Crypto at the Crossroads: ETF Flows, Leverage Reset, and Shallow Liquidity

A risk-off macro regime, softening ETF demand, and a reset in crypto market leverage

Get the best data-driven crypto insights and analysis every week:

Crypto Caught in The Crossroads

Key Takeaways:

Demand from major absorption channels like ETFs and DATs has recently softened, while October’s deleveraging and a risk-off macro backdrop continue to pressure digital asset markets.

Leverage has reset across futures and DeFi lending markets, leaving positioning cleaner and reducing systemic vulnerabilities.

Spot liquidity has yet to recover across majors and altcoins, keeping markets fragile and more susceptible to outsized price moves.

Introduction

“Uptober” started off strongly as Bitcoin cruised to new all-time highs. But optimism quickly reversed with October’s flash crash putting a dent in market sentiment. Since then, BTC has fallen by around ~$40K (over 33%), while altcoins have been further hit, bringing the total market cap down to near $3T. Even with a year full of positive fundamental developments, price action and sentiment have sharply diverged.

Digital assets appear to be caught at the intersection of multiple external and intrinsic forces. On the macro front, uncertainty around December rate cuts and recent weakness in technology stocks has compounded risk-off behavior. Within crypto, demand channels like ETFs and digital asset treasuries (DATs), which have acted as steady absorbers, have seen some outflows and cost basis pressure. Meanwhile, the October 10th liquidation cascade that triggered one of the sharpest deleveraging events is having lingering ripple effects as market liquidity remains shallow.

In this issue, we unpack the forces driving recent weakness in digital asset markets. We take a closer look at ETF flows, leverage conditions across perpetual futures and DeFi markets, and orderbook liquidity to explore what these shifts tell us about the current market regime.

