Bitcoin’s 4th Halving

Significance of the bitcoin halving, impact on miner economics and BTC price

Get the best data-driven crypto insights and analysis every week:

Bitcoin’s 4th Halving

By: Tanay Ved & Matías Andrade

Key Takeaways:

Bitcoin will undergo its 4th halving at block 840,000, (est. April 20th), with block rewards falling from 6.25 BTC to 3.125 BTC.

Miner profitability will come under pressure with revenue from issuance halved, prompting greater efficiency in mining operations while transaction fee-based income grows in importance.

Sustained or increased demand for Bitcoin may offset forced selling, decreasing issuance and drive price action.

Introduction

Amid the current environment of macro-economic uncertainty, with persistent inflation and looming federal funds rate cuts, ripple effects of the upcoming election cycle, geopolitical tensions, and record debt levels, one event stands out as a beacon of certainty—Bitcoin’s 4th halving. With its first block (genesis block) mined in 2009, Bitcoin was born as a scarce, decentralized digital currency with a pre-determined monetary policy, predictable inflation rate, and a fixed supply of 21M BTC. This week, the Bitcoin network is set to undergo the fourth halving 15-years into its existence—an event fundamental to its economic policy and value proposition on the global stage.

In this issue of Coin Metrics’ State of the Network, we understand the significance of the halving, its impact on crucial stakeholders in the ecosystem and potential effects on BTC’s price as the 4th Bitcoin halving nears.

The Significance of a “Halving”

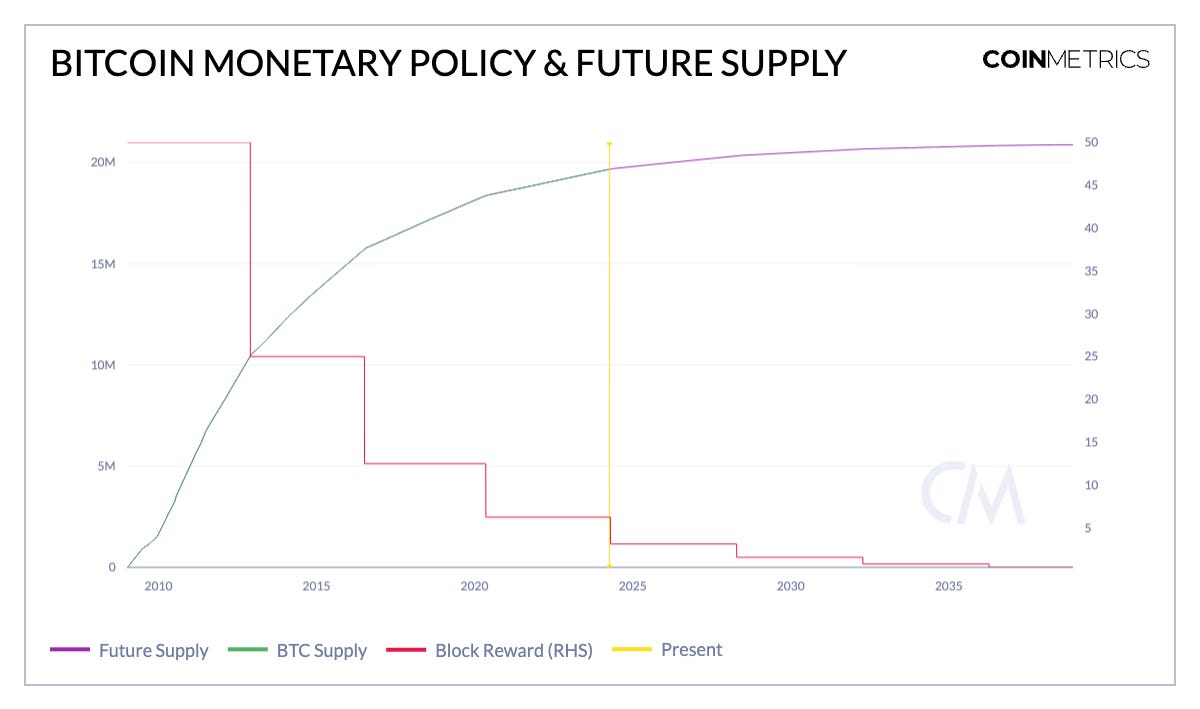

Each halving event is a pivotal moment in Bitcoin’s lifecycle, as it directly impacts its issuance and inflation rate, reducing block rewards (newly issued bitcoin that incentivize miners to produce blocks, keeping the network secure) and potentially sending shocks to the market value of BTC due to increased scarcity.

