Appraising Growth in Digital Asset Markets

Coin Metrics’ State of the Network: Issue 251

Get the best data-driven crypto insights and analysis every week:

By: Matías Andrade & Tanay Ved

Key Takeaways:

Bitcoin's correlation with the S&P 500 and Gold has strengthened since the beginning of 2024, reflecting a shift in investor sentiment towards Bitcoin as both a risk-on investment and a potential hedge against macroeconomic uncertainties.

The growing market share of altcoins and the surge in activity across various sectors of the datonomy classification suggest a more diverse and dynamic digital asset market landscape.

The increasing open interest in Bitcoin futures on the CME signifies the deepening liquidity and maturity of the Bitcoin derivatives market, potentially leading to greater price stability and reduced volatility in the spot market.

The digital asset market has experienced significant growth and a notable shift in sentiment since the introduction of Bitcoin ETFs, with the Information Technology, Decentralized Finance, and Specialized Coins sectors leading the way in terms of year-to-date returns.

Introduction

Digital asset markets have grown tremendously since the bitcoin ETFs were announced, with BTC reaching record highs of $73K and the total crypto-asset market cap expanding to $2.5T over the period. The ETF launch has brought forward institutional interest, and this in turn has brought retail back into the flow with a renewed interest in speculative assets—chief among them memecoins. But even as these speculative flows gather more attention, a momentous shift in sentiment is under way.

In this week’s issue of State of the Network, we take a closer look at the shift in digital asset market sentiment, leveraging market data and datonomy™ sector classification to contextualize the latest market movements.

Bitcoin Dominance & Correlations

Understanding Bitcoin’s dynamics relative to traditional assets and the crypto-asset ecosystem reveals crucial trends. Spurred by the introduction of spot bitcoin ETFs, new entrants are evaluating allocation towards this emerging asset class. In this context, understanding Bitcoin’s historical correlation with traditional assets like the S&P 500 and Gold is beneficial. While Bitcoin has largely exhibited properties of an uncorrelated macroeconomic asset over its lifespan, it has showcased periods of higher correlation with the S&P 500, displaying “risk-on” characteristics akin to technology stocks, as well as periods of correlation with Gold, suggesting “safe-haven” traits.

Source: Coin Metrics Formula Builder

However, these correlations have also broken down on several instances, highlighting its role as a portfolio and risk diversifier, stemming from this unique behavior. Since the beginning of 2024, its 90-day correlation to the technology heavy S&P 500 and Gold has strengthened in tandem, as both artificial intelligence driven equities and Gold surge in value. This reflects a nuanced shift in investor sentiment towards Bitcoin as both a risk-on investment and a potential hedge against macroeconomic uncertainties. With the introduction of a vast access channel through bitcoin ETFs, increased institutional participation, and changing macroeconomic conditions, Bitcoin’s market role is poised to evolve.

Similarly, Bitcoin dominance, which excludes stablecoins and other on-chain derivatives, reveals interesting insights into the dynamics between Bitcoin and altcoins in the digital asset market. Bitcoin dominance consolidated during 2023, reaching a peak of around 60% in February. This indicates that during the market downturn, investors likely favored Bitcoin as a more established and less volatile asset compared to altcoins. The resilience of Bitcoin's dominance during future market fluctuations, especially with a new access channel through spot bitcoin ETFs, will also provide insights into the long-term dynamics between Bitcoin and altcoins in the digital asset landscape.

Source: Coin Metrics Formula Builder

However, the recent trend in the chart shows a notable expansion of altcoins' market share. Since February 2024, the dominance of assets other than Bitcoin in the datonomy™ universe (excluding on-chain derivatives) has been steadily increasing. This trend can be explained by a shift in investor sentiment towards a more speculative and risk-tolerant approach, favoring the potential higher returns offered by altcoins.

As the altcoin market share continues to grow, it will be important to monitor the sustainability of this trend and assess whether it represents a fundamental shift in investor preferences or a temporary reflection of the market cycle.

Volume Growth

Since May 2023, the open interest for Bitcoin futures on the CME has experienced a remarkable upward trajectory, currently over $11B. This surge in open interest coincides with the growing acceptance and adoption of Bitcoin as a legitimate asset class among institutional investors.

Source: Coin Metrics Formula Builder

As the open interest on the CME continues to climb, it signifies the deepening liquidity and maturity of the Bitcoin derivatives market. This trend is likely to attract even more institutional participants, potentially leading to greater price stability and reduced volatility in the spot market.

