Coin Metrics' State of the Network: Issue 172

Tuesday, September 13th, 2022

Get the best data-driven crypto insights and analysis every week:

The Final(ity) Countdown

By Matías Andrade and Kyle Waters

Coin Metrics is excited to continue providing data-driven coverage of The Merge, Ethereum’s imminent protocol upgrade which will complete the network’s transition from Proof-of-Work to Proof-of-Stake. As of Monday night EDT, The Merge is estimated to occur sometime around Wednesday night / early Thursday morning. The CM research team will be keeping a close eye on-chain this week to report on the outcome of an upgrade years in the making. To catch up on all of our Merge research as well as CM’s preparation and metric updates, check out our dedicated page here.

Needless to say, The Merge introduces plenty of new terminology and ideas to become accustomed to. In this week’s State of the Network, we take a step further towards the post-Merge era and explain two concepts that are set to rise in industry dialogue.

Slashing vs Penalties

It seems we have forgotten how long it took for most people to get used to the logic of Proof-of-Work, so it's only natural we should take some time to understand Proof-of-Stake. Proof-of-Stake is premised on the notion that through carefully-designed incentives—a mix of rewards and punishments—you can provide the same functionality as Proof-of-Work without the energy-intensive computation. It is no secret that the Ethereum system will grow in complexity with the advent of Proof-of-Stake. And at the crux of PoS is the reward and punishment that precisely balances the stakes of validators to conform to a fair and trustless, censorship-resistant cryptoeconomic-system.

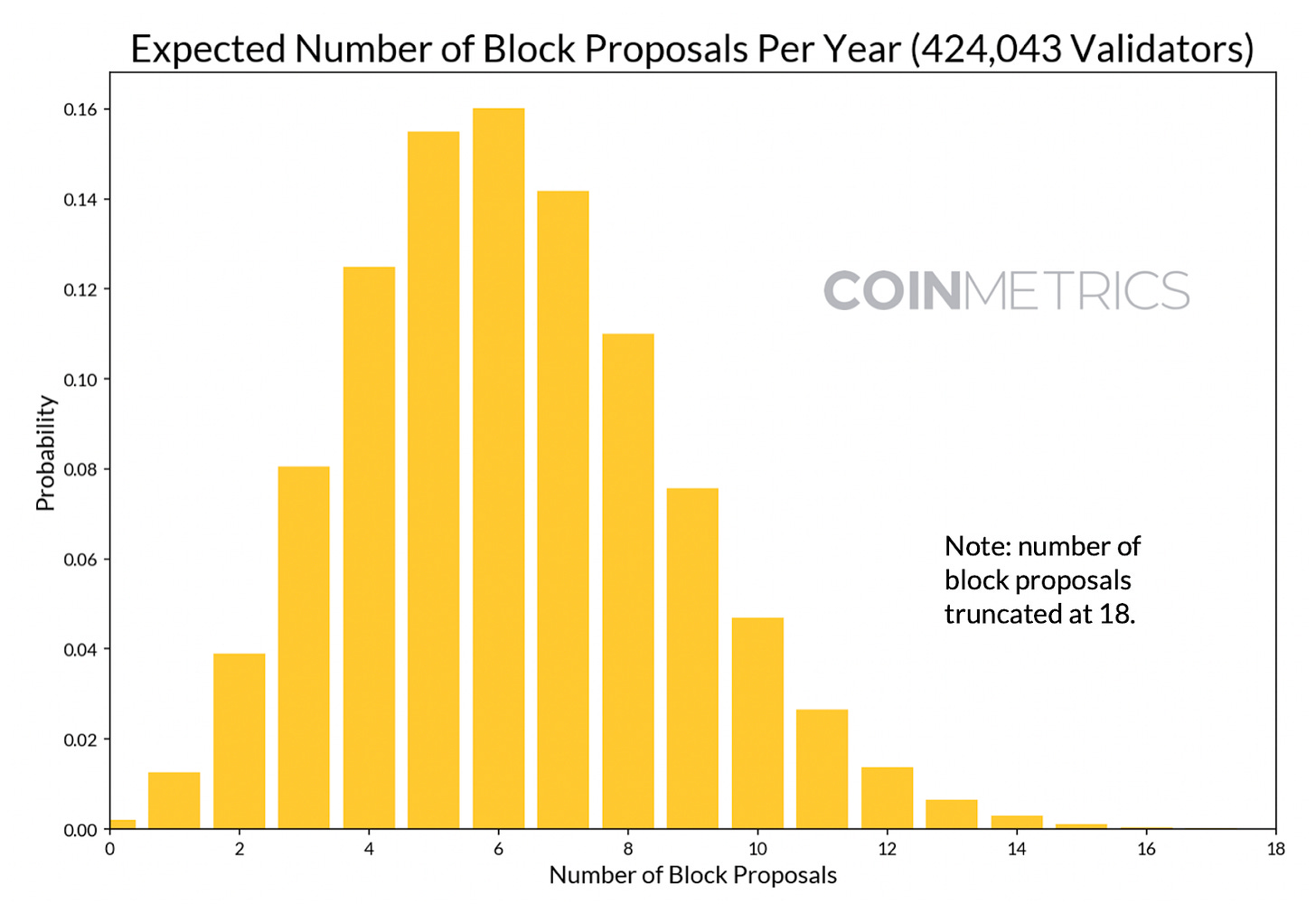

So how exactly are these rewards and punishments doled out? Validators are entrusted with duties that must be performed in a timely and proper fashion. These duties include proposing a block for the beacon chain, the largest reward; even though a single staker can only expect around 6 of these rewards yearly, it accounts for around 12.5% of staker rewards. Attestation involves smaller—but more frequent—rewards, that make a larger proportion of staker yield, altogether around 84.4%. Although proposal opportunities are probabilistic, and can create significant variance in stakers’ yield, attestation duties are more regular, and every epoch (32 slots) all active validators get exactly one attestation opportunity. Finally, around 3% is earned by participating in sync committees. These rewards are paid with freshly minted ETH.

