Get the best data-driven crypto insights and analysis every week:

NEU Blockchain Club + Coin Metrics: The Cambrian Explosion of Stablecoins

Foreword

By Kyle Waters

Coin Metrics was originally founded in 2017 as an open-source project created in response to the dearth of high-quality crypto data needed for research.

We’re excited to continue building upon that vision by supporting crypto research at some of the premier academic institutions in the world. For the past couple of months, Coin Metrics has had the privilege to support the Northeastern University (NEU) Blockchain Club in crafting a comprehensive and data-driven overview of the stablecoin ecosystem.

In today’s SOTN, we’re thrilled to be highlighting the club’s report: The Cambrian Explosion of Stablecoins. In many ways, the stablecoin ecosystem has undergone an evolutionary blooming in recent years, introducing many new vectors of analysis. The report breaks down the fast-evolving stablecoin landscape today, the key measures of its growth, and the possible future paths for this burgeoning sector of the crypto-economy. Below is a high-level summary of the report written by members of the NEU team.

Note: academic researchers can access Coin Metrics community network and market data across dozens of crypto assets and hundreds of metrics without the need for an API key. Researchers can explore our Python API client as well as our free charting tool, formula builder, and correlation tool. If you’re an academic researcher and would like to use Coin Metrics’ pro data in your future crypto research, please follow this link here.

An Introduction to Stablecoins

In just two years, the total supply of stablecoins has grown twenty fold to more than $180B today. Stablecoins are a class of cryptocurrencies that can be described as digital currencies that are mostly pegged to a reserve asset or fiat currency like the US dollar. Stablecoins are primarily used today to transfer funds, facilitate trading, and serve as collateral for borrowing and lending protocols, among other use cases.

Stablecoins solve the issue of volatility in the crypto ecosystem. They provide crypto users a stable asset while still benefiting from the advantages of blockchain infrastructure. Holders don’t need multiple bank accounts or settlement periods spanning many business days to send value across the world. Stablecoins enable borderless payments that are open 24/7. For example, at least $10.7 million dollars in stablecoins have been donated to Ukraine by people from across the world.

The Ukraine conflict is showcasing the importance of global, autonomous, and resilient payment mechanisms. The future of stablecoins looks brighter than ever as legacy institutions look to get more involved in the space.

