Coin Metrics' State of the Network: Issue 10

Tuesday, July 30, 2019

Intro and Updates

Dear crypto data enthusiasts,

Welcome back to this week’s edition of Coin Metrics’ State of the Network, an unbiased, focused view of the crypto market informed by our own network (on-chain) and market data.

This week’s housekeeping items:

We recently released an in-depth research report on the major Bitcoin forks (BCH and BSV). Read the full report here!

Coin Metrics is hiring! Please check out our Careers page to view the openings.

As always, if you have any feedback or requests, don’t hesitate to reach out at info@coinmetrics.io.

Weekly Feature

Analyzing BitMEX Net Flow Since Investigation Announcement

On July 19th, Bloomberg reported that the CFTC is conducting a probe on BitMEX. Since then, BitMEX has had an aggregate net outflow of over $145,000,000. But after a large outflow on the 19th, the net flow (i.e. the net amount sent and withdrawn) appears to have stabilized. The net flow on July 27th and 28th were $9,019,262 and -$2,131,269, respectively.

The following chart shows the daily net flow (i.e. the net amount sent and withdrawn) from BitMEX in USD since July 19th:

On July 19th, over $67,000,000 was transferred out of BitMEX. This was BitMEX’s largest daily outflow (i.e. daily withdrawal) of 2019, as seen in the below chart (July 19th is marked in red).

However, after the 19th, BitMEX’s daily outflow returned to relatively normal levels. About $12,500,000 was withdrawn from BitMEX on July 28th:

BitMEX daily inflow (i.e. amount sent to the exchange) has decreased slightly since July 19th, which is marked in red below. Daily inflow for July 27th and July 28th was $18,283,823 and $10,436,451, respectively, compared to $22,981,818 on July 19th:

BitMEX has had the largest aggregate net outflow since July 19th ($145,000,000) out of all the exchanges we track. Bitfinex came in second, with a net outflow of $71,247,801 over that same period:

BitMEX holds a little more than 171,000 BTC as of July 28th, down from a peak of 245,964.85 on March 4th, 2019:

Network Data Insights

Summary Metrics

After another market retreat, network data metrics were mostly down over the past week.

Adjusted transfer value is down in all five of the biggest crypto assets. Leading the way, XRP’s adjusted transfer value is down 55% from last week.

Active addresses also fell, down 12% for both XRP and LTC, and 18% for BCH. BTC and ETH’s daily active addresses also declined, but not as severely. BTC active addresses dropped 5% from last week, while ETH dropped 3%.

Despite a drop in most other metrics, BTC hash rate and mining revenue continue to hold steady. Mining revenue grew by 1%, to a daily average of $19.4M, while hash rate grew 7% over the past week.

Network Highlights

On July 26th, Coinbase added a new lesson to their “Earn” education platform that allowed users to earn up to $14 worth of DAI. Since then, DAI user activity has grown dramatically. On July 28th, there were 52,575 addresses that held some DAI balance, compared to 38,450 on July 25th:

Bitcoin is closing in on one billion dollars worth of cumulative transaction fees. As of July 28th, BTC has $955,797,817 of cumulative fees:

Market Data Insights

An Examination of Market Efficiency in TRON

Justin Sun, the founder of the cryptocurrency platform TRON, has been making headlines over the past week for cancelling a scheduled lunch with Warren Buffet. This sequence of events allows for a contemporary case study of market efficiency in cryptocurrency markets in which a large price decline was observed in TRON, an asset with intermediate levels of volume and liquidity.

Moreover, news was released through the various mediums and languages, including traditional financial media sources and social media channels, with varying levels of clarity. How fast are market-moving announcements priced in by market participants?

This study examines three events that occurred between July 22 and July 24 in which TRON experienced a peak-to-trough decline of 23 percent:

At 2019-07-22 21:28:00 UTC, the TRON Foundation Twitter account announces the postponement of Justin Sun’s lunch with Warren Buffet after Justin Sun falls ill with kidney stones. In the subsequent minutes, Bloomberg would write an article summarizing the contents of the tweet at 21:35:00, Justin Sun would announce on Weibo to his 1.2 million followers that he was canceling the lunch with Warren Buffet at 21:49:00, and Dovey Wan would tweet an English translation of Justin Sun’s announcement at 22:39:00.

