Coin Metrics' State of the Network: Issue 126

Tuesday, October 26th, 2021

Get the best data-driven crypto insights and analysis every week:

Unpacking the data behind bitcoin’s new all-time high and inaugural ETF launch

By Kyle Waters and Nate Maddrey

After a 189-day gap between its last all-time high, bitcoin’s price soared to new heights on October 20th, breaking above the $65K mark for the first time. The new highs followed on the heels of the successful launch of the first ever US Bitcoin-focused exchange-traded fund.

While there are crucial differences between the two futures-based ETFs that launched last week and a yet to be approved spot ETF that would hold and custody underlying bitcoin, the ETFs have reinvigorated interest in BTC and further legitimized crypto in general. And while it might seem like only a short time ago that BTC was trading near its peak, there are some signs that the market dynamics of this latest rally are markedly different from earlier this year.

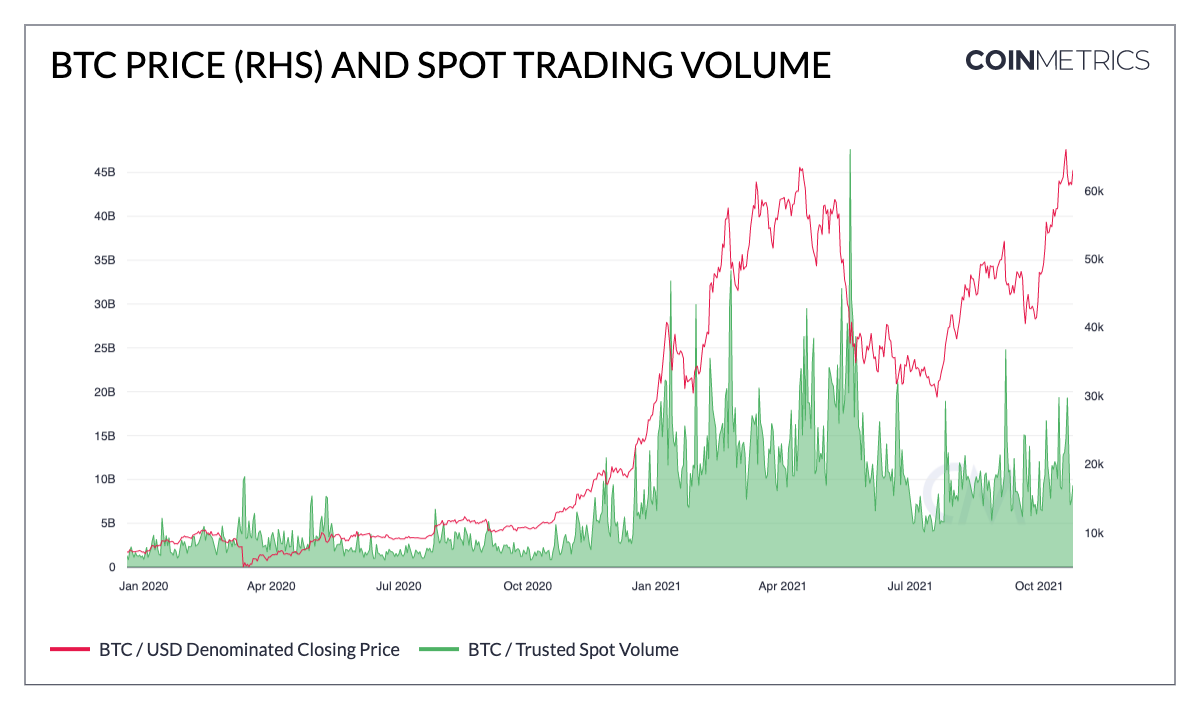

BTC Spot Volume Dynamics

Unlike the rise in BTC price earlier this year, the recent all-time high has not yet led to new records in daily spot trading volume.

Source: Coin Metrics Network Data Charts

BTC spot volume across Coin Metrics trusted exchanges has averaged ~$11.5B per day in October, with a high of $19.4B on October 15th. This is considerably lower compared to earlier this year, when spot trading volume frequently topped $20B. Assuming that the remaining 7 days in October track the daily average of the month, total BTC spot volume in October is set to be around $350B. This would be higher than July, August, and September’s totals but lower than the total monthly volume recorded in each month between January-May of this year; volume topped $400B in each of the first 5 months of this year.

