The Launch of Ether ETFs

A look into ETH ETF fees, Grayscale funds and demand & supply dynamics heading into Ether ETF Launch

Get the best data-driven crypto insights and analysis every week:

The Launch of Ether ETFs

By: Tanay Ved & Matías Andrade

Key Takeaways:

Nine Ether spot ETFs are set to debut on July 23rd, with fees ranging from 0.15% for Grayscale’s Ethereum Mini Trust to 2.5% for Grayscale’s ETHE.

Ethereum's market cap stands at $420 billion, about one-third of Bitcoin's $1.3 trillion market cap, with daily spot trading volumes for ETH at approximately half of BTC’s volumes across Coin Metrics’ Trusted Exchanges.

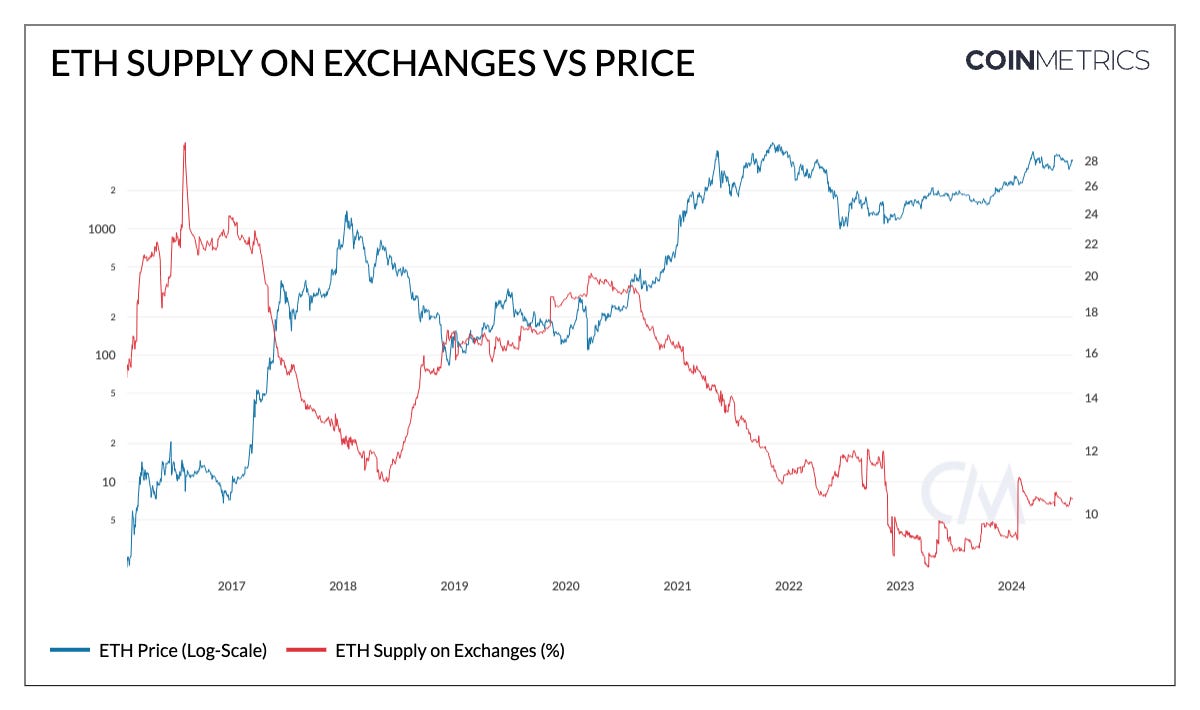

33.2 million ETH (28% of supply) is staked on the Ethereum consensus layer, with 13.5 million ETH (11% of supply) locked in smart contracts and 12.5 million ETH (10% of supply) currently on exchanges. The ETFs could further stimulate prices by locking-up funds in an already well-utilized asset.

