Get the best data-driven crypto insights and analysis every week:

Following Celsius’ On-Chain Financial Activity as Withdrawals are Halted

By Kyle Waters, Lucas Nuzzi, and Nate Maddrey

Late Sunday night (ET), the Celsius Network, one of the largest crypto asset lenders, dampened the mood on an already fragile crypto market with news that it was pausing all withdrawals, swaps, and transfers of crypto assets for user accounts on the platform.

Celsius posits itself as a “network” or “lender”, but in reality its market operations closely resemble that of a high-leverage hedge fund. User deposits are actively managed and deployed across DeFi lending platforms for its products to reach double-digit yields.

These DeFi lending markets enable liquidity providers to attain leverage by maintaining a Loan-To-Value (LTV) ratio called the collateralization ratio in DeFi lingo. When prices collapse and the market value of the collateral flirts with that ratio, lenders must provide more liquidity or the loan might be liquidated and leverage unwound.

By design, this model entails increased liquidation rates when there is substantial market volatility, as there has been over the last few days. Mounting selling pressure across BTC, ETH, and the crypto markets as a whole led up to Celsius’ announcement and continued on as the US equity markets opened with a sharp decline on Monday.

Source: Coin Metrics Reference Rates

In the wake of the Terra fiasco, the market has become more sensitive to solvency issues. There’s increased awareness of the cascading failures that might emerge when highly-levered projects unwind. Unsurprisingly, the announcement of the suspension of withdrawals generated panic and not only led to a sell off of Celsius’ CEL token but also the market as a whole as participants feared spillovers. The announcement that it was pausing withdrawals sent Celsius’ native token CEL plunging from around $0.35 to $0.15 in under 30 minutes.

Source: Coin Metrics Reference Rates

What makes matters worse is that Celsius does not explicitly disclose the protocols and strategies it employs to give its users upwards of 20% yield. However, we were able to use our blockchain search tool, ATLAS, to follow the financial activity of crypto addresses that are likely to be Celsius-controlled.

We have found that if Celsius is indeed facing solving issues, the market’s reaction is warranted. After all, as of May 17, Celsius controlled over $11B of crypto assets with at least 150,000 BTC.

One area of concern is the liquidation of Celsius’ outstanding DeFi positions. As mentioned previously, Celsius actively deposits user funds into DeFi protocols and has in the past been impacted by high-risk DeFi protocols. For example, last December, Celsius admitted losses in the hack of BadgerDAO, a DeFi protocol.

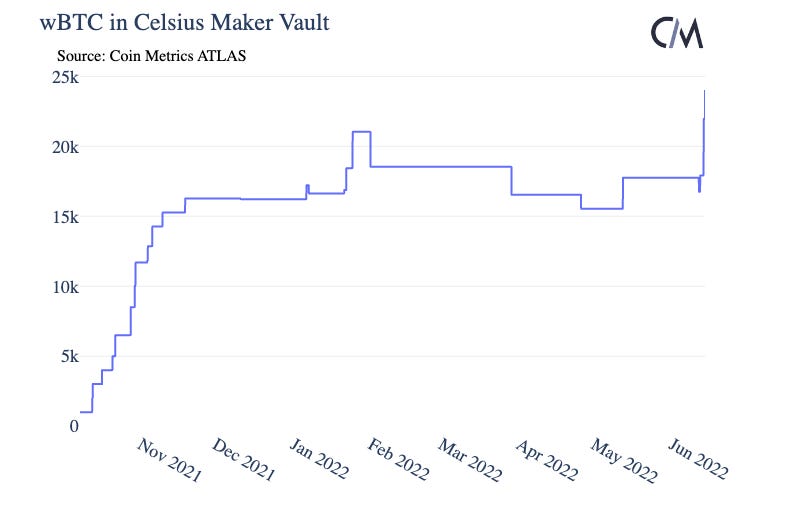

Celsius has also deposited many funds into Maker, the Ethereum collateralized lending protocol, to generate Dai stablecoins.

Celsius currently controls the largest vault in the wrapped Bitcoin (wBTC, an Ethereum token representing underling BTC held in custody) type-A vault on Maker. As of June 13th at 10:30 PM ET Celsius’ Maker vault held 23.96K wBTC, worth around $500M.

Celsius’ single wBTC vault represents around 85% of all Dai generated in the wBTC-A Maker vault type.