Stablecoin Classification

By Ivan Rosales & Jeremy Koch

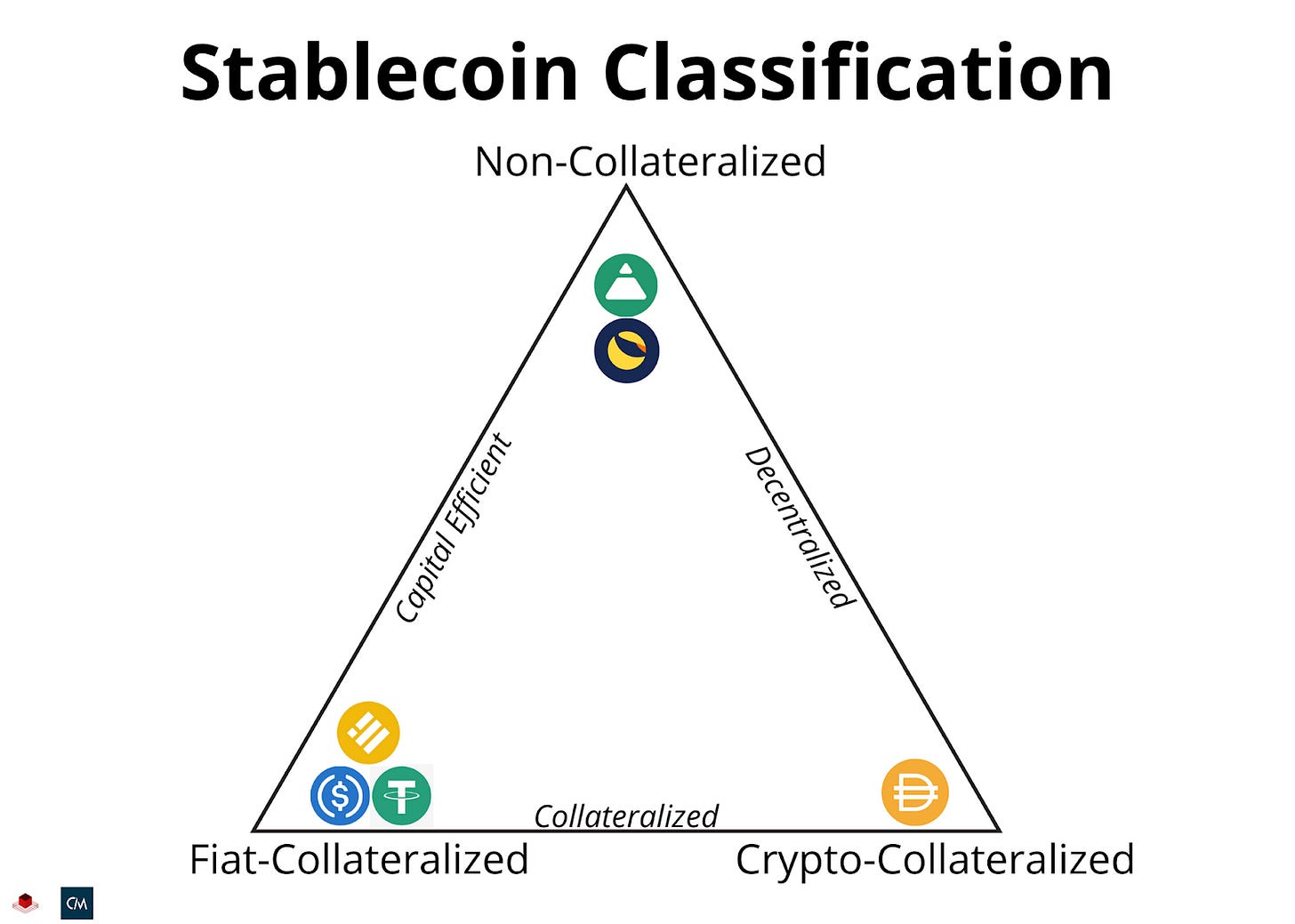

Stablecoins can be grouped under three main classifications: Fiat-collateralized, crypto-collateralized and non-collateralized. The main differences between each are the type and amount of collateral needed to mint the stablecoin. Each stablecoin’s respective peg mechanism also differs depending on how it is collateralized.

Fiat-collateralized stablecoins are stablecoins that are backed by fiat currencies like the US dollar. Their reserves are held by a central entity. The most popular fiat-backed stablecoins at this time are USDC, USDT, and BUSD.

The main weakness of fiat-collateralized stablecoin is centralization. The collateral of a fiat-collateralized stablecoin is held by one independent party. This motivated the development of more decentralized, cryptocurrency-backed stablecoin. The main player in this category today is MakerDAO’s Dai stablecoin.

While crypto-backed stablecoins are good for their decentralization, they are capital inefficient. The average consumer or institutional investor would rather mint 1:1 through a centralized fiat stablecoin than have to over-collateralize by at least 150% to issue a decentralized stablecoin. For this reason, developers set out to create non-collateralized (or algorithmic) stablecoins. These coins maintain their peg without having to directly collateralize the issuance. The two largest forces in the market in this category are Terra and Fei.

Stablecoin Usage and Adoption

Looking closer to the behavior of market participants and the stablecoins they choose to use allows for patterns and hierarchies to be recognized. Supply growth is a good measure for adoption and one thing is clear from the table below, adoption is certainly in an uptrend.

Source: Coin Metrics’ Network Data

The highest supply growth in this cohort of Stablecoins is Binance USD (BUSD) growing at 401% in the past year alone. There was only one stablecoin that actually declined significantly in supply over the last year, Huobi USD (HUSD).

The Ethereum network is the largest smart contract chain with significant stablecoin usage. Today, over $30B in stablecoins are held in smart contracts on Ethereum. The chart below shows the breakdown of ERC-20 stablecoins held in smart contracts on Ethereum.

Source: Coin Metrics’ Formula Builder

Many of these smart contracts are related to DeFi, and could be a liquidity pool, token bridge, lending protocol, yield aggregator, among many other forms. USDC represents the largest share, with 60% or about $19B in smart contracts.

