Inside dYdX: On-Chain Perpetual Futures

Examining DYDX tokenomics, market listings and exchange dynamics

Get the best data-driven crypto insights and analysis every week:

Inside dYdX: On-Chain Perpetual Futures

By: Tanay Ved

Key Takeaways:

The DYDX token plays a central role in the dYdX ecosystem, enabling governance, securing the chain through staking, and aligning trading activity via DYDX-denominated rewards.

dYdX has rapidly expanded its market listings, reaching 267 perpetual futures markets that span diverse sectors, offering access to both blue-chip assets and emerging tokens.

Open interest has grown to $200M in Q2, with BTC and ETH markets accounting for 80% and a majority of perpetual futures trading volume on dYdX.

Liquidity on dYdX remains deep but more variable than on centralized venues, suggesting differences in market-making models and participant behavior across platforms.

Introduction

Interest in crypto derivatives markets has been gaining momentum and perpetual futures are emerging as a widely traded instrument of choice. Perpetuals offer continuous exposure to crypto assets without expiry and have grown to attract participants across centralized (CEX) and decentralized exchanges (DEXs), thanks to their liquidity and market maturity that support speculation and hedging alike. Today, BTC perpetual futures alone see upwards of $65B in weekly volumes, far outpacing spot and options markets. Competition is also intensifying, with Coinbase and Robinhood recently unveiling perpetual futures offerings, and DEXs vying for market share.

With adoption growing, on-chain order book DEXs are evolving with purpose-built infrastructure designed to match the performance of centralized exchanges, while preserving the transparency and self-custody of on-chain systems. dYdX was a first mover in this trend, launching dYdX Chain as an application specific blockchain (“appchain”) built for perpetual futures.

In this issue of Coin Metrics State of the Network, we build on our previous coverage of dYdX, examining the evolving role of the DYDX token, the exchange’s expanding market breadth, and recent trends in trading volume, liquidity, and funding dynamics.

Role of the DYDX Token

With its transition to a standalone Layer-1 blockchain, dYdX functions as a decentralized, purpose-built chain for perpetual futures trading. This architecture combines an off-chain order-book and matching engine with on-chain settlement enabling high throughput while preserving the transparency and self-custody benefits of decentralized exchanges (DEXs).

The DYDX token plays a central role in this ecosystem, evolving from an Ethereum-based utility token to the native asset of the Cosmos-based dYdX Chain. Core functions of the DYDX token include governance, network security via staking and aligning trading incentives:

Governance: As a governance token, holders who stake their DYDX with validators gain the right to vote on software upgrades to the protocol, fee adjustments, market additions and other operations like treasury expenditures. Voting power is proportional to DYDX staked.

Staking: DYDX secures the dYdX Chain via delegated proof of stake. Delegators and validators stake DYDX, enabling them to earn rewards from protocol fees (USDC denominated trading fees).

Trading Rewards/Incentives: DYDX-denominated trading rewards are issued to users executing successful trades, and are allocated based on the net trading fees paid (denominated in USDC), with up to 90% of these fees eligible to be returned as DYDX rewards.

Together, this model transforms DYDX from a governance-focused token to one that aligns validators and trader activity with protocol growth, making it intrinsic to the chain's operations.

