Coin Metrics’ State of the Network: Issue 227

A data-driven overview of the events from Q3–2023

Get the best data-driven crypto insights and analysis every week:

State of the Network’s Q3 2023 Wrap-Up

By: Tanay Ved & Kyle Waters

In this special edition of State of the Network, we take a data-driven look at the most important events that impacted the digital assets industry from Q3 2023.

Q3 Market Performance

With Q3 in the books, it’s an opportune time to reflect on the notable developments and trends shaping digital asset markets as we transition into the final quarter of 2023. Q3 continued to be characterized by macroeconomic and regulatory developments or, in some cases, the lack thereof. Evolving trends in the stablecoin and exchange landscape also made headlines.

Following the collective surge in Q1 and the relative calm of Q2, this quarter trended generally lower, with the total crypto-asset market capitalization approaching $1.09T, down around 10% from $1.2T in July 2023. Despite this, BTC and ETH have so far posted gains of 63% and 40% YTD with several other assets showcasing outsized returns buoyed by asset specific catalysts. Notably, MKR rallied 185% following the successful incentive schemes to increase Dai supply, driven by a hike in the Dai Savings Rate and capitalizing on the DAO’s US T-Bill allocation (more on this trend below). Solana (SOL) also had its fair share of positive developments, while XRP ended the quarter up 53% higher year-to-date despite giving up some gains after Ripple Labs’ partial victory against SEC in the courts.

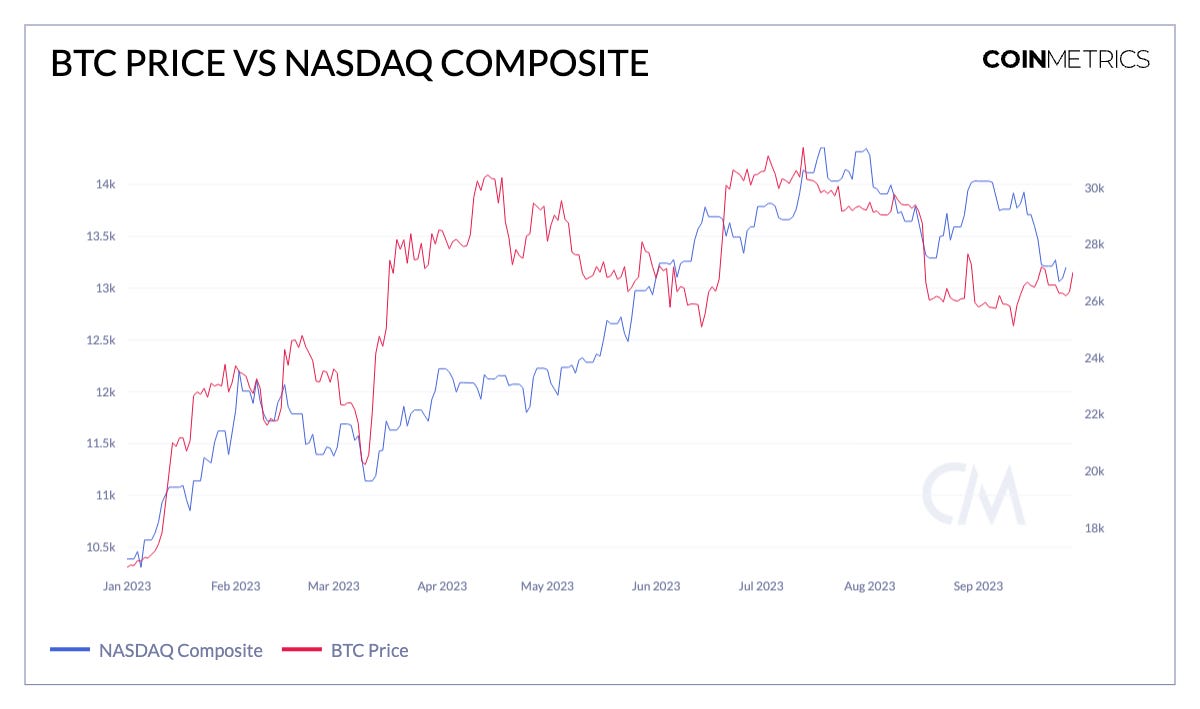

Source: Coin Metrics Reference Rates

However, monetary and liquidity conditions remain tightened as global central banks hint at further rate hikes to bring inflation down to their targets. With total crypto market capitalization and the Nasdaq index up 32% and 28% year-to-date, it raises the question of whether risk-assets can continue their march forward. On the back of banking crisis fears in March, BTC’s 90D correlation with the S&P 500 index reached a low of 0.05, while its correlation with Gold strengthened. As of Q3, however, BTC’s relationship with the highly technology concentrated S&P 500 index seems to be strengthening again. Consequently, market participants will be keen to follow whether there emerges a general aversion to risk-assets amidst a higher interest rate environment, or if the tightening correlation between stocks and BTC experiences a reversal.

