Coin Metrics' State of the Network: Issue 19

Tuesday, October 1, 2019

A double header this week: This week’s issue has two weekly features. The first is about the recent market sell-off, and the second is about the recent BTC hash rate dip.

Weekly Feature # 1

Belief in Bull Market Remains Unchanged Despite Large Market Sell-Off

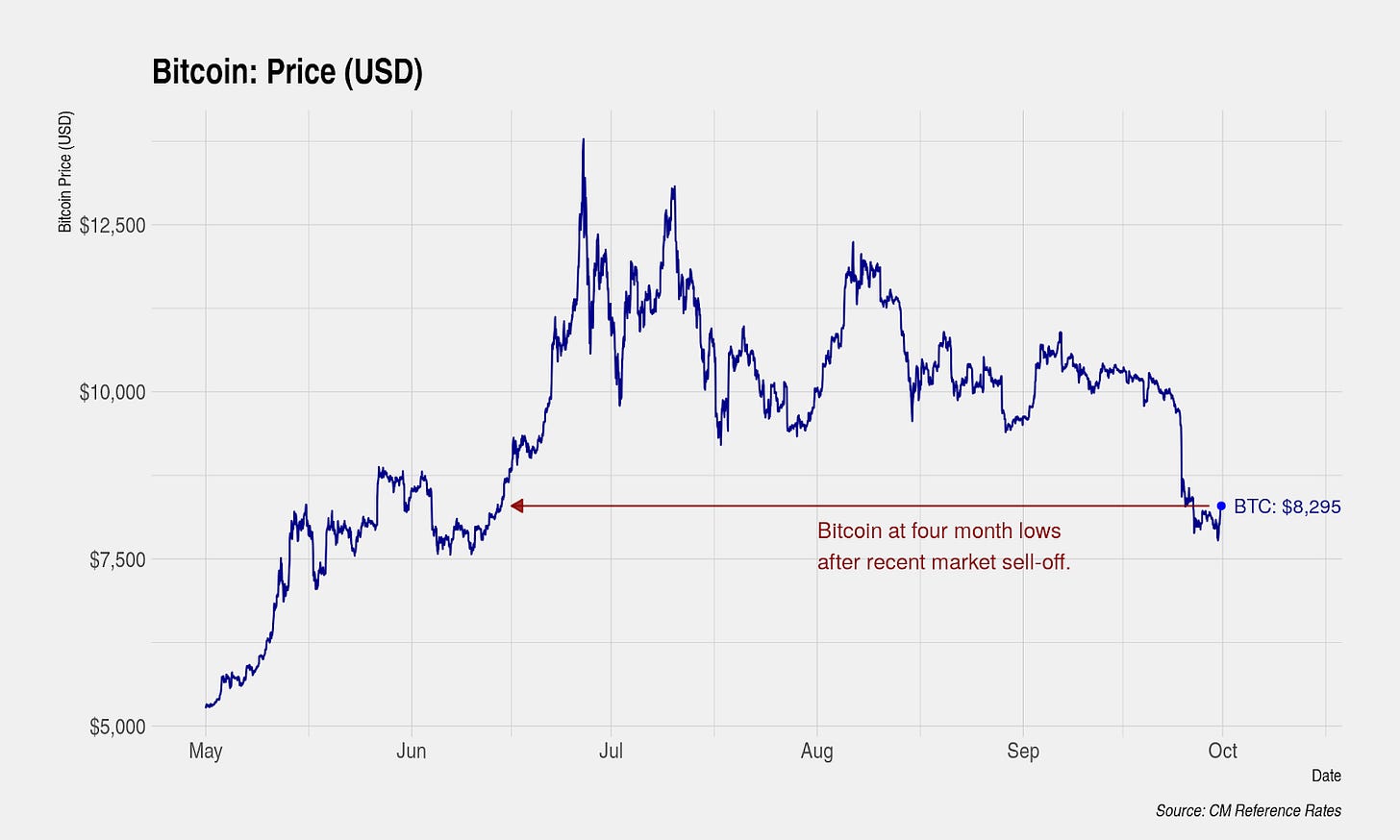

Crypto markets were hit hard last week. Bitcoin experienced the largest single-day decline in price in 2019 and reached lows not seen since mid-June. All major assets are down roughly 20 percent or more with no clear catalyst.

