State of the Network’s Q2 2025 Wrap Up

A data-driven overview of developments shaping crypto markets in Q2-2025

Get the best data-driven crypto insights and analysis every week:

State of the Network’s Q2 2025 Wrap Up

By: Tanay Ved

Key Takeaways:

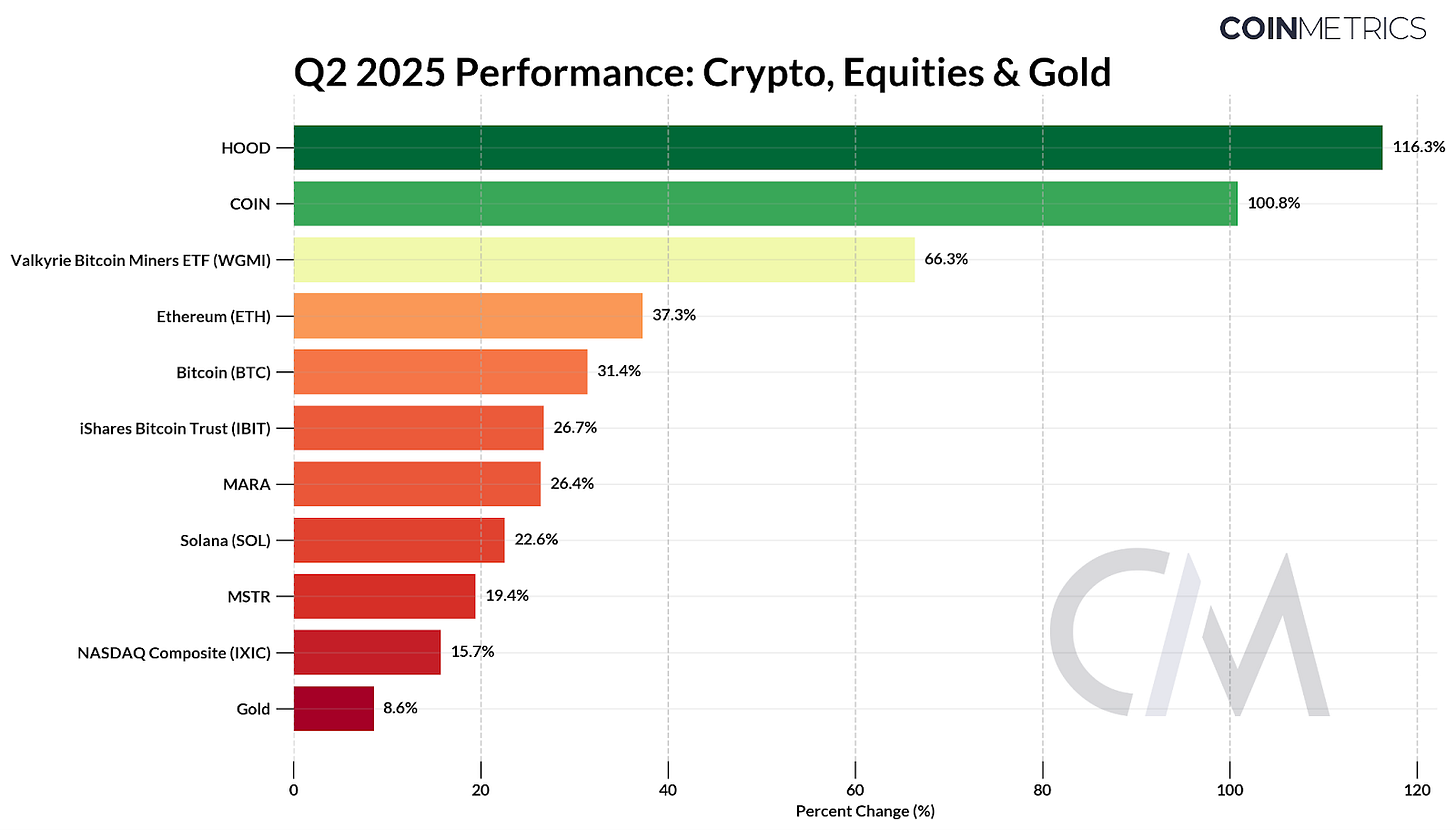

The total crypto market cap rebounded to $3.3T in Q2. Investor focus shifted toward equities tied to crypto infrastructure, with Robinhood (+116%) and Coinbase (+100%) outperforming. ETH (+37%), BTC (+31%), and SOL (+22%) all posted strong gains as markets turned risk-on.

