Coin Metrics' State of the Network: Issue 44

Is the Upcoming Bitcoin Halving Priced In? - Understanding Miner Economics From First Principles

Get the best data-driven crypto insights and analysis every week:

Understanding Miner Economics From First Principles

By Kevin Lu and the Coin Metrics Team | Tuesday, March 31st, 2020

The next halvening is approaching, yet debate about its impact on asset prices remains mired in controversy.

Two camps have formed. One believes the halvening is already priced in by market participants, citing the efficient market hypothesis. The other camp believes it isn’t yet fully priced in and expects the halvening to plant the seed for further increases in prices due to the increase in perceived scarcity and the change in supply-side dynamics.

Source: Coin Metrics Network Data Pro

We believe the intensity of the debate partially stems from the limited empirical record. Bitcoin has only experienced two halvings in its history and only a handful of other proof-of-work coins have gone through the same events. Discussions are stalled because of the lack of shared terminology, small sample size, and inaccessible data regarding critical questions.

In this week’s State of the Network, we present a framework for understanding miner economics and how to best navigate the upcoming block reward halving. The intention is to present a framework reasoned from first principles rather than relying purely on empirical data. We also apply this framework in examining the upcoming halving for Bitcoin, Bitcoin Cash, and Bitcoin SV.

Three Miner Axioms and Inferences

We present a set of three miner axioms which we believe to be largely true as a starting point for further reasoning. We say “largely true” because there are always edge cases -- they may not hold for certain assets or for certain miners. But for the most part, these axioms hold water.

We also present three miner inferences that are built upon our three axioms. These inferences form the foundation of our framework for understanding miner economics.

Axiom 1

Miners operate as profit-maximizing commercial enterprises with large economies of scale

Mining has gotten so difficult and resource-intensive that is largely uneconomical for an individual or hobbyist to participate. Instead, there are large economies-of-scale to mining. Large miners locate themselves in areas of the world where electricity is cheap. They are able to negotiate lower rates with electricity utility companies, purchase large quantities of the most efficient mining equipment, and rent large facilities to operate the equipment.

The ability to mine at scale lowers the cost of mining a single coin. And since mining is a competition, miners organize as a profit-maximizing commercial enterprise. Miners do not operate for ideological or altruistic purposes and cannot continue operating in the long-term if they are not profitable.

Axiom 2

Mining is a competition with a fixed total reward that is split among all participants with a regular cadence

Issuance is mandated by the protocol and controlled via a difficulty adjustment. In the case of Bitcoin, the protocol generates a block reward of 12.5 coins per block (currently) and regularly adjusts mining difficulty such that blocks are generated on average every 10 minutes. All miners compete for this reward, along with transaction fees. The total block reward revenue for all miners over a given period of time is predetermined and cannot be changed except for marginal amounts and for brief periods of time between difficulty adjustments.

Axiom 3

Miner revenue is denominated in crypto while miner costs are denominated in fiat

Miner revenue consists of the block reward and transaction fees, both of which are denominated in crypto.

Mining costs include mining hardware, electricity to operate the miners, cooling fees, facility rental fees, server maintenance, internet connectivity, salaries, insurance, legal services, taxes, and so on. These costs are denominated in fiat since most traditional companies do not currently accept crypto as payment (electricity utility companies will not take Bitcoin as payment, for example). Even if certain expenses end up being paid using crypto, such as instances where miners pay for equipment or employee salaries using crypto, the price of the good or service is still quoted in fiat currency.

Inference 1

Mining is a (Nearly) Perfectly Competitive Industry

Based on the first two axioms above, the first inference we introduce is that the mining industry operates under an equilibrium of nearly perfect competition where the market price faced by each miner equals the miner’s marginal cost. This is achieved by two mechanisms.

First, profit-maximizing miners enter the industry or invest in more equipment when mining is profitable and exit the industry or turn off miners when it is unprofitable. Second, the change in hash rate triggers a difficulty adjustment which constantly seeks to bring the cost of mining a single coin equal to the current market price.

Mining is zero-sum (in the long-term) in that each miner is in competition with other miners over the same block reward. This also means that miners operate in an equilibrium state of zero economic surplus -- that is, in the long-run, miners earn only normal profits and are compensated only for the opportunity cost of their time plus an allowance for risk. Due to the competitiveness of the miner economy, it seeks a long-term equilibrium where miners profit margins are small and close to zero.

Miner profit margins, however, can meaningfully fluctuate around this equilibrium due to delays inherent in the system which has important implications on miner-led selling pressure. We discuss this more in the following two inferences.