Analysis of on-chain activity indicates that selling pressure during the market sell-off came primarily from short-term traders that last acquired Bitcoin at prices between $10,000 and $12,000. Comparisons to previous market cycles indicate that drawdowns of this magnitude are rare but to be expected. Although several narratives have been proposed as to the cause of this market sell-off, the mean-reverting nature of volatility combined with the increased use of derivatives appear to be the primary factor.

Selling Pressure Originated from Short-Term Traders that Acquired Bitcoin at Prices Between $10,000 and $12,000

Coin Metrics has previously introduced realized capitalization as an alternative to market capitalization. Instead of valuing each coin at the current market price (as market capitalization does), realized capitalization values each coin at the price of the last on-chain movement (e.g. if a coin was last moved in 2017 when BTC price was for $2,500, that particular coin would be priced at $2,500 instead of the current market price). This gives a more realistic measure of the economic significance of a crypto asset. Realized cap can be thought of as a measure of the average cost basis of Bitcoin holders (cost basis is basically the total amount originally invested).

Although we commonly use realized capitalization as a summary metric, an analysis of its composition reveals important information about the psychology of current owners. Here we present the current state of Bitcoin’s UTXO set, represented by the number of Bitcoin that last moved at a given price. For instance, approximately 4 million Bitcoin last moved when prices were between $0 and $500. And there are 1.2 million Bitcoin that last moved near the current price of $8,065.

Assuming that the price of the last on-chain movement is the cost basis of each Bitcoin, 63% of Bitcoin now have unrealized gains while 37 percent have unrealized losses. Most of the Bitcoin holders are unequally distributed at prices between $0 and $13,000. There are few Bitcoin with a cost basis above $13,000 as these holders have long since capitulated at lower prices and the remaining have likely converted into long-term, jaded holders.

Here we show the change in the number of Bitcoin in each cost basis bin between September 20, 2019 (the day before the start of the sell-off when Bitcoin was at $10,000) and today. An analysis of the change between the two dates reveals important insights into the psychology of various Bitcoin trader profiles.

One cohort of traders are owners with a cost basis above $13,000. Prior to the market sell-off, roughly 720,000 Bitcoin belonged to this cohort. Analysis of on-chain activity indicates that virtually all Bitcoin owned by this cohort remained dormant during the sell-off, suggesting that capitulation among these traders is complete. Only 4,140 of the 720,000 Bitcoin moved over the past nine days and did not contribute meaningfully to selling pressure. These traders have apparently become numb to a 20 percent drop in prices and are now firmly long-term holders.

Another cohort of traders are owners that acquired Bitcoin at prices between $10,000 and $13,000. This cohort represent fresh capital that recently bought in during the minor euphoria over the summer when prices reached new highs of this market cycle. Analysis of on-chain activity indicates that the majority of the selling pressure came from this cohort of traders and suggest that these short-term holders were protecting their positions by taking a moderate loss. A particularly large rotation was observed from the $10,000 cost basis bin to the $8,000 cost basis bin over the past nine days -- roughly 500,000 Bitcoin with a cost basis of $10,000 was sold over the past nine days and the $8,000 cost basis bin increased by 750,000 Bitcoin.

Finally, we have a third cohort of traders that acquired Bitcoin at prices below $8,000. These owners represent long-term holders with a strong long-term conviction in Bitcoin. Approximately 11.46 million Bitcoin belong to this cohort. Despite the extreme market movement, these holders have remained resolute in their market views -- only 150,000 of the 11.46 million Bitcoin were seen to have moved on-chain. Profit taking or panic selling was limited among these holders. This behavior indicates that for the majority of Bitcoin holders, the market view of Bitcoin being in a bull market remains unchanged.

