Intro and Updates

Dear crypto data enthusiasts,

Welcome back to this week’s edition of Coin Metrics’ State of the Network, an unbiased, focused view of the crypto market informed by our own network (on-chain) and market data.

This week’s housekeeping items:

Coin Metrics is hiring! We recently opened up new roles, including Blockchain Data Engineer and Data Quality and Operations Lead. Please check out our Careers page to view the openings.

As always, if you have any feedback or requests, don’t hesitate to reach out at info@coinmetrics.io.

Weekly Feature

Bitcoin Shows Potential as A Unique Safe Haven Asset

Bitcoin was born as a response to a deep, global recession caused by a financial system driven to the brink of collapse. Afterwards, central banks around the world responded with unprecedented and unconventional monetary policy. Amongst questions about its sustainability, Bitcoin got off to a slow start – in 2009, there were several days when less than one Bitcoin was transacted. But Bitcoin was able to survive in its early years partially because of the extreme macroeconomic environment that existed during the time.

Macroeconomic conditions were supportive of Bitcoin’s growth for several years after its creation. The Fed alone initiated three rounds of quantitative easing between 2008 and 2013. Such extreme monetary policy decisions combined with the willingness of governments to bailout critical financial institutions led many to question the sustainability of such policies, creating many ideological-converts to Bitcoin in the process.

For the past several years, the world has enjoyed relative stability with moderate growth and the longest U.S. economic expansion in history. Thus, most recently, Bitcoin and other cryptoassets have grown without the supportive macroeconomic environment in which they were born in.

Recent developments present a radical shift in the macroeconomic and geopolitical environment. Faced with some softness in the latest macroeconomic indicators, widespread inversion of most developed world economy yield curves, negative nominal interest rates, a persistent inability to achieve central bank inflation targets, falling inflation expectations by market participants, and the possibility of a full-blown U.S.-China trade war, the Fed is once again leading the way in easing monetary policy. In the recent meetings of the Federal Open Market Committee, it is clear that the Fed is growing increasingly concerned about the potential impact of a negative shock to the economy and are willing to consider “insurance-type” interest rate cuts to sustain the current economic expansion.

Other central banks around the world have responded similarly. The ECB, although not yet cutting key interest rates, has adjusted its forward guidance to indicate more monetary easing. The PBoC recently has indicated its willingness to allow the yuan to float above the psychologically-important 7 level against the dollar (which they have defended in the past) to blunt the negative impact of additional U.S.-imposed tariffs. And a trio of emerging market central banks in New Zealand, India, and Thailand surprised market participants by announcing larger than expected rate cuts.

Bitcoin has not been immune from the impact of this dramatic pivot – it too has risen in concert with the decline in global yields and rise in gold. Bitcoin’s intrinsic qualities indicate that it could effectively serve as a safe haven asset – particularly its decentralized nature making it immune to the control of and the policy errors of any centralized institution, as well as its high stock-to-flow ratio. Such qualities are important for something to serve as hard money. Analyzed under this lens, it shares many qualities with gold, and it is theoretically sound and logical to make the comparison between Bitcoin and gold.

This theory, combined with a look at the year-to-date price action, has breathed new life in the Bitcoin as a safe haven narrative. Indeed, the decline in real interest rates and increased concerns of geopolitical instability have driven gold to six-year highs and, as the narrative goes, has also driven Bitcoin to steeply recover from its lows.

Looking at a plot of the prices of Bitcoin and gold can easily lead to the conclusion that there is some positive relationship. Correlation coefficients, a summary statistic that is simple to interpret and calculate, is commonly used to provide an objective measure of the linear relationship between two timeseries. Despite the widespread use of correlation and its ease of interpretation, it is prone to misuse. Some analysts mistakenly calculate correlation using the prices (or level) and not the returns (or changes) of the two timeseries. Such an analysis can lead to misleading conclusions. Our analysis uses daily returns to calculate an economically-meaningful correlation coefficient.

The actual data provides only moderate support for the safe haven narrative. An analysis of a 90-day rolling correlation indicates that the Bitcoin and gold return has historically been uncorrelated with values oscillating around zero. Interestingly, the correlation has been steadily increasing since the beginning of this year as theory would expect. Current correlation is +0.20 – high relative to its historical range and increasing, but still low on an absolute scale where correlation coefficients can range from -1.0 to + 1.0.

Such a result should cause market participants to critically examine the safe haven narrative and be open-minded to the possibility that the relationship between Bitcoin and gold is spurious. Although backed by strong theory and the presence of compelling evidence that Bitcoin and gold both respond similarly to specific geopolitical events, a proper correlation analysis suggests that the relationship between the two is weak.

How can we reconcile these empirical results with the prevailing narrative? Perhaps Bitcoin has been rising in concert in gold not because they both respond similarly to the same macroeconomic and geopolitical factors but because Bitcoin has already experienced an 85 percent drawdown (historically the bottom of previous cycles) in combination with Bitcoin-specific factors like the news of Facebook launching its own cryptocurrency and continued institutional interest.

