Coin Metrics' State of the Network: Issue 169

Tuesday, August 23rd, 2022

Get the best data-driven crypto insights and analysis every week:

TTD set, volatility TBD

With Ethereum’s final steps to PoS engaged, how is the options market pricing in The Merge?

This is a special guest post by Data Always, an independent crypto researcher, with support from the Coin Metrics Research team

After years of delay and three dramatic public testnets, a final time for Ethereum’s long awaited transition to proof-of-stake has been set. The time measured in accumulated difficulty, a proxy of total mining hashes computed, is scheduled for a total terminal difficulty (TTD) of 5.875E22. At the current network hashrate, TTD is expected on September 15, but with decreased mining profitability, high market volatility, and the possibility that miners could leave the network early, there remains an uncertainty on the scale of days as to when the transition will take place.

In this week’s State of the Network, we’re diving into the options markets to examine how participants have repriced their expectations as The Merge has become increasingly likely, and now imminent.

Mapping Options Volatility

The Black-Scholes options pricing model is the most common and simplest options pricing model, yet remains notoriously complex for non-institutional investors. From an instructional standpoint we can cast away the majority of the details, and envision any given options contract as a one-to-one mapping between the market price and the implied volatility, i.e.: the annualized expected volatility throughout the remaining lifetime of the contract.

Put simply: if options sellers expect higher volatility in the underlying asset, they will demand a higher price when selling to buyers. With all other parameters well defined and independent of the actions of market participants, implied volatility becomes an annualized cross-asset and cross-contract gauge of how expensive an option is.

As a primary example of the volatility premium demanded by options sellers, we can look at timeseries data in the aftermath of interest rate change decisions. As cryptoasset correlations to traditional finance have increased and the financial markets have become increasingly driven by aggressive tightening of monetary policy, the options markets have taken notice by pricing in additional volatility around FOMC meetings.

In the figure below, we notice deepening drops in implied volatility in the immediate aftermath of interest rate announcements. The increasing magnitude of these falls implies that options sellers have begun demanding additional premium to offset the risk of being short options as the market sees the potential for more and more violent bitcoin price reactions to the announcements.

Source: Coin Metrics Market Data Feed

For options tracking the price of ether, the figure below focuses on August 10th which saw both the latest release of Consumer Price Index data and the final public testnet. Similar to the trend around interest rate decisions, we see a large drop in expected future volatility in the aftermath of the data release–as a large unknown becomes known.

The implied volatility reaction to the Goerli testnet Merge is an interesting brief case study. The immediate community response to the testnet transition was overwhelmingly positive, catching traders underallocated and causing a rush of buy pressure both for spot ether and in call options on ether. This resulted in both a price surge and a short-term volatility surge as demand overwhelmed the supply of options sellers.

Source: Coin Metrics Market Data Feed

Volatility Profiles

Taking an orthogonal step, we can switch from looking at timeseries data from individual options contracts to taking a snapshot of the entire options chain at a single point in time. In the figure below we see a volatility smile characteristic of the imperfect nature of the Black-Scholes pricing model. The increase in risk premium demanded by sellers as we look at strikes further away from the current underlying price (excl. skew), is an artifact of the inaccurate assumption of the model that returns abide by a lognormal distribution—the model underestimates tail risk to both the upside and the downside.

Of particular interest today is the difference in the implied volatility profiles between consecutive expiry dates. Focusing on strikes near the spot price, we see that in early August all three curves were at a near equilibrium state indicating that the expected volatility during the intervals between measurement and all three expiry dates had a similar average magnitude. However, after the CPI release on August 10th, we see that implied volatility for the time period between a second measurement (August 13) and August 26th falls well below the implied volatility between the new measurement and the late-September or October expiries. This shift is a discrete visualization of the volatility reactions in the previous figures. The August expiry curve falls much more sharply than the later expiries because there are no remaining known high-volatility events between now and the expiry date, meanwhile the September date retains another interest rate decision and another CPI reading.

Source: Coin Metrics Market Data Feed

Repeating the measurements for Ethereum, we see a comparable change in the relative volatility profiles. One subtlety worth drawing attention to is that even before the CPI release and testnet merge, the options expiring August (red curve) were already priced at a lower volatility than the September and October options. This behavior is an indication that the options market had already begun to price in the possibility of a Merge date during the period between the August 26 and September 30 options expiry dates.

