Get the best data-driven crypto insights and analysis every week:

Decoding Crypto Pricing: Insights for Institutional Investors

By: Kyle Waters, Matías Andrade, Kevin Lu, and Uriel Morone

As one reads this issue of State of the Network, Bitcoin and other major digital assets are almost certainly being traded in an active market. Whether it be a weekend, middle of night, a holiday—digital asset markets are open 24 hours a day, 7 days a week, and 365 days a year.

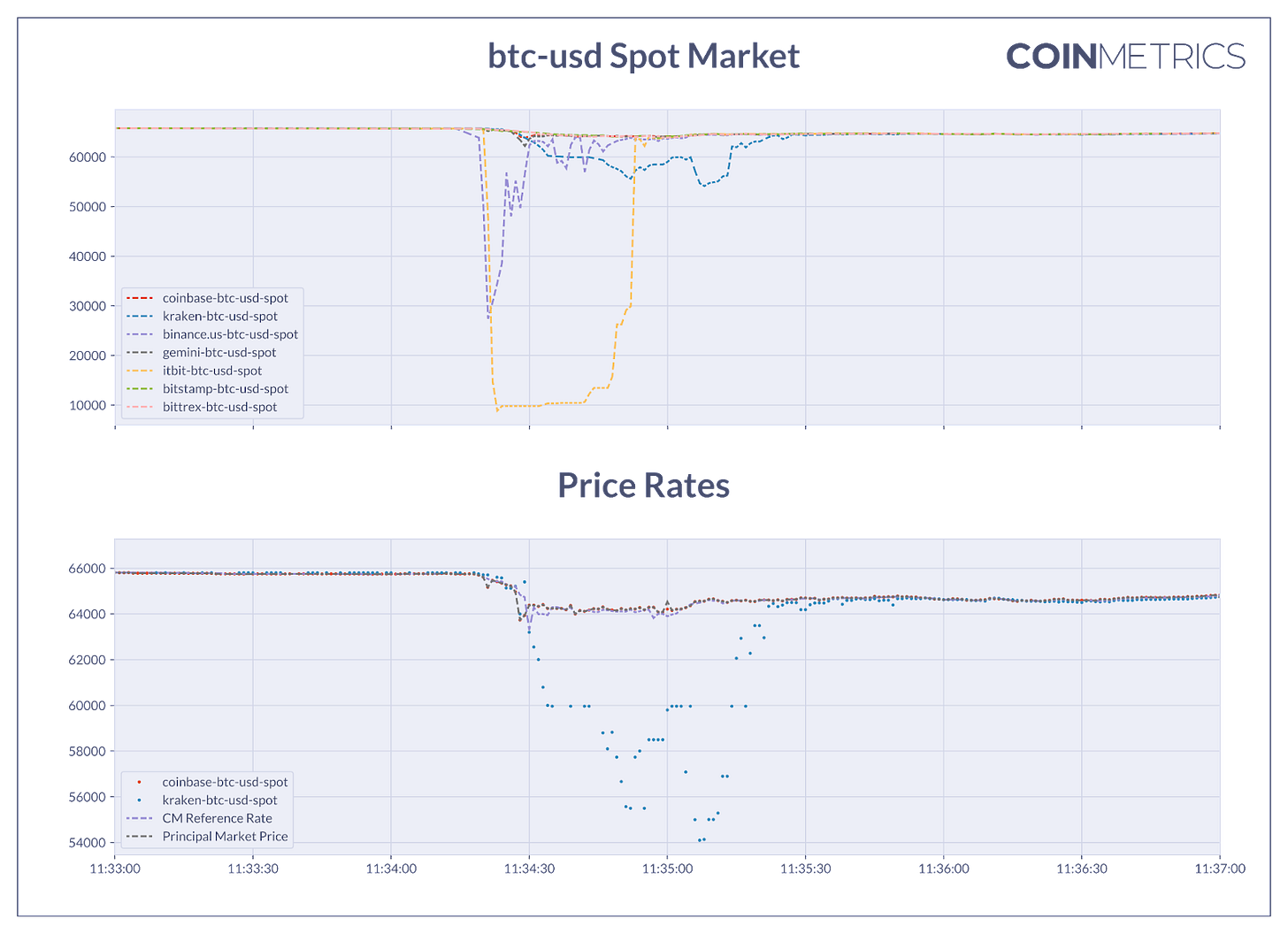

Crypto assets are also well-known for their historical bouts of volatility, which can sometimes lead to material deviations among the prices observed for even a single asset’s market prices. Consequently, a seemingly simple question such as: What is the current price of bitcoin?—can be unexpectedly challenging to answer without robust price benchmarks.

Above: an example case study of a market dislocation in BTC-USD markets on October 21, 2021, explored in our new report, linked below.

But as institutions venture into this emerging asset class, robust prices are needed to confidently invest, trade, custody, manage risk, and accurately account for digital assets on a balance sheet.

To this end, Coin Metrics has been studying, researching, and collecting data from digital asset exchanges for over four years to produce institutional-grade price data. We now offer two different price benchmarks to clients: CM Reference Rates and CM Principal Market Price.

In a new report we are releasing today, we aim to compare and contrast Coin Metrics’ two independent pricing methodologies, elucidate their underlying accounting rationale, and examine their historical performance through real-world case studies.

You can download our report, Decoding Crypto Pricing: Insights for Institutional Investors—for free—after visiting the CM website from the link below.

For more custom insights, make sure to explore our on-chain metrics with our free charting tool, formula builder, correlation tool, Python API client, and mobile apps.