Furthermore, the industries that reside upstream to mining such as miner hardware and semiconductor manufacturers show elements of oligopoly market structure. Based on this supply chain, certain miners (such as the Bitmain affiliated mining pools) can leverage information advantages or access mining hardware earlier than their competitors which reduces the degree of perfect competition in the mining industry.

Inference 2

Miners Are a Continuous and Significant Source of Selling Pressure

Combined with the third axiom, we present an important inference: miners represent the single largest cohort of natural, consistent sellers. Their selling pressure is significant because miners must sell the crypto that they earn to cover their fiat-denominated costs. And since their profit margins tend to gravitate towards zero, miners must sell nearly all of the crypto that they earn.

Here we use Bitcoin to contextualize the magnitude of miner-led selling pressure. Miner revenue in 2019 was nearly $5.5 billion dollars. Some researchers compare this number to the annual trading volume of Bitcoin, which is several magnitudes bigger, and conclude that miner-led selling pressure has a negligible impact on the market. However, selling from miners represents net capital outflows from the space and the fiat obtained by miners is unlikely to ever return to the market, which is not necessarily the case for other trading volume. Therefore, miner selling has an outsized influence on the rest of the market

Put differently, the best estimates indicate Coinbase has roughly 1 million Bitcoin in customer deposits. At current prices, this is equivalent to $6.8 billion dollars, an amount similar to annual miner revenue in 2019. Under the assumption that miners sell the majority of the crypto they mine, miner-led selling pressure is nearly equivalent to all customers on Coinbase liquidating their Bitcoin over the course of a year and permanently exiting the market.

Source: Coin Metrics Network Data Pro

We extrapolate miner revenue for the entire year of 2020, assuming prices remain at current levels and accounting for the halving of the block reward. Under these assumptions, we should only see half-of-a-Coinbase worth of selling pressure this year -- a significant reduction.

Inference 3

Miners Have a Pro-Cyclical Impact on Asset Prices

While the mining industry is constantly seeking a long-term equilibrium where miner profit margins are small but close to zero, the reality is that profit margins experience large fluctuations around this steady state.

Elements influencing the cost side of the equation are slow moving and react with a meaningful lag. Decisions regarding entering or exiting the industry, purchasing additional equipment, and scaling up operations all take time. And difficulty adjustments by their nature have an approximately two week lag.

On the opposite side, revenue is fast moving because one of the main determinants is the price of the coin which is subject to extreme levels of volatility. Bitcoin regularly experiences annualized volatility of over 50 percent.

Source: Coin Metrics Reference Rates

Varying profit margins due to these factors mean that the amount of selling pressure by miners to cover their fixed, fiat-denominated costs varies as well. When prices are particularly volatile or trend in one direction over a sustained period of time, miner profit margins can be consistently positive or negative for meaningful amounts of time. These deviations are more likely to occur when prices are rising, since delays regarding more capital investment in mining hardware are more prominent compared to delays when prices are declining. The decision to shut off miners when prices fall below electricity costs can be made quickly.

Inventory management of miners is not a well-studied topic since access to this information is not available, but it stands to reason that each miner makes their own decision on how much of their block rewards to sell for fiat and when to sell it. Since miner variable costs are slow moving and fairly constant in fiat terms, miners are required to sell less of their block rewards to cover their expenses during periods of rising crypto prices.

On the other hand, when crypto prices are falling, they are required to sell more. Under this theory, miners have a pro-cyclical effect on the market, in that they further exacerbate price increases. There are limitations to this dynamic, however. Sustained increases in prices can compel miners to sell more of their block rewards to fund additional capital investment in new mining hardware suggesting a counter-cyclical impact on prices under certain market conditions.

During periods of capitulation where profit margins for many miners are negative, miner-led selling flow is likely to be high. Miners may attempt to endure periods of short-term pain, and perhaps may temporarily operate at a loss until less cost-efficient miners exit the industry. Miners may be willing to sell block rewards earned in prior periods that they kept on their balance sheet to be used in an attempt to outlast other miners.

All of these behaviors reinforce the direction in which crypto prices are moving and are a key determinant in why crypto prices regularly experience bubbles and crashes.

While we believe this framework characterizes the pro-cyclical behavior of most miners, the rise of a robust lending market has the potential to change this dynamic. This allows miners to speculate on the future price of Bitcoin and engage in market timing where they pay for their fiat expenses using borrowed funds that are collateralized with the Bitcoin on their balance sheet. Miners that engage in this behavior believe that Bitcoin’s price will rise in the future and delay selling. The rise of a derivatives market which allows miners to hedge against future price movements can play a similar role.