Still, this explanation does not fully explain the entire range of observations. Certain specific geopolitical events, not priced in by market participants, have caused strong intra-day movements in both Bitcoin and gold. Some of the most compelling of these events include Donald Trump’s presidential election, the Brexit referendum, and most recently the depreciation of the yuan in response to growing U.S.-China trade tensions. Such events suggest that the relationship between Bitcoin and gold is market regime dependent.

Under normal times, gold is responsive to standard macroeconomic variables, particularly changes in real yields. Bitcoin, an asset still in the process of maturing into a full-fledged asset class, is unresponsive to macroeconomic data. This explains the typically low levels of Bitcoin-gold correlation that oscillates around zero.

During times of heightened geopolitical risk, the desire for the stability of haven assets takes center stage over the macroeconomic situation. Under such circumstances, the intrinsic qualities of both Bitcoin and gold attract capital and can experience short-lived periods of high correlation.

Examining the Bitcoin-gold rolling correlation over a shorter time period like 30-days lends evidence to this narrative. Thus far, geopolitical tensions are rising but contained, and any flare up has been short-lived. A shorter rolling correlation window is more responsive to these short-lived events. Indeed, the current 30-day rolling correlation is +0.49, high relative to its historical range and also on an absolute basis. This trailing 30-day periods has been characterized by the highest escalation of U.S.-China trade war tensions thus far and suggests that Bitcoin serves as a unique safe haven asset – unresponsive to macroeconomic surprises but reactive to geopolitical tensions.

Bitcoin shows qualities of a unique safe haven asset, able to hedge against true black swan-type events where centralized institutions fail or commit policy errors while simultaneously being unresponsive to normal macroeconomic surprises. Bitcoin’s unique hedging capabilities combined with its volatility (almost a magnitude higher than traditional financial assets) makes it extremely desirable from a portfolio construction perspective, particularly portfolios that tend to volatility-weight asset classes.

The world is taking a decisive step towards a macroeconomic environment and geopolitical climate that is more similar to conditions that were present at Bitcoin’s genesis – low interest rates, unconventional monetary policy, and rising geopolitical tensions. This shift should be supportive of Bitcoin’s price in the long-run. Moreover, the probability of some severe event has risen sharply – driven either by some policy error in a major developed world economy, the ineffectiveness of current monetary policy tools to address slowing economic growth, unexpected election outcomes, social unrest, or sovereign debt defaults and wars at the extreme. Most troubling is that the undercurrent of social tensions is occuring in a world where macroeconomic conditions and asset prices are quite good. Under a global recession, these social tensions should increase in intensity and could lead to a watershed moment in Bitcoin’s status as a safe haven asset.

Network Data Insights

Summary Metrics

On August 5th, LTC’s block reward halved from 25 LTC to 12.5 LTC. Since then, LTC’s market cap and realized cap have both declined; LTC’s market cap is down 4.7% week over week, while BTC’s market cap is up 13.9% over the same period.

LTC mining revenue is down 54.3% over the previous week, due to the decrease in issuance per block. This sudden drop in total mining revenue will force many inefficient miners out of the market, unless they are able to adapt and quickly cut costs. LTC’s hash rate fell by over 12% from the previous week which signals that miners are already starting to leave the network.

LTC transfers and active addresses, on the other hand, both grew by over 65% since last week. Additionally, LTC’s adjusted transfer value is up over 32%, while BTC’s adjusted transfer value is up only 1.2%.

BTC’s average daily fees also shot up by over 44%, even though transactions and transfers stayed relatively flat. BTC and ETH hash rate both rose, in contrast to LTC’s hash rate drop.

Network Highlights

The number of addresses owning at least 1 billionth of Bitcoin’s supply is at an ATH. At current prices, only addresses owning >$200 in BTC are counted towards this metric.

LTC’s hash rate began to drop after the block reward halving on August 5th, and bottomed out at 358 TH/s on August 7th. However, it began to rebound after the 7th, and climbed back to 413 TH/s by August 10th.

The number of addresses that held any LEO balance (on Ethereum) plateaued over the last month. On August 10th, there were 1,789 addresses with any balance, up by only 79 addresses (1,710 total) on July 10th.

