Coin Metrics’ State of the Network: Issue 233

November Rally Reaches New Corners of the Digital Asset Market

Get the best data-driven crypto insights and analysis every week:

November Rally Reaches New Corners of the Digital Asset Market

By: Tanay Ved, Matías Andrade, & Kyle Waters

Introduction

Building on the upward momentum from the previous month, digital asset markets extended their strength into November. This market-wide rally elevated the total crypto-asset market capitalization to over $1.4T, with BTC and ETH climbing over $37K and $2K respectively. Notably, the recent upswing was not just exclusive to the two largest digital assets; SOL and a host of other altcoins were also major beneficiaries of this broader market rally as positive sentiment around spot Bitcoin and Ethereum ETFs spread to other sectors of the market.

In this issue of Coin Metrics’ State of the Network, we delve into market data underpinning this move, to discern primary beneficiaries and explore the diverse avenues channeling this momentum from spot markets to Grayscale’s institutional funds.

Market Rally Broadens

While the rally originated from the impending launch of a spot Bitcoin ETF, it gained further momentum following the news of a potential ETF approval window on November 9th, coupled with BlackRock's filing for a spot Ethereum ETF. Despite strong reactions to this news, a major beneficiary was Solana (SOL)—experiencing year-to-date gains of 470% buoyed by catalysts of its own.

As seen in the chart below, the price of SOL temporarily reached $62 and is hovering around $55—a fivefold increase in price since January 2023. Trusted spot volumes also experienced notable upticks reaching $1.95B on November 1st and $2.15B on November 11th, marking the highest spot volume since FTX’s collapse in November last year.

Source: Coin Metrics Market Data

Solana’s close affiliation with FTX had initially cast a shadow over its prospects following the exchange’s meltdown, leading to a period of suppressed performance. However, there’s been a noticeable shift in sentiment as market participants re-evaluate the overhang of FTX’s bankruptcy related liquidations and oversold nature of the asset, resulting in the stellar performance of SOL & GSOL, Grayscale’s Solana Trust. Network activity is also showing signs of resurgence as participants recognize its potential as an inexpensive, high throughput blockchain, distinct from prior affiliations. While the recent release of Firedancer testnet—a validator client aimed at enhancing performance and growth of decentralized applications—offers promise, participants will be keen to see these developments translate into sustained network activity.

