Real World Assets (RWAs) & Tokenization

Coin Metrics’ State of the Network: Issue 278

Get the best data-driven crypto insights and analysis every week:

Real World Assets (RWAs) & Tokenization

By: Matías Andrade, Tanay Ved, Cooper Duschang

Introduction

Real-world asset (RWA) tokenization represents a significant step forward in the evolution of financial markets, bridging the gap between traditional finance and the world of digital assets. While blockchains and cryptocurrencies have garnered significant attention for their potential to revolutionize various aspects of the financial system, skeptics have often pointed out that many digital assets lack intrinsic value or connection to real-world economic activities. Tokenization of RWAs addresses this concern by creating a tangible link between on-chain infrastructure and off-chain assets, unlocking new efficiencies and opportunities in how we manage and trade these valuable assets. While still in its early stages, we’ve seen an acceleration in interest, with major financial institutions and crypto-native protocols entering the space in tandem.

Source: Coin Metrics RWA Report

In our newly released report, we explore the emergence of the real-world asset tokenization sector, examining the current landscape, sectors and networks gaining adoption, regulatory implications and market opportunities.

Key Takeaways From the Report:

Bridging Traditional Finance and Digital Assets: Real-world asset (RWA) tokenization represents a significant step in the convergence of traditional finance and digital assets bringing a wide array of assets such as fiat currencies, government securities, private credit, and commodities onto blockchain infrastructure.

Increased Liquidity and Accessibility: Tokenizing real-world assets can drastically improve liquidity and lower barriers to entry. Through fractional ownership, 24/7 markets, and global accessibility, blockchains democratize access to previously illiquid and exclusive asset classes.

Network Adoption: Ethereum currently stands as the dominant blockchain for RWA tokenization, home to major projects like BlackRock’s BUIDL. Networks like Solana and Stellar are also gaining traction, each offering unique advantages for different types of RWA products.

Regulatory Landscape: The regulatory environment is evolving, with key developments like the EU's Markets in Crypto-Assets (MiCA) regulation and the SEC's Staff Accounting Bulletin No. 121 (SAB 121) shaping the future of RWA tokenization across the globe.

Institutional Involvement: Major financial institutions, including BlackRock and Franklin Templeton, are entering the space, signaling growing mainstream acceptance of tokenized RWAs.

DeFi Integration: The integration of RWAs into decentralized finance (DeFi) is on the rise, with protocols such as MakerDAO and Aave integrating with tokenization projects like BUIDL. This convergence opens up new revenue streams and opportunities for TradFi and DeFi stakeholders.

Challenges and Opportunities: While the tokenization of RWAs offers significant advantages—such as enhanced liquidity, transparency, and efficiency—challenges remain, including regulatory uncertainty and the need for robust infrastructure. However, with growing institutional interest, regulatory clarity, and development in crypto infrastructure, RWAs are poised to reshape how a wide array of assets are managed in the digital age.

Source: Coin Metrics Reference Rates

The chart above illustrates the performance of select Real World Asset (RWA) project associated tokens benchmarked against the performance of the total market index. Returns for these tokens are likely to be influenced by a variety of factors, including overall market conditions, catalysts like the entrance of BlackRock and other large financial institutions into the tokenization space and underlying fundamentals of these products. To learn more about the RWA & Tokenization landscape, be sure to check out our report.

