Coin Metrics' State of the Network: Issue 57

Tuesday, June 30th, 2020

Get the best data-driven crypto insights and analysis every week:

Introducing Free Float Supply

By Ben Celermajer and the Coin Metrics Team

Key Takeaways

Until now, a standardized approach to determining the free float supply (the supply that is available to the market) of cryptoassets has not been established. This has hindered the market from developing a clear understanding of available supply and market capitalization.

Coin Metrics’ free float supply takes many of the best practices from traditional capital markets and applies them to cryptoassets to identify supply that is highly unlikely to be available to the market in the short to mid-term. In doing so, free float supply provides a better approximation of a cryptoasset’s liquidity and market capitalization.

Index weighting can benefit from using free float supply - free float supply reflects the liquid market more accurately and reduces potential manipulability.

Tracking free float supply provides insight into primary token holder behavior. This can lead to more transparent reporting of foundation and team selling, increased knowledge of total market supply and behavioral analysis of stakeholders.

Many cryptoasset valuation metrics use market capitalization which primarily utilize the on-chain visible supply. Deriving these metrics with a free float capitalization may improve the signal achieved.

Introduction

In April, Coin Metrics announced a new methodology for the determination of a cryptoasset’s supply that is ‘available’ to the market, cryptoasset free float.

Without reporting standards and regulations that require foundations and companies to accurately report holdings in a timely manner, obtaining supply data that is reflective of market trading opportunities can be a challenge.

Coin Metrics’ free float supply takes many of the best practices from traditional capital markets and applies them to cryptoassets to identify supply that is unlikely to be available to the market. In doing so, free float supply provides a better approximation of a cryptoasset’s liquidity and market capitalization. For more information on the supply that is considered restricted, please refer to the CMBI Adjusted Free Float Methodology.

While initially created to help inform CMBI design, cryptoasset free float supply can be applied in many different ways to help market participants make smarter investment decisions. Some of the areas where free float can be applied to improve market understanding include:

Market Capitalization

Indexes

Valuation methods

Foundation and Founding Team Transparency

Applying Free Float to Market Capitalization

Typically, investors expect a market size measurement to reflect the total value of assets that are available in the market. For example, to determine market capitalization in equity markets, data providers and participants exclude company and executive team owned shares, as well as shares owned by other strategic investment partners that do not provide liquidity to markets.

A standardized approach like this has not yet been consistently applied to determining the free float supply and market capitalization of cryptoassets. This has hindered the market from developing a clear understanding of available supply and market capitalization.

For determining supply and market capitalization, the CMBI Adjusted Free Float Methodology applies a standardized criteria for which units of supply to exclude from free float, including but not limited to:

Supply owned by foundations, companies and founding teams

Supply in addresses that have been inactive for over 5 years

Supply staked in a smart contract to partake in governance and long-term strategic outcomes of a network without any direct monetary incentive to do so

Supply that is vesting on-chain

Supply that is burned or provably lost

Applying the above methodology rigorously to the top cryptoassets identifies a more comprehensive supply that is not available to the market. Utilizing the available supply to trade (free float supply) rather than either reported supply by foundations/companies or total visible on-chain supply can significantly impact investor’s understanding of the total market size of a cryptoasset and related metrics such as dominance and liquidity.

Evidenced in the above, standard industry reporting of cryptoasset supply, and thus market capitalization, has traditionally been overstated. Some of the more pertinent examples of this are:

Bitcoin - where the industry standard has been 18.4M. Coin Metrics free float calculations determine that a more accurate representation of free float supply is 14.3M (22% lower), reflecting that 4.1M Bitcoin has not been transacted in over 5 years and as such can be considered to be owned by long term strategic holders that do not provide liquidity to markets (or lost).

Bitcoin Cash and Bitcoin SV - the industry standard has been to utilize their on-chain supply of ~18.5M native units to determine market capitalization. Through understanding how many BCH and BSV have been moved since the fork, Coin Metrics has determined that a more accurate representation of supply for BCH and BSV is 12.0M (36% lower) and 9.9M (45% lower) respectively.

XRP and Stellar - both of these foundations report their own holdings to data distributors. Due to an absence of regulatory standards and the irregularity of reporting, not all addresses may be disclosed and the reported values may not be maintained. Coin Metrics has identified additional supply that can be traced to the foundations and team members, which is reflected by XRP and Stellar having a free float supply of 30.4B and 16.5B, lower than is typically reported.

Applying Free Float to Indexes

Most multi asset indexes are weighted by each constituent asset’s market capitalization. Thus, redefining a cryptoasset market capitalization to reflect free float will impact the construction of indexes.

The key benefits of weighting an index using the free float market capitalization as opposed to the reported market capitalization include: reflecting the liquid market more accurately, maintaining more timely supply data to weight indexes, reducing potential manipulability of index weightings, and reducing index rebalancing costs.

