Polymarket and the Power of Collective Intelligence

Coin Metrics’ State of the Network: Issue 283

Get the best data-driven crypto insights and analysis every week:

Polymarket and the Power of Collective Intelligence

By: Matías Andrade Cabieses & Tanay Ved

Key Takeaways:

Prediction markets provide real-time, market-driven insights into event probabilities, offering a more dynamic alternative to traditional polling methods.

Polymarket has emerged as one of the most widely adopted prediction market platforms, built on the Polygon Layer-2 blockchain. It has amassed over $200M in TVL and consumes 25% of all gas on Polygon.

Polymarket’s 2024 U.S. presidential election markets have gained tremendous traction, with bitcoin returns showing moderate positive correlation to election odds, suggesting intermittent connections between crypto and political sentiment.

Introduction

Polls have traditionally guided decision-making across domains like political forecasting and consumer behavior. However, conventional polling methods and mainstream media face growing skepticism due to concerns over bias and lack of transparency. Against this backdrop, prediction markets like Polymarket have emerged as a compelling alternative. By leveraging digital infrastructure and public blockchains (in the case of Polymarket), these platforms enable market-driven, real-time predictions that capture collective intelligence—qualities that have fueled tremendous interest in prediction markets, particularly in the lead up to the 2024 U.S. Presidential Election. Polymarket now stands at a unique crossroads where political outcomes and market sentiment intersect with digital asset dynamics.

In this issue of Coin Metrics' State of the Network, we dive into how Polymarket’s prediction markets operate on Polygon and analyze data behind the 2024 Presidential Election market to understand potential implications for digital assets.

What are Prediction Markets?

Prediction markets are platforms where users can buy and sell “contracts” on the outcomes of future events. Similar to a stock exchange, where participants buy and sell shares of publicly traded companies, prediction markets enable users to trade on the probabilities of specific events occurring. These events can range widely from the winner of the Premier League to the Federal Reserve’s next interest-rate move. Each share’s price, typically structured as a “yes” or “no”, reflects the collective probability of an event, with prices adjusting in response to new information and evolving sentiment. Unlike traditional polls that provide valuable but momentary snapshots of public opinion, the uniqueness of prediction markets lies in their ability to reflect information dynamically, across a plethora of domains.

The idea of prediction markets dates back several years with various modern platforms from Kalshi and PredictIt to Augur and Polymarket. While they share a common goal of harnessing collective intelligence to predict outcomes, they differ in their underlying technology, level of decentralization, accessibility and regulatory status. Recently, however, Polymarket has emerged as one of the most widely adopted prediction market platforms, leveraging blockchain rails for global accessibility, transparency and low-cost settlement.

How does Polymarket work?

Overview of Architecture

At its core, Polymarket is a blockchain based prediction market leveraging the Polygon Layer-2 network. It enables users to buy “shares” representing different outcomes of a future event. The platform functions as a hybrid-onchain application, with certain components off chain to support larger trades at greater scale while settlement occurs on-chain in a non-custodial manner.

Polymarket utilizes a central limit order book (CLOB), which facilitates trades between ERC-20 collateral assets (currently only USDC) and Gnosis Conditional ERC-1155 assets (a multi-token standard). In practice, units of a user’s USDC collateral is split into binary outcome tokens (“yes” or “no”), maintaining a market price that adds up to one unit of collateral. Users can also acquire these tokens through direct trading on the orderbook or by interacting with AMM liquidity pools. “Operators” are actors responsible for matching, ordering, and submitting trades to the exchange for settlement on chain.

Source: Coin Metrics Labs

Polymarket also integrates with the UMA protocol’s oracle to determine the correct outcome of an event. If there is a dispute about the outcome, UMA token holders vote to determine the final resolution. This hybrid approach, combining the Polygon network, Gnosis Conditional ERC-1155 tokens, a CLOB with off-chain order matching, and the UMA protocol’s oracle, allows Polymarket to function with greater scalability and performance compared to a purely on-chain solution. As a result of its recent traction, Polymarket has amassed over $200M in total value locked and contributes to over 25% of gas consumption on Polygon.

Source: Coin Metrics Labs

Understanding Events, Markets & Odds

At the core of Polymarket are events, markets, and odds, which work together to enable the system to function. Events refer to the specific outcomes that users are attempting to predict, also referred to as questions. These can range from political events, such as the results of an election, to real-world occurrences, like the weather or the outcome of a sports game. Markets are the platforms where users can place bets on the potential outcomes of these events.