Macro Turns Risk Off

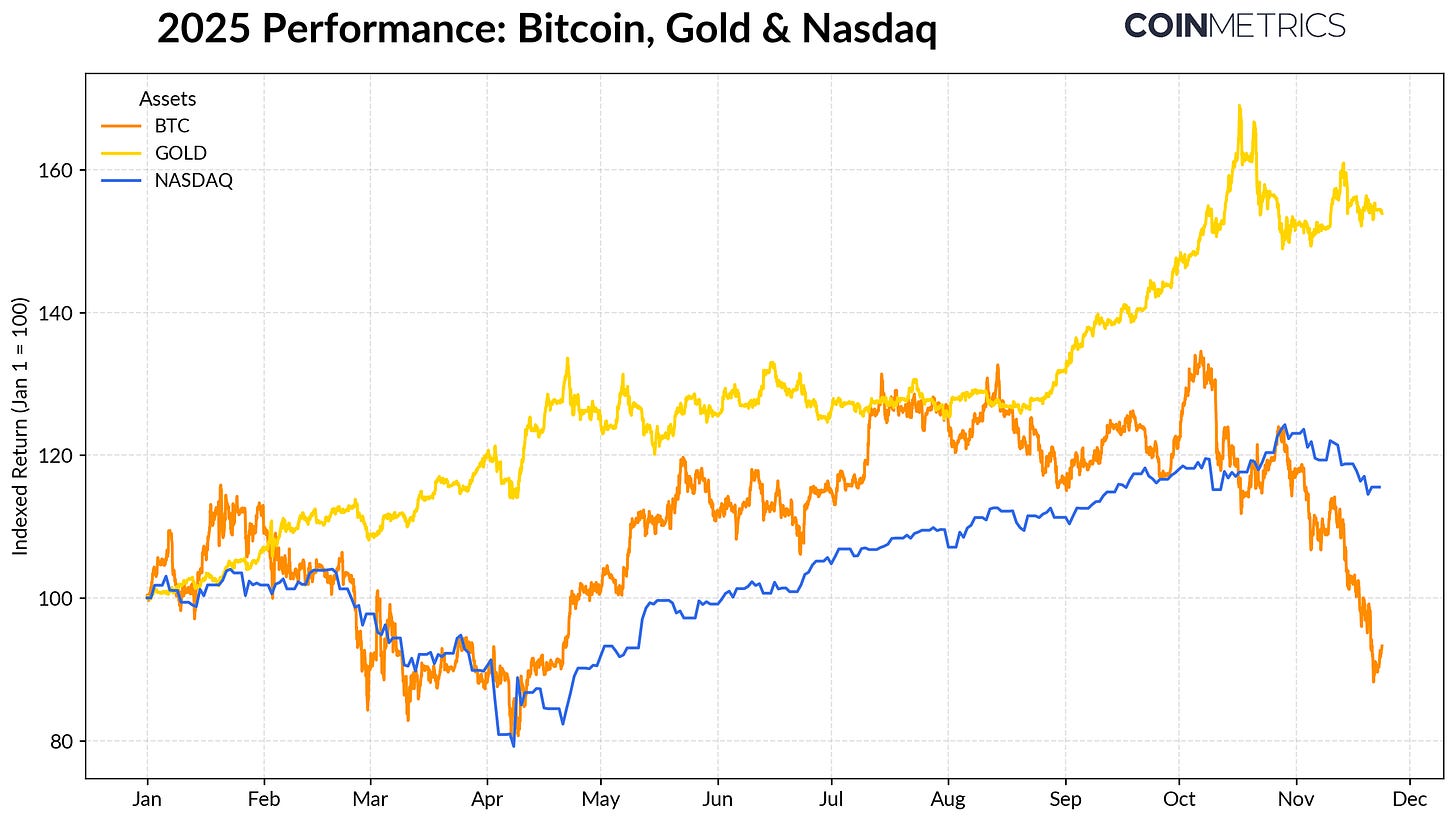

The performance of Bitcoin has increasingly diverged from major asset classes. Gold has powered ahead with year-to-date returns exceeding +50% amid record central bank buying and ongoing trade tensions, while technology equities (NASDAQ) lost momentum in Q4 as markets reassessed the probability of upcoming Fed rate cuts and the sustainability of AI-driven valuations.

As our previous research highlighted, BTC typically has an oscillating relationship with both “risk-on” tech and “safe-haven” gold, shifting with the prevailing macro regime. This makes it particularly sensitive to market shocks or catalysts, such as the October flash crash and the latest bout of risk-off sentiment.

Source: Coin Metrics Reference Rates & Google Finance

With Bitcoin serving as the anchor for the broader crypto market, its drawdown has spilled over into other assets, as they continue to move closely in step with BTC despite short bursts of outperformance from themes like privacy.