Source: Coin Metrics Formula Builder

ETF Anticipation Builds with Grayscale Court Win

Q4 arrives amid continued hunger for the approval of a spot bitcoin exchange traded fund (ETF) in the United States, a development long stalled by the Securities and Exchange Commission’s (SEC) persistent rejections. Optimism jumped at the end of the previous quarter as BlackRock, the world’s largest asset manager, filed its own bid for a bitcoin spot ETF, lending substantial gravitas to ongoing efforts given BlackRock’s track record at obtaining approval for their ETFs.

Set against this optimistic backdrop, the third quarter delivered a mix of both hope and uncertainty. On August 29th, Grayscale—the crypto asset manager behind the $16B Grayscale Bitcoin Trust (GBTC)—emerged victorious in its lawsuit against the SEC with the Court of Appeals for the D.C. Circuit unanimously ruling in favor of Grayscale. The court's opinion stated that "the denial of Grayscale's [spot ETF] proposal was arbitrary and capricious because the Commission failed to explain its different treatment of similar products." In the wake of the news, BTC's price surged as GBTC's discount to NAV tightened on increased odds of the trust’s conversion to an ETF. While this provided a huge boost for Grayscale and the industry at large, the SEC still retains the option to contest and potentially reject the spot ETF again under newfound rationale.

Source: Coin Metrics, Grayscale

Meanwhile, the SEC’s penchant for procrastination continues, with decisions on numerous ETF applications being deferred. Assuming the other applications are delayed as long as legally possible, this positions the ARK 21Shares spot ETF (which would have the ticker “ARKB”) up first for a final decision due in January 2024. While the pursuit of a bitcoin spot ETF encounters bureaucratic roadblocks, yesterday’s launch of 9 Ethereum futures ETF products offers a silver lining, a milestone Bitcoin attained nearly two years prior.

The unfolding drama sees Washington’s corridors filled with escalating pressure, with scrutiny intensifying on Gary Gensler’s SEC and bipartisan voices from Congress urging the immediate approval of a spot bitcoin ETF. The protraction is also intertwined with a divided Congress that only narrowly escaped a federal government shutdown this past weekend—a scenario that would have seen the SEC operating with a skeletal staff—thereby influencing the trajectory and timelines of ETF approvals. The convergence of crypto markets, dynamics in Washington, and the aspirations of traditional finance will be decisive in shaping the future of bitcoin spot ETFs in the US, potentially marking a seminal moment for the integration of digital asset markets and financial institutions.