Maker is an automated system that liquidates borrowers’ collateral when the protocol-set collateralization ratio for that vault is not being maintained. For the wBTC-A vault, the required collateralization ratio is currently set at 145%, meaning that at least $145 worth of wBTC must always be present for every $100 worth of Dai outstanding. When the price of the collateral falls, the vault owner can avoid liquidation by either adding more collateral or paying back the Dai.

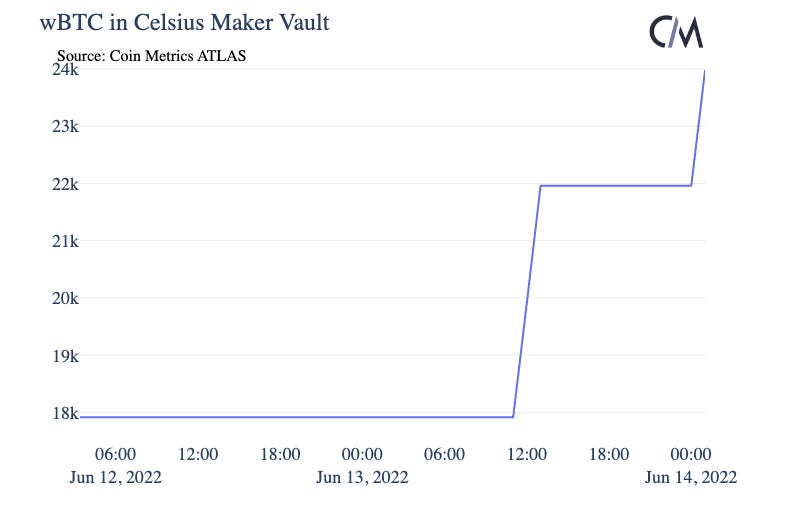

As BTC price fell below $25K, Celsius’ Maker vault quickly approached its liquidation price of ~$22.5K as the vault’s collateralization ratio reached as low as 155%.

On Monday morning (June 13th) ATLAS data shows that the vault was topped up with an additional ~4K wBTC, sending the new implied liquidation price down to ~$18K and collateralization ratio up to 185%. As BTC fell near 21K Monday night, Celsius added an additional ~2K wBTC to the vault, lowering the liquidation price to ~$17K. The situation remains precarious though, and unfortunately is only one part of Celsius’ ongoing woes.

Celsius is also a large holder of Lido’s staked ETH token (stETH). Lido provides a staking service that allows users to stake ETH and receive stETH, which is a synthetic token that represents ETH staked for the upcoming transition to Proof of Stake. stETH will eventually be redeemable 1:1 for ETH after the Ethereum merge, but until then the staked ETH is locked in the staking contract. stETH is commonly used as collateral in DeFi protocols, allowing investors to earn additional yield on their staked ETH. stETH supply grew to over 4M over the last year before plateauing in May.

Source: Coin Metrics Network Data Charts

As of June 13th Celsius held 445K stETH, worth over $500M at the time. However there’s much less liquidity for stETH than there is for ETH on decentralized exchanges. Further complicating things, the stETH/ETH peg has started to slip, with stETH trading at a discount to ETH. This means that if Celsius tried to liquidate their stETH holdings they would likely have to sell at a substantial loss due to liquidity issues and potential further de-pegging.

While there isn’t sufficient transparency to make authoritative claims about the solvency of Celsius, an unwind of this proportion would most certainly further impact crypto markets. Like Terra, it is possible that Celsius might witness a bank run once withdraws are enabled. In the event that trust in the project is completely eroded, a liquidation might be inevitable.