Weakening Absorption From ETFs & DATs

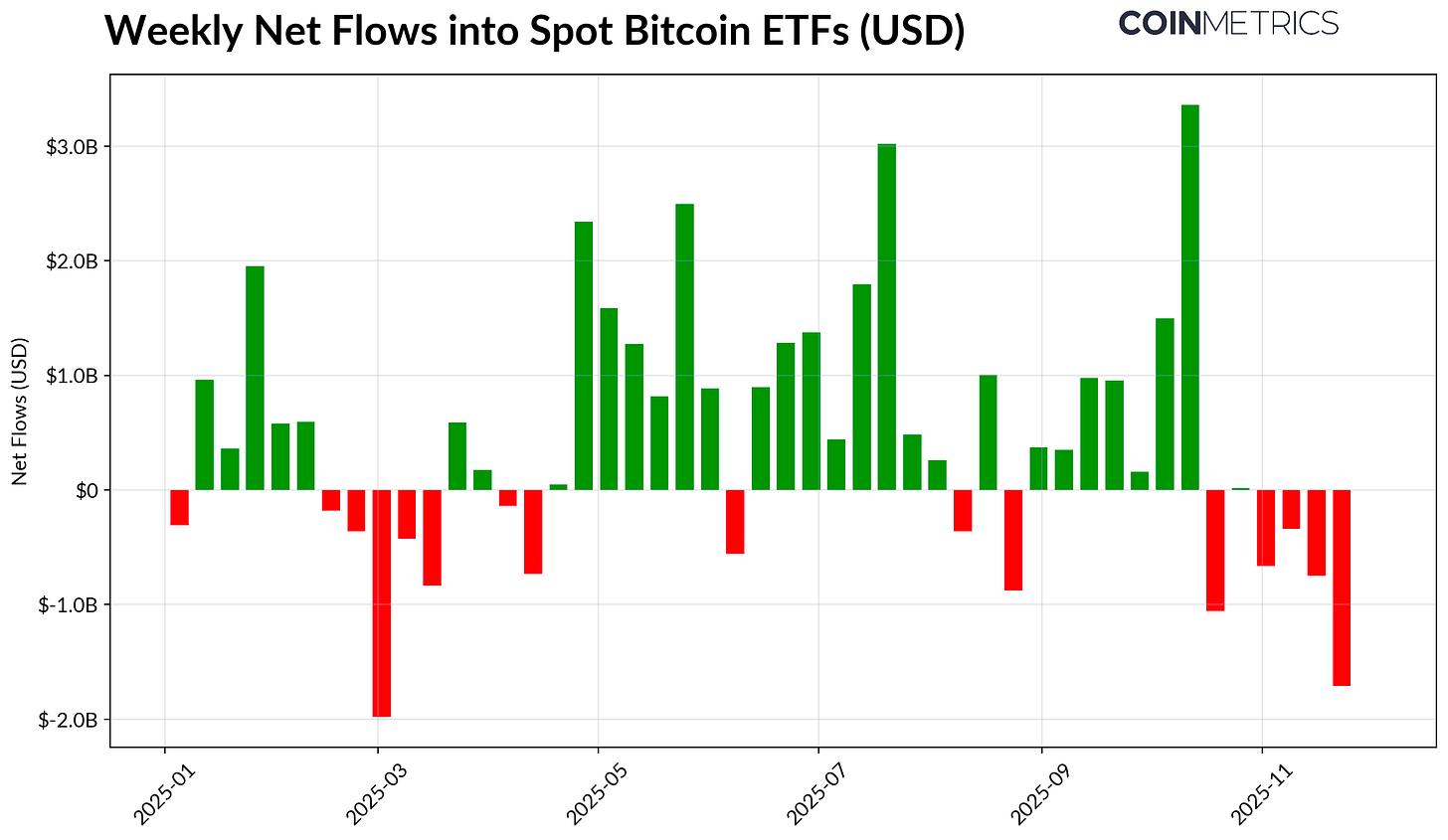

Bitcoin’s recent weakness is partly driven by softer demand from the channels that supported the asset through much of 2024 and 2025. ETFs have now seen multi-week net outflows of $4.9B since mid-October, the largest bout of redemptions since April 2025 when BTC fell toward $75K ahead of the “Liberation Day” tariff announcements. Despite near term outflows, on-chain holdings continue to be in an uptrend, with BlackRock’s IBIT ETF alone holding 780K BTC, ~60% of all current supply in spot Bitcoin ETFs.

A return to sustained inflows would signal that this channel is stabilizing, as ETF demand has historically acted as a key absorber of supply when risk appetite improves.