As implied by its name, a “halving” refers to the reduction of bitcoin issuance by 50%, effectively halving Bitcoins inflation rate—the rate at which new bitcoins enter the market. With this halving, Bitcoins issuance will drop from 900 bitcoin per day (1.8% issuance rate) to 450 bitcoin per day (0.9% issuance rate). Consequently, the rewards miners receive for validating new blocks and securing the network (excluding fees) are also cut in half, impacting their incentives and profitability (more on this in the next section). The halving is programmed to take place every 210,000 blocks, approximately every 4 years, and it is immutable—the rules governing this process are etched into the very code that underpins the Bitcoin network.

Source: Coin Metrics Formula Builder

Bitcoin’s monetary policy is rendered in the chart above. Since its inception in 2009, the network has undergone three halving events, each cutting the block reward for miners in half. The first halving in November 2012 reduced the reward from (50 BTC to 25 BTC), followed by the second in July 2016 (25 BTC to 12.5 BTC) and the most recent in May 2020 (12.5 BTC to 6.25 BTC). The upcoming halving is estimated to occur on April 20th at block 840,000 and will cut the block reward further to 3.125 BTC.

Source: Bitcoin Halving Countdown Dashboard

However, as Bitcoin progresses along this schedule, with a decaying issuance rate and ~19.7M of the capped 21M supply already mined, each incremental halving will have a diminishing impact on overall supply. Consequently, the significance of future halvings will gradually wane as Bitcoin approaches its finite supply.

Miner Economics & Incentives

Miners play an indispensable role in the Bitcoin ecosystem, acting as the backbone for the security and integrity of the blockchain. They use computational power from specialized hardware to hash transaction data, seeking a nonce—the solution to a hash function—that when found, validates a new block and adds it to the Bitcoin blockchain. For a deeper understanding of hash functions and nonces, which underlie Bitcoin’s Proof of Work (PoW), check out our Foundations issue on hashes.

In return for the computational work, miners are rewarded with a block reward (block subsidy) consisting of a predetermined amount of newly minted bitcoins and transaction fees from transactions included in a block.

Source: Coin Metrics Network Data Pro

The block subsidy forms the primary economic incentive for miners. However, with this reward being slashed by 50% from 6.25 BTC to 3.125 BTC, miners will be stress-tested as a substantial source of income diminishes. Consequently, transaction fees are expected to play an increasingly important role for miner revenue, along with the appreciation of BTC’s value amid greater demand.

Since the 3rd halving, Bitcoin revenue from block subsidy climbed to $43B, 180% higher than the prior halving in 2016. While transaction fees currently account for a smaller portion of the total miner revenue, they are growing in significance with each halving, with fees bringing in a total of $2.5B—doubling from the prior halving.

Source: Coin Metrics Network Data Pro

Aggregate mining revenue continues to reach new heights, with block rewards bringing in more than $76M in a single day on March 11th, a new all-time high. Although the block subsidy will decrease in BTC terms, appreciation of BTC’s market value has offset this decline, leading to greater USD-denominated revenue for miners. With BTC showing strength towards the start of this year, miners will hope for this trend to sustain post-halving.

Furthermore, Ordinals, which enable the inscription of data like images, video and text into non-fungible tokens, have also boosted transaction fees for miners. In Q1 2024, miners earned an average of $3M daily in transaction fees, well-above historical norms. In fact, in May and December 2023, revenue from fees spiked to $17M and $24M respectively, representing close to 40% of total miner revenue from fees on those days. With the upcoming introduction of “Runes”—fungible tokens on the Bitcoin network—alongside the halving, miners may see further increases in transaction-fee based income, potentially counteracting the impacts of a declining block subsidy.

Mining Profitability & Efficiency

Mining profitability is intricately linked to the efficiency of the mining hardware used, as well as the cost of electricity needed to power it. This relationship is depicted in the ASIC breakeven power cost chart provided below, which reflects the maximum electricity cost (in kWh) at which different ASIC models (Application-Specific Integrated Circuit) used in Bitcoin mining can remain profitable.