Stablecoins moved closer to mainstream legitimacy, as Circle’s IPO and momentum behind the GENIUS Act signaled growing investor interest and recognition of their role in global markets.

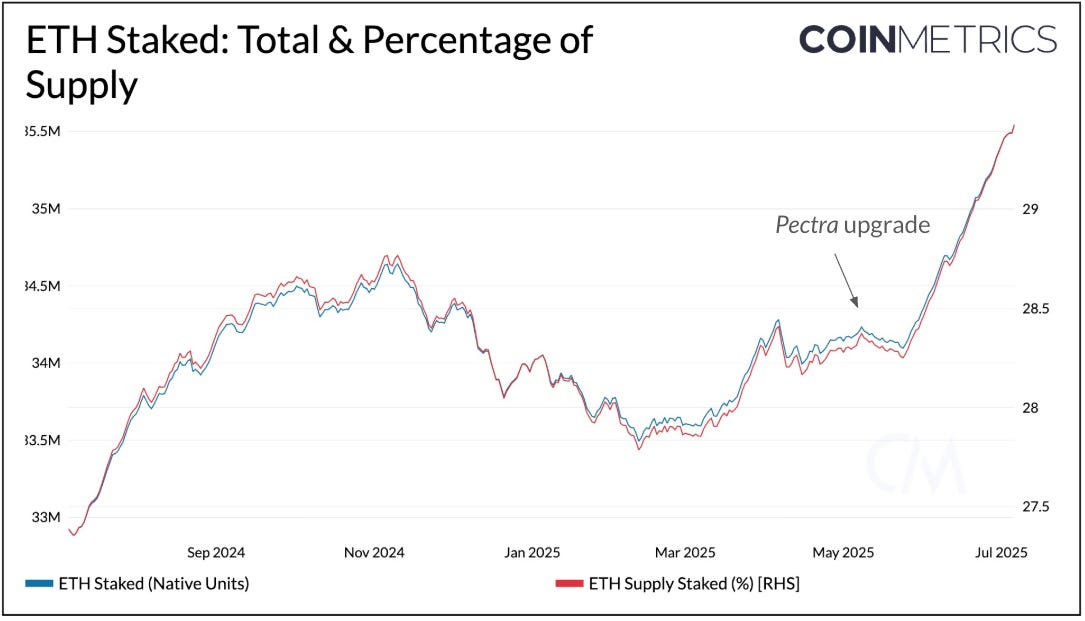

Ethereum’s Pectra upgrade improved staking and scaling, with 35.5M ETH (29.4% of supply) now staked. Blob space remains underutilized, keeping blob fees near $0, while improving rollup economics and supporting Layer-2 growth.

Exchanges and institutions continued their on-chain expansion. Robinhood announced plans to launch a rollup for tokenized RWAs, joining Coinbase and Kraken in adopting rollup-based infrastructure. Meanwhile, private networks like Canton are gaining traction for regulated financial use cases.

In this special edition of State of the Network, we take a data-driven overview of major developments that shaped digital assets markets and on-chain activity in Q2 2025.

Markets Rebound After A Volatile Q1

Q2 2025 was a period of extremes, featuring a complex interplay of macroeconomic pressures from trade policy and geopolitical tensions. At the same time, regulatory tailwinds and momentum in on-chain infrastructure adoption continued to build.

A quarter that began with turbulence after President Trump’s April 2nd tariff announcements ended in a sharp recovery, with BTC hitting new all-time highs and rising 31.4%. Bitcoin dominance climbed to 65%, keeping most altcoins under pressure. Spot volumes across centralized exchanges (CEXs) softened to a weekly average of ~$45B, while activity in futures markets remained elevated.