Source: Coin Metrics Network Data Pro

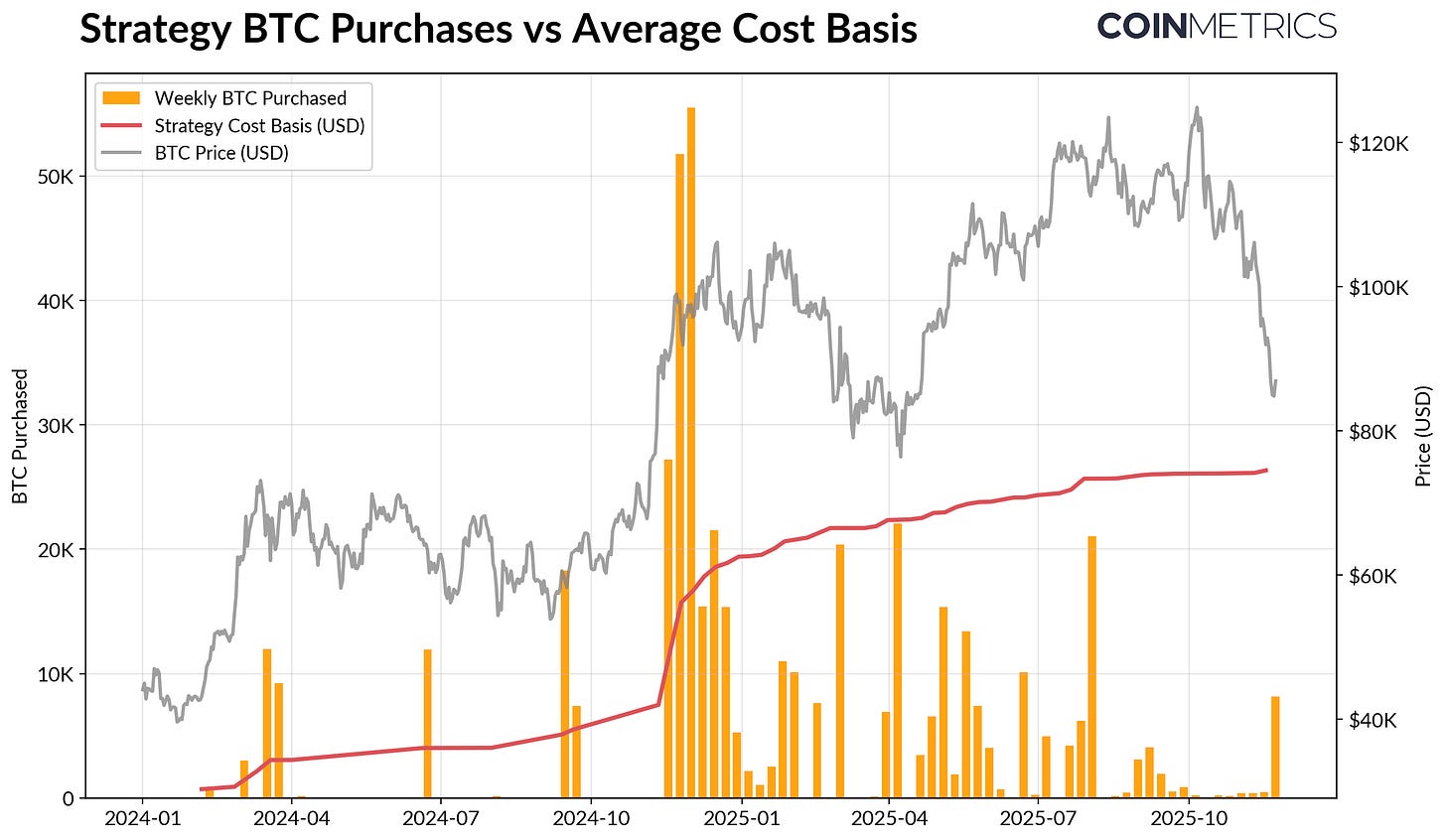

Digital asset treasuries (DATs) are also showing signs of strain. As prices pull back, the value of their shares and crypto holdings compresses, pressuring the premium to NAV that underpins their growth flywheel. This reduces their capacity to raise new capital through equity issuance or debt, limiting their ability to increase crypto holdings per share. Smaller and newer DATs are especially sensitive to this dynamic, as shifting market conditions can make cost-basis and equity valuations unfavorable for further accumulation.

Strategy, the largest DAT currently owns 649,870 BTC (~3.2% of Bitcoin’s current supply) at an average cost of $74,333. As seen in the chart below, Strategy’s accumulation accelerated sharply when BTC was rising and its equity valuation was strong, and has slowed recently, rather than being a source of active selling. Even so, Strategy still sits on unrealized gains, with its cost basis below the current market price.