However, it is essential to monitor the sustainability of this growth in open interest and assess whether it translates into long-term institutional commitment or reflects short-term speculative positioning. Nonetheless, the increasing institutional presence, as evidenced by the CME open interest, is a positive sign for the overall development and mainstream adoption of Bitcoin as an established asset class.

Source: Coin Metrics Formula Builder

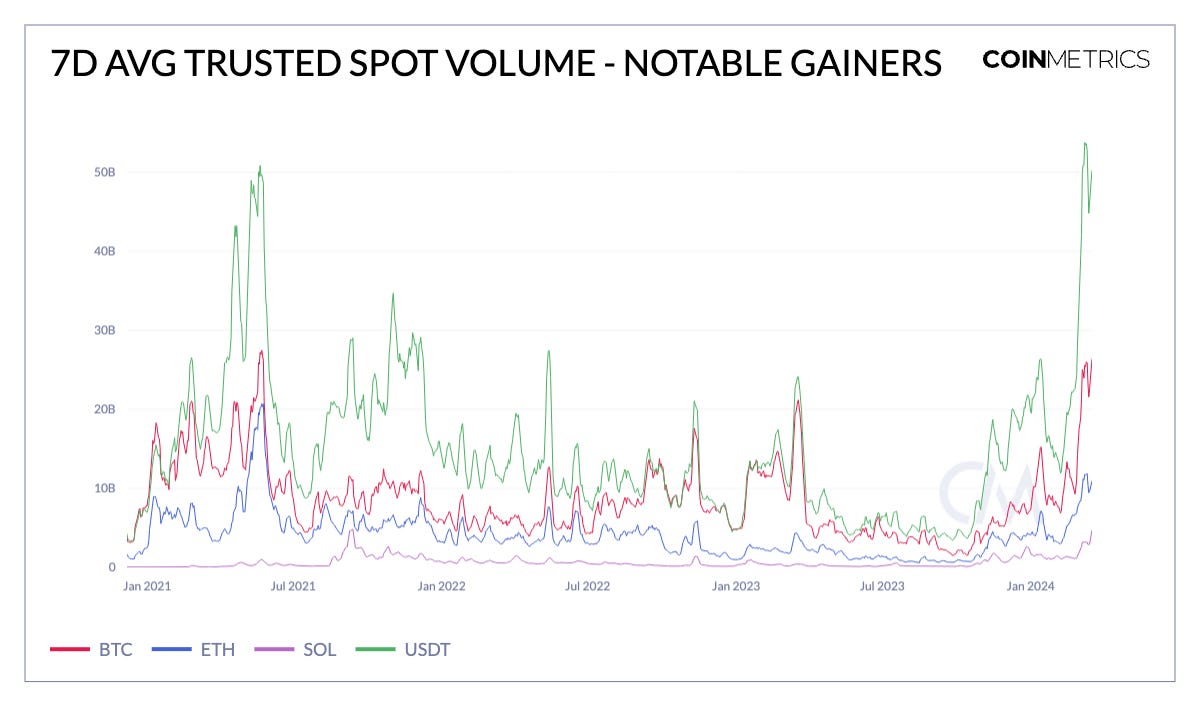

A breadth of digital assets have benefited from the recent expansion in crypto-asset markets. This is exhibited in rising trusted spot volumes for notable assets, including Bitcoin (BTC), Ethereum (ETH), Tether (USDT) and Solana (SOL), amongst others. The 7-day average of trusted spot volumes for BTC, currently near $26B, is just $1B shy from its all-time high in May 2021. While ETH has yet to hit its historical high mark in spot volume, the successful Dencun upgrade could provide a boost in activity. USDT–denominated volumes reached an all-time high of $53B in March as supply crossed $100B. Similarly, Solana (SOL) volume is also nearing its peak of $4.7B—reflecting a substantial rebound in interest amid this market cycle.

