Coin Metrics’ State of the Network: Issue 203

Review of Ethereum's 'Shapella' Upgrade

Get the best data-driven crypto insights and analysis every week:

Ethereum’s Shapella Upgrade Goes Live

By Matías Andrade, Kyle Waters & Tanay Ved

Ethereum’s highly anticipated Shapella network upgrade went live last Wednesday without issue, ushering in a new era for the nearly $40B staking ecosystem and marking the first upgrade to Ethereum since The Merge. As we explained last week, the upgrade activated the important function of staking withdrawals, granting validators liquidity to their staked ETH and accumulated staking rewards. In this week’s State of the Network, we analyze the network impacts and economic ramifications of the Shapella upgrade through the data we have observed in the days after its activation.

Network Health & Impacts

The Shapella upgrade was completed as a hard fork—which, in simple terms, just means a planned change to the rules of the Ethereum protocol. Hard forks require node operators to update their client software to integrate the new changes. Clients can be thought of as software implementations of the rules of the Ethereum protocol. The Shapella upgrade included the “Shanghai” upgrade to the Ethereum execution layer (EL) and the “Capella” upgrade on the consensus layer (CL) or Beacon Chain (hence the handy portmanteau Shapella). To understand more about Ethereum nodes and clients check out our walkthrough on running an Ethereum node here.

Hard forks have been important events in Ethereum’s history because they have enabled the protocol to change, but they also can carry implementation risk. Although core developers rigorously test upgrades on “testnets”(test versions of Ethereum), there is always a risk of something going awry when the upgrade hits mainnet. But in the case of Shapella, things went off without issue. One observable impact to the network, however, was a short-lived rise in the number of missed block proposals from a normal rate of about 1–2% to around 10%. Every 12 seconds, a single validator is selected at random to propose a block and collect a proposal reward in addition to transaction fees. A rise in the number of missed slots suggests a subset of validators failed to upgrade their clients in time for Shapella and thus fell out of sync with the rest of the network. A few clients also needed to patch small issues to accommodate the upgrade. The chart below shows the higher density of missed proposals in red after Shapella went live at epoch 194048 (epochs are a time-keeping parameter for Ethereum and 1 epoch equals 32 slots at 12 second intervals).

Source: Coin Metrics Labs

Critically, though, a 10% rate of missed slots is tolerable for the network to continue to progress with new blocks and finalize. By Thursday, 97% of slots were back to containing blocks—a much healthier rate.