While Strategy could face pressure if prices fall further or from potential index-exclusion risks, a reversal in market conditions could improve balance-sheet strength and valuations, restoring an environment that supports more aggressive accumulation from DATs.

Source: Strategy & Bitbo Treasuries

This appears consistent with the on-chain profitability trends. Short-term holder SOPR (<155 days) has slipped into realized losses of ~23%, a level that historically reflects capitulation pressure within the most price-sensitive cohort. Long-term holders remain in profit on average, but SOPR shows a modest pickup in distribution, indicating selective profit-taking. A recovery in STH SOPR back above 1.0, alongside slowing LTH distribution, would suggest that the market is regaining its footing.

Crypto’s Deleveraging: Perpetual Futures, DeFi Lending & Liquidity

The October 10th liquidation cascade marked the beginning of a multi-layered deleveraging cycle across futures, DeFi, and stablecoin-backed leverage, the aftershocks of which continue to linger on crypto markets.

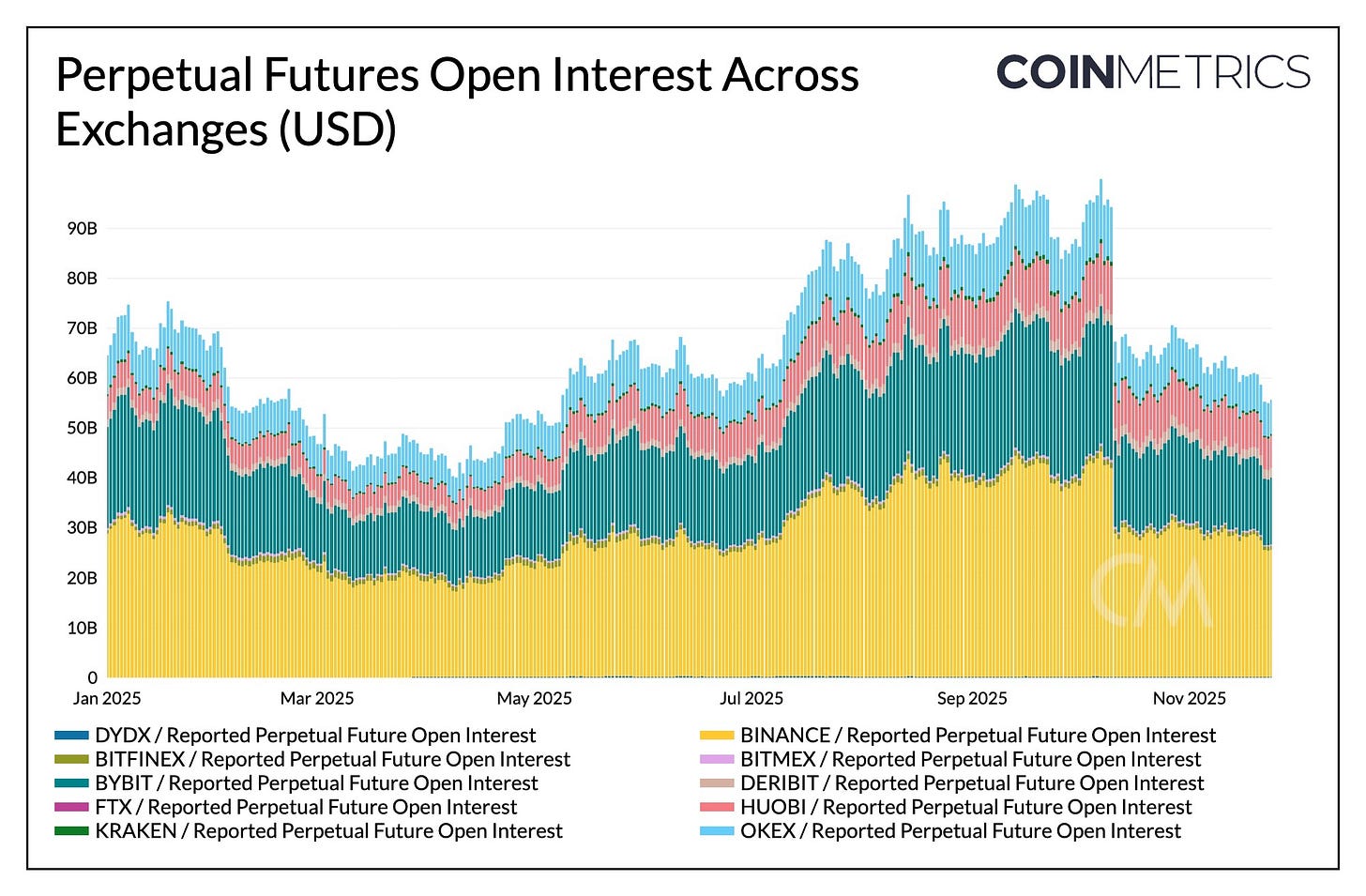

Perpetual Purge

In a matter of hours, perpetual futures saw the largest forced unwinds on record, erasing over 30% in open interest that had built up over multiple months. Altcoins and retail-heavy venues like Hyperliquid, Binance and Bybit saw the steepest OI declines, consistent with where leverage had built up most aggressively heading into the event. As seen below, open interest remains meaningfully below pre-crash highs of over $90B, and has modestly declined after. This suggests a flush in leverage in the system as the market stabilizes and recalibrates.

Funding rates also softened through this period, reflecting a reset in long-side risk appetite. BTC funding has more recently hovered around neutral or slightly negative, consistent with a market that has yet to fully rebuild directional conviction.