The Opportunity Cost for Yield

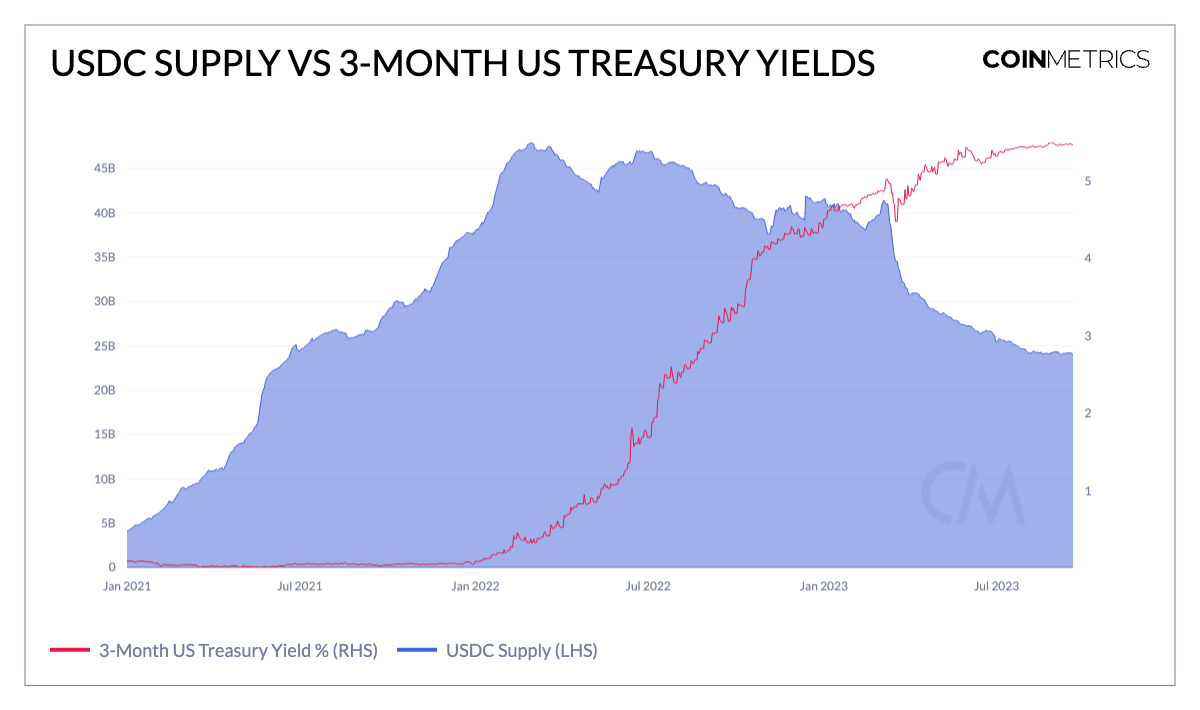

Stablecoins continue to be a central theme within the digital asset landscape, with the launch of PayPal’s stablecoin, PYUSD, and Visa’s foray into stablecoin settlement marking important developments in the quarter. The launch of the Federal Reserve’s instant payment system, FedNow, also stirred the conversation. As of Q3, the market capitalization of USDT and USDC approached $84B and $23B, respectively. Of this, $39B of Tether’s current supply resides on Ethereum, while $44B originates from Tron. Meanwhile, current supply of Dai experienced a boost this quarter, rising above $5B, fuelled by an increase in the interest rate paid to Dai depositors in the Dai Savings Rate contract.

An overarching trend over the last two years has been the rise in US Treasury yields, reaching decade high levels amidst an environment of financial tightening. With short-dated treasuries yielding greater than 5%, it raises the question of whether simply holding stablecoins represents an opportunity cost. This trend is depicted in the chart below, where USDC supply started shrinking from its all time high in January 2022, as US Treasury yields increased. This was further accentuated by the Silicon Valley Banking crisis, resulting in a loss of perceived safety for USDC holders.

Source: Coin Metrics Formula Builder

Yields earned on deposits to DeFi lending protocols like Aave also reached levels below those seen in 2021, which largely fueled growth in DeFi pools. However, as the “risk-free rate” has grown in its attractiveness, stablecoin liquidity in DeFi pools have subsequently experienced declines as capital rotates in search for safer yields. The rise of tokenized treasuries and interest-bearing stablecoins leveraging crypto native and RWA collateral, however, have helped service the demand for yields while interest rates remain higher. The de-risking of ETH staking after the Shanghai upgrade has also allowed stakeholders to capitalize on ETH validator yields through avenues such as liquid staking tokens. In essence, this trend has resulted in the birth of several emerging stablecoin models that pressure existing stablecoin issuers like Circle and Tether by passing on some of treasury yield to token holders.