The January launch of spot bitcoin ETFs marked the end to a decade-long wait, widening access to the largest crypto-asset through a regulated investment vehicle familiar to all. Recent 13-F filings revealed the firms behind the $16B inflows (and counting) into these products. With this development, market attention naturally turned to the next frontier: Ethereum (ETH). Standing at a $420B market cap today, ETH emerged as the logical successor, making its ETF approval a question of when, not if. The SEC's unexpected approval of spot Ether ETFs in May brought forth clarity around ETH's status as a commodity, further reinforcing the value proposition of the asset class. Now, merely 6-months later, the launch of spot Ether ETFs is imminent.

In this issue of Coin Metrics’ State of the Network we delve into the launch of spot Ethereum ETFs, contextualizing demand and supply dynamics, and implications for Ethereum and the broader digital asset ecosystem.

Issuers in the ETH ETF Race

Nine Ethereum ETFs are set to debut on July 23rd, expanding the universe of crypto-based financial products. Sponsored by both traditional asset managers like BlackRock and Fidelity and crypto-native firms like Bitwise and Grayscale, these products will track the spot price of Ether (ETH). By being listed on public exchanges like the Chicago Board Options Exchange (CBOE), New York Stock Exchange (NYSE) and Nasdaq, investors will now have another avenue to gain exposure to ETH via major brokerage platforms, complementing existing options like user-owned wallets.

Source: Bloomberg, James Seyffart

With the launch date nearing, fee wars have ensued. Issuers have filed their final S-1 registration statements, revealing management fees for their respective funds ranging from 0.15% for the newly introduced Grayscale Ethereum Mini Trust (ETH) to 2.50% for Grayscale’s Ethereum Trust (ETHE), which will convert from its current trust structure to an ETF upon launch. Several issuers have also temporarily waived fees in a strategic move to attract AUM, as was seen with Bitcoin ETFs.

Contextualizing Demand & Near-Term Pressure’s

Using metrics that serve as a barometer for ETH’s demand relative to BTC, we can contextualize the potential demand for an Ether ETF.

Ethereum’s (ETH) market capitalization today stands at $420B, approximately one-third of Bitcoin’s (BTC) market value of $1.3T. On average, daily spot trading volumes (across trusted exchanges) are half that of BTC, reflecting the relative market activity and liquidity. In the futures market, BTC's open interest is approximately 2.6x higher than ETH's across all exchanges, and about 9x higher on the Chicago Mercantile Exchange (CME) specifically. Prior to the launch of their respective ETFs, assets under management (AUM) in Grayscale's Bitcoin Trust (GBTC) were roughly 2.8x those of its Ethereum Trust (ETHE). Collectively, these metrics suggest that ETH ETF inflows may largely align with the established scale difference between the two assets.

Source: Coin Metrics Market Data Feed

An important consideration is that the current ETF structure excludes staking, presenting an opportunity cost for potential investors who would forgo additional staking yields. This limitation could influence demand for Ether ETFs in the near term and may spark discussions about developing more comprehensive ETH investment products that incorporate staking yields. However, the inclusion of staking would also pertain to considerations around ETH's staking ratio and rewards, overall network security and regulatory clarity around the Proof-of-Stake (PoS) consensus mechanism.

Grayscale’s Funds In Focus

With Grayscale’s Ethereum Trust (ETHE) converting from a trust structure into an exchange-traded fund (ETF) upon launch, it’s important to factor in the potential outflows that may arise from this product.

Source: Coin Metrics Institutional Metrics, Grayscale

Dynamics around Grayscale’s Bitcoin Trust (GBTC) can serve as a precedent. GBTC held a large pool of ~620K BTC (~3.1% of BTC supply), amounting to ~$30B in assets under management prior to the launch of spot bitcoin ETFs. The conversion of GBTC from a trust to an ETF created opportunities for investors that previously bought GBTC at a discount to exit their capital or rotate into ETFs with lower management fees. Consequently, GBTC's Bitcoin holdings decreased by ~55% to 270K BTC, exerting downward pressure on BTC's price.

Grayscale’s Ethereum Trust (ETHE), on the other hand, holds ~$10B in AUM pre-launch, comprising 3M ETH (2.5% of ETH supply). While ETHE could experience similar outflows, the distinct timeline of events leading up to the ETH ETF launch and the introduction of Grayscale’s Ethereum Mini Trust (ETH) may mitigate the extent of these outflows.