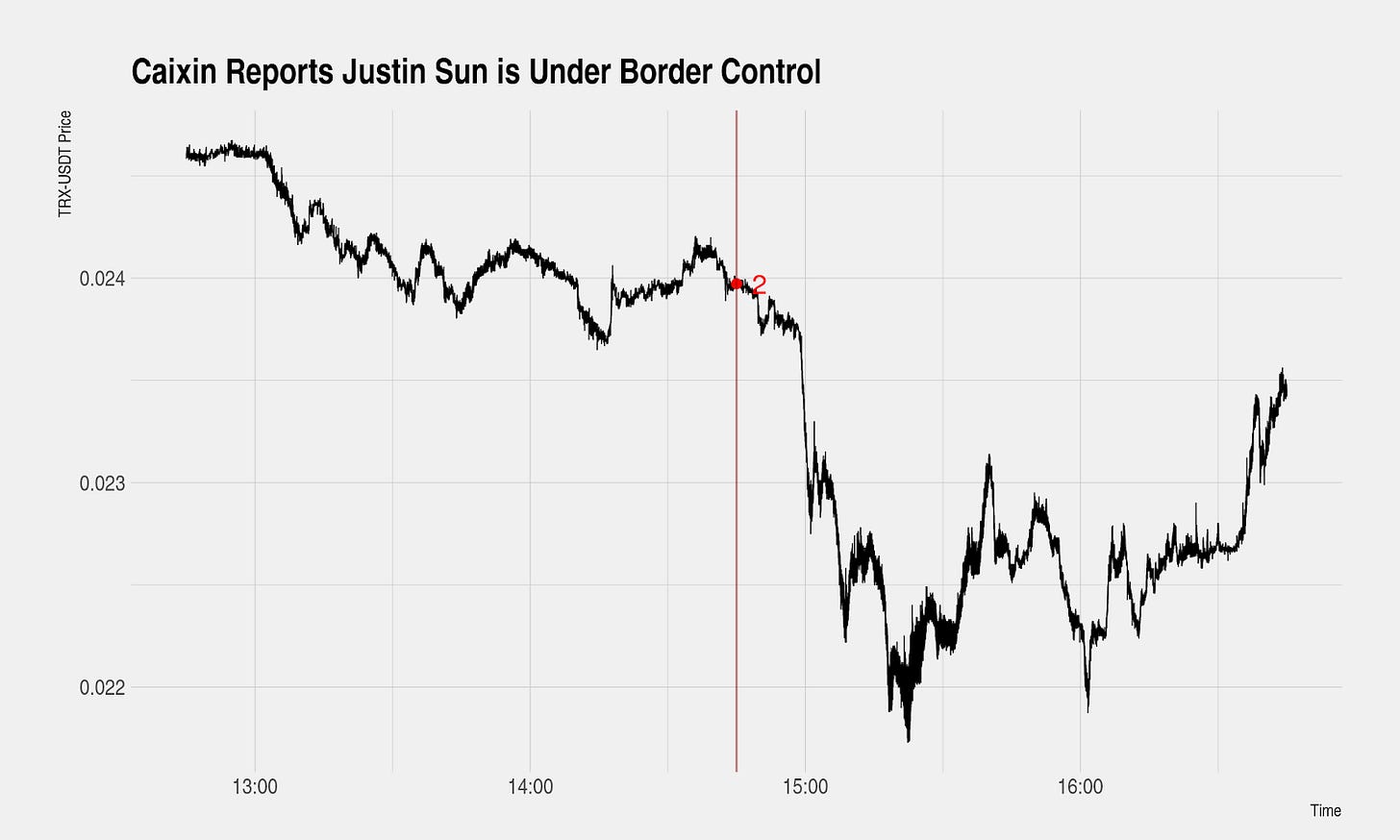

At 2019-07-23 14:45:00 UTC, Beijing-based Caixin first reports that Justin Sun is under border control and unable to leave China. This article would be syndicated to many other Chinese media publications over the next fifteen minutes.

