Coin Metrics' State of the Network: Issue 6

Tuesday, July 2, 2019

Intro and Updates

Dear crypto data enthusiasts,

Welcome back to this week’s edition of Coin Metrics’ State of the Network, an unbiased, focused view of the crypto market informed by our own network (on-chain) and market data.

This week’s housekeeping items:

Coin Metrics is hiring! Please check out our Careers page to view the openings.

For those in the U.S., have a happy Fourth of July!

As always, if you have any feedback or requests, don’t hesitate to reach out at info@coinmetrics.io.

Weekly Feature

Litecoin Will Test the Block Reward Reduction Theory in August 2019

Litecoin’s block reward halving, anticipated to occur in August 2019, will test the effect that halvings have on prices and market cycles. Additionally, it serves as a catalyst for a series of events that affect both miner and market participant behavior.

The Litecoin issuance model is identical to Bitcoin's except that blocks are produced every 2.5 minutes, and the total amount of Litecoin is capped at 84 million. The block reward initially started at 50 units per block in October 2011 and halved to 25 units per block in August 2015. The block reward is anticipated to be halved again to 12.5 units in August 2019.

Bitcoin has experienced two halvings and Ethereum has similarly experienced two reductions in its block reward. Although the short history and infrequent block reward reductions prevent us from drawing strong conclusions, the limited track record of a block reward reduction’s impact on prices (principally for Bitcoin) is quite strong. Because of this, an upcoming block reward reduction is often cited as a reason to be bullish about an asset’s future price appreciation. Litecoin will test this theory in the coming months.

Market Participants Price in the Impact of Block Reward Halvings

Market participants anticipate the impact of the block reward halving by bidding up prices in advance. This occurs because they understand the impact of reduced mining-led selling pressure post-halving. Market participants also position in advance because, much like technical analysis, they believe others will act similarly in response to this event, thus becoming self-fulfilling.

During Litecoin’s first block reward halving in August 2015, prices had bottomed 7 months earlier with peak-to-trough price gains over 600% -- far exceeding the gains in Bitcoin and other assets. Although other assets that experienced halvings managed to sustain these price gains post-halving, the reaction in Litecoin’s prices were confounded due to suspicious on-chain activity immediately preceding the halving. Nearly 9 million Litecoin cycled through a single address, representing about 22% of all Litecoin in existence. There was widespread speculation that a Chinese ponzi scheme was behind the address, but this has not been confirmed. Transactions from this address peaked in July 2015 -- the same month that Litecoin experienced a local peak in prices. Significantly, prices stemmed their declines immediately after the first halving and recovered slightly in the months that followed.