If Ethereum’s proposal and attestation rewards are the carrot, penalties and slashing are the stick. It is common to use “slashing” and “penalties” interchangeably; however, they are very different in their intentions and impacts.

Penalties are put in place to incentivize validators to perform their duties in a timely manner. They are not designed to punish for malicious behavior, only late attestations. Critically, missed proposals are not punished in any way; the price paid is only the opportunity cost. However, it increases the variance that validators should expect in their yield, especially because most validators are sure to miss their duties periodically due to downtime, network issues, client bugs, and other issues.

Slashing is reserved for the sort of behaviors that would otherwise threaten the functionality and integrity of Ethereum. Users staking on Ethereum may be slashed if they propose two blocks for a single slot, which is a mistake that sometimes happens when users incorrectly configure redundant staking servers. Finally, if stakers fail to attest for checkpoints in a correct and timely manner, they could be liable to be slashed, especially if they have a poor attestation record. Furthermore, if a staker is slashed within 18 days of other slashing events, they could receive a correlation penalty and lose an even greater portion of their funds. For example, if 3% of validators receive a slashable offense, after the Bellatrix hard fork, each validator would be slashed by 3 × 3% = 9% of their staked ETH (2.88 ETH at the staking minimum of 32 ETH), where 3 is a constant. Although every staker should be concerned about slashing, there are rewards given to stakers if they witness a slashing take place called whistleblower rewards. However, they are not inflationary since the slashing they witness will always burn more ETH.

Finality

One of the most critical changes that PoS is designed to achieve is bringing finality to the Ethereum blockchain. Finality is a property that informs users that the transaction is considered final once it is included in a block. Finality gives users greater certainty over the economic finality of their transactions. Under PoW, a longer chain offers more confidence to users as it becomes harder and harder to revert these past transactions. But the receiver is left to decide for themselves what is considered ‘final’. For example, the exchange Kraken currently requires 20 block confirmations for Ethereum deposits (about 5 minutes with 14 second block times). Compared to PoW, where users have to use this probabilistic function to mitigate the risk of having their transactions roll back, Ethereum will offer a stronger definition of a block being final after a given period of time.

We can easily compare this to Ethereum’s current PoW outlook using data on uncle blocks, which are blocks that include valid PoW solutions but lost the race to propagate through the network. Nonetheless, they are recompensed for the work and energy expended solving the PoW problem using the uncle mechanism that Ethereum started. Ethereum’s uncle rate allows us to (somewhat imprecisely) measure the uncertainty a user experiences when making a transaction. Essentially, users may exchange valuable goods in a transaction they believe to be final, only to find that their transaction was one of many included in an uncle block and not yet in the main chain.

Source: Coin Metrics Network Data

Uncle blocks are part of Ethereum’s design and allow for quick block times. Furthermore, uncle blocks contribute to the security of the chain with the work done by their respective miners even though the transactions that were included in the uncle blocks may not have been included in that block. This usually poses no problem, because the transactions go right back to the transaction pool available for inclusion in the next block. However, it isn’t ideal for a merchant that wants conclusive confirmation that their transaction is indeed final.

While no PoW chain offers finality in quite the same way, once Ethereum transitions to Proof-of-Stake it will be able to provide very strong assurance that a block (and all the transactions contained therein) will be final. Finality is reached on the Ethereum Beacon Chain (Consensus Layer) when at least two thirds of active validators have confirmed 2 epochs. Epochs last 6.4 minutes and contain 32 slots each separated by 12 seconds, so finality arrives in roughly 12.8 minutes. These exact design features were chosen to optimize across trade offs between decentralization of the network and a reasonable time to wait for finality.

For a finalized block to be reverted in Ethereum post-Merge, one third of the validators would have to lose their entire stake by slashing, giving users a strong guarantee of finality. However, there is a trade off for this increased certainty: 12.8 minutes is a lot longer than the ~5 minutes most exchanges and other users consider final in practice under Ethereum PoW. But finality is ultimately one of the design considerations that drives the vision of Proof-of-Stake and Ethereum going forward. A decrease in time-to-finality under “single-slot finality” is an active research area on the Ethereum roadmap.

Network Data Insights

Summary Highlights

On-chain activity has slowed down this week. Average Bitcoin daily active addresses rose 1% to 934K and Ethereum active addresses hovered around 505K. In advance of The Merge, speculation abounds about miners moving towards Ethereum Classic (ETC) once Ethereum transitions to Proof-of-Stake. ETC active addresses rose by 9% to 26K, accompanied by an increase in market cap of 17% to $5B. Following Binance’s recent announcement that it would be converting USDC on the exchange to BUSD, BUSD supply rose to 20B, 2.2% over the week.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Coin Metrics is keeping a close eye on The Merge as it draws closer. Follow along on Twitter for all of our Merge coverage and updates.

In case you missed it, we released a special report Mapping out The Merge last week, you can download it here.

For the best in-depth discussion of CM data and research, come check out our research community on the web3 social media platform gm.xyz.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.

© 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.