How Stable are Stablecoins?

Since the primary utility of stablecoins is to maintain their value against an anchor fiat currency, we want to know which stablecoins have done a good job of producing this price behavior and which have fluctuated away from their intended fiat counterparts.

Source: Coin Metrics’ Formula Builder

Observing the spot Stablecoin / USD markets, we can get a sense of how each stablecoin tends to fluctuate from its intended 1:1 peg with the USD. Taking a look at the 30-day moving average, we can see that DAI & Gemini’s GUSD have historically traded the furthest away from the fiat peg — at times drifting as far as 2.5% and 1.5% away. Since early October 2021, all of the subject stablecoins have maintained a relatively reliable peg to USD with the exception of PAX, which drifted ~0.50% away in January 2021.

Taking a look at key factors that impact a stablecoin’s ability to maintain a consistent price, an important aspect to consider is the degree to which stablecoins react to market conditions leading to sudden changes in supply & demand dynamics. A prime example of this was the market volatility experienced in March 2020, leading to a sudden surge in stablecoin demand from traders seeking a “flight to safety.” We can observe this phenomenon causing DAI to trade at a ~3.5% premium during this time before settling back to par value over the next few months.

CBDCs & Regulation

By Alyson Liu

Many countries have started to look into establishing their own Central Bank Digital Currencies, or CBDCs, as an alternative to stablecoins. Due to the volatile nature of cryptocurrencies, CBDCs provide a more stable means of digital currency exchange as they’re backed by a government and controlled by a central bank. However, this means that the system is not decentralized, which means CBDCs do not strictly require the use of blockchain technology and consensus mechanisms.

With stablecoins as a decentralized system that is not controlled by a government or a central bank, there are uncertainties associated with maintaining their value. US regulators have been turning their focus to stablecoins with the President’s Working Group on Financial Markets (PWG) releasing a Report on Stablecoins on November 1, 2021 that outlined some of the potential risks associated with stablecoins.

The outcome of whether CBDCs and stablecoins will co-exist in the future is still quite uncertain but is not entirely impossible. According to Federal Reserve Chair Jerome Powell, there is room for CBDCs to “exist alongside a well-regulated, privately issued stablecoin” as they are not mutually exclusive.

Looking Ahead

As stablecoins play a crucial role in crypto markets to facilitate the exchange and store of value, having a regulatory framework will allow them the clarity to play an even more valuable role outside of the crypto ecosystem.

The benefits stablecoins offer businesses and individuals are not to be overlooked. As the world becomes more global and intertwined, reducing the friction and speeds at which we transact gains more importance. Stablecoins have emerged as crypto’s linchpin as they provide low-risk liquidity for the entire ecosystem alongside increasing integration within the broader economy.