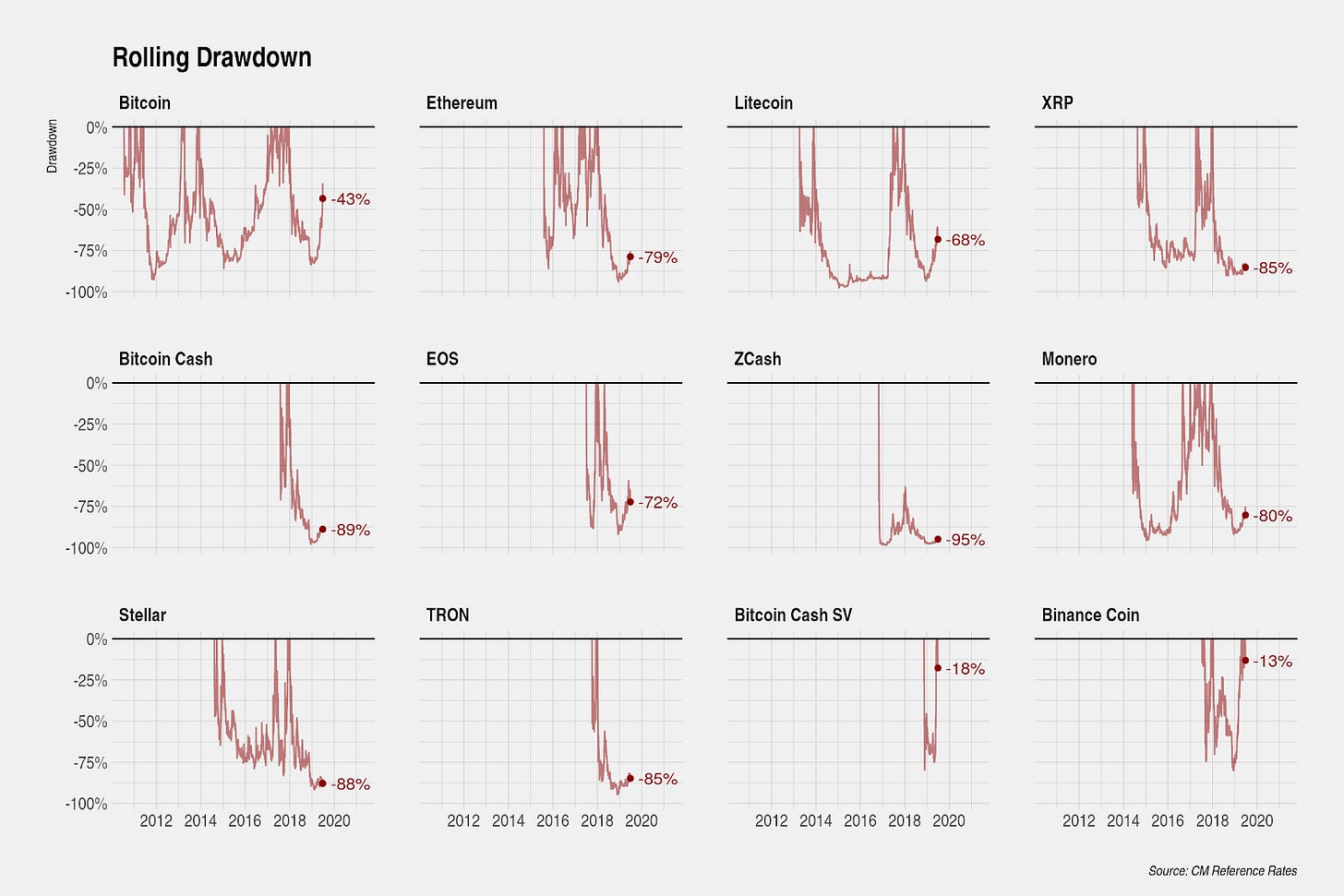

As the second halving approaches, Litecoin is one of the best performing assets in the current market cycle. Litecoin has returned +52% over the past year and is only 68% below its all-time high.

Miners Are a Continuous Source of Selling Pressure

Miners represent a significant and continuous source of selling pressure for any proof-of-work coin. Because miners operate as large-scale businesses and face recurring fiat-denominated operational costs (primarily the cost of electricity), miners must regularly sell some of their block rewards to cover costs. And since mining represents a perfectly competitive industry where profits are constantly seeking a steady state of zero economic surplus, the majority of miner block rewards must be sold for fiat. The selling pressure from miners is significant. In 2018 alone, Litecoin miner revenue totaled nearly 5.3 million native units, equivalent to $561 million in U.S. dollars.

Current annualized inflation is 9% and is anticipated to decline to 4.4% post-halving. This represents a significant drop in miner-led selling pressure. Although the actual amount of Litecoin sold by miners varies depending on how breakeven costs evolve relative to current prices and the degree that miners speculate on future prices, the maximum amount that miners can sell will be halved, leading to a large reduction in selling pressure.

Thus, even if market participants rightly anticipate the impact of block reward halvings months in advance, once the halving actually occurs, the reduced selling pressure can lead to continued increases in prices post-halving.