Source: Coin Metrics Labs & US Department of the Treasury

Volumes & Exchange Outlook

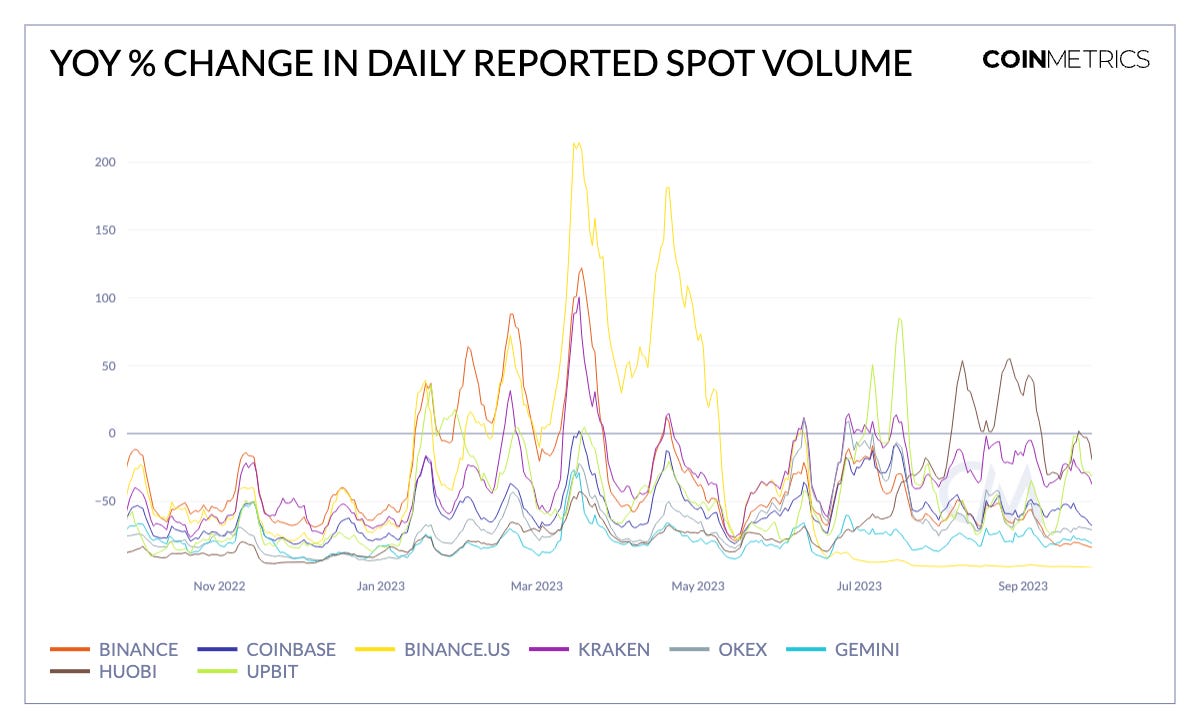

The digital asset exchange landscape has also garnered significant attention due to the continued friction with the SEC. This is visible in the changing market share of spot volume by exchange below. For instance, Binance—which started the year off with a 68% share of spot volumes has seen its market share reduce to 43% as of Q3. Meanwhile, the market share Binance US (depicted in yellow) has completely shrunk on the back of increased regulatory pressure.

Source: Coin Metrics Formula Builder

Looking at the year-over-year change in reported spot volume (7d moving average) paints a similar picture. Spot volume on Binance shrunk from $18B a year ago to about $3.5B—84% lower than it was a year ago. Similarly, Binance US spot volume ended the quarter 98% lower than levels seen last year. Meanwhile, despite an overall slump in spot volumes, Coinbase has moved to diversify its business model and expand its on-chain presence, thereby reducing its reliance on transaction volumes as a primary source of revenues. It remains to be seen whether any exchanges emerge as direct beneficiaries of these changes, however, market shares of Bybit, Huobi and Bullish have widened over the year.

Source: Coin Metrics Formula Builder

At large, we’ve seen trusted exchange volumes dwindle as market-makers scaled back over the past year. Additionally, the closure of Silvergate Bank and SigNet in March—which served as a crucial link between traditional banking infrastructure and the digital asset market, have also contributed to lower volumes and lower volatility in BTC, ETH and altcoins. However, as we approach the final quarter of 2023, there remains plenty of optimism and opportunity for digital asset markets to escape the shadows of late 2022.

Conclusion

In a quarter characterized by uncertainty on the macroeconomic and regulatory front, there are several positive underpinnings that digital asset market participants can take away. The launch of futures and spot based exchange traded funds represent major investment vehicles for greater institutional adoption and inflow into the asset class—a crucial piece missing from prior cycles. Additionally, partial victories in the courts along with accommodative regulation overseas signal a potential reversal in the SEC’s grip over the industry. Moreover, the ability to service demand for yield against various economic backdrops through off-chain and on-chain avenues are crucial developments for the linkage between traditional and decentralized finance. The adoption of on-chain infrastructure, Ethereum Layer-2 networks (including the likes of Optimism, Arbitrum, Base) and the 2024 Bitcoin halving indicate several potential catalysts on the horizon.

Network Data Insights

Summary Metrics

Source: Coin Metrics Network Data Pro

Bitcoin and Ethereum active addresses declined 3% and 5% respectively while market cap remained mostly unchanged. DeFi ERC-20 tokens CRV, MKR and COMP experienced 13% gain in market capitalization.

Coin Metrics Q3 Updates

This quarter’s updates from the Coin Metrics team:

We released 3 new special long-form reports in the quarter, check them out below

CM’s Head of Research & Development Lucas Nuzzi appeared on the Galaxy Brains Podcast to discuss the rise of Crypto Data & Analytics

Check out Coin Metrics’ company and product announcements from over the quarter

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.