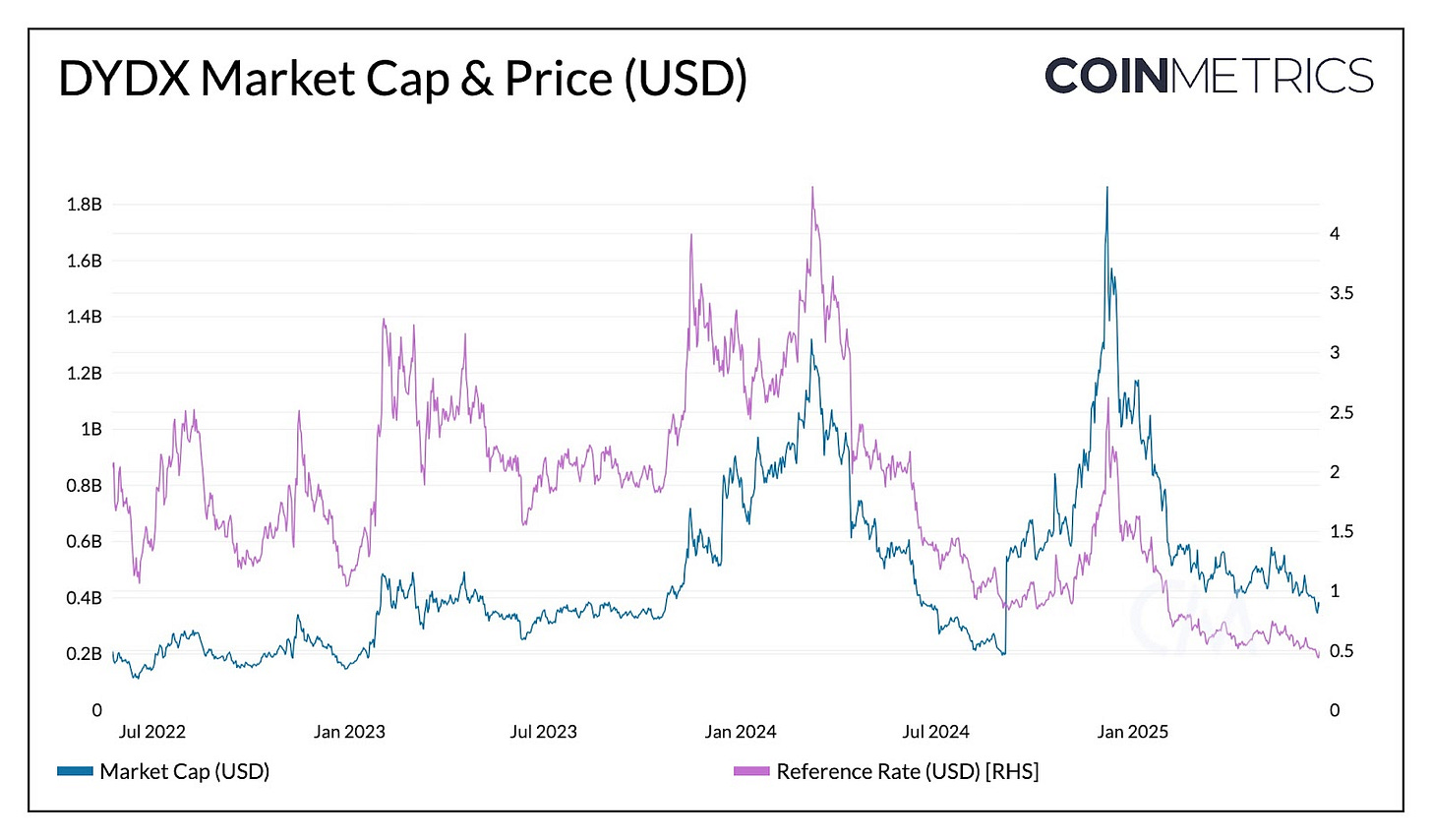

Source: Coin Metrics Reference Rates

As of June 29th, DYDX trades at approximately $0.54 with a market cap near $400M. Both price and market cap have experienced swings coinciding with periods of heightened market activity, with price peaking at $4.3 in March. However, market cap remained elevated even as price declined in late 2025, indicating growth in tokens circulating supply. Based on the ratio of estimated market cap to the reference rate, DYDX supply appears to have increased to ~780M tokens, reflecting continuous token unlocks on the road to a maximum supply of 1B in July 2026.

