Coin Metrics' State of the Network: Issue 158

Tuesday, June 7th, 2022

Get the best data-driven crypto insights and analysis every week:

Analyzing FTX & Coinbase Spot Volume Trends

By Kyle Waters and Nate Maddrey

May 2022 was a month full of changes in the crypto market. Amid the volatility, crypto exchanges experienced a big uptick in trading volume. In this week’s State of the Network, we take a look at some recent crypto trading volume trends sourced from our market data feed.

FTX, the international crypto exchange, first launched in 2019 with a primary focus on crypto derivatives. FTX is a significant player in the crypto futures market today but has also captured an increasing share of spot trading volume as well. May 2022 marked the first month where total bitcoin (BTC) spot trading volume was higher on FTX than Coinbase, with May totals of ~$30B and ~$28B for the two exchanges respectively.

Source: Coin Metrics Market Data Feed (note this only counts FTX International)

May was also the first month where ETH spot volume on FTX was higher than on Coinbase.

Source: Coin Metrics Market Data Feed (note this only counts FTX International)

FTX’s share has been steadily rising over the last couple of years as the exchange has grown in its influence and size. FTX’s success has caught the attention of the greater financial world, with reports that Goldman Sachs and FTX have discussed possible collaborations in areas such as crypto market making.

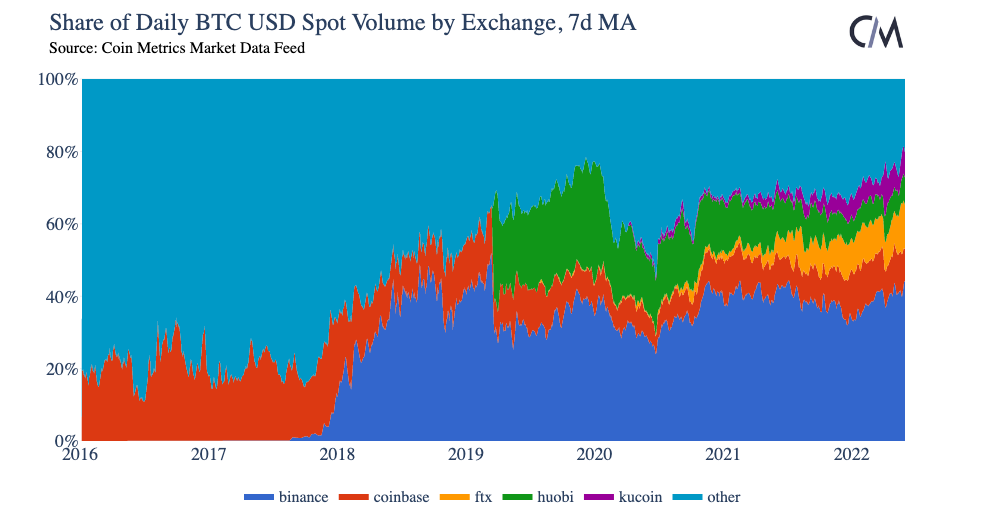

Coinbase has been able to maintain a steady share of BTC spot volume over recent years despite FTX’s quick rise. At the same time, Binance has also maintained its strong lead on the market as the largest exchange by volume. Binance, which was originally founded in China, recently signaled its intention to scale up operations in France after receiving a Digital Asset Service Provider (DASP) registration in the country.

Source: Coin Metrics Market Data Feed

Huobi, on the other hand, has seen its share of total spot volume continue to dwindle, as the exchange was hit hard by last year’s wave of crackdowns in China on Bitcoin mining and crypto assets generally.

Last month’s turmoil in the stablecoin ecosystem also resulted in some jolts across exchange data. Tether (USDT) has long maintained its dominance in the stablecoin ecosystem from its superior liquidity profile and ubiquity as a quote asset on Binance and other large exchanges where crypto-stablecoin pairs are the norm.

Historically, about 70% of all daily spot volume on Binance has come from USDT-quoted markets. This quickly fell last month when USDT briefly de-pegged from $1 amid the meltdown of the ‘algorithmic’ stablecoin TerraUSD (UST) and Terra’s LUNA. The volume share of USDT-quoted markets on Binance has since recovered somewhat as USDT has recovered its peg.

Source: Coin Metrics Market Data Feed

Despite the intensified scrutiny around USDT, the share of all volume from USDC-quoted markets has remained much lower by comparison. Binance and Kucoin have both seen an uptick in USDC-quoted market volume from last month but those markets in aggregate still make up single-digit percentages of all spot volume on those exchanges.