Source: Coin Metrics Market Data Feed

Comparing Volatility Across Cryptoassets

Volatilities are intrinsically relative quantities, so it can be a useful exercise to compare correlated assets and analyze divergences. Reviewing year-to-date realized volatilities, we notice that both BTC and ETH hit their local peaks as Three Arrows Capital collapsed and subsequently filed for bankruptcy. In the subsequent two months bitcoin’s volatility has fallen to its lowest point since January, while ETH’s volatility has remained comparatively elevated.

Source: Coin Metrics Formula Builder

Extending the analysis by taking the quotient of the realized volatilities of the two cryptoassets, we see that the excess volatility seen in ether price data over the past 90 days is approaching levels historically indicative of industry shaping events. With the magnitude of the event and Bitcoin’s lack of exposure to it, Ethereum’s transition away from proof-of-work certainly belongs on the list. Speculating, it would not be surprising if the peak excess volatility surpasses the peak from DeFi Summer in 2020.

Source: Coin Metrics Formula Builder

To get a view of how the options market sees the relative volatilities of the assets going forward, we can use the differences in the volatility profiles discussed earlier. We can recursively calculate the front-loading of volatility expectations for both BTC and ETH to determine the expected volatility in each of the intervals between subsequent expiry dates.

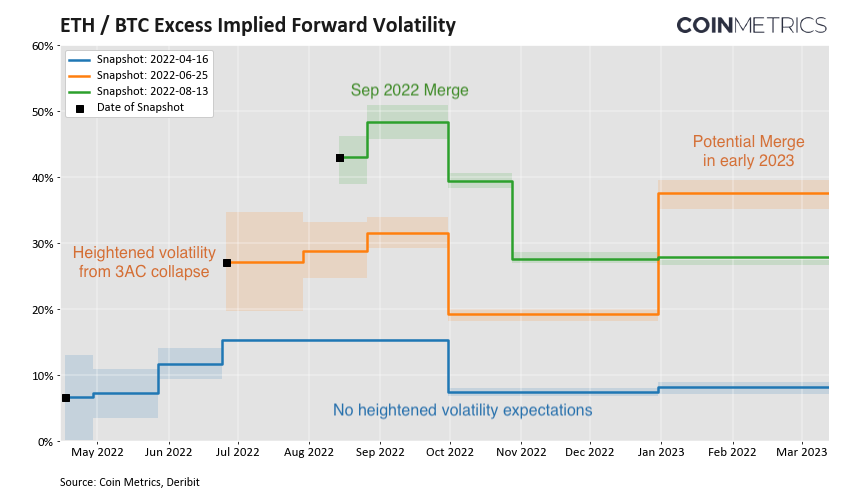

Then using a similar methodology to the excess realized volatility figure above, we can take the quotient of the two profiles at various times to see how the market’s expectations have evolved. The result is shown in the figure below, with the solid lines representing the excess volatility for at-the-money options and the shaded areas representing quotients for 5% above spot price compared to 5% below spot on the alternative asset to act as error bounds.

Source: Coin Metrics Market Data Feed

Performing this set of calculations in April illustrated that the options market was pricing in no meaningfully heightened excess volatility going forward. Repeating the calculations in June saw a surge in short-term relative volatility expectations stemming from the on-going collapse of Three Arrows Capital, while also not pricing in a credible Merge date in 2022.

However, carrying out the calculations a third time earlier this month, we see that the market has finally begun to price in a timeline for The Merge with volatility expected to peak in September before falling off into November.

With the most significant event in Ethereum’s history since its 2015 genesis fast approaching, crypto market participants are closely following the lead up to The Merge. Pronounced expectations of volatility tied to The Merge are sure to build excitement as everyone awaits the realization of a project that spent years in development and planning.

Network Data Insights

Summary Metrics

Source: Coin Metrics Network Data Pro

On August 18th, the Huobi USD stablecoin (HUSD) briefly de-pegged from $1, dropping as low as 84 cents on Thursday afternoon ET before recovering later that day back to 99 cents. HUSD is a centralized stablecoin issued by an entity called Stable Universal Limited (originally in conjunction with Paxos), and circulates on Ethereum. The brief de-peg sparked a sharp increase in HUSD on-chain activity. On Thursday, Huobi announced that the de-peg was the result of liquidity issues after the exchange moved to “close several accounts in specific regions to comply with legal requirements”. With a circulating supply of just around $80M though, HUSD is a small player overall in the stablecoin landscape and represents less than 0.1% of all stablecoin supply on Ethereum today. In other stablecoin news, the market cap of Binance’s BUSD hit a new all-time high last week, at close to $19B on Ethereum.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

For the best in-depth discussion of CM data and research, come check out our research community on the web3 social media platform gm.xyz.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

To learn more, acquire our data, or contact Coin Metrics reach out here.

© 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.