Polymarket offers two types of markets:

Single multi-outcome markets: These markets allow users to bet on multiple possible outcomes of a single event. For example, what will be the “Highest grossing movie in 2024?”. Outcomes include names of multiple films such as “Inside Out 2” or “Deadpool 3”, with the probability of all outcomes summing to 100%.

Source: Polymarket

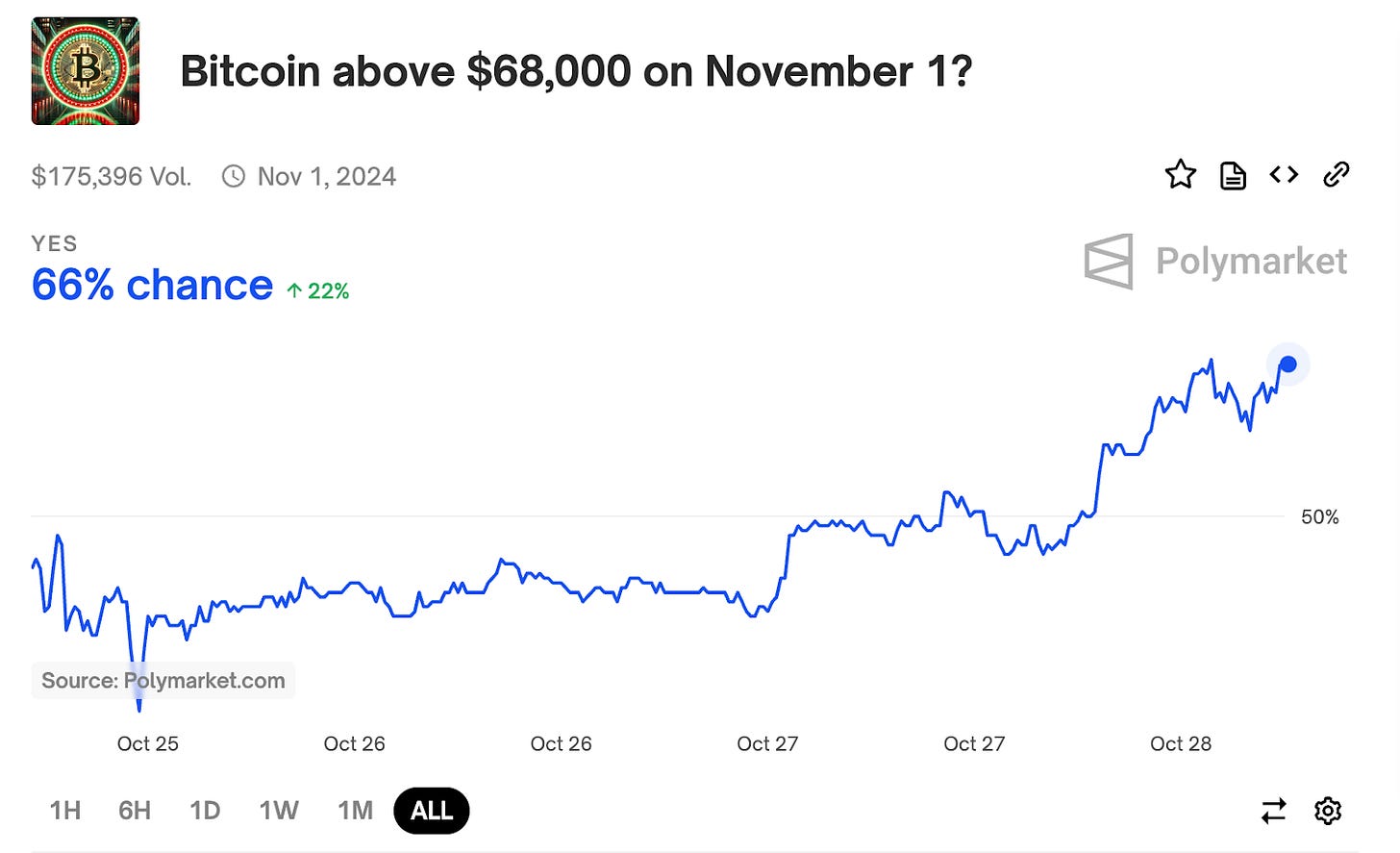

Mutually exclusive binary markets: These markets are structured as simple “yes” or “no” propositions, where users can only bet on one of the two possible outcomes. For example, “Bitcoin above $68,000 on November 1?”.

Source: Polymarket

Users deposit USDC as collateral on the Polygon network to participate in these markets, which is split into binary outcome tokens representing yes or no positions for an event. Users can trade these tokens via a centralized limit order book or on-chain AMM contracts, with token prices (or “odds”) reflecting the market’s collective assessment of each outcome’s probability. As market conditions shift, token prices fluctuate, allowing users to adjust their positions.