Source: Coin Metrics Network Data

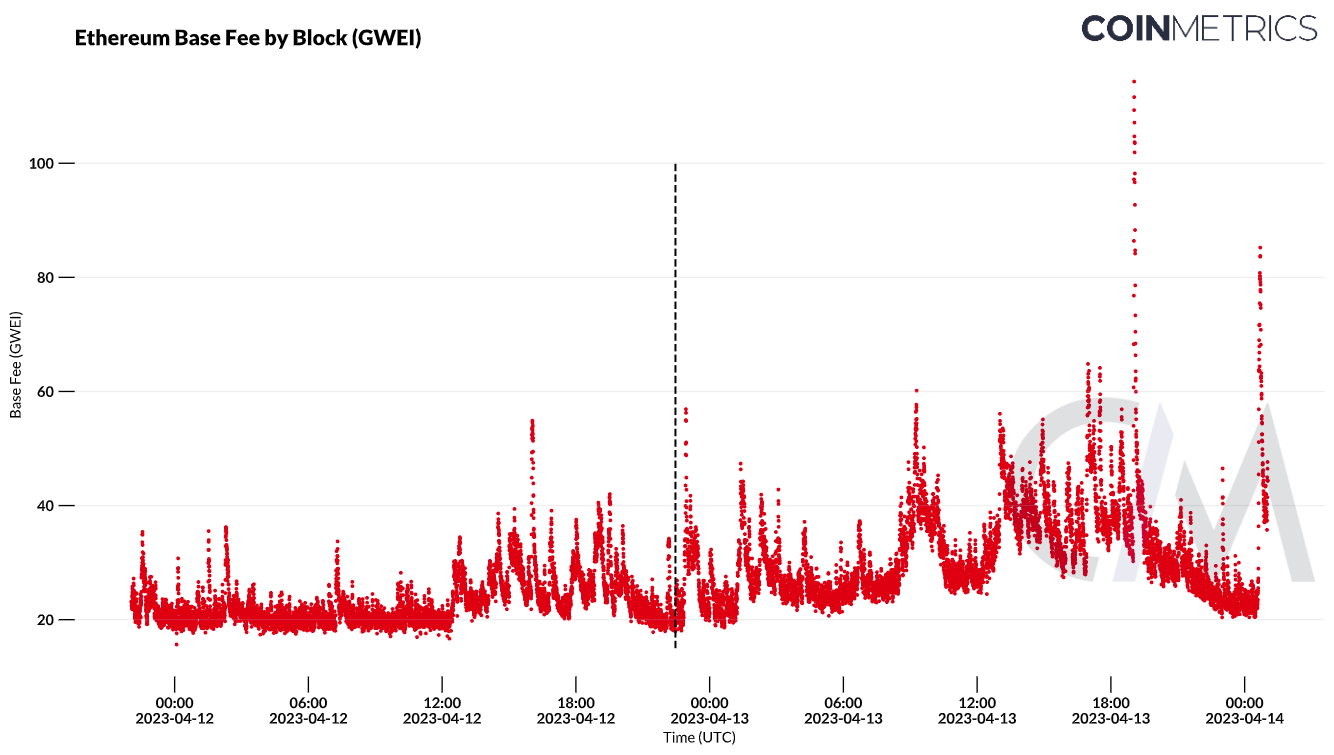

Turning to the Ethereum fee market, transaction fees rose only slightly in the immediate hours after Shapella. Because withdrawals are processed as state changes, and don’t require payment for gas like in normal Ethereum transactions, they did not directly cause congestion on the network as anticipated. The slight increase in the level of base fees was likely attributable to the slower rate of block production described above, leading to an effective decrease in throughput, and a demand to move newly withdrawn ETH around.

Source: Coin Metrics Network Data Pro

With the network humming along like normal after the upgrade, attention quickly turned to the economic impact of validator withdrawals.

Withdrawal Economics

Withdrawals have caused a stir in the Ethereum community due to the expectation of fresh supply entering circulation. While Ethereum has mostly been net-deflationary since The Merge, validator supply and rewards locked up on the Beacon Chain, since 2020, have further removed supply from circulation. Only after Shapella has this supply been made available to re-enter circulation and to be used or sold.

A total of almost 1.06M ETH has already been withdrawn from the Beacon Chain, and it is projected that up to 1.2M ETH will be withdrawn in the next few days. This projection includes withdrawals from excess staked balances by validators who plan to continue staking in the future (304K ETH), as well as balances from validators who are in the process of exiting or waiting for withdrawal (899K ETH). Therefore, the total projected withdrawals amount to 1.2 million ETH.