Previous market cycles indicate that drawdowns of a magnitude similar to what we have observed since the market peaked early this summer are rare but not unprecedented. During the run-up to the 2017 bubble, Bitcoin price corrected by nearly 40 percent from peak in two circumstances, once in July 2017 and another in September 2017. If the $13,000 level is assumed to be a local peak, the current drawdown is also nearly 40 percent -- the edge of historical norms.

Given the activity seen from the current cohorts of traders, belief in Bitcoin’s bull market remains unchanged -- although this narrative could be challenged if price continues to decline or we start to see on-chain evidence of panic selling from long-term holders.

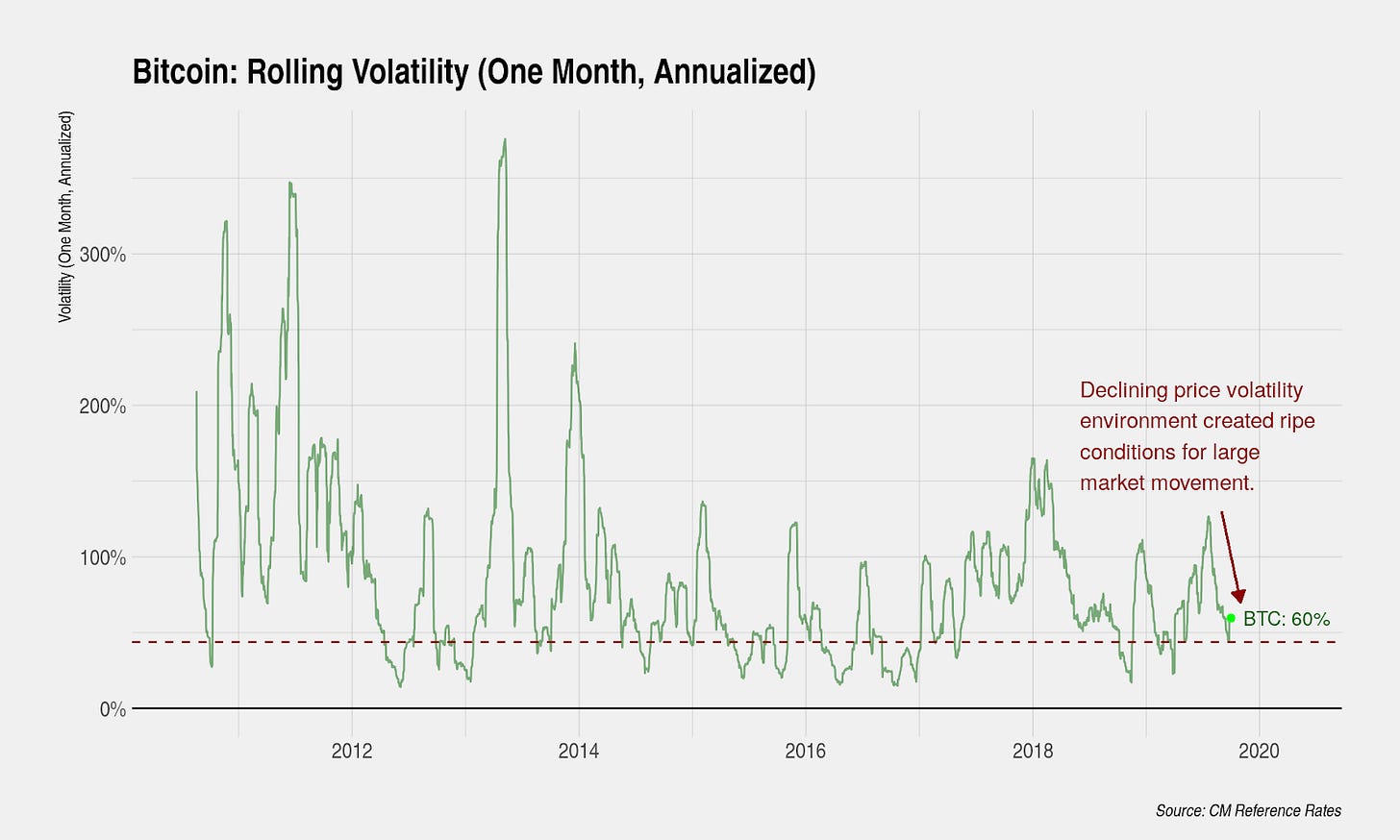

Mean-Reverting Nature of Volatility and Use of Derivatives Likely the Cause of Large Market Movement

The market environment immediately prior to last week were gradually building towards the conditions necessary for a large market movement. For roughly two months, Bitcoin traded within a short price range of between $9,500 to $11,000 causing short-term measures of realized volatility to drop to historical lows. Measured on a one-month rolling basis, annualized volatility of Bitcoin’s price reached 44 percent, well below its historical average and bringing it inline with the volatilities of traditional financial assets. Since the beginning of 2017, volatility has only been this low or lower only 3.5 percent of the time.

Here we can separate one-month rolling volatility into two distinct regimes, one prior to January 2017 and one after. Prior to January 2017, volatility tended to be low and stay low. After January 2017, which coincides with the start of the modern volatility era in which derivatives now have outsized impact, the lower bound of volatility is elevated and reverts rapidly when it reaches low levels.

Low periods of volatility are typically followed by high periods of volatility because under an environment of low volatility, traders extrapolate this state to the future and take on more risk in the form of borrowing or the use of leveraged instruments. As prices begin to move, margin calls and forced liquidations tend to reinforce the direction of the initial move, exaggerating the magnitude of the move and normalizing the level of volatility. According to an analysis by Skew, forced liquidations of long positions on BitMEX’s XBTUSD contract alone totaled roughly $700 million over the past week causing the basis relative to spot markets to momentarily reach negative 3 percent. The same phenomenon works in reverse -- when volatility is high, risk taking is reduced, eliminating this feedback loop. Thus, volatility exhibits mean-reverting behavior.