Once an event is resolved, anyone can propose a resolution using UMA by posting a USDC bond and earning a reward if the outcome is undisputed. UMA token holders vote on the outcome of the event when disputed over the challenge period. Poorly worded markets can lead to such disputes, like a recent event on whether Israeli troops will invade Lebanon. After an event is resolved, owners of shares of the winning outcome can trade them one to one for USDC collateral, while the losing shares become worthless.

Zooming into the 2024 Presidential Election Market

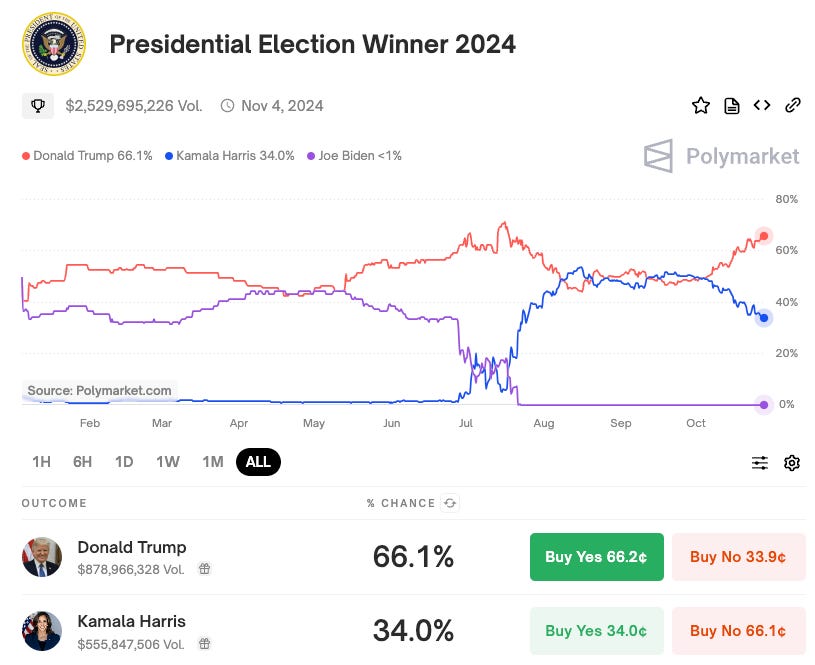

The politics category, and in particular the “Presidential Election Winner 2024” has been the largest and most actively traded market on Polymarket. As of October 28th , this market has attracted $2.5B in cumulative trading volume since its inception. Share prices (or odds) for each candidate have fluctuated significantly throughout the year, capturing shifts in public perception and market sentiment as real-world events have unfolded.

Trump's election odds fluctuated around 50% early in the year before rising to over 65% in recent months, while Harris saw increased odds following Biden's withdrawal in July. Given Trump's perceived pro-crypto stance, analyzing the relationship between candidate odds and bitcoin prices offers insights into potential correlations between political and crypto market sentiment.

Source: Coin Metrics Reference Rates & Polymarket

With bitcoin’s price largely range-bound over the year, its relationship with Donald Trump’s odds of winning the election on Polymarket isn’t immediately clear. However, they show periods of alignment, especially during significant trend reversals—such as Trump’s rise over 50% in May, drop below 70% in July and recent climb towards 65% in October.