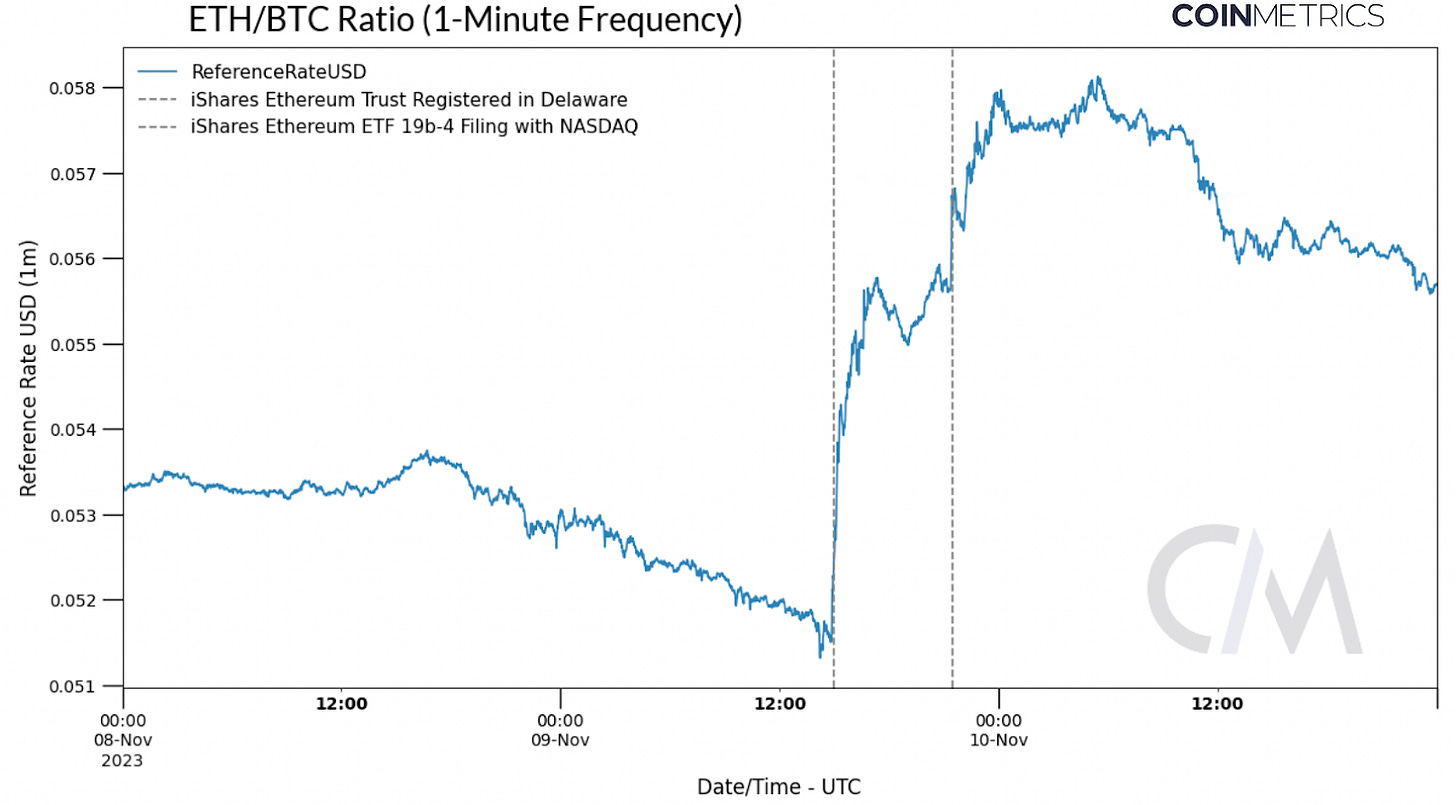

Over the past week, BlackRock's application for a spot Ether ETF, called the "iShares Ethereum Trust," has captured industry attention. This move signifies a broadening of their initiative to launch spot investment vehicles for bitcoin, expanding market access for a diverse cohort of investors, including registered investment advisors (RIAs) and wealth managers. While this application awaits SEC review, the optimism for its approval is bolstered by the precedents set by existing futures ETFs and reinforced by the district court’s ruling in favor of Grayscale, suggesting a potentially favorable regulatory outlook.

Source: Coin Metrics Market Data

Sparked by this news, ETH spiked to over 2.1K for the first time since the Shapella upgrade in May. The move was fuelled by activity in spot markets, with trusted spot volumes breaking levels last seen during FTX’s meltdown in 2022—reaching $8.5 Billion on November 9th. This resulted in a temporary rotation towards ETH, as seen in the chart below.

The ETH/BTC ratio reversed from below 0.052 to 0.056 on reports that the iShares Ethereum Trust was registered as a corporate entity in Delaware, an event that also preceded the filling of the spot BTC ETF. This was shortly followed by confirmation of the 19b-4 filing by Nasdaq, causing another surge to 0.058 before tapering off. On a longer time-frame, the ETH/BTC ratio sits right above levels last seen in May 2021, showcasing its relative underperformance.

Source: Coin Metrics Reference Rates

Despite the 13% rally and temporary rotation towards ETH since November 1st, near-term focus still remains on impending spot Bitcoin ETF approvals. Heightened activity in derivatives markets over the past month highlights this growing anticipation.

Open Interest Rises, Grayscale Products Surge

Turning to the crypto derivatives markets, there has been a significant surge in open interest across the board. Open interest measures the number of contracts which are currently open—i.e., not yet settled or closed. When open interest rises, it means more market participants are entering new positions than closing existing ones. Open interest of bitcoin futures traded on the Chicago Mercantile Exchange (CME) has soared in recent weeks, notably surpassing open interest on Binance, the juggernaut of international exchanges.

Source: Coin Metrics Market Data

One possible catalyst of this uptrend could be residual demand from an arbitrage trade involving the Grayscale Bitcoin Trust (GBTC). This involves shorting futures, purchasing GBTC, hedging against spot price risk, while capturing on the remaining discount (see next section below) to the Net Asset Value (NAV) that would close with the conversion to an ETF product.

