated as market capitalization divided by realized capitalization, is significantly below 1 and is approaching levels close to all-time lows. At current prices, most Litecoin holders are now underwater with values below their cost basis. Historically, low levels of MVRV for Bitcoin have marked good entry points and have accurately identified periods of undervaluation.

Conclusion

Several theories have been advanced to explain the impact or lack of impact of block reward halvings and active debate continues over whether block reward halvings are priced in and whether reductions in miner-led selling are impactful to prices. The few historical instances of block reward halvings, including Litecoin’s recent halving this year, deserve continued study. Over the course of 2020, a number of major cryptoassets are scheduled to experience a block reward halving, including Bitcoin, Bitcoin Cash, Bitcoin Cash SV, and ZCash, all of which will provide additional opportunities to test the current set of halving-related theories.

Network Data Insights

Summary Metrics

BTC showed some early signs of recovery this past week, after a mostly negative December. Although BTC market cap was still down week-over-week, BTC estimated hash rate grew by over 10%. ETH, LTC, and BCH hash rate, however, all dropped by at least 2.9%, with ETH experiencing the largest drop of 8.3%. This is a potential signal that BTC may be gaining even more ground on the major cryptoassets in the wake of the latest downturn.

ETH, on the other hand, continues to slide, losing over 10% of market cap week-over-week. Despite the drop in market cap, ETH active addresses, transaction, and fees all increased week-over-week, which could be a sign that ETH usage is somewhat independent of market cap.

Network Highlights

Bitfinex’s BTC supply has increased sharply over the last month, despite the decrease in BTC price. Bitfinex held 204,150 BTC on December 22nd, up from 154,996 BTC on November 22nd.

BitMEX’s BTC supply has also been increasing over the last month, despite an email leak that exposed client email addresses. On November 1st, it was reported that BitMEX suffered a security breach that caused over 23,000 email addresses to be leaked. Since then, BitMEX’s BTC supply has increased from 246,937 to 255,741 back to near all-time highs.

Market Data Insights

This week, the market has staged a recovery off the lows experienced on December 18, although many assets are still down over the past week. Bitcoin (+5%) has been one of the few assets that increased in price in addition to TRON (+7%). Tezos (-13%) has continued to decline despite the market staging a recovery in the past few days.

Ethereum Classic (+10%) is the strongest performing asset among this set. Huobi Token (+5%), Maker (+2%), and UNUS SED LEO (+1%) also sustained small gains for the week.

CM Bletchley Indexes (CMBI) Insights

Crypto assets had a very volatile week, ending with mixed results across the market. For the first time in months, Bitcoin not only outperformed most of the market, but was one of few assets that returned positive weekly gains. This is reflected in the below charts where only the Bletchley 10 (~70% BTC) and Bletchley Total (~66% BTC) were positive performers. The negative performance of the even indexes, which lower the weight of BTC, are testament to the fact that most of the Bletchley 10’s and Total’s positive performance was due to BTC.

This pattern was a sustained phenomena during early 2019 when BTC rose from $4k to $14k with very few other crypto assets managing to keep up. It will be interesting to monitor this over the coming weeks to see if markets will repeat their early 2019 trend.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Coin Metrics is hiring! We recently opened up 6 new roles, including Blockchain Data Engineer and Data Quality and Operations Lead. Please check out our Careers page to view the openings.

As always, if you have any feedback or requests, don’t hesitate to reach out at info@coinmetrics.io.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.