On one hand, the discount to NAV for ETHE closed rapidly, with ETF approvals in May, giving investors sufficient time to exit close to par. Additionally, with a 0.15% fee, the mini trust provides fee-sensitive investors with an option to transition to this low expense product. 10% of ETHE has already been rotated into the new mini trust product as seed capital, resulting in a reduction of $1B in AUM or 300K ether holdings.

Source: Coin Metrics Institutional Metrics, Grayscale

Ether’s (ETH) Supply Dynamics

The multi-faceted utility of ETH lends itself to a relatively high velocity (turnover rate) and has material impacts on its supply dynamics leading into the ETFs.

Ether (ETH) plays a crucial role as the native asset in the Ethereum ecosystem. It functions as a backbone for its proof-of-stake (PoS) consensus mechanism, means of paying fees on the network, and is used as collateral or source of liquidity on decentralized finance (DeFi) platforms like lending applications and decentralized exchanges (DEXs). Additionally, as Ethereum’s layer-2 ecosystem develops, an increasing amount of ETH is being bridged to access infrastructure and services built atop the Ethereum base layer.

Source: Coin Metrics Network Data Pro

As of July 22nd, of the 120M ETH supply in circulation, 33.2M ETH (~28% of supply) is staked on the Ethereum consensus layer, 13.5M ETH (~11% of supply) is locked in various smart contracts and 12.5M ETH (~10% of supply) is on exchanges. In total, this amounts to 39% of ETH supply not readily available to the market, without considering inactive supply.

Source: Coin Metrics Network Data Pro

The introduction of Ether ETFs is likely to further absorb ETH, potentially constraining available market supply. However, the magnitude of this impact will depend on the adoption rate of these newly launched ETFs.

Other Ethereum Data to Watch

Despite recent trends towards inflation, partly due to growth in layer-2 activity and fee reductions with Dencun, ETH's supply has remained largely deflationary (-0.24%) since "The Merge". The interaction between ETH's constrained supply and potential ETF inflows could kickstart a flywheel of network activity and benefit ETH's overall economics and on-chain metrics.

Source: Coin Metrics Network Data Pro

Greater activity on Ethereum, whether through growing stablecoin supply, L2 blob adoption or DEX transactions may influence base fees on Ethereum mainnet, and in turn affect the rate of ETH burn. This would ultimately constrain supply further, making price potentially more susceptible to changes in demand.

ETH Performance & Volatility

The performance of ETH relative to BTC, as depicted in the ETH/BTC ratio, has been in a consolidation phase since 2021. The ratio currently stands at 0.052, trending down from 0.084 around the time of the Merge. Since the launch of spot bitcoin ETFs in January, ETH has managed a return of 35%, trailing the performance of Coin Metrics’ Total Market Index (CMBITM) and BTC, each bringing returns of 41% and 46% respectively, driven by a surge in demand for BTC.

Source: Coin Metrics Reference Rates, Formula Builder

The extent to which ETH’s trajectory changes course remains to be seen, however, the launch of spot Ether ETFs represents a major catalyst for broader awareness and adoption of ETH as an asset, the Ethereum ecosystem and the digital asset industry as a whole.

Conclusion

While initial attention may focus on the immediate performance of Ethereum ETFs, their true impact will become evident over the coming months. This period will provide insights into the demand for ETH ETFs relative to Bitcoin, the characteristics of these investment cohorts, and broader effects on the Ethereum ecosystem, including network adoption, scaling infrastructure, and applications. Nevertheless, this launch marks a pivotal milestone in the expansion and maturation of crypto-asset markets. By broadening accessibility to ETH and its ecosystem, the introduction of ETH ETFs represents not just a new investment vehicle but also a significant catalyst for Ethereum's expanding role in the global financial landscape.

Network Data Insights

Summary Highlights

Source: Coin Metrics Network Data Pro

Coin Metrics Updates

This quarter’s updates from the Coin Metrics team:

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

Subscribe and Past Issues

As always, if you have any feedback or requests please let us know here.

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.