Block Reward Halvings Force Inefficient Miners from the Network

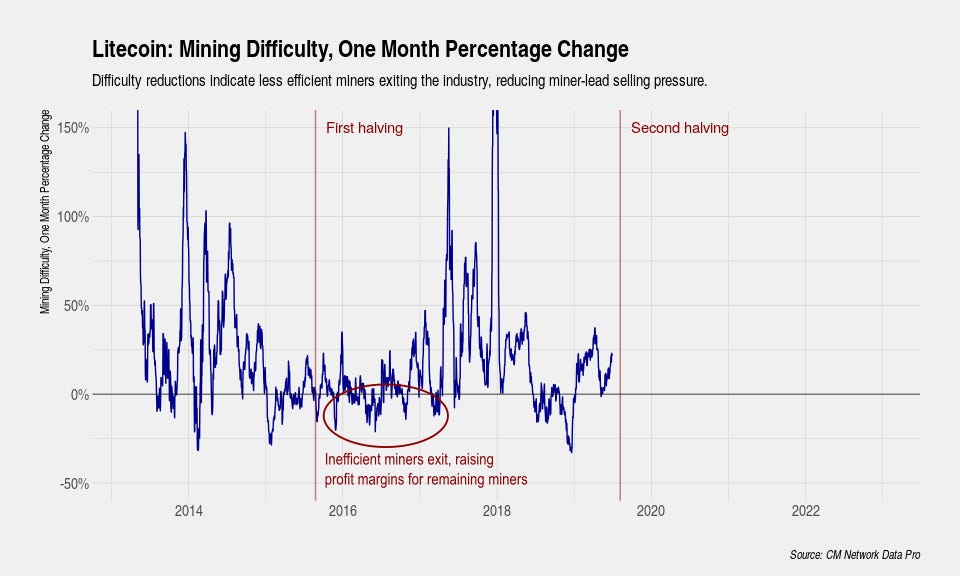

At the instant that the halving occurs, block rewards will be reduced by 50% but the mining difficulty will, for the moment, remain constant. For a time, miners will have to expend the same amount of electricity to mine fewer Litecoin, drastically reducing profit margins for miners as a group and raising the breakeven cost above the cost of production for certain inefficient miners.

Unprofitable miners that cannot increase their mining efficiency will eventually leave the network. Litecoin adjusts its mining difficulty every 2016 blocks (roughly once every 3.5 days) to target a block production time of 2.5 minutes. For the first year after Litecoin’s first halving, mining difficulty growth was flat or negative, culminating in a miner capitulation in mid-2016. Due to increases in mining technology, any flat or negative difficult growth is an extremely rare event.

As inefficient miners leave the network, the aggregate efficiency of remaining miners rises. Thus, the block reward halving leads to a second-order effect that supports prices. Not only do halvings reduce the maximum amount of Litecoin that can be sold, it also increases the profit margins of miners that remain in the network once inefficient miners leave the network. Since the profit margin of miners is higher, they can sell less of their Litecoin to cover fiat-denominated expenses, further reducing selling pressure.

Summary

Block reward reductions play a key element in fueling cryptocurrency market cycles. Litecoin’s upcoming block halving should serve as a catalyst for a series of events:

First, market participants bid up prices in advance of a block reward reduction because of an increase in perceived scarcity and in anticipation of other market participants acting similarly to the event.

Second, miners are a large source of continuous selling pressure. The block reward reduction reduces the maximum amount that miners can sell, reducing selling pressure going forward.

Third, the block reward reduction forces inefficient miners from the network thereby raising the aggregate efficiency and profit margins of remaining miners. Miners begin selling less block rewards and retain more as profits, further reducing selling pressure.

So far, Litecoin is following the market cycle pattern established by other major assets that have experienced block reward reductions. As the block reward halving occurs, we expect the other events to occur.

Network Data Insights

Summary Metrics

Amidst the recent price surge, network activity increased across all five of the top crypto networks over the past week. Bitcoin led with surges in mining revenue, transfer value, and daily fees (growing 26%, 38%, and 55% respectively) during its 19% rise in market cap with Ethereum seeing the next most gains. Interestingly, Bitcoin Cash saw a decline in its hash rate of 11% while Bitcoin saw a rise of 8% perhaps suggesting that some miners switched from mining Bitcoin Cash to Bitcoin during BTC’s recent price increase.