Source: Coin Metrics Reference Rates & Google Finance

A decline in BTC’s volatility and market uncertainty set the stage for a rebound in Q2. Markets turned risk-on, with crypto equities like Robinhood (+116%), Coinbase (+100%) and Bitcoin mining stocks being major beneficiaries. ETH and BTC posted strong double-digit gains, while gold, the best-performing asset of Q1, lagged behind.

Source: Coin Metrics Market Data Pro & Reference Rates (Hourly)

In particular, publicly traded crypto companies created a new focal point for investors this quarter, with renewed interest in equity proxies tied to crypto infrastructure, from the growing cohort of corporate treasury vehicles to Circle's IPO. Their outperformance hinted at a broader trend of deepening convergence between traditional capital markets and on-chain infrastructure, especially through stablecoins and the tokenization of real-world assets (RWAs).

“Stablecoin Summer” & the GENIUS Act

Stablecoins emerged as the focal point of this quarter. USDT’s continued dominance, Circle’s explosive public market debut and momentum in U.S. stablecoin legislation drew intense attention to the sector. The GENIUS Act (Guiding and Establishing the National Innovation for United States Stablecoins Act) advanced in the Senate, moving the industry closer to the regulatory clarity it sought. With transaction volumes (adjusted) exceeding $2T per month, stablecoins already serve as the backbone for transacting and storing value on-chain, and a key vehicle for U.S. dollar access in emerging markets.

Source: Tether & Circle Attestations

If passed, the GENIUS Act could legitimize dollar-backed stablecoins as upgraded rails for payments and capital markets, expanding their addressable market and range of use cases. The bill establishes a framework for “payment stablecoins,” requiring issuers to hold reserves in short-term U.S. Treasuries and cash, provide monthly reserve reports, and comply with AML regulations. Tether and Circle already hold over $135B in U.S. Treasuries, making them the 17th largest foreign holder of U.S. debt. This regulatory clarity could deepen global demand for U.S. dollars and the Treasury market.

The bill also defines who can issue stablecoins in the U.S., limiting issuance to banks and licensed non-bank entities. This could pave the way for large, regulated market entrants, from banks and fintechs to Big Tech firms. Interest is already accelerating, with JP Morgan piloting a tokenized bank deposit (JPMD) on the Base Layer-2 network, Stripe deepening its stablecoin stack, Walmart and Amazon reportedly exploring stablecoin issuance, while payments giants like Visa and Mastercard integrate stablecoins into their widespread merchant networks.

Source: Coin Metrics Network Data Pro

Against this backdrop, the total stablecoin supply rose to $245B in Q2. Paxos-issued PYUSD was the largest gainer, reaching the $1B milestone across Ethereum and Solana, supported by its alignment with upcoming stablecoin regulations. In contrast, Hong Kong-based FDUSD’s supply declined by 54%. USDT grew by 8%, driven primarily by issuance on Tron, while USDC saw a modest decline.

Ethereum’s Pectra Upgrade Boosts Scaling and Staking

Ethereum’s Pectra hard-fork went live on May 7th, bringing key improvements to staking efficiency and Layer-2 scalability. Among the most notable Ethereum Improvement Proposals (EIPs) was EIP-7251, which raised a validator’s max effective balance from 32 ETH to 2048 ETH. This allowed participants to consolidate or top up validators, enabling compounding rewards while reducing the communication load on the network.

Following the upgrade, staking demand has accelerated, with 35.5M ETH, or 29.4% of ETH’s current supply being staked. After an initial dip from validator consolidation, the number of active validators has climbed to 1.089M, with an average effective balance of 32.6 ETH and 15.4K consolidation requests submitted so far.