Last week, CoinDesk reported that the SEC has opened talks with Grayscale over the company's efforts to convert its trust to an ETF, building off Grayscale's court win in August, which the SEC chose not to appeal. On Monday, Grayscale CEO Michael Sonnenshein shared a post on X: "it's been a ten year dress rehearsal. we're ready for the main event."

While the remaining arbitrage might explain some of the uptick, open interest is broadly growing ahead of the potential launch of a spot bitcoin ETF in the US. This prospect seems to be capturing the attention of institutional players in the U.S. The burgeoning interest in the CME's bitcoin futures is a critical market indicator, especially for institutional entities engaging with BTC and the market structure of BTC in the U.S. Moreover, the open interest of ETH futures on the CME has picked up to its highest level since April, but not to the same magnitude as BTC. However, this dynamic might shift in light of BlackRock's recent move to file for a spot ether ETF product. As mentioned earlier, BlackRock’s application could foreshadow a growing institutional interest in ETH, potentially leading to a similar surge in open interest as seen with BTC.

A significant avenue for digital asset market participants are Grayscale’s Trust products—an array of investment products providing exposure to individual assets like BTC, ETH and more. With momentum building since Grayscale’s victory in the courts, the performance of their products merit a closer look.

Source: Coin Metrics’ Institutional Metrics, Grayscale

Grayscale’s Bitcoin Trust (GBTC) is of particular interest, as signs point towards its imminent conversion to a spot ETF. GBTC’s discount to net asset value (NAV) has narrowed to 10% over the course of the year. Meanwhile, ETHE is trading at a discount of 14%, closing the gap from 59% discount earlier this year. BCH and LTC trusts have surpassed parity while SOL and LINK are trading at premiums of 869% and 250%—showcasing the institutional appetite for these assets. Grayscale’s other trusts including FIL, MANA, XLM and BAT have also seen growing premiums, signaling that investors are betting on further price appreciation or eventual conversion of these trusts to ETFs.

Fee Market Uptick

Source: Coin Metrics Network Data

Along with a surge in performance, there has also been an uptick in activity on the Bitcoin and Ethereum networks. As seen above, daily total transaction fees (in USD) hit $9.15M for Bitcoin and $12.8M for Ethereum on November 9th—the highest since May.

On Bitcoin, this spike in transaction fees partially aligns with heightened activity around Ordinals and BRC-20 tokens, reminiscent of the elevated fee market in May, where transaction fees soared to $17.4M. This is also a welcome development for miners, with fees constituting 21% of daily miner revenue. On the other hand, the surge in fees on Ethereum has helped turn issuance deflationary, while priority fees see an uptrend as a result of increased activity on Ethereum mainnet.

Sector Returns

Source: Coin Metrics Formula Builder & datonomy

As alluded to earlier, this market rally reached a wide spectrum of sectors within the digital asset ecosystem. Looking back over this month so far, several sector indices in the datonomy universe have fared well, with the total market index (CMBITM) returning 11%. The Decentralized Finance sector currently leads the pack at 33.5%, followed by Smart Contract Platforms at 30.5%, Intermediated Finance at 28%, and the Metaverse at 27%, all benefiting from a strong month for smart contract networks and the tokens linked to their applications.

Conclusion

The recent surge in crypto-asset markets encapsulates a broad-based rally, catalyzed by the prospect of spot ETFs for the two largest digital assets. This has not only bolstered market sentiment but also spurred network activity and adoption, while promising to expand access for the asset class across a wide range of participants through a previously untapped investment vehicle. While the immediate impact of spot ETF approvals has yet to be seen, the positive market response and heightened institutional participation underscore a wider acceptance and maturation of digital assets.