Combined with this, there is a broader trend of increased use of derivatives such that certain exchanges such as BitMEX and CME are now critical trading venues where much of the price discovery takes place. BitMEX in particular regularly has notional trading volumes up to one magnitude higher than the largest spot exchanges. New platforms like Binance and FTX have also recently launched and have attracted meaningful volume.

These trends indicate that the phenomenon of large, concentrated price movements should continue. It also suggests that modeling volatility, the prices at which leverage is applied and how much leverage is applied, along with their implied liquidation prices, are critical to understanding and predicting price movements.

Market Microstructure Remains Underdeveloped

A close analysis of trading activity on a selection of major Bitcoin-U.S. Dollar and Bitcoin-Tether markets was conducted. Although there are some questionable trades, such as two sells of 100 Bitcoin each on Bitfinex’s market immediately prior to the large decline in prices, there were no clear signs of market manipulation in this case (unlike previous incidents in which constituent markets for BitMEX’s Bitcoin index were specifically targeted). Major markets traded with a close spread immediately prior and during the decline. Immediately after the decline, however, several spot markets started to trade with a large spread between each other. Coinbase, in particular, traded as high as $9,000 afterwards when other markets were around $8,300. It is unknown why such a large spread was observed for a sustained period of time.

Tether markets also show some questionable trades, with elevated trading activity from HitBTC’s and LBank’s markets, but the quality and reliability of their reported trading data is low. Tether markets experienced lows of nearly $7,500, nearly $500 lower than the lows reached in Bitcoin-U.S. Dollar markets. Binance’s market, perhaps the largest and most efficient market in this set, reached a low of $7,800 during this time.

