Get the best data-driven crypto insights and analysis every week:

Digital Alchemy: Do Coinbase Listings Turn Altcoins Into Gold?

By Jon Geenty and the Coin Metrics Team

Key Takeaways

A Coinbase listing has historically shown, not surprisingly, to have a positive impact on listed assets’ prices immediately following the announcement.

The uplift from a listing is more muted than some may perceive, with the average and median uplift ranging from roughly -1% to 14% against US Dollar, Bitcoin and Ethereum benchmarks. Price trends seen with assets such as the recent OmiseGo listing are outliers.

Coinbase’s ‘Exploration’ announcements tend to have less of a direct impact on mentioned asset’s prices. The price movements surrounding these events are less significant and largely related to the general market regime at time of announcement. We compare these changes in a bearish, bullish and flat market using past examples.

Does a Coinbase Listing Always Deliver Results?

With the recent rise in altcoin prices and volumes, it is as good a time as any to discuss a phenomenon that typically elicits a lot of trading activity: The Coinbase listing.

Exchanges with a significant amount of market share at times can be “king makers” for altcoins. The simple suggestion or rumor that you will be listed on a top exchange has the potential to turn a valueless crypto “bag” into a large profit. Binance, Bittrex and Poloniex are exchanges known for listing the long tail of altcoins, but what about Coinbase?

With the industry consensus being that Coinbase is the largest ‘retail’ onramp, the impact of a Coinbase listing should hold some significance on assets that might make the cut. However there is another big factor that influences the impact of the listing: market conditions.

In this piece, we explore three separate instances that Coinbase announced they would be exploring new assets for potential listing, and analyze how the assets performed afterwards. Additionally, we explore the market conditions at time of announcement, and how different market environments (bear vs. flat vs. bull) impact the listings.

Source: Coin Metrics Reference Rates

Methodology

For details on the methodology used in this piece see the full-length report on the Coin Metrics blog.

The Impact of the Possibility of Listing

December 2018 - Bear Market

On December 7, 2018, Coinbase announced the ‘exploration’ of 31 assets for potential listing. The below chart shows the median and mean performance for the mentioned group against different benchmarks.

Prior to that announcement the assets were generally tumbling in price. It is important to put in context of the asset class, with the 25 day prior mark being mid-November 2018. During this period, Bitcoin sold off from ~$6,350 to ~$3,200, the lowest range that we have seen since the 2017 peak. This is reflected in the following chart, which shows asset price change in USD.

This announcement date precedes this “bottom” by a few days. In the period following these assets saw rebounds in value and over the following 100 days appreciated generally 50% in price against Bitcoin. The histogram below displays how the appreciation changed over time, from a tightly distributed decline in the 10 days immediately following the post to a broader, more positive distribution over the following 100 days.

August 2019 - Flat, Choppy Market

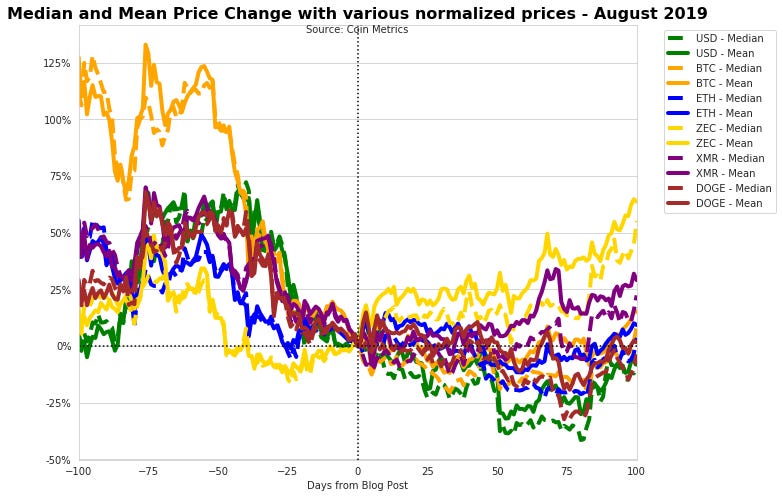

The group of assets in the second ‘exploration’ blog post in August 2019 was a much smaller sample size than the first, with only eight assets.

The market environment had also changed significantly. In this period Bitcoin had just hit 2019 highs in July and was trading in a choppy range between $12k and $8k, trending down.

Continue Reading

Continue reading the full article including analysis of the June 2020 blog post and impact of actual listings.