Network Data Insights

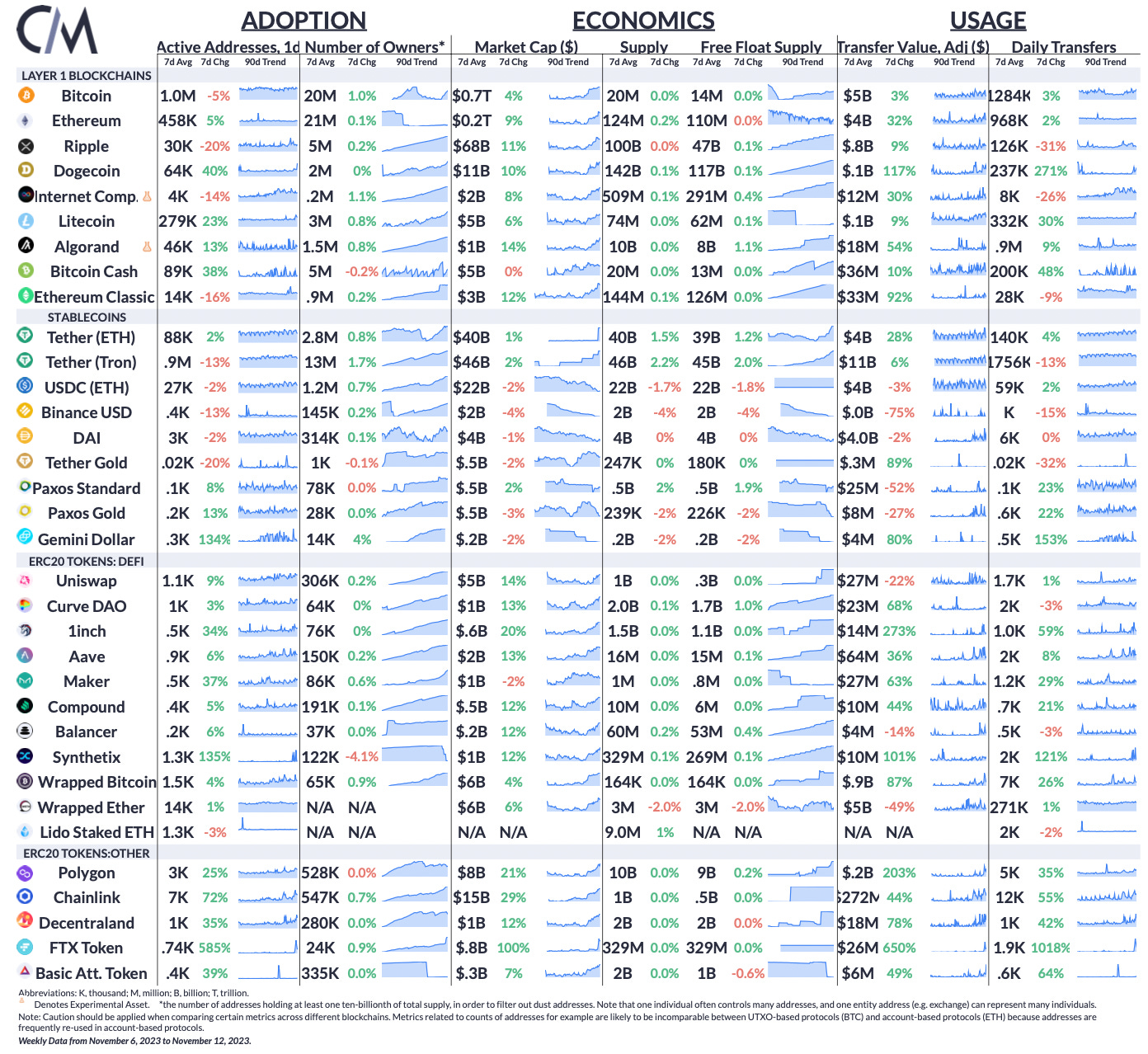

Summary Metrics

Source: Coin Metrics Network Data Pro

Bitcoin active addresses declined 5% while Ethereum active addresses gained 5% over the week. Active addresses for the FTX Token (FTT) increased by 585% as price rose to the highest levels since FTX’s collapse, as speculation rose for the chances of a reboot of the exchange under fresh leadership and oversight.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Follow Coin Metrics’ latest State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary from the Coin Metrics team, rich visuals, and timely data.

Check out Coin Metrics’ Trusted Exchange Framework 2.1 evaluating digital asset exchanges based on thorough quantitative analysis of transparency, resilience, data quality and more.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.