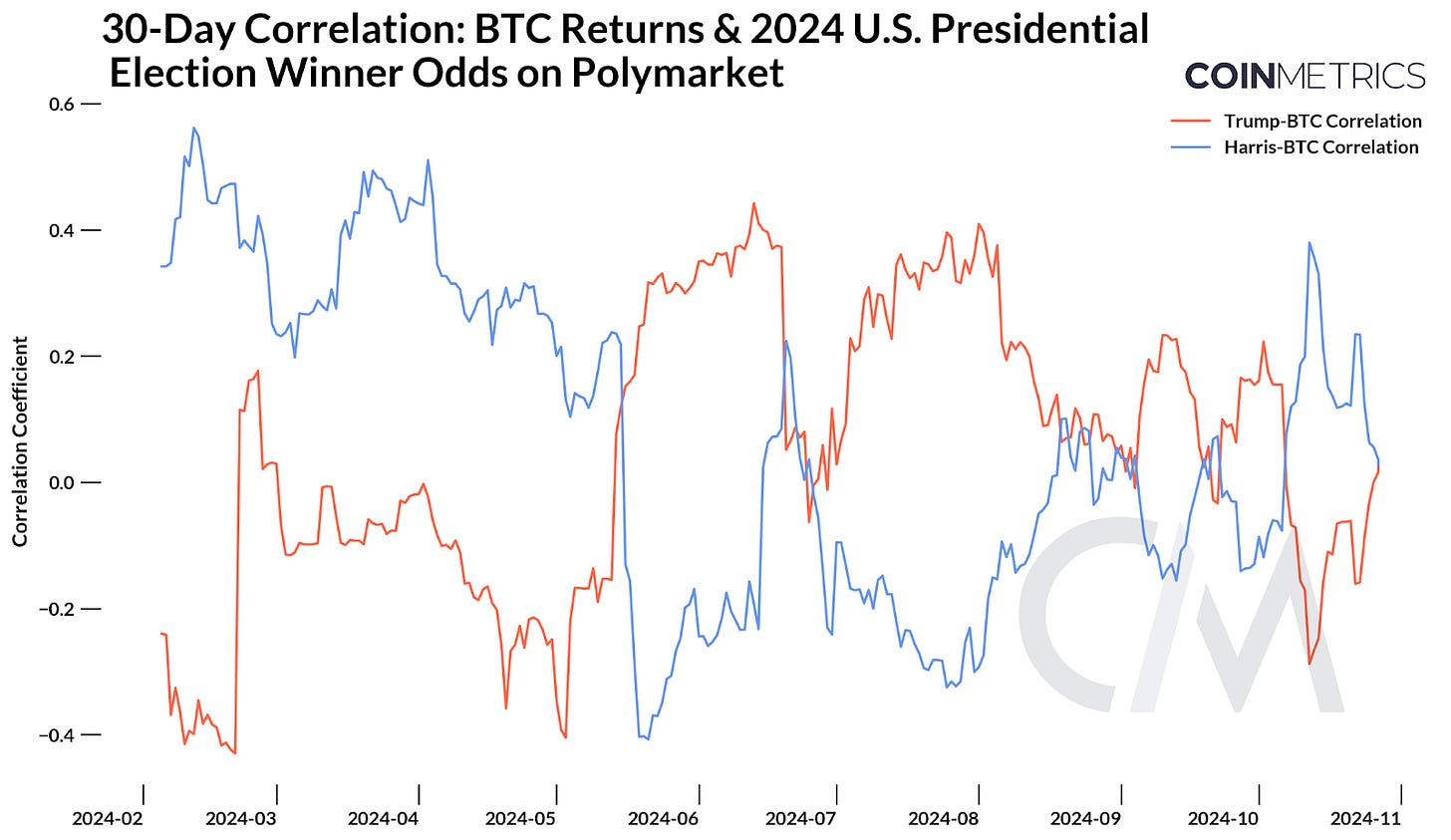

As seen below, the rolling 30-day correlation between BTC returns and changes in odds provides a clearer picture. Trump's odds showed a moderate positive correlation with bitcoin returns (peaking at 0.4) between May and August, while Harris' odds displayed weaker, often inverse correlations, reflecting perceptions of her stance on digital assets. The recent convergence of both correlations toward zero suggests that while short-term relationships exist, BTC’s long-term outlook is not currently tied to either candidate’s success. Instead, the market may be awaiting election outcomes before decisive moves, with global factors like money supply driving BTC’s broader trajectory.

Source: Coin Metrics Reference Rates & Polymarket

Looking Ahead

Polymarket has garnered undeniable traction as a widely utilized blockchain-based prediction market and for its role leading up to the elections. However, it also faces certain challenges in the form of dispute resolution and regulatory scrutiny. The platform was recently subject to allegations of market manipulations from “whales” against the backdrop of rising odds of a Trump victory. It appears that a single user, controlling four accounts with a combined $46M in election bets was responsible for this divergence. Notably, other prediction markets and polls have trended in a similar direction. While this does not suggest the presence of market manipulation, Polymarket may continue to be subject to regulatory hurdles as an offshore platform, however, recent court rulings in favor of Kalshi—a U.S based prediction market may offer a precedent.

As we approach the final stretch of the 2024 U.S. elections, it remains to be seen if Polymarket and similar platforms will sustain their prominence in decision-making. However, they bring clear and unique advantages, offering dynamic, transparent, free market driven “source of truth” that complement traditional models and proprietary data. The election outcome may provide further validation of Polymarket’s forecasting capabilities and value in shaping informed decision-making.

Network Data Insights

Summary Highlights

Source: Coin Metrics Network Data Pro

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

Subscribe and Past Issues

As always, if you have any feedback or requests please let us know here.

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.