Finally, the differences between transactions and transfers between Bitcoin and Ethereum are worth highlighting. Bitcoin has a much larger number of transfers compared to transactions whereas the opposite is true for Ethereum. What’s behind this?

Batching -- defined as a transaction with three or more outputs -- has become increasingly common as a way for mining pools and exchanges to save on fees and increase efficiency when transferring BTC. You can read more about batching at our blog here. Batching is the likely culprit behind the disparity between the number of transactions and transfers observed for Bitcoin (as a reminder, transfers measure the movements of native units from one address to another distinct address so one transaction can include multiple transfers). Conversely, because of the rise in contracts and ERC-20 tokens, Ethereum has a much higher transaction count than transfer count (note: only ETH transfers are counted) meaning users are conducting many more transactions that don’t involve the transfer of ETH than those that do (this could include transfers of tokens or non-transfer operations).

Network Highlights

Bitcoin addresses holding at least $1 are rapidly approaching an all-time high. Bitcoin addresses holding at least $1 peaked at 22,080,252 on 1/10/18. As of 6/30/19 there are 19,568,778, up from 14,535,957 on 1/1/19:

Similarly, BTC median transaction fees are on the rise. BTC median fees reached $3.50 on 6/27/19, which is the highest they have been since February 2018. This is still far off from the all-time high of over $33 on 12/23/17, but signals that the network is starting to trend towards larger transfers:

Market Data Insights

As the second quarter of 2019 comes to a close, we review the performance of major assets over the past three months. One of the critical narratives affecting prices this quarter is increased regulatory scrutiny, particularly in the United States. Although the SEC and other national regulators have maintained a cautious tone in public statements, exchanges have already begun responding.

This quarter, Poloinex, Bittrex, Binance, and Gate.io all took steps to restrict U.S. investors from investing in a number of smaller assets, citing regulatory uncertainty. In its most public demonstration that the SEC will be unyielding in its interpretation of existing securities law, it sued Kik for illegally raising $100 million in an unregistered securities offering.

This quarter, assets that are less at risk of being deemed a security outperformed by large margins. Bitcoin led major coins with a +144% return in the quarter, although other assets like Ethereum (+99%), Litecoin (+90%), Bitcoin Cash SV (+184%), and Ethereum Classic (+53%) all saw strong gains. ZCash and Monero, assets that are slightly less regulatory-friendly due to their privacy features, achieved moderate gains.

The laggards in this quarter were smaller assets that U.S. investors cannot access in the future. Most smaller assets only achieved modest gains despite the large rally in the large cap assets. Some assets like Tezos (-12%) and Maker (-18%) even declined during the quarter.

CM Bletchley Indexes (CMBI) Insights

After three consecutive weeks of positive price action for the Bletchley Indexes, this week (Sunday midnight UTC to Sunday midnight UTC) all but one index experienced a price correction. Interestingly, with the exclusion of Bitcoin, it was the large cap assets that fared the worst this week. This is evidenced by the Bletchley 10 Even performing the worst, returning -12% for the week.

As has been discussed in previous issues, June’s performance reflects the dominance of Bitcoin throughout the month compared to its peers. Further, the monthly performance of the Bletchley 20 and Bletchley 40 demonstrate how alt assets have largely not contributed to the positive performance of the market this month.

There is an odd result in both the weekly and monthly charts, the Bletchley 20. In both cases the Even index significantly outperformed the market cap weighted index and experienced positive returns. This can be explained by the exceptional performance of Chainlink (2.1% of Bletchley 20 and 5.0% of Bletchley 20 Even), which finished the week up 100% after a Coinbase listing and the month up near 300% after many partnership announcements.

Monthly rebalancing was completed as of 01:00 UTC on 7/1, with a cut-off date of 6/28. Changes to index constituents are as follows:

Subscribe and Past Issues

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.