Source: Coin Metrics Formula Builder & datonomy™

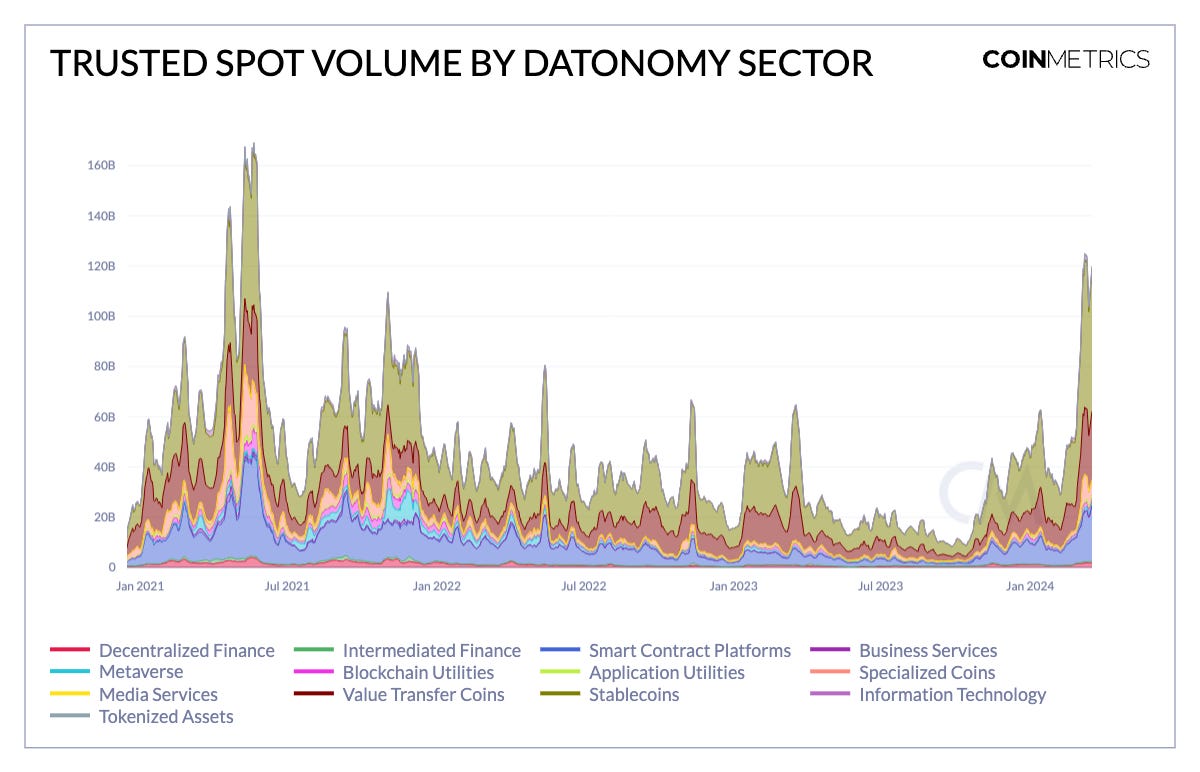

Breaking down this growth by Coin Metrics’ datonomy™ sector classification reveals deeper trends into the beneficiaries of the recent market action. With aggregate spot volumes across exchanges hitting $160B in March, this growth is mirrored in several sectors of the datonomy™ universe. Most notably, this surge is particularly pronounced in sectors associated with “Value Transfer Coins,” “Smart Contract Platforms,” and “Stablecoins”. However, recently, there has also been significant activity in “Specialized Coins,” (including memecoins), the “Information Technology” sector, and the “Decentralized Finance” sector, indicating diverse areas of growth.

The strong performance of these sectors demonstrates the diversification of the digital asset market and the growing interest in blockchain-based solutions beyond traditional cryptocurrencies. As investors seek to capitalize on the potential of these emerging sectors, it is likely that we will continue to see increased capital inflows and innovation in these areas.

Conclusion

The digital asset market has experienced significant growth and a notable shift in sentiment since the introduction of the Bitcoin ETFs. While bitcoin remains a dominant force, the increasing market share of altcoins and the surge in activity across various sectors of the datonomy™ classification suggest a more risk-on and dynamic market landscape. As institutional interest continues to grow, as evidenced by the record ETF volumes and skyrocketing open interest in Bitcoin futures on the CME, the market is likely to see increased liquidity and maturity. However, it is crucial to monitor the sustainability of these trends and assess whether they represent fundamental shifts in investor preferences or temporary market cycles.

Network Data Insights

Summary Highlights

Source: Coin Metrics Network Data Pro

Bitcoin and Ethereum active addresses grew 4% and 11% over the week, respectively. The supply of Tether (ETH) expanded by 4.2% over the week, while USDC (ETH) supply increased by 3.5% to reach $26B.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

Subscribe and Past Issues

As always, if you have any feedback or requests please let us know here.

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.