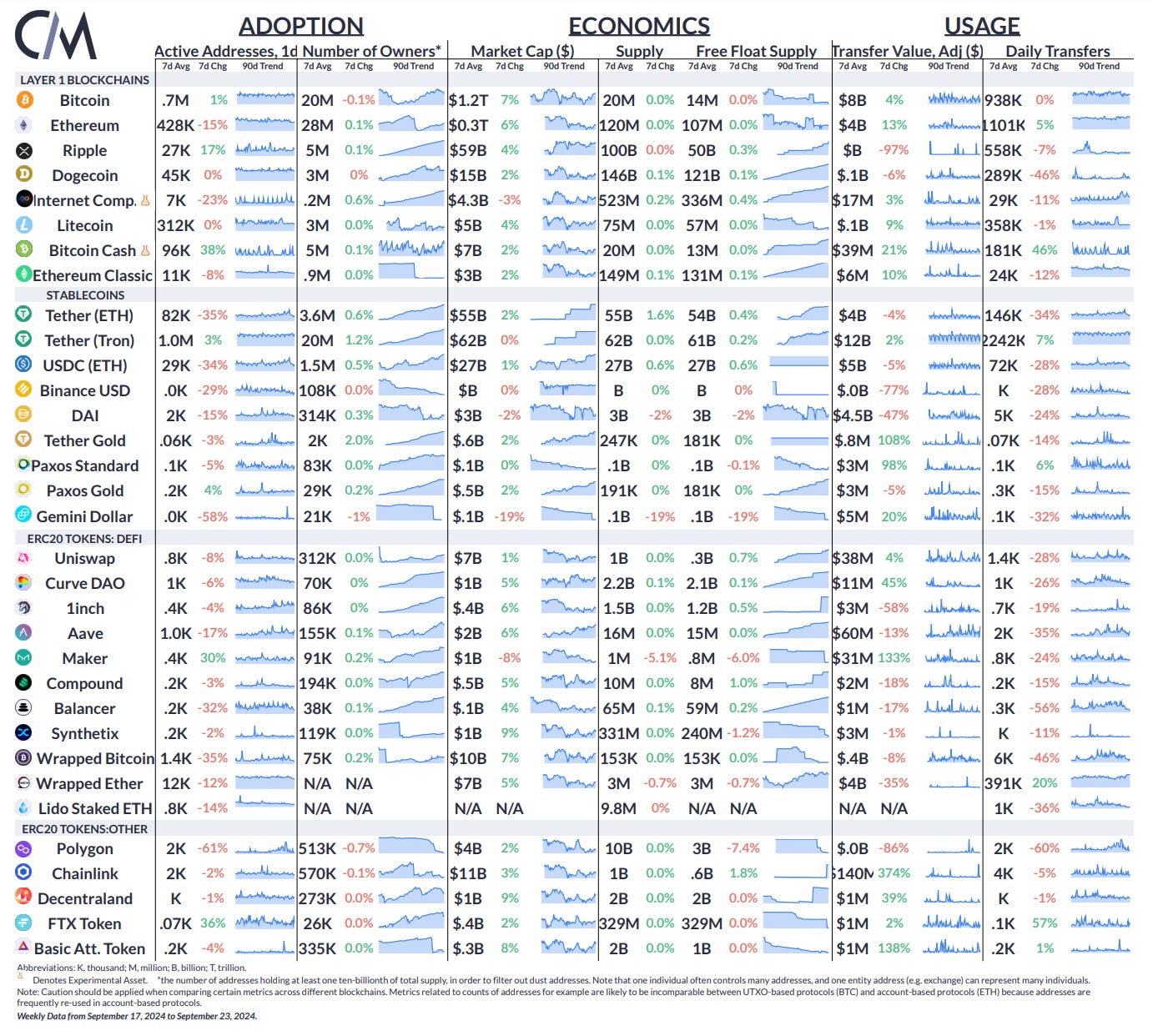

Network Data Insights

Summary Highlights

Source: Coin Metrics Network Data Pro

The market cap of Bitcoin and Ethereum rose by 7% and 6% over the week, respectively, on the back of a 0.5 bps rate cut from the Federal Reserve. The (adjusted) transfer value of MakerDAO’s MKR token increased by 133% amid its rebrand to Sky, with its governance token (MKR) and stablecoin (DAI) being replaced by SKY and USDS.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

Subscribe and Past Issues

As always, if you have any feedback or requests please let us know here.

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.