Source: Coin Metrics Labs

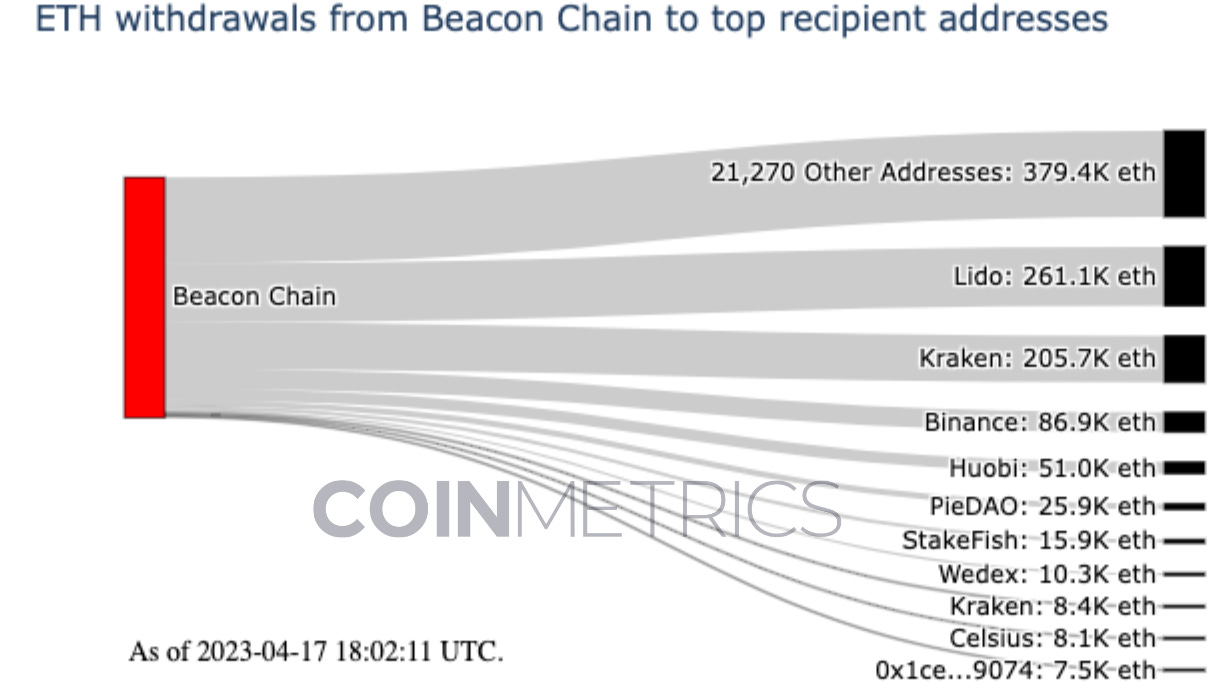

The chart below presents the most significant flows of withdrawals from the Beacon Chain to validators’ Ethereum addresses, as of Monday afternoon ET. Out of the 1.06M ETH withdrawn, we see 380K ETH sent to ~21K addresses, which may belong to solo stakers or unmarked pools, followed by ~680K sent to the top 10 withdrawal addresses. The top two we believe to be associated with the Lido and Kraken staking pools, respectively. However, it is worth noting that withdrawals using Lido are not expected to go live until May after the liquid staking protocol undergoes additional testing and audits. Kraken is expected to bring a portion of its staking operations offline after being charged $30M to settle SEC charges for offering its staking-as-a-service product to US clients.

Source: Coin Metrics Labs

Validators process withdrawals in a round-robin manner, meaning that they are processed in the order that the validators joined the validator set. Our observation of the withdrawal amounts per hour reveal a downward trend, reflecting the larger average balance of older validators who have been staking for a longer time and hence have accumulated a greater reward. Interestingly, we also noticed a significant clustering of validators performing full withdrawals between April 15th and 16th, which can be tracked using the withdrawal address 0x210b3c… we believe belongs to Kraken.

Source: Coin Metrics Labs

During this period, the number of withdrawals processed per epoch remained constant. However, the variation in ETH withdrawal flows can also be explained by the prevalence of partial versus full withdrawals in the validator sample. This means that some validators chose to withdraw their entire staked balance, while others withdrew only the rewards portion of their staked assets.

It is important to emphasize that the rate of partial withdrawals is currently heightened as validators access ETH on the Beacon Chain for the first time since its December 2020 launch. Going forward, the average active validator will automatically withdraw just the rewards accrued from 3–5 days of participation (the time it takes to cycle through the active validator set) which currently should be somewhere in the range of 0.01 to 0.015 ETH—assuming good uptime.

Staking Ecosystem

With the activation of withdrawals, impacts across the wider staking ecosystem can also be observed. For instance, Coinbase’s liquid staking token—Coinbase Wrapped Staked ETH (cbETH)—can be redeemed by making an “unwrap” request, turning cbETH to ETH2 based on a conversion rate. Token wrapping is a process whereby the underlying ETH is locked in a smart contract and a wrapped token (cbETH) is issued to the user. Since the upgrade, cbETH supply has experienced a slight slump with 35.5K being redeemed on April 13th. This decline in cbETH supply could be attributed to several factors, such as users seeking to arbitrage the cbETH discount to ETH, diversifying to other liquid staking solutions, or deciding to stop staking altogether.

Source: Coin Metrics ATLAS V2

Market Impact

The price of ETH remained relatively stable during the initial hours after the Shapella upgrade went live on April 12th at 10:27 PM UTC. However, starting from 09:00 UTC on the 13th, the price of ETH began to increase rapidly, eventually closing above $2,000 by the end of the day. This marked the first time that ETH had reached this level since May 2022.

Source: Coin Metrics Hourly Reference Rates, Trading View

The ETH/BTC ratio was dropping leading up to the hard fork, meaning BTC price was outperforming ETH. But that trend reversed on the 12th, and has been rising back in favor of ETH since then. As of April 16th the ratio reached .07, its highest level in over a month.

Conclusion

The success of the Shapella fork has brought significant changes to the Ethereum network. The introduction of withdrawals to the Beacon Chain validator staked balances has enabled validators to access their stake with greater flexibility and efficiency, providing greater liquidity and reducing barriers to entry for new validators. This has also improved the capital efficiency of staking pools and large validators, who will be able to either re-stake their proceeds or use them as they see fit.

As the Ethereum network continues to evolve, we should continue to monitor changes to the validator ecosystem, and keep track of improvements and innovations in the staking and governance mechanisms of validators—including Lido V2—as well as the effects of the SEC's regulatory stance on the ongoing evolution of the staking-as-a-service industry.