Source: Coin Metrics Market Data Pro

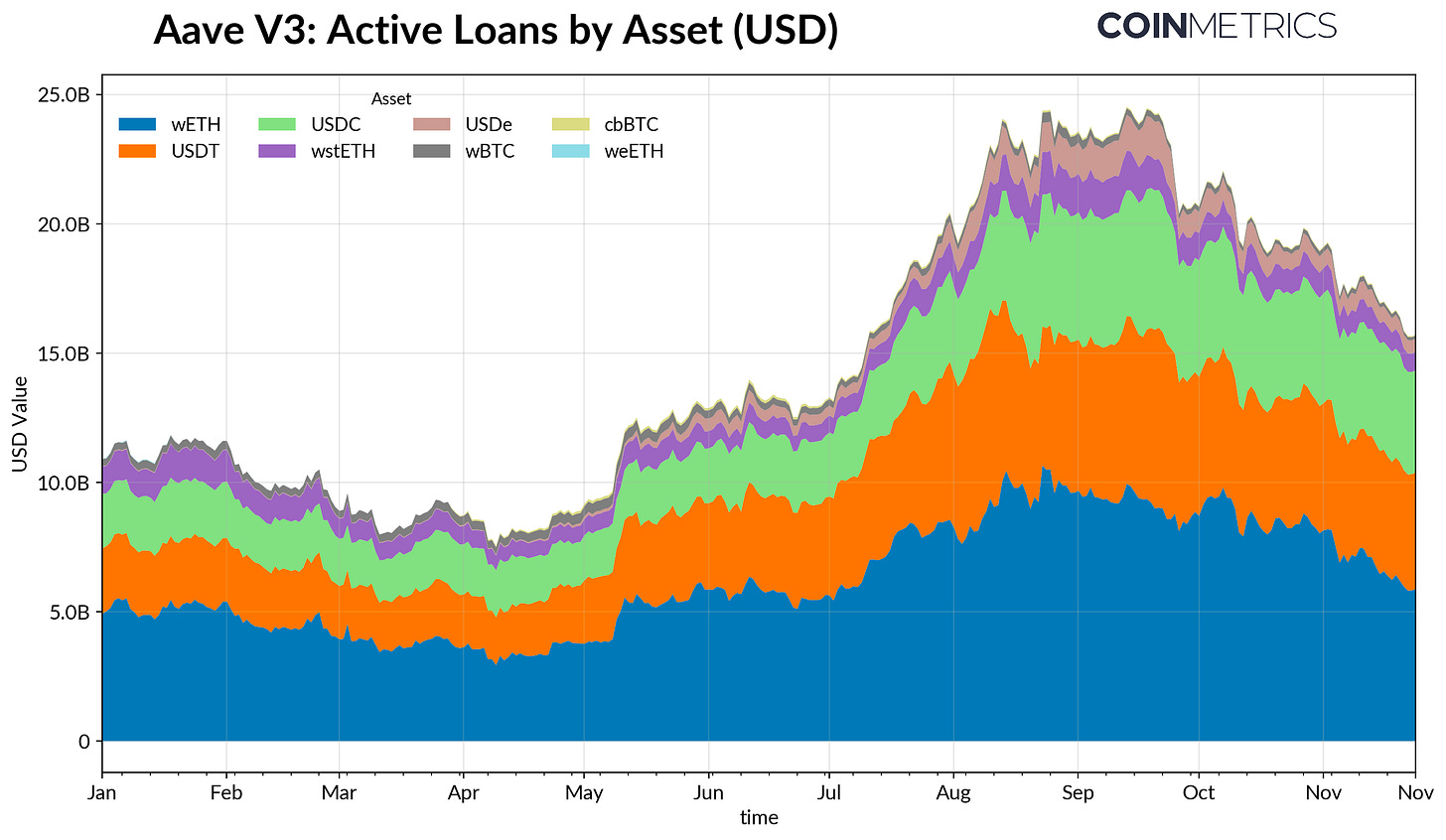

DeFi Deleveraging

DeFi credit markets also underwent a gradual phase of deleveraging. Active loans on Aave V3 have trended lower since their late-September peak as borrowers reduced leverage and repaid debt amid softer risk appetite and collateral repricing. The pullback was sharpest in stablecoin denominated borrowing, amplified by Ethena USDe’s depegging, which drove a 65% decline in USDe borrows and a broader unwind of synthetic-dollar leverage.

ETH-based borrowing also contracted, with WETH and liquid staking token (LST) loans falling around 35–40%, pointing to reduced looping and the scaling back of yield-bearing collateral strategies.

