Get the best data-driven crypto insights and analysis every week:

Coin Metrics is hiring Research Analysts, Data Scientists, and many other positions. Check out our open roles here.

Launching Uniswap Swap Data

By Kyle Waters and Nate Maddrey

As part of an ongoing effort at Coin Metrics to collect and contextualize on-chain data from DeFi protocols, we’re excited to be releasing data for decentralized exchanges (DEXs) as part of our market data feed. Our first release covers swaps (i.e. trades), liquidity data and pool metadata for Uniswap and Sushiswap, two of the largest DEXs on Ethereum. In this week’s State of the Network, we explore how this data can be useful for analyzing some of the most important DeFi protocols today.

As a brief refresher, unlike centralized crypto exchanges that collect bids and offers on a central limit order book, trading on Uniswap and other DEXs is completed autonomously through smart contracts that pool funds from liquidity providers. Each token swap is recorded on-chain, and any ETH user can create a new market on Uniswap or provide liquidity to earn trading fees. While the first version of Uniswap launched just 4 years ago in 2018, an intricate network of tradable assets has already emerged. DEXs have created a rich new set of questions for crypto researchers, as they require a knowledge of both blockchain and market data mechanics.

Trading Volume

One of the most fundamental DEX metrics is trading volume. Uniswap trading volume now regularly outpaces some large centralized exchanges. The chart below shows daily trading volume in the ETH-USD spot markets across a selected group of centralized exchanges compared to daily volume in the Uniswap V3 pool (the 3rd iteration of the protocol released in May ‘21) for wETH-USDC (0.05% fee tier).

Source: Coin Metrics Market Data Feed

Daily volume in this pool has typically ranged between $600M-$800M in 2022 so far. Uniswap volume also tends to peak on days where there is also high volume on CEXs, as one might expect.

Market Prices and Price Impact

An important area of crypto asset market research is understanding how the price discovery process occurs and the overall function of different exchanges. Price discrepancies can arise between exchanges, and comparing against benchmark prices robust to dislocations like Coin Metrics’ reference rates can be useful to gauge a market’s efficiency. This analysis is also relevant in the context of DEXs.

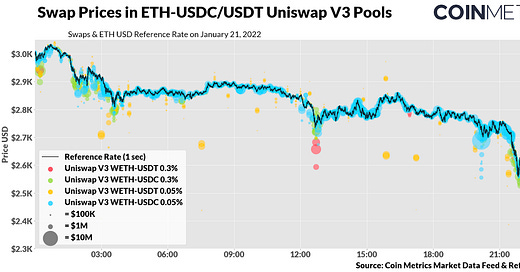

The chart below shows a sample of swap prices in four different ETH-USD (USDC/USDT) pools on Uniswap V3 vs. Coin Metrics’ ETH-USD reference rate on January 21, 2022.

Sources: Coin Metrics Market Data Feed and Reference Rates

This sample shows that swap prices tend to closely track ETH’s reference rate. Some larger swaps can deviate from the reference rate, though. Like traditional order book based markets, larger swaps in pools with lower liquidity will incur high price impact.

Arbitrage and MEV

When prices do move out of sync from prevailing market prices, lucrative opportunities for arbitrage can emerge. But unlike arbitrage in traditional financial markets, the unique complexities of blockchain consensus and smart contracts have spawned an entirely new field of research called miner extractable value (MEV), first dubbed in an influential 2019 paper called Flashboys 2.0 by Phil Daian.

MEV broadly encompasses any opportunities miners (or validators in PoS) have to profit from the ability to reorder, include, or exclude certain transactions in blocks being added to the chain. MEV comes in many forms, but data collected from Flashbots, an MEV R&D organization, shows that arbitrage comprises many of the most profitable opportunities.

The chart below shows an example of arbitrage on Uniswap V3 where the price of ETH deviates below the market price in the WETH-USDT 0.3% fee pool. In this transaction, an MEV bot first swaps 5,243 ETH for $16.19M USDC (top chart). It then transfers the USDC for USDT (incurring a small amount of slippage) and finally uses that USDT to buy 5,518 ETH, for a roughly 275 ETH profit (~$815K).

Source: Coin Metrics Market Data Feed

Although outsized opportunities like this are rare (this example ranks in the top-25 largest MEV transactions on the Flashbots leaderboard), large examples like this show why MEV is such an important area of research and how DEXs play a key role in its development.

Transaction Fees and Users

By being on-chain, DEXs introduce exciting new properties like composability. But they also inherit the current scalability limitations of the blockchain they run on. This is very important to Uniswap on Ethereum, where smaller swaps only make sense when fees are sufficiently low. The chart below shows the bottom 5th percentile of swap size per day in the WETH-USDC 0.05% pool. Charted on the right-hand side is the mean transaction fee (in $) on Ethereum that day.

Sources: Coin Metrics Market Data Feed and Network Data

There is a close relationship between fees and the distribution of swap sizes. When fees are low, as they were in the beginning of March, small swaps are more practical. But when fees rise, swaps below a certain threshold can get priced out. However, Uniswap has now been deployed to layer 2s (L2s) Optimism and Arbitrum, as well as Polygon, where fees are much cheaper. This should help smaller users but also introduces more complexity for tracking DEX analytics like TVL across multiple networks.

Conclusion

This is just a small taste of where this data might be useful. The rise of DEXs has introduced many more questions such as competition between DEXs and fee structures, liquidity provider (LP) profitability and impermanent loss, and the effects of more exotic DeFi use cases like flash loans.

