Coin Metrics' State of the Network: Issue 116

Tuesday, August 17th, 2021

Get the best data-driven crypto insights and analysis every week:

JPEG Summer: Exploring The Data Behind the NFT Boom

By Nate Maddrey and Kyle Waters

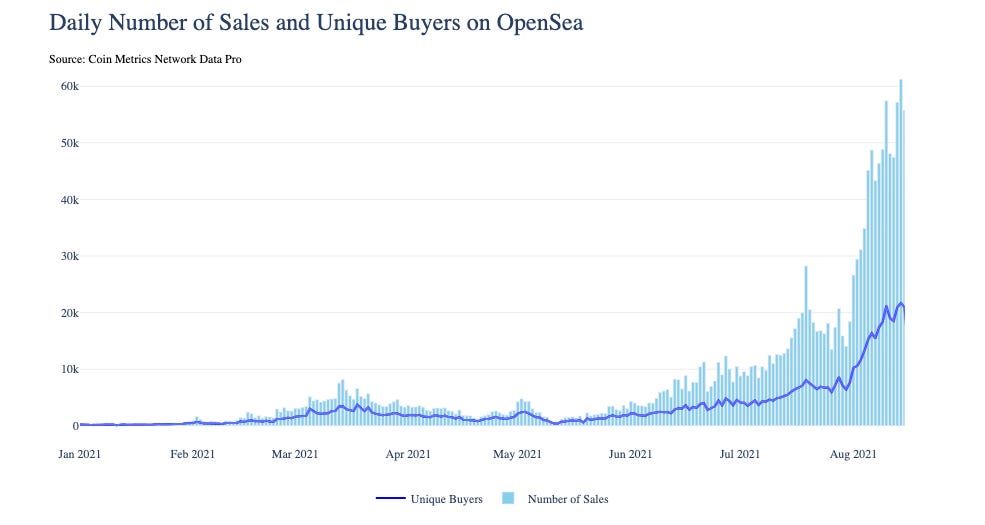

Over the last two weeks NFT sales have exploded to levels well beyond the NFT boom seen in March. The number of sales on OpenSea, the largest NFT marketplace, reached a peak of over 60K per day over the last week which is close to 8X the peak reached in March. OpenSea volume has already topped $1B in August, and the number of daily unique buyers has also hit a new all-time high.

Source: Coin Metrics Network Data Pro

A few events at the end of July appear to have sparked the boom. On July 30th, an anonymous buyer spent $7M to acquire 104 CryptoPunks in a single block. They selectively bought the 104 least expensive CryptoPunks on the market, significantly raising the floor (“floor” price refers to the price of the cheapest available NFT within a collection). They went on to explain that they view CryptoPunks as a long-term store of value and targeted the floor Punks as part of their strategy to optimize liquidity and diversification.

The buyer also used MiningDAO to privately send all of the 104 transactions directly to miners. This meant that the transactions were not publicly visible until they were already added to a block which prevented frontrunners from buying up the floor before the transactions went through. Before the floor sweep the average CryptoPunk sale price was about $60K (over the previous 500 sales). But since the purchases, the average CryptoPunk sale has increased to close to $200K.

Sources: Coin Metrics Reference Rates & OpenSea API

CryptoPunks sales volume has exploded since the beginning of August. But in addition to Punks there’s also been an onslaught of animal-based NFT projects taking over Twitter profile pictures.

Sources: Coin Metrics Reference Rates & OpenSea API

Bored Ape Yacht Club (BAYC) sales volume took off after an announcement that they will be featured in a Christie’s auction. Since then BAYC has had million dollar sales, and floor price reached over 15 ETH. In addition to BAYC, other profile picture collections have climbed the OpenSea charts. After a Twitter war with the BAYC, Pudgy Penguins trading volume shot up, topping $13.5M on August 13th.

Around the same time as the CryptoPunks floor sweep, Singapore based hedge fund Three Arrows Capital started to go on an NFT buying spree. Over the last two weeks the firm has spent thousands of ETH buying NFTs mostly focused on Art Blocks and CryptoPunks.

Art Blocks is a generative art platform that has produced popular collections including Ringers, Chromie Squiggles, and Fidenzas. The Art Blocks market has exploded following the start of Three Arrows Capital’s investments.

Sources: Coin Metrics Reference Rates & OpenSea API

Two NFTs from the Ringers collection sold for 400 ETH and 370 ETH each on August 9th, the two highest sales for the collection to date. On August 14th a Chromie Squiggle sold for 750 ETH, approximately $2.4M.

Art Blocks prices have shot up over the last two weeks. There are dozens of Art Blocks projects, and price varies between them, but on average sales price has reached as high as $29,500, peaking on August 10th.

The cryptoart marketplace is also starting to make a comeback after the peaks in March. Daily volume on SuperRare, the leading one-of-one cryptoart marketplace, is picking up after setting new all-time highs in March. On August 3rd, summer.jpg by XCOPY, one of the earliest artists on SuperRare, sold for 336 ETH, about $838K.