At 2019-07-23 17:45:00 UTC, Justin Sun tweets a picture of himself timestamped with a TRON blockchain hash in front of San Francisco’s Bay Bridge, proving to his followers that he is residing abroad. Approximately 10 minutes later, he livestreams himself with the Bay Bridge in the background.

In each case, the market reacts relatively swiftly to each announcement, regardless of the medium and language of announcement. Major markets in TRON traded in a very tight spread during this period of price discovery. This is empirical evidence that cryptocurrency markets have reached a level of maturity where market participants are able to efficiently and swiftly price in unexpected and material events.

A closer look at each of the three events reveals the limitations of the current state of market efficiency, however. Below we examine TRON’s intraday price two hours before and two hours after each event. The initial announcement of Justin Sun falling ill with kidney stones and the postponement of the lunch with Warren Buffet was not immediately acted on by market participants. Price movement in the initial hour of publication was muted, despite an article by Bloomberg and a post by Justin Sun. In fact, the price did not start to violently react until nearly an hour after publication.

As events unfolded, market efficiency increased due to widespread reporting by media sources and focused trader attention. An article published by Beijing-based Caixin in Chinese had almost immediate market impact as the story was syndicated across more media outlets. For this material event, strong market impact was felt within 15 minutes of publication.

The impact of Justin Sun’s selfie in front of San Francisco’s Bay Bridge, refuting widespread rumors that he is unable to leave China, reveals that cryptocurrency markets can be highly efficient under the proper circumstances. In this case, market impact was felt immediately.

TRON paints a picture of moderate market efficiency in cryptocurrency markets. Under normal market conditions in which news is unexpected, it can take a meaningful period of time for market participants to price in the impact of material developments. This stands in contrast to equity markets in which new developments are priced in nearly instantaneously. But as events unfold over the course of several hours or days, markets can become highly efficient in connection with increased news reporting and focused trader attention.

Engineered Price Movements Continue

Recent price movements over the past week reveal that engineered price movements designed to trigger stop losses, margin calls, and forced liquidations of leveraged positions continue with high frequency. Cryptocurrency prices have been characterized by periods of low trading activity and price movement interspersed with extremely concentrated trading designed for maximum market impact. Weekends can be targeted by traders seeking to engineer these price movements because there is strong seasonality in trading volume with much lower trading volume on Saturdays and Sundays, particularly in the morning hours in the UTC timezone.

Volatility Continues to Increase

The maximum volatility experienced by Bitcoin has continued a long-term secular decline as the asset class matures. However, despite continued increases in trading volume, market participant sophistication, and trading infrastructure, the lower range of recent volatility appears elevated relative to historical minimums.

This is driven by increased fragmentation of liquidity across trading venues (whereas in the past, trading was concentrated only on a handful of large exchanges) and the increasing popularity of margin and derivatives trading, both of which can trigger forced liquidations during times of large market movements.

Recent three-month annualized volatility is at 101%, a level rarely reached in the past five years, and continues to increase. Volatility is not far from it’s most recent local high of 135%, last reached in early 2018, immediately following the peak of the bubble.

CM Bletchley Indexes (CMBI) Insights

Correlation charts can provide interesting insight into the expected price relationship between assets. A correlation of 1 or -1 implies a perfect positive or negative relationship between two assets. Through assessing the correlation of Bletchley assets we can derive insight into how the market has been behaving.

During the bear market of 2018, generally speaking, much of crypto was correlated with Bletchley Indexes all having a correlation score >0.9 (i.e. If any of the Indexes increased, the most likely scenario was that the others increased as well, the same can be said for a decrease). However, since the beginning of the year Bitcoin has continually outperformed most of its peers. Since the Bletchley 10 is comprised ~70% of Bitcoin, the performance of the Bletchley 10 has outperformed the Bletchley 20 and Bletchley 40. Additionally, the level of correlation between them has reduced to around 0.7. This demonstrates a lower relationship between the price movement of the Bletchley 10 with the Bletchley 20 and Bletchley 40. However, more recently there is a flattening and even a slight increase in correlation, potentially signalling an improvement in short term strength for mid and low market cap assets.

Subscribe and Past Issues

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.