While the overall impact on the amount of miner-led selling flow depends on how accurate miners are in their market timing efforts, we believe that miners will tend to borrow fiat under certain market conditions. Assuming that miners intrinsically have a long-bias for Bitcoin, miners will tend to borrow fiat when they believe prices are well below the long-term fundamental value and when they believe we are firmly in a bull market. This should moderate the pro-cyclical impact when prices are declining but accentuate the impact when prices are increasing.

The Upcoming Halving

Bitcoin will soon experience its third halvening where the block reward will be reduced from 12.5 coins per block to 6.25 coins per block, equivalent to annualized issuance being reduced from 3.6 percent to 1.8 percent. This is anticipated to occur in approximately 45 days or May 14, 2020.

Source: Coin Metrics Network Data Pro

Prices have sharply declined over the past several weeks in concert with risk assets in traditional markets. The pro-cyclical behavior of miners implies that miner-led selling pressure should be increasing as well. Prices have almost certainly declined below the breakeven price for the set of miners who are least efficient and have the lowest profit margins. These miners have likely either temporarily or permanently shut off their machines. This can be seen in the most recent difficulty adjustment where difficulty declined by 16 percent, one of the largest drops in history.

Source: Coin Metrics Network Data Pro

Such a large difficulty adjustment indicates that inefficient miners are already reaching a point of capitulation where they are forced to sell all the coins they mine to cover their costs.

Miner-led selling pressure for Bitcoin is likely to continue to increase because both Bitcoin Cash and Bitcoin SV will be experiencing their halving on April 8 and April 9, respectively. All three assets share the same SHA-256 mining algorithm and miners can seamlessly redirect their hash power to the asset that provides the highest return on investment.

When Bitcoin Cash and Bitcoin SV halve their block rewards, this should force miners to direct even more hash power to Bitcoin as it will still have a 12.5 native unit block reward (instead of 6.25) for about a month longer. Therefore, we should expect difficulty increases for Bitcoin that should further squeeze profit margins for all miners.

Source: Coin Metrics Network Data Pro

It is concerning that miners are in a state of capitulation even before the halving. Once the block reward halves, miner revenue will be cut in half while miner costs will remain constant, so we expect even more miners to capitulate in the months ahead.

Miner capitulation increases selling pressure until inefficient miners are forced off the network, but in the long run these events are supportive for prices. Culling inefficient miners allows only the most efficient miners with the lowest cost of production to remain. Once inefficient miners exit the network, profit margins will improve for the remaining miners, which reduces selling pressure, increases prices, and should repeat in a virtuous cycle. Eventually, if prices bottom and recover, the pro-cyclical behavior of remaining miners should support further price increases.

Conclusion

Using a set of axioms, we provide a framework reasoned from first principles that illustrates how miners are a continuous and significant source of selling pressure that has a pro-cyclical impact on prices. Miner-led selling pressure for Bitcoin, Bitcoin Cash, and Bitcoin SV is currently high and is likely to increase further in the coming months as all three coins undergo their halvings.

We expect miners to follow a cycle of decreased profit margins, increased selling, capitulation, and a culling of the least efficient miners from the network. Once this cycle is complete, the miner industry should return to a healthier state that is supportive of future price increases.

Network Data Insights

Summary Metrics

Source: Coin Metrics Network Data Pro

The major cryptoassets remained relatively stable this past week. Although market cap increased, realized cap stayed stable or dipped for all five assets in our sample. The ratio of realized cap to market cap (MVRV) can be used to help gauge market tops and bottoms, and also gives insight into the behavior or holders vs speculators, as explored in State of the Network Issue 41.

Bitcoin’s estimated hash rate rose week-over-week after plummeting in the aftermath of Black Thursday, which led to Bitcoin’s second largest difficulty percentage drop in history. Although fees have been down this past week, mining revenue increased due to Bitcoin’s price gains.

Network Highlights

Binance USD (BUSD) market cap has almost tripled since March 1st, increasing from about $68M to over $181M. Huobi USD (HUSD) market cap has almost doubled, growing from $78M to $136M.

The following chart was created using our free community charting tool. We recently added BUSD and HUSD to fill out our stablecoin data set.

Source: Coin Metrics Community Charts

Tether also continues its rapid growth. There has been $1.4B worth of Tether issued on Ethereum (USDT-ETH) since March 1st. Tron-issued Tether’s (USDT-TRX) market cap has increased by about $165M since March 1st, while Omni-issued Tether (USDT) has stayed relatively stable. Tether’s total market cap is now over $6.4B

Source: Coin Metrics Network Data Pro

The amount of Bitcoin held by most exchanges has decreased over the last 30 days. Out of the exchanges in our coverage, only Kraken and Bitfinex have increased their BTC supply over the last month (1% growth each).