During the March NFT run cryptoart was getting a bulk of the media attention, highlighted by Beeple’s $69M sale on March 11th. But during this summer’s run there has not been a similar level of mainstream media attention, at least to this point. In hindsight, the $69M Beeple sale marked the top of the March boom.

But in addition to the Beeple sale, ETH’s price started to take off in mid-March, peaking at a new all-time high of $4.1K in April. As ETH price passed $4,000 NFT sales dipped. After ETH crashed NFT sales started to take off again.

Sources: Coin Metrics Network Data and Reference Rates

This may show a relationship between the NFT market and ETH’s price. NFTs are typically priced in ETH, so if ETH price suddenly rises new entrants can get priced out. For example, an NFT that is priced at 2 ETH might suddenly go from costing about $3,000 USD to over $6,000 USD. These types of price rises may make it too expensive for some potential buyers who do not already own ETH and need to buy into the crypto market using fiat.

But there also may be some reflexivity between the NFT market and ETH price. People buy ETH to buy NFTs, sell their NFTs for more ETH, and then often reinvest that ETH back into more NFTs. High NFT sales bring new attention to ETH and help bring more users into the Ethereum ecosystem.

During the March NFT boom NFT sales and ETH price were both increasing simultaneously until the market suddenly slowed as supply outpaced demand. NFT sales and ETH price are now both increasing once again.

Although NFT sales volume has surged this summer, the amount of worldwide Google searches for “NFT” is still well below its peak in March. If NFTs start gaining as much outside attention as they did earlier this year there may be an even bigger boom yet to come.

Sources: Google Search Trends and Coin Metrics Network Data

Network Data Insights

Summary Metrics

Source: Coin Metrics Network Data Pro

ETH fees grew by 52% week-over-week for an average of about $21.9M total fees per day. Total BTC fees averaged $600K per day over the same period. ETH fees are increasing mostly thanks to the NFT boom - NFT launches can lead to gas wars with average gas price often reaching over 1000 GWEI as buyers compete to try to mint an NFT before the collection sells out. The average ETH transaction fee is now over $18, while the average BTC fee is about $2.70.

Network Highlights

Data from TxStats.info, a collaborative project between Coin Metrics and BitMEX Research, suggests that the growth of the Lightning Network has surged in recent months. The Lightning Network is a layer-2 scaling solution for Bitcoin powered by the opening and funding of payment channels between users.

The number of open channels has increased 76% YTD, rising from 38K to 67K today. Much of that growth has come in just the last few months, however, with the number of channels increasing from 49K to 67K since June 1st alone. The amount of bitcoin held in these channels has also risen from ~1,067 at the start of the year to ~2,297 today.

On top of this growth, it is likely that the true size of the Lightning Network is even larger than this today given that some nodes open private or “unadvertised” channels and the data above capture only public channels.

There are many factors that might be contributing to this growth including new ways to onboard with Lightning, the adoption of the network for remittances and micropayments, and an expanding universe of applications and use cases.

First, developers are simplifying the protocol making it easier for all users ranging from entrepreneurs to enthusiasts to successfully use the Lightning Network. For example, last month the blockchain technology company Blockstream announced a new service called Greenlight that simplifies the process of launching a personal Lightning node.

Additionally, the largest public nodes have increased the amount of bitcoin they hold, signaling a need for more liquidity as Lightning usage increases. OpenNode, a company building Lightning-powered payment plug-ins that operates the 4th largest public node by current capacity (~93 BTC), announced in June that they would partner with the e-commerce platform BigCommerce to allow any of the over 60,000 global merchants on the platform to accept bitcoin payments.

The Lightning Network is also a cheap and convenient way to facilitate micropayments and remittances. In El Salvador, the Lightning-enabled wallets Strike and Galoy’s Bitcoin Beach Wallet have remained in the top-25 most downloaded finance apps in the Apple App Store since the country passed legislation to give Bitcoin the status of legal tender. Even before the announcement, Strike was already in the top 25, perhaps due to the success of local experiments like Bitcoin Beach.

Finally, apps are being built on top of the Lightning Network such as Stakwork, a permissionless marketplace for microtasks like data labeling that uses the Lightning Network for payment infrastructure. Other applications using the Lightning Network include Sphinx Chat, Impervious A.I., and Satoshis.Stream, to name a few.

App development further incentives investment in the Lightning Network itself, starting a virtuous cycle between network adoption and the application ecosystem, an observation Lightning Labs, a software company developing infrastructure for the Lightning Network, has recently made.

With Jack Dorsey hinting at a potential integration of the Lightning Network with Twitter, there is much to watch out for in the development of the Lightning Network in the near future.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

We’re excited to announce the new Coin Metrics mobile app. View real-time cryptoasset pricing and relevant on-chain data in a single app! Download for free here: https://coinmetrics.io/mobile-app/

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.