These irregularities show that the current state of crypto’s market microstructure remains underdeveloped. Under times of market stress, Tether’s peg with the U.S. Dollar can break, large spreads can still exist between major markets, exchange trading systems and matching engines can become unstable, and arbitrageurs and market makers can do a better job at rapidly identifying arbitrage opportunities and transporting liquidity across exchanges.

Until the quality of price discovery can be improved upon, regulators will still likely have unresolved questions regarding the susceptibility of crypto markets to manipulation, and approval of any crypto-related ETFs are unlikely to be approved.

Weekly Feature #2

An Investigation Into The Recent BTC Hash Rate Dip

On the 24th of September, the east coast of the US woke up to twitter erupting with a plethora of pundits commenting on BTC’s drop in hash rate on 23rd of September. On face value, the metric indicated that hash rate had come crashing down 32% from 98 to 67 exahashes per second.

Needless to say the community scrambled to find a narrative for the drop in hashrate which included some of the following:

Reports that Mongolia cracked down on mining, forcing a large amount of miners to shut down operations as they left the country

Kyrgyzstan cutting off power to as many as 45 mining firms

An update to the previous gen Bitmain S9 ASIC miners that had optimizations to efficiency but lowered the performance by ~30%

Disgruntled miners and mining pool operators switching off when Bakkt didn’t positively impact prices, leaving them as unprofitable.

However, what lacked across many channels was discussion about the construction of the metric itself and the source of the data anomaly. It turns out that the way that hash rate is measured (or as we explain below, the way that hash rate is estimated) played a big role in the apparent hash rate drop. Below we discuss how data can help provide ground truths and insight into the health of a network such as Bitcoin.

What is Hash Rate and How is it Calculated?

Without connecting to all mining firms and mining pool operations directly it is impossible to determine the exact hash rate of the network. Thus, many data providers, including Coin Metrics, estimate the hash rate by looking at the mining difficulty on any given day and the number of blocks produced in that 24 hour period.

To approximate hash rate, we use the following formula:

For example, BTC difficulty adjusts to target generation of 1 block every 10 minutes, which is equal to 144 blocks every 24 hours. However, there’s a degree of randomness involved in block production which means that it is impossible to predict exactly when the next block is mined, and therefore it is also impossible to predict the exact amount of blocks expected in a 24 hour period.

A Brief Refresher on Mining Randomness

Miners compete to find a random nonce that, when hashed with the remaining block data, produces a hash whose numerical value is lower than a protocol defined target (19 leading zeros for BTC). Implicitly, this process implies a high degree of randomness that should follow a Poisson distribution over time, thus PoW followers should expect variations in the timing of block production where the probability that a block does not arrive in x time period is:

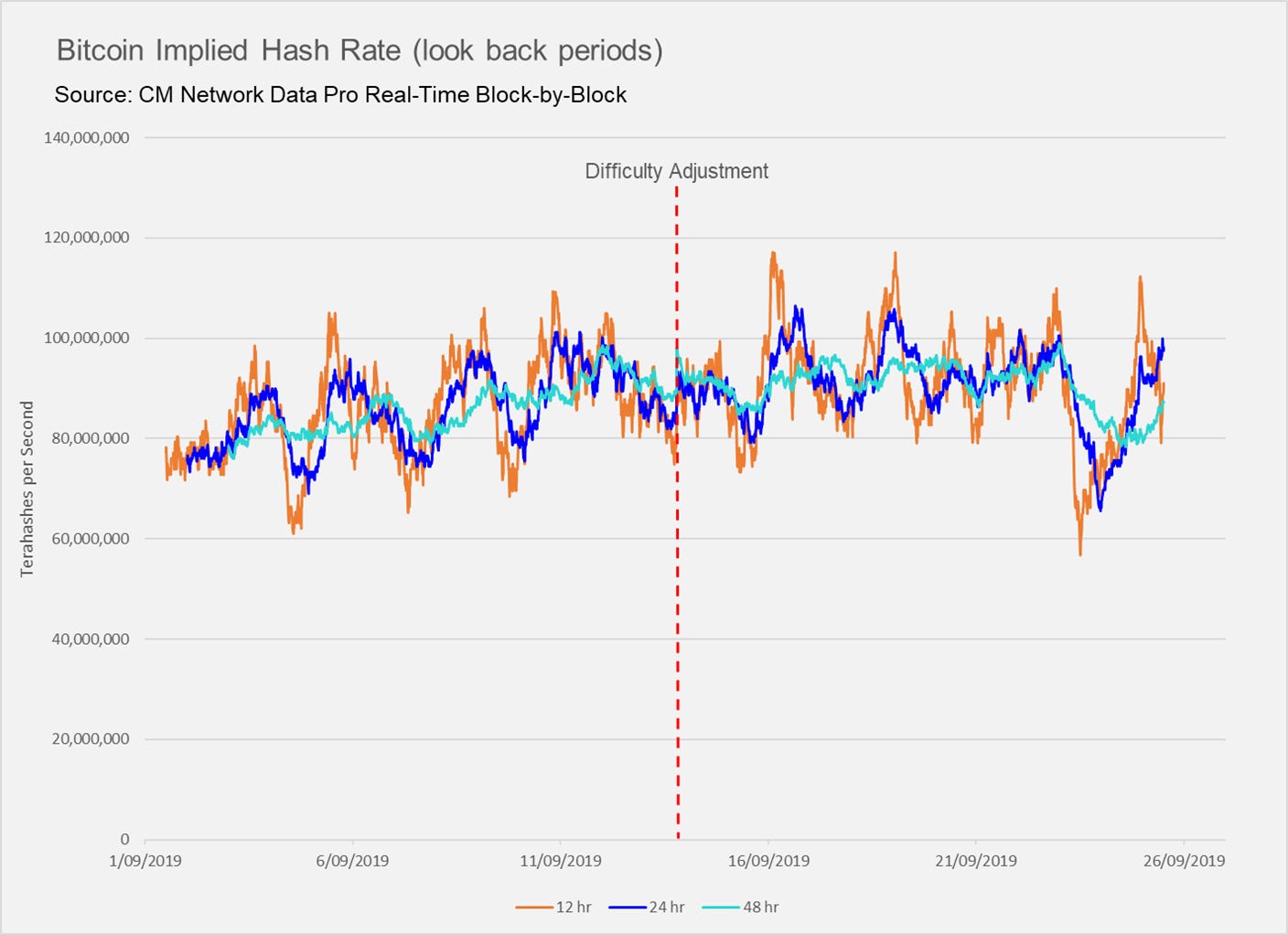

Hash Rate “Drop” on the 23rd of September

Understanding the randomness of block generation, we can investigate what actually occurred that day. Here is the fact; 114 blocks were produced between the 22nd of September midnight UTC and the 23rd of September Midnight UTC, and the Bitcoin network expected there to be 144 produced (i.e. one block every 10 minutes). The probability of this happening is low (0.56%) but not out of the realm of possibility.

This was largely due to 3 blocks that took over 50 minutes to be produced, whose impact can be seen by the 26 hour blip in the orange 144-block moving average line below.

Additionally, yesterday (30 Sept) there was a Bitcoin block that took 119 minutes to produce (odds of this are 0.00068%)! This was followed by a block that took 52 seconds. Similarly this has lead to a decrease in implied hash rate, but the overall impact seems to have not been as drastic due to the distribution of other block production times throughout the day.

Impact to Industry Hash Rate Calculations

As discussed above, hash rate can only be estimated by the rate at which blocks are produced. As such, hash rate values printed once daily with a 24 look back (the industry standard) fell noticeably given the slow block arrivals. These types of metrics can be misleading during probabilistically low events as demonstrated last week.