Source: Coin Metrics Network Data Pro

The amount of Bitcoin held by BitMEX has been in freefall over the past two weeks after experiencing mass liquidations on March 13th (see State of the Network Issue 43 for our coverage on the BitMEX liquidation spiral). As of March 29th, BitMEX held 244k BTC, down from a peak of 315k on March 13th.

Source: Coin Metrics Network Data Pro

Market Data Insights

Most cryptoassets remained largely unchanged over the past week but with significant volatility. Bitcoin and other coins continue to show intermittent periods of high correlation with risk assets, particularly during pre-market trading. Volatility remains at high levels with Bitcoin’s rolling one month volatility at 148%, nearly the same level as during the late 2017 bubble.

Source: Coin Metrics Reference Rates

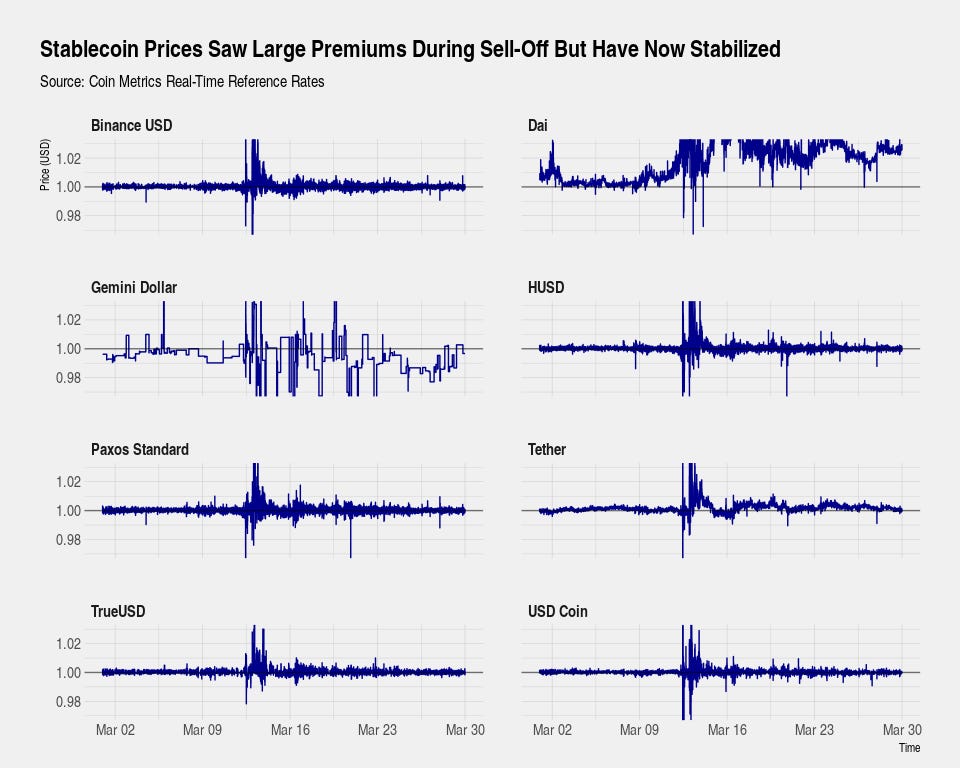

Stablecoins are seeing large increases in issuance but their pegs to the U.S. dollar remain relatively stable outside of an unstable period on March 12. The reason for the increase in issuance across the board is still unknown, but stablecoins do not appear to be selling at a meaningful premium. While most stablecoins remain close to the $1 U.S. dollar peg (with the exception of Dai), there appears to be a small but marked regime shift between and after March 12. Stablecoin prices and bid-ask spreads appear to have entered a more volatile regime.

Source: Coin Metrics Reference Rates

CM Bletchley Indexes (CMBI) Insights

Cryptoasset markets had a turbulent week with most CMBI and Bletchley Indexes experiencing intraweek highs of over 10% above last week’s close. However after a strong start to the week, all indexes fell significantly through the weekend, but still managed to finish up between 0-5%.

The Bletchley 40 (small-cap) finished the week strongest, up close to to 5% against the U.S. dollar and 3.5% against Bitcoin. All Bletchley multi-asset indexes outperformed the CMBI Bitcoin and CMBI Ethereum single-asset indexes this week.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

We are happy to announce that we completed a $6 million round of funding led by Highland Capital Partners with participation from FMR (Fidelity Management & Research), LLC, Castle Island Ventures, Communitas Capital, Collaborative Fund, Avon Ventures, Raptor Group, Coinbase Ventures, and Digital Currency Group.

Coin Metrics is hiring! Please check out our Careers page to view the openings.

As always, if you have any feedback or requests, don’t hesitate to reach out at info@coinmetrics.io.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.