Continue reading the full report, The Cambrian Explosion of Stablecoins…

Network Data Insights

Summary Metrics

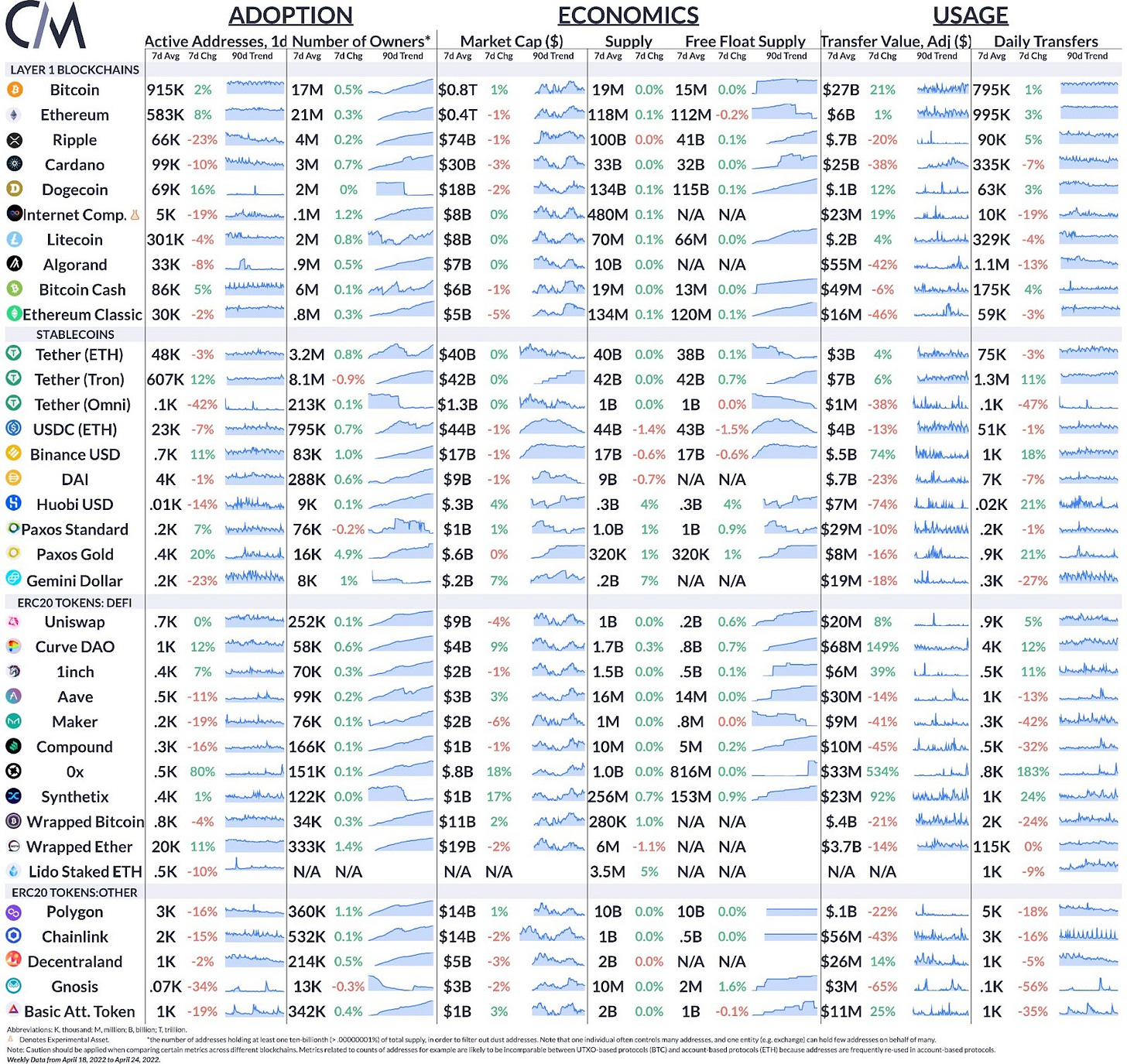

Source: Coin Metrics Network Data Pro

On-chain activity picked up week-over-week with Bitcoin and Ethereum active addresses rising 2% and 8%, respectively. Activity involving 0x protocol’s ZRX token accelerated last week following the announcement that Coinbase’s NFT marketplace, which launched in beta last week, uses 0x to facilitate trading. ZRX daily active addresses were up 80% while transfer value was up 534% week-over-week. The growth of ETH liquid staking continued over the week with total stETH supply passing 3.5M, rising 5%.

Network Highlights

Last Friday (April 22), the Ethereum node infrastructure provider Infura experienced an outage. Infura is the default node provider for the popular Ethereum wallet MetaMask and the outage impacted some users' ability to access the Ethereum mainnet. While the outage only lasted a couple hours, it left a clear impact on the network. Ethereum base fees, which are determined based on demand for Ethereum block space, sunk to a low of ~8 GWEI during the service disruption (for context the median base fee in April has been about 43 GWEI) signaling lower block fullness and reduced network congestion.

Source: Coin Metrics Network Data Pro

However, it is important to emphasize that the Ethereum network did not go down with transactions being processed and Ethereum blocks still being produced every ~13 seconds as usual. In addition, MetaMask users looking to make a transaction during the outage could simply switch to another working node provider.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

For the best in-depth discussion of CM data and research, come check out our research community on the web3 social media platform gm.xyz.

Check out Coin Metrics’ market-data focused newsletter State of the Market.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.

© 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.