This principle applies more broadly to data and is commonly referred to as the ‘map’ versus ‘territory’ issue, where ‘the map of reality is not reality’. This applies to many of the daily crypto metrics that enthusiasts, traders and asset managers track - they are useful tools to provide insight but require knowledge of a metric’s weaknesses as well as strengths and where possible additional context to truly understand what is happening on the network (especially during the 0.56% occurrences). To this extent, Coin Metrics is striving to provide more context than just data through an end to end data solution that includes market data, network data, indexes, alternative data (twitter sentiment) and research.

What Coin Metrics is Doing About This

This was one of the primary motivations for Coin Metrics to create a suit of Real Time Network Data metrics. Real time data helps understand the health of a network and provides more data points to inform the market. Examples in relation to the hash rate drop recently include:

Real time network data analysis of block intervals (as shown above) would indicate that the determination of the backwards looking hash rate metric would print a decrease.

Rather than speculating on the cause of the drop in hash rate for the 24 hour period after the midnight UTC metric print, Coin Metrics was witnessing the recovery of implied hash rate throughout the day, surpassing 80 exahashes by midday EST. Further, as evidenced by the red lines below, it was coincidental that the previous end of the day print was at the daily high and the 67 exahash print was at the daily low.

CM Network Data Pro Real-Time Block-by-Block 12hr Implied Hash Rate and the 48hr Implied Hash Rate

As hash rate is sensitive to the randomness of block generation, these new metrics can act to improve the robustness of the current hash rate metrics used by the majority of the market.

As expected:

The 12hr implied hash rate is even more sensitive than the 24hr implied hash rate and can provide earlier indication that average block generation has reduced on the network.

The 48hr implied hash rate takes a bigger sample of data and is thus less sensitive to abnormally slow or high block production, providing a more robust view of hash rate by cutting out some noise.

In summary the ‘hash rate flash crash’ of last week deserved more context and investigation than it received. The cause of the perceived drop in hash rate itself can be explained by a reasonable and innocuous increase in the time to generate blocks (which is a random process) over a 24 hour period. Since determination of true hashrate cannot be done without connecting to every miner, the industry standard is to derive an implied hashrate using a 24 hour lookback window. However, as discussed above, this approach does have its limitations and through applying various time windows you can generate a more informed perspective of hash rate health.

At Coin Metrics we are striving to build the required tools to more accurately assess, monitor, predict and create actionable insights off of in our mission to educate the masses on the still nascent crypto asset market. Hopefully this leads to less speculation about events like this and more informed conversations across the industry.

Network Data Insights

Summary Metrics

After a strong run during mid-September, the major crypto networks were down this past week. All five of the largest assets lost over 13% of market cap week over week, with BTC and ETH down 16.4% and 15.5%, respectively. All five major assets also declined in terms of realized market cap, with BCH taking the biggest loss of 1.8%.

Fees and mining revenue are also down significantly. BTC and ETH daily fees are down 11% and 8.1%, respectively. Fees on XRP, LTC, and BCH fell even further, and are all down by over 25%. BTC still leads fees in total fees seven day average, but not by much. Over the past week, BTC had an average of $274,000 of daily fees, which ETH had an average of $233,700.

Network Highlights

ZCash recently passed the $1B cumulative miner revenue figure (this doesn’t take into account the founders reward). Only 5 assets are part of the >$1B cumulative miner revenue club. However, ZCash is the only asset in that club whose market cap and realized cap are both lower than its cumulative miner revenue.

ETH gas usage continues to hover near all-time highs. Over 61B gas (daily total) was used on both September 28th and September 29th.

CM Bletchley Indexes (CMBI) Insights

Having recently experienced the lowering of correlation across the market, this week we experienced a significant market wide move, leading all Bletchley Indexes to fall by ~20%. The market wide nature of the move can be seen when analysing the returns of indexes in terms of Bitcoin value, where we can see that the move relatively evenly impacted large cap, medium cap and small cap assets.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Coin Metrics is hiring! We recently opened up 7 new roles, including Blockchain Data Engineer and Data Quality and Operations Lead. Please check out our Careers page to view the openings.

As always, if you have any feedback or requests, don’t hesitate to reach out at info@coinmetrics.io.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.