Source: Coin Metrics Market Data

There are a few potential factors at play. First, some retail trading volume may have shifted away from BTC to other crypto assets. BTC’s relative share of spot trading volume across some of the largest crypto assets is lower now than it was at times earlier in the year. The chart below breaks down the daily spot trading volume on Coinbase by base asset and shows that newer listings such as Solana (SOL), Cardano (ADA), and Shiba Inu (SHIB) have captured significant shares of daily volume. ETH’s share of total volume has also grown as DeFi and NFT adoption have ramped up. However, BTC’s share has been increasing over the last few weeks, perhaps signaling that retail traders are returning to the BTC market.

Source: Coin Metrics Market Data

As the BTC market matures, there might also be increased trading activity occurring via OTC (over-the-counter) desks that is not being captured in open market data. In contrast to trading on exchanges, OTC trading happens directly between two parties, with one of those parties generally being a “desk” that facilitates the buying and selling of an asset class. This type of discrete trading would be preferable to institutions needing to fill large BTC orders that might otherwise be too disruptive if placed on open exchanges.

Another important factor is the total availability of spot BTC to the market. BTC is increasingly being held for relatively long periods, and as of October 25th over 66% of total BTC supply has been held for at least 6 months. This metric dipped down to close to 50% in May as some investors sold during the early 2021 bull run. But a large portion of investors who bought in before April appear to have held through the spring crash, leading to the rise in BTC held for at least 180 days.

Source: Coin Metrics Network Data Charts

This is an important trend to watch as the market cycle develops because it is likely impacting the current supply and demand dynamics in the BTC market. If higher spot volume returns, this might lead to relatively higher volatility in the near term as well. But even as a relatively small amount of spot BTC has been changing hands, new investment products are seeing immense demand.

The Launch of the First Bitcoin-Focused ETF

In an important moment for Bitcoin and the crypto industry as a whole, the ProShares Bitcoin Strategy ETF began trading last week under the ticker BITO on the New York Stock Exchange. The fund saw close to $1B in total volume traded on the first day making it one of the largest ETF launches ever, with close to $570M of inflows. BITO saw record breaking inflows over the week and as of Friday, the fund held $1.17B worth of assets. Closing out the week, the Valkyrie Bitcoin Strategy ETF also launched under the ticker BTF.

While the launch of the first Bitcoin ETF products in the US is an exciting development, there are crucial differences between the futures-based ETFs like BITO and BTF that launched last week and spot-based ETFs - the latter which have yet to be approved in the US.

At the most basic level, the difference is in the type of asset held in the fund. Futures are a type of derivative that represent an agreement to buy or sell an asset at a future date and are widely used in financial markets as well as crypto markets. In fact, the majority of crypto trading volume occurs in futures and other derivatives each day and there is typically over twice as much futures trading volume per day as there is spot. For more on crypto futures and how to interpret them, check out our crypto futures data primer.

Source: Coin Metrics Network Data Charts

There are many venues that offer various futures products for BTC and crypto assets, but the Chicago Mercantile Exchange (CME) is unique as a regulated exchange falling under the purview of US regulators like the Commodities Futures Trading Commission (CFTC). Due to this regulatory framework and long track record of the CME, the Bitcoin Futures ETFs approved in the US to-date are holding CME futures contracts.

The launch of the CME-futures based ETFs has had a big impact on the market structure for Bitcoin CME futures. Open interest is a measurement of the total number of active futures contracts at a given time. Amidst last week’s ETF launches, CME open interest for BTC futures has hit all-time highs:

CME futures contracts have a traditional contract structure with a defined time when the contract expires, known as the expiration date. At expiration, the contract will settle at a price based on the spot price of the futures contract’s underlying asset. However, investment vehicles like ETFs will avoid settlement and “roll” the contract by moving their position to a contract with a later expiration date (sell the contract that is about to expire and buy the later one). This has important implications for the performance and efficiency of a fund holding CME BTC futures.