Network Data Insights

Summary Metrics

Source: Coin Metrics Network Data Pro

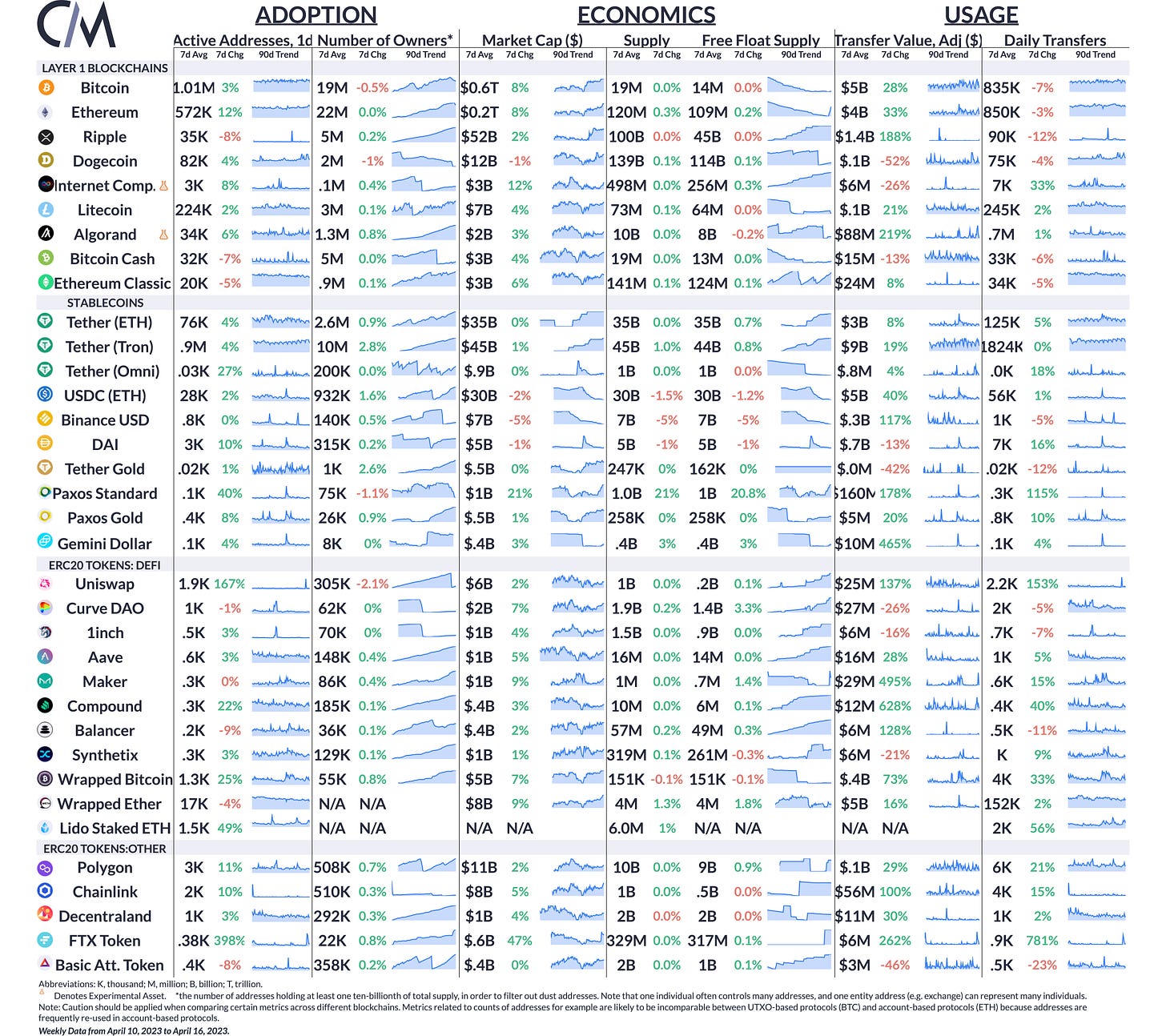

Keeping in focus with Ethereum, active addresses rose by 12% on the back of a successful hard-fork. A few ERC-20 tokens also experienced an increase in active addresses with Uniswap’s governance token rising 167%, as well as a few other stablecoin and DeFi tokens.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

We invite readers to join Coin Metrics COO Katie Chase, Cryptoasset Research Analyst Matías Andrade, and Senior Data Scientist Uriel Morone for a live fireside chat moderated by Noelle Acheson, founder, Crypto is Macro Now on April 20th, 2023 at 10:30 AM ET for a wide-ranging conversation about crypto pricing and markets, what asset prices don’t tell us, and why regulators are paying attention.

Explore our entire catalog of data-driven research on our revamped insights page on the Coin Metrics website, which makes it easier to browse through previous State of the Network issues, as well as our other original research.

For the best in-depth discussion of CM data and research, come check out our research community on the web3 social media platform gm.xyz.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.