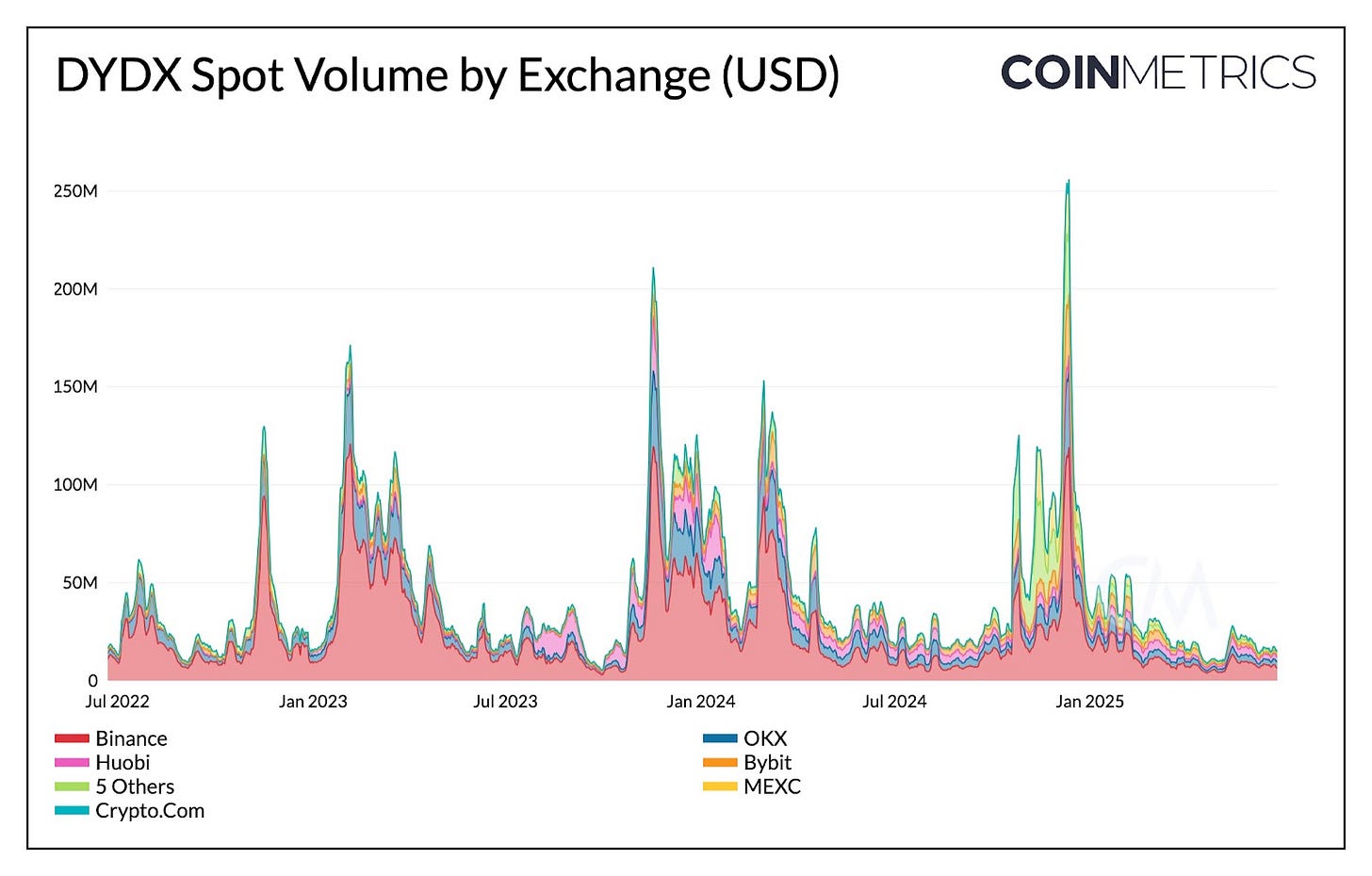

DYDX continues to be accessible across both centralized (CEXs) and decentralized (DEXs) venues, with the bulk of spot activity occurring on Binance, OKX, and Huobi. Spot volumes have seen periodic spikes, often aligning with protocol upgrades and broader market moves.