Source: Coin Metrics Formula Builder

Newer ASIC models, such as the Antminer S19 and S19 XP are profitable at any electricity cost below $0.13/kWh and $0.20/kWh compared to older models like the S9 and S17. This is because technological advancements in ASIC design have led to more energy-efficient miners, allowing for profitable mining operations at higher electricity rates. However, this metric is set to get cut in half, making these models unprofitable even at $0.08/kWh, the average industrial rate in the United States. As the 4th Bitcoin halving nears, miners with access to the most efficient hardware and cheapest electricity will be better positioned to withstand the reduction in block rewards.

Consequently, mining companies have been employing strategies such as partnering with renewable energy providers, locating operations near cheaper and sustainable energy sources, implementing advanced cooling techniques and harnessing stranded energy to enhance sustainability and profitability. Those burdened with older, less efficient hardware will find it increasingly challenging to maintain profitable operations, potentially leading to a consolidation of mining power among the most efficient operators and a gradual phasing-out of less efficient ASICs from the network.

This, in turn, could impact hash rate—a measure of computational resources being allocated to mining. Bitcoin’s hash rate has grown to 605 EH/s in the run up to this halving. However, post halving, there is typically a temporary decline in hash-rate as less efficient hardware goes offline. In order to maintain the target block time of 10 minutes, a drop in hash rate may be met with a downward adjustment in Bitcoins difficulty, easing the hashing process under changed conditions.

Influence of Demand Drivers

While the halving is a supply side event, the diminishing impact of issuance would suggest that demand plays a crucial role in driving the market value of an asset with an inelastic supply like bitcoin. The launch of spot BTC ETFs in January has catalyzed a substantial source of new demand, altering Bitcoins market dynamics when compared to prior halving cycles. Sustained inflows into US based and recently approved Hong Kong BTC exchange-traded products, alongside other sources of demand from funds to public company balance sheet holdings and smart-contracts, will help absorb pressure from forced selling and newly issued supply more effectively.

Price Dynamics

As with every halving, a central question on everyone's mind is: how will the halving impact bitcoin's price? While we can extrapolate insights from performance during past halving cycles, they may not directly indicate future outcomes. Given that we’ve had only three prior halvings under varying market conditions and different investor profiles, predicting whether the halving is priced in can be misleading despite it being an event known well in advance.

Source: Coin Metrics Reference Rates

Bitcoin’s price tends to move in four year cycles. If we look back to each halving epoch, Bitcoins price has appreciated substantially in the year following each halving event. Before the 1st halving in 2012, bitcoin returned over 14,000%. After the 1st and 2nd halving, BTC’s price increased by over 5100% and 1200%, respectively, eventually reaching an all-time high approximately 500 days into the halving. In the current epoch leading up to the 4th halving, we’ve seen an appreciation of 664% as of April 15th, with BTC reaching an all-time high of $73K before a halving for the first time.

The role of ETF-induced demand, and subsequent attention has resulted in a slightly different dynamic and promises to play an outsized role going forward. Several other factors could also provide a boost to the demand side of the equation, such as broader macroeconomic and liquidity shifts, regulatory changes, growth in global digital asset adoption, and speculation which could all influence BTC’s price trajectory.

Source: Coin Metrics Reference Rates

The historical drawdowns chart above, illustrates the resilience in Bitcoin’s price trajectory. Despite consistently retracing over 70% away from all-time highs during halving cycles, the price has rebounded and establishes new highs toward the beginning of every cycle. As the 4th halving approaches—even though BTC was able to reach ATHs even before the halving is triggered—it is important to factor in price volatility which could arise as a result of external conditions or increased attention and speculation around the halving itself.

Conclusion

The Bitcoin halving exemplifies a predictable monetary rhythm amid uncertain financial conditions. Bitcoin's inherent scarcity and deflationary nature make it a unique asset across various economic cycles. While the reduction in block rewards will strain miners, it will drive them towards more efficient and sustainable operations. The convergence of this supply side event and strong drivers of demand suggest that Bitcoin is poised for its next phase of growth. With no shortage of innovation on Bitcoin—such as the upcoming Runes and Bitcoin L2s, boosting transaction fees and scalability, Bitcoin is well-positioned for its next epoch.

For an exploration of Bitcoin mining dynamics, ASIC dominance and a live countdown to Bitcoin’s 4th halving, dive into our Bitcoin Mining Dashboard.