Network Data Insights

Summary Metrics

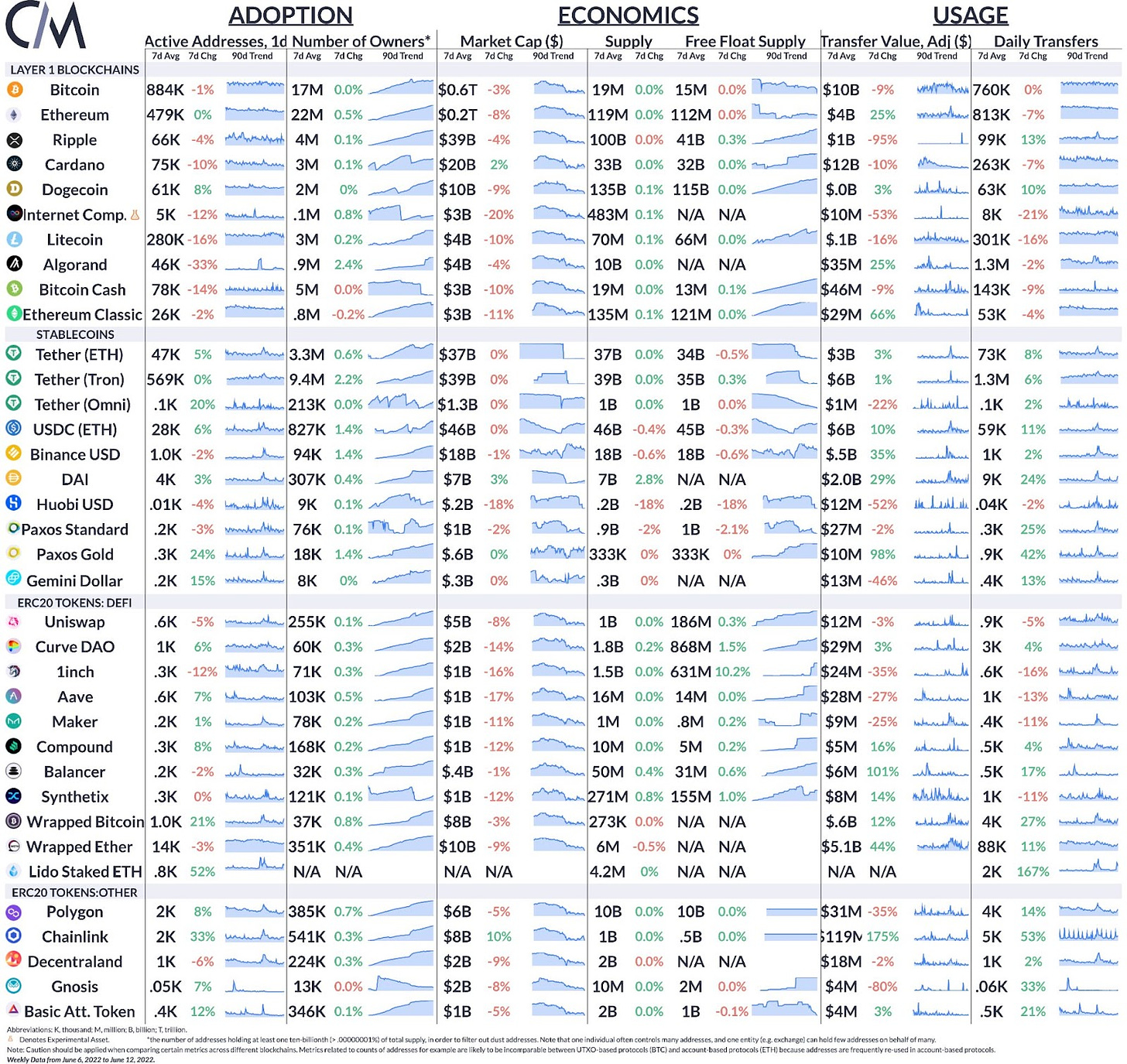

Source: Coin Metrics Network Data Pro

Bitcoin active addresses averaged around 884K per day over the last week, a 1% decrease from the previous week. Active addresses were flat for Ethereum, at just under half a million. Activity on fork chains such as Litecoin and Bitcoin Cash dropped off sharply. Stablecoin activity picked up amid the renewed volatility with Tether active addresses rising 5% on Ethereum. Finally, as volatility has spread throughout the DeFi ecosystem, tokens such as stETH and wrapped Bitcoin (see feature above) have seen higher activity.

Network Highlights

Following a new wave of redemptions Tether free float supply (Coin Metrics’ free float supply deducts coins held by Tether’s treasury) fell below $70B for the first time since October 2021.

Source: Coin Metrics Formula Builder

But despite the redemptions, total stablecoin market cap is still holding near $140B total with >$100B on Ethereum. The ratio of ETH market cap to stablecoin market cap (stablecoins on Ethereum) is fast approaching parity as ETH’s price has rapidly fallen. For every $1 worth of ETH there is now 76c worth of stablecoins on Ethereum. Put differently, ETH market cap is only 1.3x stablecoins market cap.

Source: Coin Metrics Formula Builder

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

For the best in-depth discussion of CM data and research, come check out our research community on the web3 social media platform gm.xyz.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.

© 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.