Coin Metrics' State of the Network: Issue 148

Tuesday, March 29th, 2022

Get the best data-driven crypto insights and analysis every week:

Coin Metrics is hiring Research Analysts, Data Scientists, and many other positions. Check out our open roles here.

The State of the Network Q1 Mining Data Special

By Kyle Waters, Parker Merritt, and Nate Maddrey

As the crypto asset class matures, understanding the quickly developing landscape of crypto mining is critical. In proof-of-work (PoW) blockchains like Bitcoin and Ethereum, miners play a key role in securing the global, shared ledgers that settle tens of billions of dollars of transactions per day and store trillions in wealth. Mining is also an economically significant industry: in 2021 total Bitcoin miner revenue was ~$17B while Ethereum miners received just over $18B.

2021 ushered in dramatic change to the mining industry. In the wake of China’s sudden crackdown on crypto mining in spring 2021, North America-based miners emerged as the new global industry leaders.

2022 is shaping up to be another important year. In this week’s SOTN, we dive into some mining data fundamentals and contextualize the current state of this important sector of the crypto-economy.

Hash Rate & Mining Difficulty

Hash rate is one of the most frequently studied mining metrics. It provides an estimate for the total amount of computational activity that miners spend when working to add new blocks to the chain. In PoW, miners compete to add new blocks which come with block rewards (currently 6.25 BTC or $300K per block at a BTC price of $48K).

Hash rate is an implied measure that is calculated based on the speed that new blocks are added to the chain. You can read more on how Coin Metrics calculates an implied hash rate measure from on-chain data and how to interpret it here.

After falling close to 50% in spring 2021 amid the exodus of China-based mining, Bitcoin’s hash rate (measured in EH/s, quintillion hashes per second) is at an all-time high today of ~200 EH/s, when measured on a 30-day moving average.

Source: Coin Metrics’ Formula Builder

More miners have been incentivized to come online recently because of the positive economics at today’s BTC price. Growth in hash rate has largely lagged bitcoin’s rapid rise in price.

Bitcoin mining difficulty is another important metric to follow. Bitcoin’s mining difficulty is a network-determined parameter that automatically adjusts roughly every 2 weeks (2,016 Bitcoin blocks) to target a 10-minute block interval. Mining difficulty fell 26% in July 2021, the most in the network’s history. However, most difficulty adjustments have since been positive as new hash rate has come online.

Source: Coin Metrics’ Formula Builder

But as hash rate growth has slowed in recent weeks and BTC price has moved sideways, the last two adjustments have both been downward, the first time this has happened since last summer.

Ethereum’s hash rate has also moved higher in 2022. Although growth has slowed recently, the network’s hash rate is close to breaking past 1,000 TH/s for the first time.

Source: Coin Metrics’ Network Data Charts

Miner Revenue

Bitcoin miners have so far recorded over $3B in revenue in 2022, the vast majority of which has come from block rewards.

Source: Coin Metrics’ Formula Builder

Ethereum miners, meanwhile, have captured close to $3.7B while recording over $1B/month in revenue for the past 12 months straight. Miner tips (priority fees) have accounted for ~$300M or about 8% of Ethereum miner revenue in 2022 so far. This is slightly lower than in Q4 2021 when fees accounted for roughly 10% of miner revenue.

Source: Coin Metrics’ Formula Builder

Ethereum miners have also received an additional ~$90M from MEV rewards YTD.

But with over 10M ETH in the staking contract now and the successful testing of The Merge recently on the Kiln testnet, progress is being made towards Ethereum’s impending move to proof-of-stake.

Hashprice & Hashvalue

Mining difficulty adjustments are an important mechanism for maintaining Bitcoin’s target block interval of 10 minutes. But they also have an outsized impact on the profitability of mining itself. Miners around the world are constantly searching for a competitive edge, whether that be lower electricity costs or more advanced ASIC hardware. No matter how cost-effective a miner’s operation, however, all participants are compensated equally for their incremental contribution of hashrate.

The most common metrics for measuring a miner’s top line are Bitcoin-denominated daily revenue per TH/s (“Hashvalue”) and USD-denominated daily revenue per TH/s (“Hashprice”).

Due to price volatility, Bitcoin-denominated revenue is a far more predictable measure. The amount of new coins issued per block is fixed (currently at 6.25 BTC), meaning that between each difficulty adjustment, a miner should expect to earn approximately the same amount of Bitcoin on a daily basis.

Block discovery is a probabilistic process, and new coins are occasionally issued faster or slower than the targeted 10-minute interval, so there is still some level of variability in hashvalue. For the most part, however, difficulty adjustments have a clear and measurable relationship with the amount of coins earned— negative difficulty adjustments precipitate higher Bitcoin-denominated revenues, while positive difficulty adjustments lead to lower Bitcoin-denominated revenues.