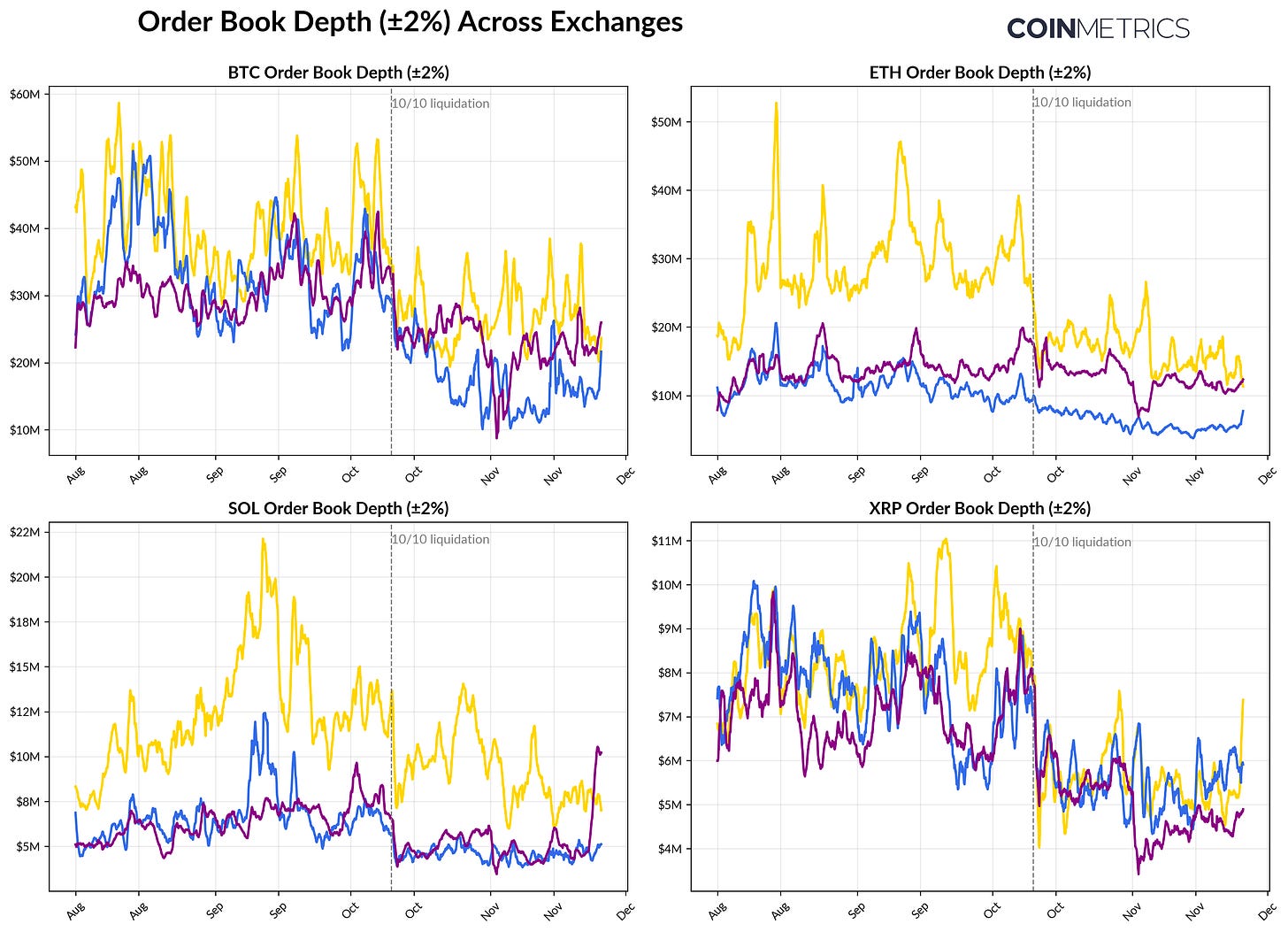

Shallow Spot Liquidity

Spot market liquidity remains thin following the October 10th liquidation cascade. Across major exchanges, top-of-book depth (±2%) for BTC, ETH, and SOL is still 30–40% below early-October levels, showing that liquidity has yet to recover alongside prices. With fewer resting bids and asks, markets remain more fragile, small bursts of activity can move price disproportionately, increasing volatility and amplifying the impact of forced selling.

Liquidity conditions are even weaker across altcoins. Order books outside the majors saw a sharper and more persistent drop in depth, reflecting continued risk aversion and reduced market-making activity across majors and altcoins. A broad improvement in spot liquidity would help reduce price impact and stabilize market conditions, but as of now, depth remains one of the clearest signs of lingering stress in the system.

Source: Coin Metrics Market Data Pro

Conclusion

Digital asset markets are undergoing a broad recalibration, shaped by softer demand from ETFs and DATs, a reset in leverage across futures and DeFi, and still shallow spot liquidity. These dynamics have weighed on prices, but they also leave the system healthier, less levered, more neutral in positioning, and increasingly anchored by fundamentals.

At the same time, the macro backdrop remains a headwind: weakness in AI equities, shifting rate-cut expectations, and a broader risk-off tone have tempered appetite. A sustained recovery in the major demand channels, ETF inflows, DAT accumulation, stablecoin supply growth, alongside a rebound in spot liquidity, would provide the foundation for market stabilization and eventual reversal. Until these turn, markets will remain driven by the tension between a risk-off macro backdrop and crypto’s internal market structure.

Coin Metrics Updates

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you’d like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.