Cryptoassets have varying levels of auditability and transparency when it comes to foundation and team holdings. For this reason, Coin Metrics applies a free float supply banding approach when weighting CMBI Indexes. The banding methodology reflects that supply determination is currently not a perfect science. For example if Coin Metrics identify 53% of cryptoassets as the free float supply, but the ‘true’ value is 56% (or 50%), the asset will ultimately fall into the 50-60% band. Such an approach helps to overcome nuances in supply determination and varying levels of transparency, reporting and auditability.

Simply, after determining the ratio of free float to on-chain available supply, each asset’s ratio is rounded up to the closest 10%. This value is then applied for the purpose of weighting assets in the CMBI Market Cap Weighted Asset Index Series. For example:

Bitcoin’s free float ratio is 77.8% (free float supply of 14.3M of a total on-chain supply of 18.4M).

Rounded up to the nearest 10%, Bitcoin’s band would be 80%

Applied to the total supply of Bitcoin, 18.4M, Bitcoin’s in weight in the index would be derived using a supply of 14.7M (18.4M * 80%)

Increasing Market Transparency

As part of Coin Metrics’ new free float supply metric identification process, addresses in the following categories have been tagged by Coin Metrics and are considered to be restricted:

Owned by foundations/companies

Owned by founding team members

Governance contracts where there is no direct financial benefit

Provably lost

Doing so can provide timely and transparent reporting of the movements and actions of each category of stakeholder on a cryptoasset’s network. This can lead to more transparent reporting of foundation and team selling, increased knowledge of total market supply and behavioral analysis of stakeholders.

Without transparency, market participants are left uninformed on the actions of foundations and teams, making it impossible to understand the holistic market dynamics.

Case Study 1: Tether (USDT)