In US-domiciled exchanges like Coinbase, direct crypto to fiat trading is the far more popular option, with crypto to stablecoin pairs seeing much less volume.

Source: Coin Metrics Market Data Feed

Finally, the composition of spot volume by asset continues to fluctuate on exchanges.

Last week, we looked back at the biggest changes in the crypto ecosystem since SOTN launched in May 2019. We noted that on May 29, 2019, there were only 20 crypto assets that were tradable on Coinbase while today there are over 160.

Below we provide a detailed look at this make-up. As tokens on Ethereum have continued to proliferate, their share of trading volume on exchanges has also picked up. Of the 145 new tradable assets added to Coinbase since Jan 1st, 2020, 116 have been Ethereum (ERC-20) tokens.

Source: Coin Metrics Market Data Feed

ERC-20 tokens now make up a nearly-equivalent share of spot volume on Coinbase as ETH. On June 1st, 2022, total spot volume on Coinbase was $2.5B, with $980M BTC volume, $570M of ETH volume, and $370M coming from ERC-20 tokens. On June 1, 2022, the top-5 ERC-20 tokens by spot trading volume on Coinbase were:

1. Chainlink (LINK): $43M

2. Shiba Inu (SHIB): $36M

3. Polygon (MATIC): $27M

4. Bored Ape Yacht Club (APE): $20M

5. NuCypher (NU): $19M

Source: Coin Metrics Market Data Feed (note “stablecoin” includes stable-stable and stable-fiat asset pairs)

Earlier this year, Coinbase also began listing Solana SPL tokens (Solana’s ERC-20 equivalent), including ORCA, FIDA, GMT, and GST.

But as the altcoin rally has quieted, BTC’s share of spot volume has ticked back up on the exchange, but is still far below its level of dominance pre-2021.

Overall, the number of tradable crypto assets across all exchanges has exploded as new blockchains and tokens that run on top of them have been created and listed in recent years. Over 350 unique crypto assets are traded on Binance today while over 1,100 unique crypto assets are traded on the exchange Gate. io. However, this is far from the tens of thousands of tokens tradable on decentralized exchanges (DEXs).

To follow more crypto market data make sure to follow our weekly market-data focused newsletter, State of the Market.

Network Data Insights

Summary Metrics

Source: Coin Metrics Network Data Pro

On-chain activity was mostly flat over the week with Bitcoin daily active addresses averaging around 895K, an increase of 2% over the past week. Ethereum activity ticked slightly downward with daily active addresses averaging below half a million for the first time since 2020. Adjusted on-chain transfer value also fell for both BTC and ETH over the week. However, at $11B and $4B per day, both chains are still seeing activity well above 2020 levels. Looking at stablecoins, the nominal differential between USDC and Tether (USDT) free float supply on Ethereum hit a new high of close to $11B. USDC free float supply on Ethereum stood at 44.93B as of June 5th, rising close to 3.5B since May 10th.

Network Highlights

The effects of the Ethereum difficulty bomb are slowly starting to show on the network. On June 4th the mean time between blocks was 14.6 seconds, the longest since November 2019. Daily block production has fallen to ~6.1K per day.

Source: Coin Metrics Formula Builder

The difficulty bomb was first introduced just after Ethereum’s genesis in 2015 as a scheme to guarantee a hard fork and move away from PoW to PoS. The original idea was to implement a sudden exponential rise (hence the ticking time bomb analogy) in the difficulty of mining new blocks on Ethereum, rendering PoW obsolete.

However, as the ambitious early timeline for PoS shifted, the difficulty bomb has been disarmed and pushed out into the future many times now via hard forks (noticeable on the chart above). But as Ethereum’s move to PoS via “The Merge” appears to be approaching, Ethereum core developers are currently determining whether another hard fork will even be necessary.

Outside of a hard fork, one option discussed would be to raise the gas limit (effective block size increase) on Ethereum to correct for lower throughput. Some core developers also argued that it would be okay to temporarily live with higher block times, which would mean lower throughput and potentially periods of higher gas fees until The Merge.

Putting aside the question of what to do with the difficulty bomb, Ethereum is entering exciting new territory in its plans to move to PoS with the Ropsten testnet planned to merge this week.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

For the best in-depth discussion of CM data and research, come check out our research community on the web3 social media platform gm.xyz.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.

© 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.