Network Data Insights

Summary Highlights

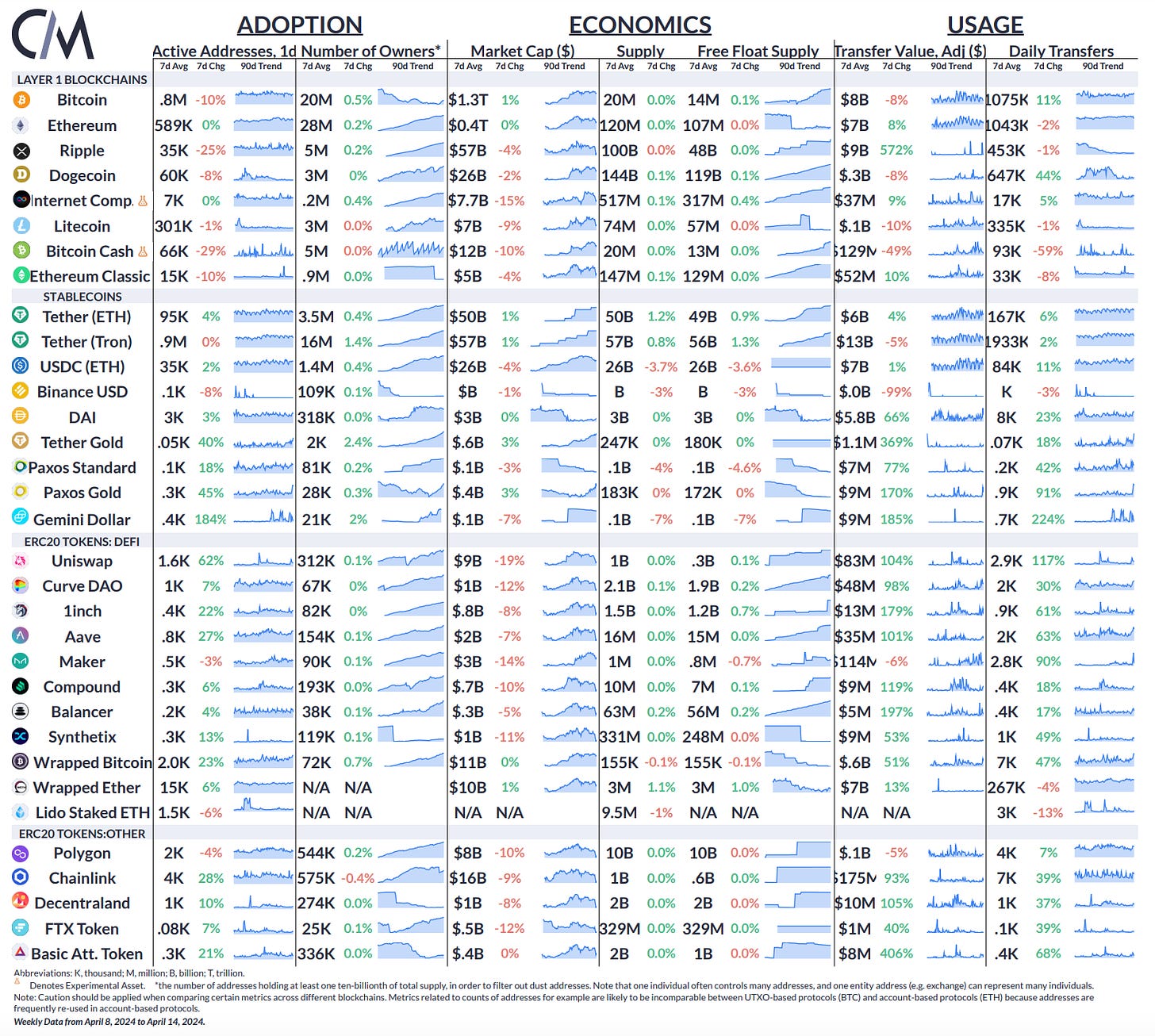

Source: Coin Metrics Network Data Pro

Active addresses on Bitcoin declined by 10%, while active addresses on Ethereum remained unchanged over the week. Uniswap received a Wells Notice from the U.S Securities and Exchange Commission (SEC), leading to a 19% drop in its market capitalization, despite growth in volumes.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

Subscribe and Past Issues

As always, if you have any feedback or requests please let us know here.

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.