Source: Coin Metrics Market Data Pro

Market Listings & Diversity on dYdX

A core strength of perpetual futures DEXs lies in the breadth and accessibility of markets they offer. dYdX enables rapid market onboarding, giving traders exposure to a wide range of crypto assets from large-cap tokens to emerging long-tail assets. As of June 30th 2025, dYdX supports 267 perpetual futures markets, up from 127 markets that were already active.

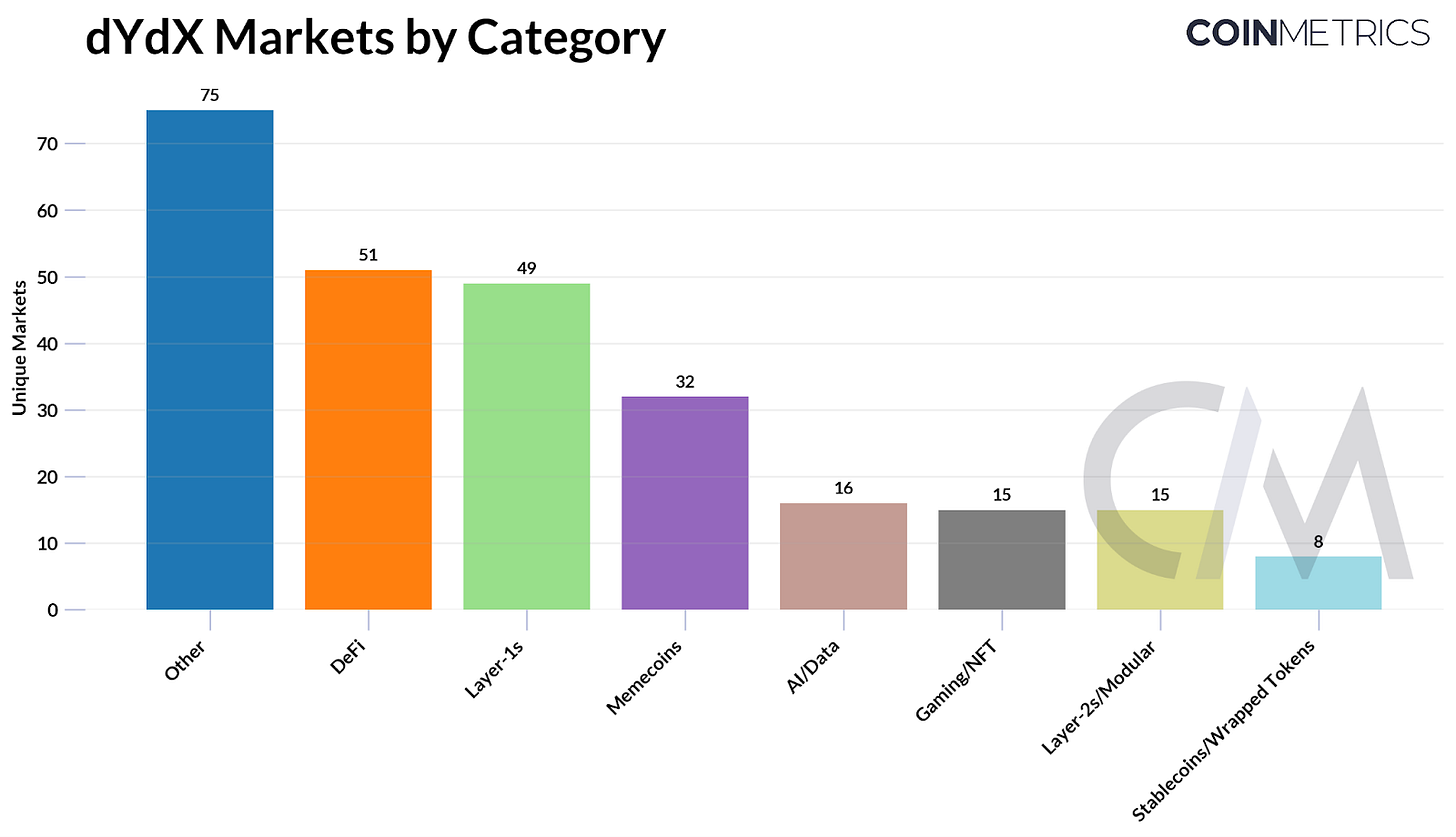

Source: Coin Metrics Market Data Feed

This growth follows the launch of “dYdX Unlimited” in late 2024, which introduced “Instant Market Listings” allowing anyone to instantly create and trade perpetual futures on any asset without governance approval. A new master USDC liquidity pool called “MegaVault” was also launched where users deposit USDC to provide day-one liquidity for new markets. Some newly launched markets include SRYUP-USD, FLR-USD and DAI-USD, with listings continuing into late June.

Source: Coin Metrics Market Data Feed

Beyond listing velocity, dYdX markets span a wide range of categories including Layer-1s, DeFi tokens, memecoins and several other themes like artificial intelligence (AI) projects. This diversity allows traders to express views across emerging narratives and sectors, in a timely and relatively frictionless manner, compared to centralized venues that often require longer approval or listing processes.

Volume & Open Interest Trends

BTC and ETH markets continue to dominate dYdX exchange activity, accounting for the bulk of daily perpetual futures trading volume throughout Q2 2025. These assets also make up 80% ($163M) of open interest on dYdX, up from 66% ($93M) at the end of Q1, when “other” assets gained share. Despite the growing number of long-tail markets, most remain thinly traded, contributing to short-lived or cyclical spikes in volume rather than sustained activity. This suggests that dYdX usage remains concentrated in its most liquid markets.

Source: Coin Metrics Market Data Feed

Funding Rates & Liquidity Conditions