ETFs must frequently sell the lower-priced, near-term contracts it holds to buy longer-dated contracts at a premium. The subsequent roll cost varies depending on market conditions but some estimate it can be between 5-10%. The cost can also be compounded by the need to purchase longer-dated contracts due to position limits imposed by the CME. Currently, the futures ETFs cannot hold more than 2,000 contracts in the near-term contract. With one CME BTC contract having a size of 5 bitcoin, this limits the ETF to $600M of exposure in the near-term contract at a bitcoin price of $60K. Strong demand last week forced BITO to buy longer-dated contracts, and as of last Friday the ETF held 1,679 contracts expiring in October (the near-term contract) and 2,133 expiring in November. Due to this high demand and relatively low position limit, ProShares has since filed for an exemption on position limits with the CME.

The position limit may also force futures-based ETFs to seek BTC-price exposure in other assets such as swaps or equities with substantial BTC exposure such as Microstrategy which now holds over 114K BTC. However, this would further dilute the ETF’s exposure to spot BTC and might increase the tracking error to the underlying price of BTC. Over shorter time horizons this error might be small though, making the futures-based ETFs good tools for short-term trading and liquidity.

But with many futures-based ETFs still in the pipeline, there might be plenty of products coming in the near future to meet the demand.

Although there are some considerable differences between futures and spot-based ETFs, the launches last week have served as a milestone in Bitcoin’s path to maturity and widespread adoption. With only ~9% of investment advisers surveyed by Bitwise earlier this year saying they had allocated to crypto for their clients, investment products accessible via traditional brokerage accounts are set to play a key role in establishing crypto as an asset class.

To follow the data used in this piece and explore our other on-chain metrics check out our free charting tool, formula builder, correlation tool, and mobile apps.

Network Data Insights

Summary Metrics

Source: Coin Metrics Network Data Pro

BTC hash rate has continued to climb higher over the last few weeks. Although the best data available indicates that China’s share of global hash rate has fallen to near zero, a notice has started circulating indicating that China might be soliciting opinions from the public regarding crypto mining activities.

ETH fees fell over the week as NFT activity as measured by daily ERC-721 transfers cooled a bit. The number of ERC-721 transfers on Ethereum was ~103K on October 24th, the lowest level in over two months when there were ~99K daily ERC-721 transfers recorded on August 23rd. However, this is still roughly 10x the daily average from January of this year.

Network Highlights

The introduction of new futures-based ETF products will likely have an impact on existing products available to investors as well as the supply characteristics of BTC.

For much of its life, the Grayscale Bitcoin Trust (GBTC) traded at a sharp premium to its net asset value (NAV). However, this premium flipped to a discount in 2021, with the trust currently trading at a ~13% discount to NAV.

Source: Coin Metrics Market Data

Following last week’s launch of futures-based Bitcoin ETFs, Grayscale has reiterated its plans to convert the trust to a spot ETF. This would be a significant move as the trust currently holds 3.5% of all bitcoin, or ~647K BTC.

Source: Coin Metrics Market Data

As a percentage of Coin Metrics’ free float supply, which measures BTC readily available to the market and removes supply provably lost, destroyed or otherwise inactive, the trust holds about 4.5%. Trusts are not currently removed from free float supply, so GBTC effectively removes an additional 647K bitcoin from free float.

In addition to this supply held by GBTC, there are other BTC trusts in the market. Coin Metrics is serving as the Index Provider for two additional crypto trust entries: BlockFi’s Bitcoin Trust and the Osprey Bitcoin Trust.

As investment products like BTC trusts (and likely spot ETFs) grow, a larger and larger percentage of supply is essentially locked up and held indefinitely, changing crypto market dynamics and supply measurements with it.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Coin Metrics is hosting its first Boston crypto meetup on October 27th.

This in person event will feature a live discussion of the latest State of the Network followed by a Q&A with the audience.Check out our market-data focused newsletter State of the Market, featuring weekly updates on market conditions.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.

© 2021 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is’ and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.