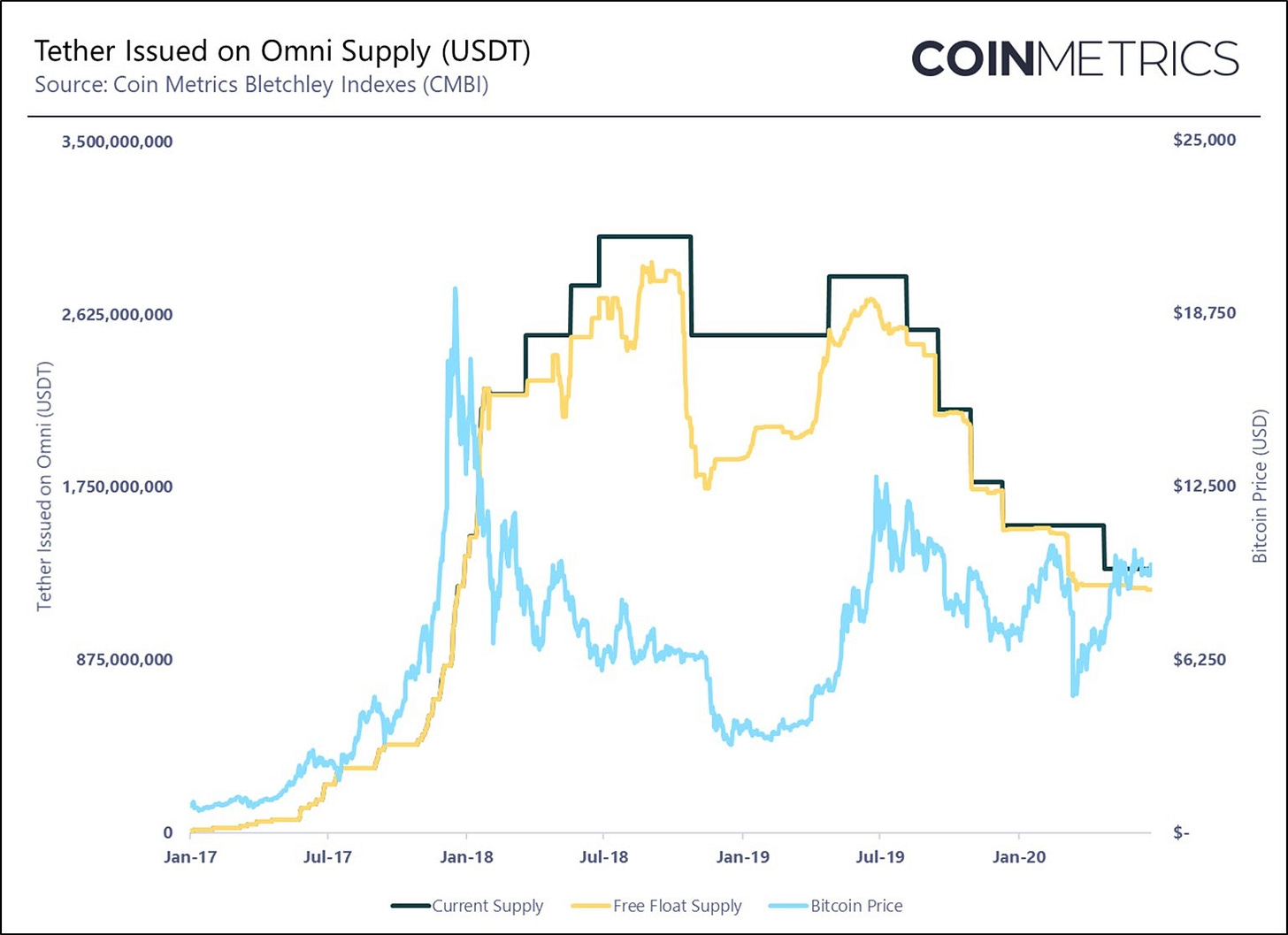

Many market spectators monitor and observe the printing and burning of USDT as significant market events that can impact the price of Bitcoin and crypto markets. Speculation to the impacts of Tether activity has been so high that many academics and regulators have investigated this activity during significant market events.

However, observing the on-chain activity of USDT can be misleading as Tether has historically printed USDT in large batches in anticipation of future demand and distributions. Thus, on-chain supply does not necessarily mean new supply in public markets. Coin Metrics’ free float supply excludes USDT held by the Tether Treasury to provide a more accurate indication of the supply that is currently in public markets.

As can be observed below, particularly through 2018 and the first half of 2019, the USDT issued does not necessarily represent the USDT in markets. Particularly interesting is the USDT activity in early 2019. Market participants observing the on-chain supply would not have noticed significant change as Bitcoin rose from $4,000 to $12,000. However, by observing free float supply, the correlation between free float USDT and Bitcoin’s price becomes clearer.

Continue Reading…

Continue reading “Introducing Free Float Supply,” including analysis of how free float supply can be used to improve valuation metrics.

Network Data Insights

Summary Metrics

Ethereum (ETH) activity surged again this past week, driven by the rise of DeFi applications like Compound as well as the continued growth of stablecoins. ETH active addresses grew another 8.4% week-over-week and have now reached their highest levels of 2020. Transactions also continue to grow at a fast rate. On average, there were over a million daily ETH transactions over the past week. ETH daily transaction fees grew another 26.4% week-over-week, bringing ETH’s average fees over the last week to $663.9K compared to $322.2K for BTC.

Despite the large growth in usage and economic metrics, ETH market cap did not significantly outperform over the last week - it only grew by 0.8%, compared to a 0.9% dip for BTC.

Network Highlights

About 40M units of 0x (ZRX) have entered free float supply since the middle of June. ZRX free float supply increased from 631.5M on June 13th to 671.4M on June 27th.

As introduced in today’s Weekly Feature, free float supply provides a better approximation of a cryptoasset’s liquidity and market capitalization by measuring the amount of supply that is freely available to the market. The large increase in ZRX free float supply is because the ZRX foundation has started using treasury funds to yield farm on Compound, contributing the 40M ZRX to liquidity pools.

Basic Attention Token (BAT) free float supply has increased by about 10M since the beginning of June, as some BAT team members have also looked to benefit from Compound farming.

ZRX and BAT have both also seen an uptick in transactions in May and June. There were over 13.63K BAT transactions on June 27th, a new all-time high. The following chart is smoothed using a 7 day rolling average.

Market Data Insights

While certain network activity may be trending up, spot market volume has continued to decline over the past month due to the dampening of volatility. In the analysis below we look at the change in aggregate volume from Binance, Binance.us, Bitfinex, Bitflyer, Bitstamp, Bittrex, Coinbase' FTX, Gemini, Huobi, itBit, Kraken, Kucoin, Okex, Poloniex and Upbit.

Bitcoin volume has been trending down over the past 30 days, nearly reaching levels not seen since the larger sell off in mid-march. This pattern correlates with falling ranges of volatility that we noted prior this month.

0x, on the other hand, did recently reach a relative peak in terms of daily volume. During June the project’s 30 day average volume increased roughly 560% to ~$33m from ~$5m following the momentum of the DeFi craze.

Basic Attention token also saw an increase in trading volume, however it was not as extreme. The recent DeFi demand brought an uptick in trading but it did not surpass the volumes seen between March and May 2019. This prior uplift was largely due to product releases from the Brave team surrounding their Brave Rewards and Advertising platform.

CM Bletchley Indexes (CMBI) Insights

This week was very similar to the last, with most CMBI and Bletchley Indexes slightly down for the week. The Bletchley 40 was the only exception of the market cap weighted indexes, finishing up 4.2%.

The strength in small-cap assets this week can be further observed through the positive returns of the Bletchley Total Even Index. Despite the slightly negative returns of the Bletchley 10 and Bletchley 20, when the 70 constituents of the Bletchley universe each receive a weight of 1.43%, the return for the week is positive.

The CMBI Bitcoin Index and CMBI Ethereum Index continue to range trade and experience historically low levels of volatility, finishing the week down 3.1% and 1.7% respectively.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Coin Metrics is hiring! Please check out our Careers page to view the openings.

As always, if you have any feedback or requests, don’t hesitate to reach out at info@coinmetrics.io.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.