Market Data Insights

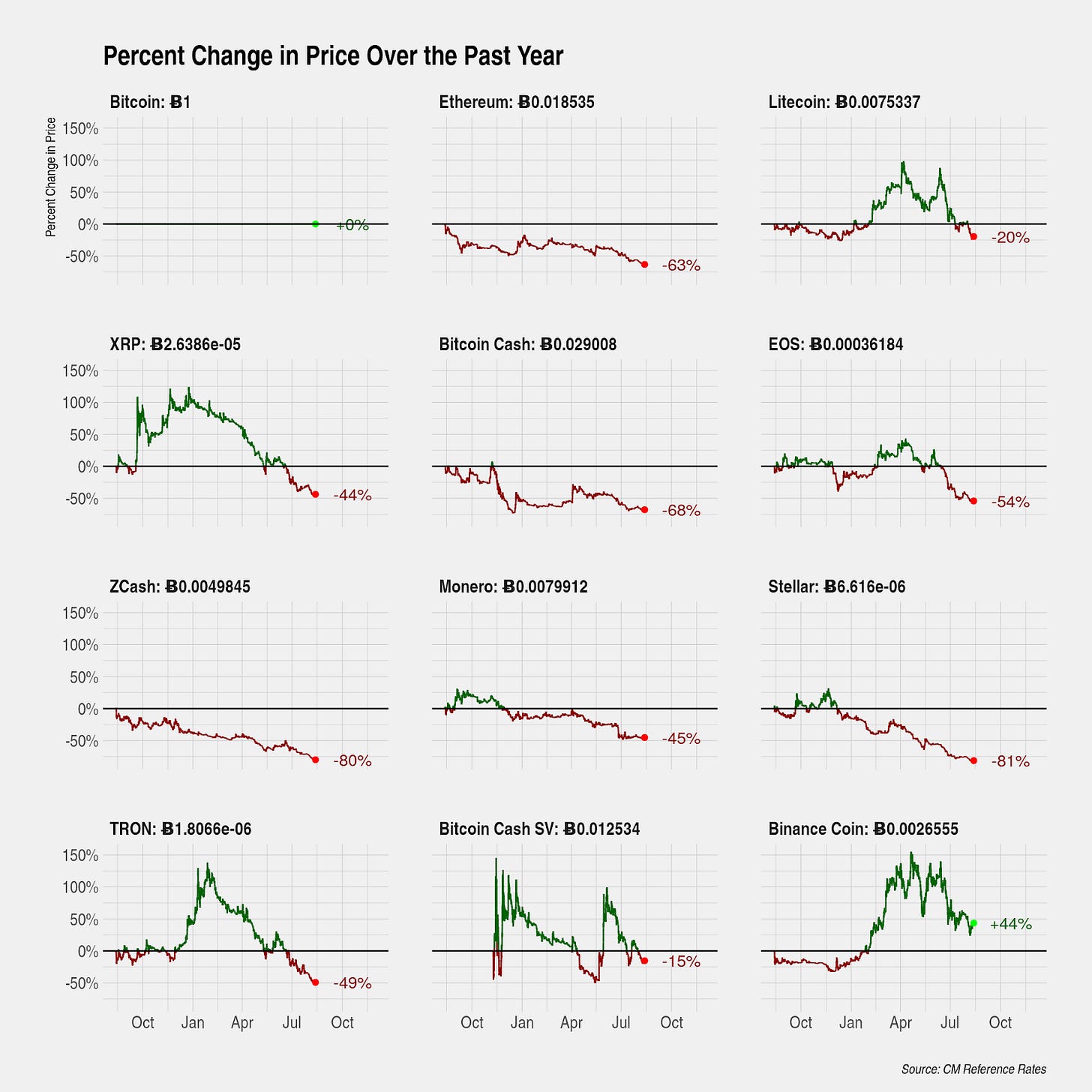

Bitcoin is up over 80% over the past year, outperforming almost all other crypto assets. Although many market participants track the value of smaller assets in prices quoted against the U.S. dollar, occasionally it is useful to view prices quoted against Bitcoin. Bitcoin-quoted markets are not only the major market for many of the smaller assets, it also represents the foregone appreciation of holding non-Bitcoin assets and not holding Bitcoin.

The following chart shows indexes prices denominated in Bitcoin over the past year. Among the major assets that Coin Metrics tracks, only Binance Coin has outperformed Bitcoin by 44%. All other major assets are down significantly in Bitcoin terms.

Smaller assets have even steeper declines. Such declines are similar in magnitude to the U.S. dollar denominated declines experienced in the depths of crypto winter. Smaller assets have been doubly hit -- declining sharply on the way down and also appreciating less as the overall market (represented by Bitcoin) has recovered.

CM Bletchley Indexes (CMBI) Insights

Bitcoin dominance, a measure of Bitcoin’s market cap relative to the total crypto assets marketcap, has been increasing significantly since April. The last 3 months have seen Bitcoin’s dominance increase from 50% to 70%, a level that has not been witnessed since April 2017. To add some context to this, the last time Bitcoin commanded a 70% market dominance the price of Bitcoin was ~$1,200 and the price of Ether was ~$20.

As can be concluded from the weekly performance of the Bletchley Indexes, low cap crypto assets have experienced the biggest drawdowns recently. Not only have they experienced negative USD price action, but since Bitcoin finished the week up 4%, their price in Bitcoin terms has depreciated significantly.

Subscribe and Past Issues

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.