Market breadth and open interest only tell part of the story. Liquidity is essential for perpetual futures exchanges like dYdX, enabling efficient trade execution with minimal slippage. To assess market quality and tradability, we examine dYdX’s liquidity conditions and how funding rates compare across exchanges.

The BTC-USD order book below shows cumulative bid and ask depth within 2% of the mid-price from March to early May. The depth profile is more volatile than typically seen on centralized exchanges, with swings on both sides reflecting bursts of activity. This may stem from a mix of passive liquidity provision via dYdX’s MegaVault and more active market making as market conditions evolve.

Source: Coin Metrics Market Data Feed, Orderbook Data

In comparison, Coinbase International’s BTC perpetual futures market exhibits lower overall depth, but a more consistent liquidity closer to the mid-price. These variances between the venues suggest differences in market structure and participant behavior, an important consideration when evaluating liquidity quality across platforms.

Source: Coin Metrics Market Data Feed, Orderbook Data

Funding rates are a core mechanism that keep perpetual futures prices tethered to spot prices. On dYdX, BTC funding rates appear more volatile and diverge from those on Binance or OKX, frequently dipping into negative territory. This suggests periods of heightened short positioning or structural differences in participant behavior across platforms. Divergences like these can also signal potential arbitrage opportunities between CEX & DEX venues.

Source: Coin Metrics Market Data Pro

Conclusion

As perpetual futures grow in their influence as the most actively traded instruments in crypto, dYdX is one of the leading on-chain venues supporting this growth. Open interest has increased over the year, boosted by new market listings while sustaining trading volumes even as activity remains concentrated in BTC & ETH. By combining high performance with on-chain transparency and access to a diverse range of markets, dYdX continues to play a central role in shaping the future of on-chain derivatives infrastructure.

Coin Metrics Updates

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.