Network Data Insights

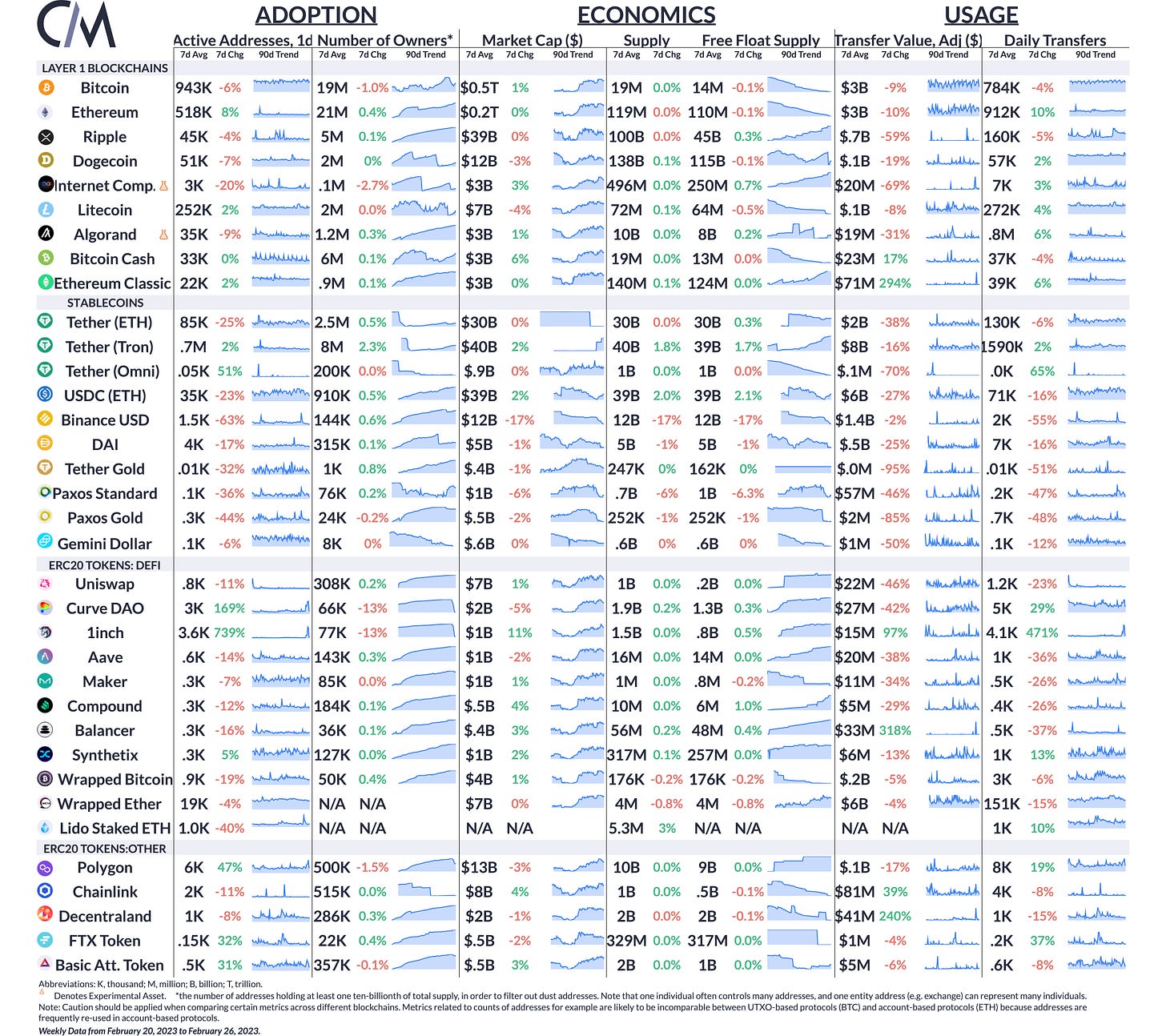

Summary Metrics

Source: Coin Metrics Network Data Pro

The supply of Binance’s BUSD stablecoin continued to fall over the week in the wake of Paxos’ halting of new BUSD minting. BUSD free float supply has fallen about $5B since the announcement. Meanwhile, as Ethereum developers prepare to test the “Shanghai” network upgrade on the Sepolia testnet this week, Lido recorded its largest daily inflow yet of new ETH staked through the protocol. A 150K ETH inflow helped the supply of Lido’s staking derivative staked ETH (stETH) rise sharply.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Make sure to also follow Coin Metrics’ market-data focused newsletter State of the Market which features a data-driven view of the crypto asset markets and timely recaps of the ecosystem’s most important events.

This week in crypto: ▪️ The Fed comes to consensus on a 25 bps rate hike ▪️ Coinbase earnings surprise to the upside— driven by USDC interest income ▪️ A federal judge affirms NBA-branded 'Top Shots' NFTs could 'plausibly' be labeled securities Here: 5264302.fs1.hubspotusercontent-na1.net/hubfs/5264302/…

This week in crypto: ▪️ The Fed comes to consensus on a 25 bps rate hike ▪️ Coinbase earnings surprise to the upside— driven by USDC interest income ▪️ A federal judge affirms NBA-branded 'Top Shots' NFTs could 'plausibly' be labeled securities Here: 5264302.fs1.hubspotusercontent-na1.net/hubfs/5264302/…

For the best in-depth discussion of CM data and research, come check out our research community on the web3 social media platform gm.xyz.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

To learn more, acquire our data, or contact Coin Metrics reach out here.