Coin Metrics looks forward to providing more data for this vibrant space of the crypto ecosystem in the near future.

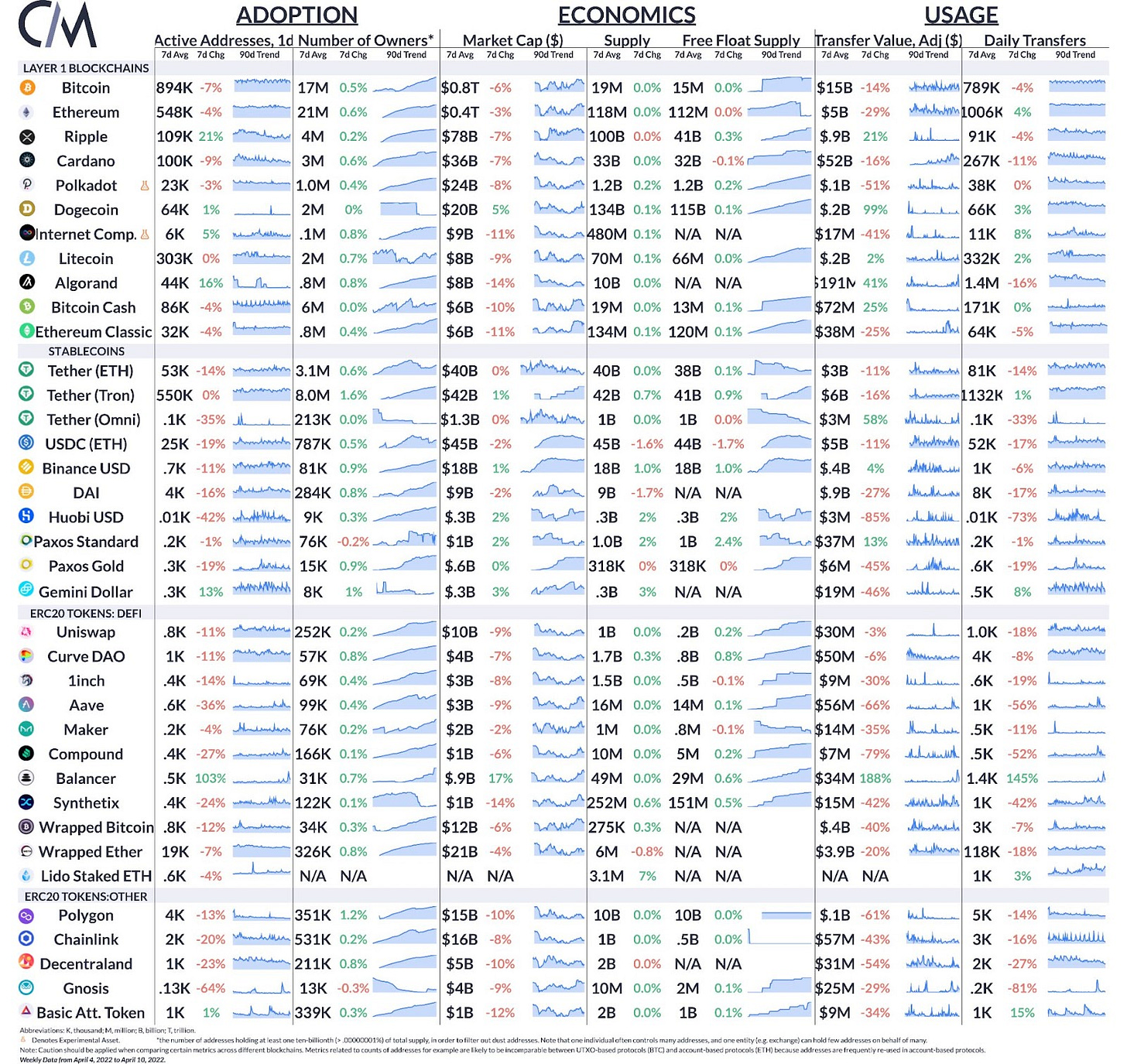

Network Data Insights

Summary Metrics

Source: Coin Metrics Network Data Pro

Most major crypto assets moved lower week-over-week amidst renewed market volatility. Weekly on-chain activity was mostly lower for the major layer one blockchains and stablecoins. Bitcoin active addresses averaged 894K per day over the week, roughly 7% lower than the prior week. Across the Ethereum ecosystem, the liquid staking protocol Lido continues to see increased adoption. The total supply of stETH, the token that represents staked ETH in Lido, passed 3.2M – doubling YTD.

Network Highlights

The Luna Foundation’s treasury now holds almost 40K BTC worth about $1.6B at today’s BTC price. The Luna Foundation has been acquiring BTC to back the TerraUSD algorithmic stablecoin. Terra’s founder Do Kwon recently announced that the Foundation plans to purchase $10B in BTC.

Crypto donations to Ukraine continue to flow in. Roughly 450 BTC ($18M) and 9500 ETH ($28.5M) have now been donated to the Ukrainian government addresses.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

We’re excited to announce that Coin Metrics has raised a $35M Series C round led by Acrew Capital and BNY Mellon, with continued investment from Goldman Sachs and Fidelity investments. Check out our press release and social media announcements!

For the best in-depth discussion of CM research, come check out our data & research community on the web3 social media platform gm.xyz.

Check out Coin Metrics’ market-data focused newsletter State of the Market.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.

© 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.