Source: Coin Metrics Network Data

While the correlation between difficulty adjustments and Bitcoin-denominated revenues is quite clear, USD-denominated revenues introduce a far less predictable input variable: Bitcoin price. Intuitively, one might expect similar principles to apply, with negative adjustments boosting revenues and positive adjustments doing the opposite. In times of lower market volatility, this assumption tends to hold true, yet the correlation can occasionally break down due to Bitcoin’s unpredictable price action.

For example, as the Chinese mining exodus unfolded, the network’s difficulty continued to ratchet sharply downward, resulting in higher Bitcoin-denominated revenues with each adjustment. At the same time, however, Bitcoin’s price also suffered a harsh downturn, pinning USD-denominated revenues to a low of $0.20 per TH/s for a more prolonged period.

Source: Coin Metrics Network Data

Inversely, as miners worldwide began to bring hashrate back online in Q3-Q4 2021, difficulty soared. Although this was quickly accompanied by a series of positive difficulty adjustments, BTC price also remained in an uptrend, raising USD-denominated revenues back to the $0.40 per TH/s highs seen in both spring and summer.

But as BTC price retreated to start 2022, hashprice has since fallen back near $0.20 today.

Source: Coin Metrics Network Data

Clearly, Bitcoin’s difficulty adjustment mechanism is an important variable for miners to monitor, particularly in periods of high volatility. However, miners must ultimately make a conscious choice about which unit of account to prioritize— BTC or USD— as each measure of revenue comes with a unique set of considerations and assumptions.

Conclusion

The mining landscape has changed dramatically from just one year ago. Tectonic shifts in the geographic distribution of Bitcoin mining have introduced new opportunities. An increasingly institutional and maturing mining industry is tapping into the depth of U.S. capital markets while synergies between existing energy infrastructure and Bitcoin mining are beginning to surface. With these new developments in place, 2022 is poised to be another exciting year for mining.

Network Data Insights

Summary Metrics

Source: Coin Metrics Network Data Pro

Most major crypto assets moved higher week-over-week with BTC passing back over $47K and ETH passing back over $3.3K. Weekly on-chain activity was mostly flat for the major layer one blockchains with daily active addresses holding near 930K for BTC and 610K for ETH. Stablecoin transfer value picked up over the week with USDT (ETH) and USDC daily adjusted transfer value averaging ~$4B and ~$5B, respectively – both double digit increases from the previous week.

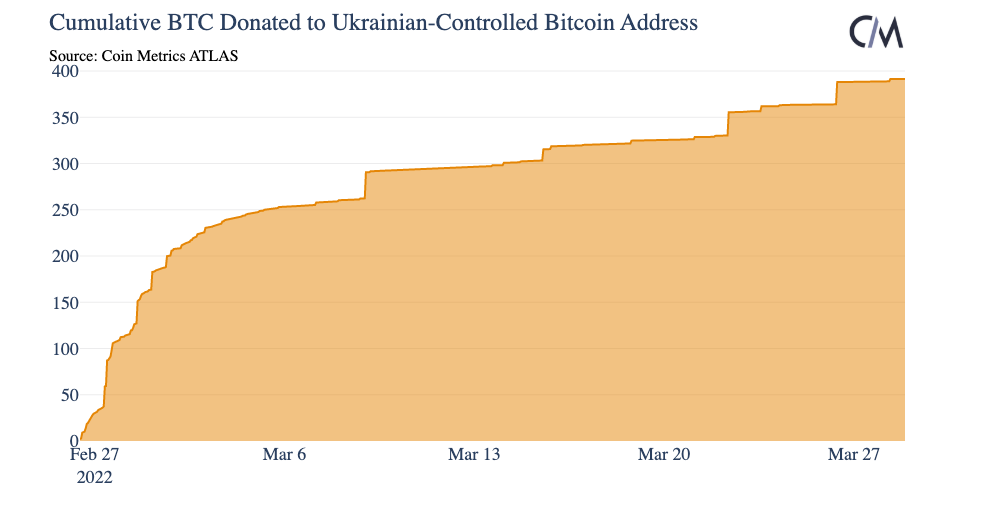

Ukraine Crypto Donations

The total amount of BTC donated to the Ukrainian government controlled address passed 390 BTC (~$18.5M at today’s BTC price). Over 60 BTC was donated in the past week, worth close to $3M at today’s BTC price.

Weekly Summary Video

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Last week we released a new special report covering our adjusted transfer value metric, you can find the full report here.

We're excited to be building a new data and researched focused community on gm.xyz, come check it out!

Check out our market-data focused newsletter State of the Market, featuring weekly updates on market conditions.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.

© 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.