Source: Coin Metrics Network Data Pro

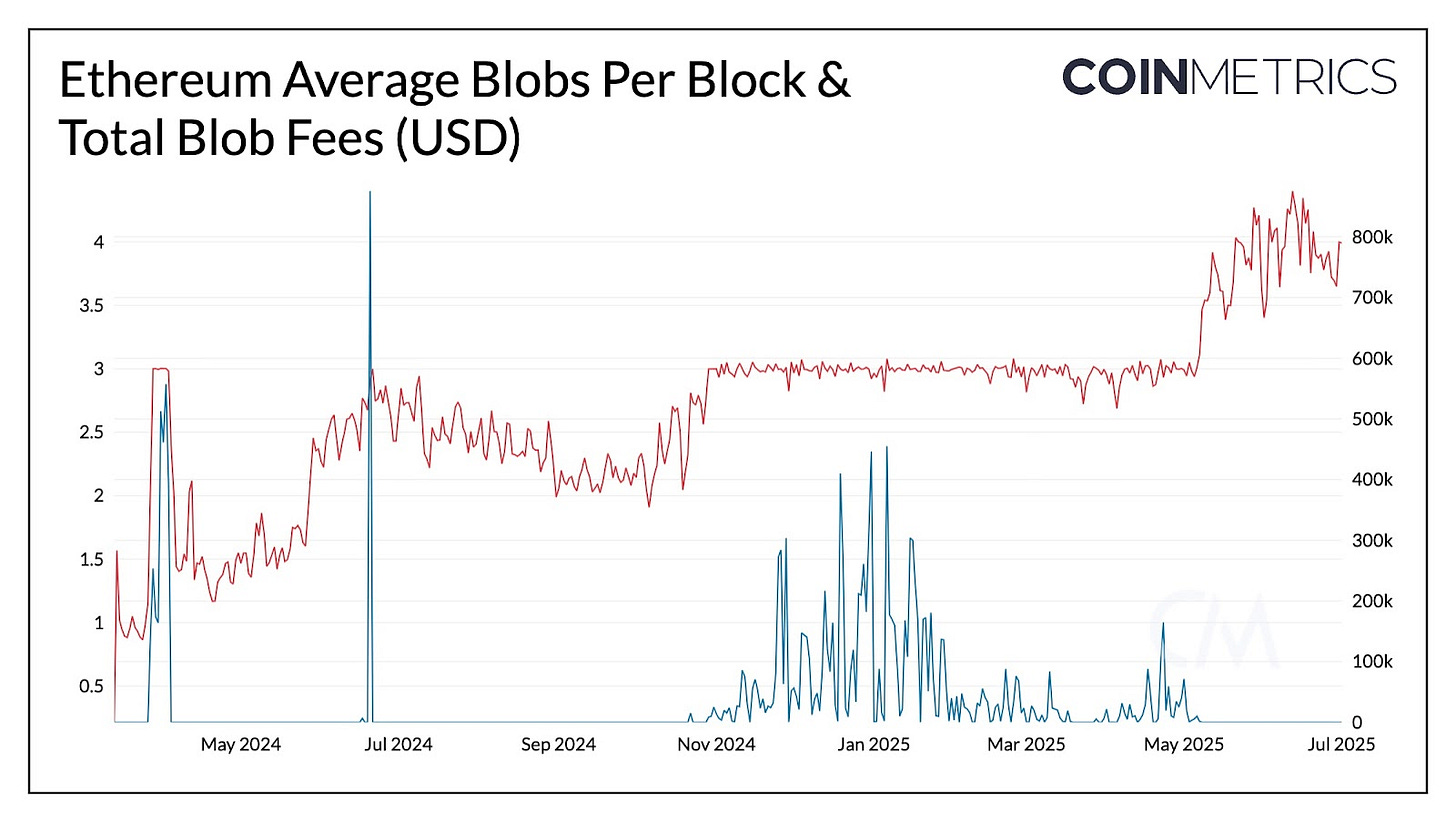

Another major focus of the upgrade was to support the scaling of Layer-2s. This came through EIP-7691, which doubled Ethereum’s blob capacity. Blobs provide a way for L2 rollups to batch and submit transaction data to Ethereum mainnet. The blob target was raised from 3 to 6 and the limit from 6 to 9, effectively increasing transaction capacity to a new threshold. This directly translated to lower data-availability costs (blob fees) and increased transaction activity on Ethereum L2s.