Network Data Insights

Summary Metrics

Source: Coin Metrics Network Data Pro

On June 9th and 10th ETH daily transaction fees soared past BTC daily fees due to two transactions that each inexplicably spent $2.6M on transaction fees (as covered in the Network Data section of State of the Network Issue 55). Although there is still confusion around the exact reason for the high fees, the sender has been revealed to be South Korean based peer-to-peer exchange Good Cycle.

ETH fees appear to be down because there were no more anomalous transactions this week, and therefore this week’s fee totals pale in comparison to last week’s. But ETH fees have actually been trending upwards over the last few weeks, as explored in this week’s Network Highlights section.

Network Highlights

Over the last two weeks ETH has flipped BTC in terms of daily transaction fees. Despite the obvious outliers due to the two mysterious transactions, ETH fees have continued to top BTC’s following June 10th. The last time that ETH fees topped BTC fees for at least 14 consecutive days was July 2018.

Source: Coin Metrics Network Data Pro

Although ETH total fees have surged, BTC median fees are still higher than ETH median fees. Over the last week, BTC median fees have fluctuated between about $1 and $1.50, while ETH median fees have remained between $0.47 and $0.65. ETH median fees have, however, grown significantly since the beginning of the year. On January 1st, 2020, ETH median fees were a little less than $0.04.

Source: Coin Metrics Network Data Pro

ETH blocks have also been getting increasingly full over the last few weeks. Relatively full blocks shows that there’s demand to use the network. To address the increase in block fullness, on June 20th Ethereum miners voted to increase the network’s gas limit by 25%. This is reflected in the following chart, which shows both the gas limit per block and the gas used per block.

Source: Coin Metrics Network Data Pro

Market Data Insights

The Compound Effect

While the overall market has remained little changed over the past month with volatility near record lows for this market cycle, Compound’s launch of their governance token has ignited interest in the decentralized finance space. The amount of collateral locked within the Compound platform has surpassed Maker due to their implementation of liquidity mining -- paying out a certain amount of Compound tokens to borrowers and lenders on the platform.

Compound token’s rapid price growth has been reflected in most other DeFi tokens such as Aave, Maker, Bancor, and Kyber Network. This is suggestive of behavior last seen during the ICO-driven market bubble, although Ren and 0x’s muted price performance indicates that some rationality persists.

While financial asset bubbles in mature markets are generally undesirable, financial bubbles in rapidly emerging markets such as DeFi can be a good thing in the long-run because it can incentive the build out of additional infrastructure that normally would not be economical.

Source: Coin Metrics Reference Rates

Tether Supply Growth is Slowing

Since the beginning of the coronavirus-related lockdowns, Tether supply growth has been extremely strong. Here we show Tether’s free float supply, a measure of supply that represents the amount of supply freely available for purchase by investors. Notably, it excludes Tether that has been issued but not yet released. This year, a fairly steady rate of growth brought total Tether free float supply from around 5 billion units to 9 billion units. In just the past few weeks, however, Tether supply growth has slowed considerably, although it is still positive.

Source: Coin Metrics Network Data Pro

Although the assumption that Tether is fully backed by fiat currency is tenuous and not fully proven, one interpretation of Tether supply growth is that it represents new capital inflows into the space. The common narrative is that Tether is printed, sent to exchanges, and then used to purchase Bitcoin or other cryptoassets. Here we plot one-month Bitcoin price growth with one-month Tether supply growth to examine the connection. Recent data points to a tight correlation between the two time series. As Tether supply growth has slowed, Bitcoin’s price growth has also attenuated.

CM Bletchley Indexes (CMBI) Insights

CMBI and Bletchley Indexes had a relatively flat week with the exception of the Bletchley 40 (small-cap) Index which closed the week up 7.4%. The CMBI Bitcoin Index and the CMBI Ethereum Index both closed the week slightly down, falling 0.6% and 2.2% respectively.

With the CMBI Bitcoin Index down near historically low volatility levels, the large and mid-cap markets seem to be awaiting Bitcoin to make its next move before experiencing too much action. However, small-cap assets have performed independently and strongly this month, with the Bletchley 40 up 15% already. The Bletchley 10 and Bletchley 20 have seen little action, returning -2.5% and 0.1% respectively.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Coin Metrics is hiring! Please check out our Careers page to view the openings.

As always, if you have any feedback or requests, don’t hesitate to reach out at info@coinmetrics.io.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.