The daily number of blobs posted by rollups has increased from ~21,300 to ~28,000 (or roughly 4 blobs per block) after Pectra went live. But with blob space still underutilized, total blob fees, or the amount of fees the Ethereum network collects from blobs daily is ~$0.000008.

Source: Coin Metrics Network Data Pro

While this means minimal fee revenue for Ethereum itself, it’s a net positive for the profitability of rollups like Base, Arbitrum and Optimism. Lower blob fees reduce the cost of posting rollup data, increasing sequencer margins and incentivize companies to build on L2s. In effect, Ethereum is prioritizing growth over near-term fee capture, supporting Layer-2 growth while continuing to scale the base layer.

Exchanges & Institutions Come On Chain

This quarter CEXs and institutions accelerated their move on-chain, enabled by maturing infrastructure and their ability to bring users and capital on-chain at scale. Companies now have many architectural choices at their disposal, from general-purpose Layer-1s and Layer-2s to emerging privacy-focused networks like Canton.

CEXs Expand With On-Chain Infrastructure

This shift is playing out through a mix of expansion and integration. Bybit announced plans for Byreal, a DEX extension of its core exchange, while Coinbase is deepening its integration with Base-native DEXs like Aerodrome. At the infrastructure level, exchanges like Coinbase, Kraken and now Robinhood are adopting the rollup model, offering more control and customizability while anchored to Ethereum’s base layer. For example, Base has retained approximately $112M to date (revenue from user transaction fees after blob fee costs), illustrating how Robinhood could similarly monetize on-chain activity and expand revenue streams by operating a rollup sequencer.

Source: Coin Metrics Network Data Pro

At EthCC, Robinhood unveiled a suite of on-chain initiatives including “Stock Tokens” for EU users. While initially on Arbitrum, these tokenized equities will eventually live on “Robinhood Chain”, an Ethereum Layer-2 built using Arbitrum Orbit. Current offerings span Robinhood’s tokenized contracts that track stock prices, wrapped products issued by regulated SPVs like those from Kraken, Bybit, and Solana with Backed Finance, and natively issued stocks like Superstate’s Opening Bell. Each model carries different implications for ownership, transferability, and utility. While this is an exciting step for capital markets moving on-chain, the tokenization of equities remains in its early stage.

Institutional Finance Takes Shape on Canton Network

Alongside the growth of public-chain infrastructure, privacy-enabled permissioned networks like Canton are emerging to meet the needs of institutional finance. Built on the DAML smart contract language, Canton is a synchronized network of private ledgers designed for regulated financial use cases. Its native utility token, Canton Coin, underpins the Global Synchronizer network by incentivizing validators for securing the network and rewarding application builders based on usage. Canton Coin currently has a supply of 27.8B tokens and a market cap of $1.39B, with a token price of $0.050.

Canton offers a parallel approach to on-chain infrastructure, tailored for inter-institutional workflows like collateral management and settlement, where privacy, regulatory compliance, and integration with existing systems are essential.

Conclusion

Q2 2025 was an encouraging quarter, supported by a market recovery, regulatory momentum, and growing convergence between traditional finance and on-chain infrastructure. Stablecoins and tokenization were dominant narratives this quarter, with the GENIUS Act carrying meaningful implications for U.S. dollar demand, competitive dynamics of the market and modernization of global financial rails. Equity proxies and base layer networks tied to these trends benefited. The Pectra upgrade laid important groundwork for long-term scalability, as exchanges and institutions expanded on-chain across both public and permissioned networks.

Looking ahead, global liquidity, regulatory clarity, and the accelerating pace of on-chain adoption will continue to shape how the market evolves in the second half of the year.

Coin Metrics Updates

This quarter’s updates from the Coin Metrics team:

This quarter, we released two special insights reports on stablecoins: Tether (USDT) Analyst Spotlight and Stablecoin Sector Report.

We also launched a new and improved dashboard application, allowing analysts, investors, and data enthusiasts to explore or share insights.

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.