Coin Metrics' State of the Network: Issue 65

Tuesday, August 25th, 2020

Get the best data-driven crypto insights and analysis every week:

Weekly Feature

The Business Trends of Crypto Exchanges

By Huyette Spring and the Coin Metrics Team

The following is an excerpt from the full piece, which has been truncated due to space limitations. Read the full report here.

Overview

State of the Network has predominantly focused on the network and market data happenings of the crypto industry. In this issue, we zoom out a bit to discuss the business trends and strategies of the exchanges building atop these decentralized protocols.

From a standing start in October 2008, the cryptocurrency exchange industry has matured at an astonishing pace. But there is no guarantee that this maturation is sufficient for cryptocurrency exchanges to remain independent indefinitely.

Below, we explore the maturation of the crypto exchanges through the years.

Satoshi to ~2017

The first challenge for crypto exchanges was how to gain traction in a basically non-existent market. Simply put, could they build a product that early adopters would actually use?

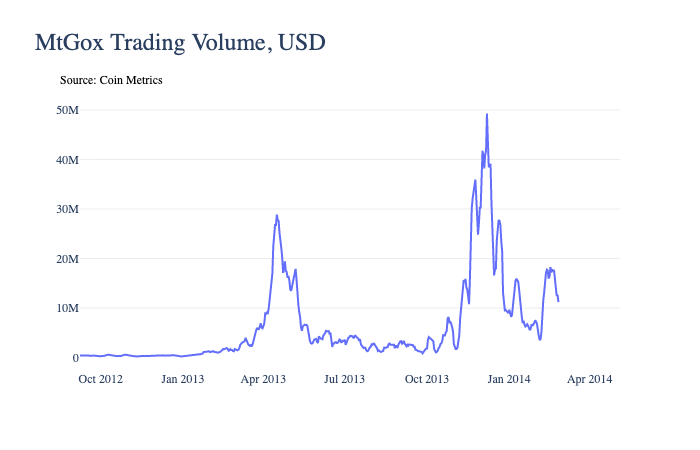

In the early days of crypto centralized exchanges began to emerge, horrifying the hardcore decentralization-focused cypherpunks. Trust is a luxury of optionality and there was almost no competition for any given job-to-be-done. These conditions allowed MtGox to simultaneously have 70% of the Bitcoin market and absolutely no controls upon which users could place their trust. It’s no surprise, then, that the inevitable MtGox hack was a significant event in the history of crypto exchange development and threatened the future of the industry.

MtGox 7-day avg. trading volume before the exchange was abruptly taken offline on February 25th, 2014

But the hot air gushing into the balloon during the 2017 price run-up brought with it more users, employees, business models, and competition. Users of these crypto exchanges had now been given the Promethean fire of business: choice, and with it, expectations. Those expectations meant that exchanges needed to do more than just build a product which early adopters would use. They also needed to make a product that people would trust.

~2017 to 2020

Here’s the challenge with trust: it’s expensive and it mainly accrues to the brand, not the product. Thus, exchange’s point of focus shifted from the product to the company: Can you build a going concern; i.e. an actual run rate business?

There are two distinct but interconnected trends occurring today which demonstrate exchange’s strive to capture the hearts and minds (read, trust) of the ever fickle customer: Professionalization and Strategy Optimization.

Professionalization

The first trend is to win the minds of customers through Professionalization. Regardless of the segment, customers now expect exchanges to act like they’ve been there before.

The quickest way to do this is hiring. Visionaries started the crypto industry from whole cloth but the theme now seems to be “professional businesses require professional managers”. And while a first principles re-imagining of the social contract of money has always attracted top talent, now the talent is operating professionals coming in at the top of the org chart, with “traditional world” experience. To name just a few recent examples: Coinbase has hired executives from Barclays, Google, Lyft; BlockFi has hired executives from AmEx and Credit Suisse; Gemini hired a former Goldman Sachs executive to lead their Asia expansion.

The second approach to Professionalization is acceptance of regulation. True, this was a hand forced by regulators, especially in the U.S., but much of the industry has, in one form or another, turned this into a trust-building competitive advantage. Regulation, and accompanying attestations like SOC audits, appears to have become a marketing positive rather than a negative. Despite it’s well documented flaws, the number of BitLicense approvals is accelerating. International companies such as Binance.US and FTX.US have cleared the regulatory hurdles necessary to enter the U.S. market, typically by registering as an MSB. Luxembourg-based Bitstamp went a step further and got a full BitLicense. BitMEX has announced a User Verticiation (read KYC) program. And unlike many crypto “exchanges” which aren’t, ErisX sought and received a DCO and DCM license from the CFTC, enabling it to fulfill its business model of targeting the institutional market.

Continue reading “The Business Trends of Crypto Exchanges”...

Network Data Insights

Summary Metrics

Source: Coin Metrics Network Data Pro

Ethereum (ETH) transaction fees came back down to earth this week after reaching new all-time highs last week due to the rapid rise and fall of YAM. But despite a 28.4% drop week-over-week, ETH total daily fees still remain relatively high. Over the past week, ETH average daily transaction fees were over $3.8M, compared to about $1.4M for Bitcoin (BTC).

Network Highlights

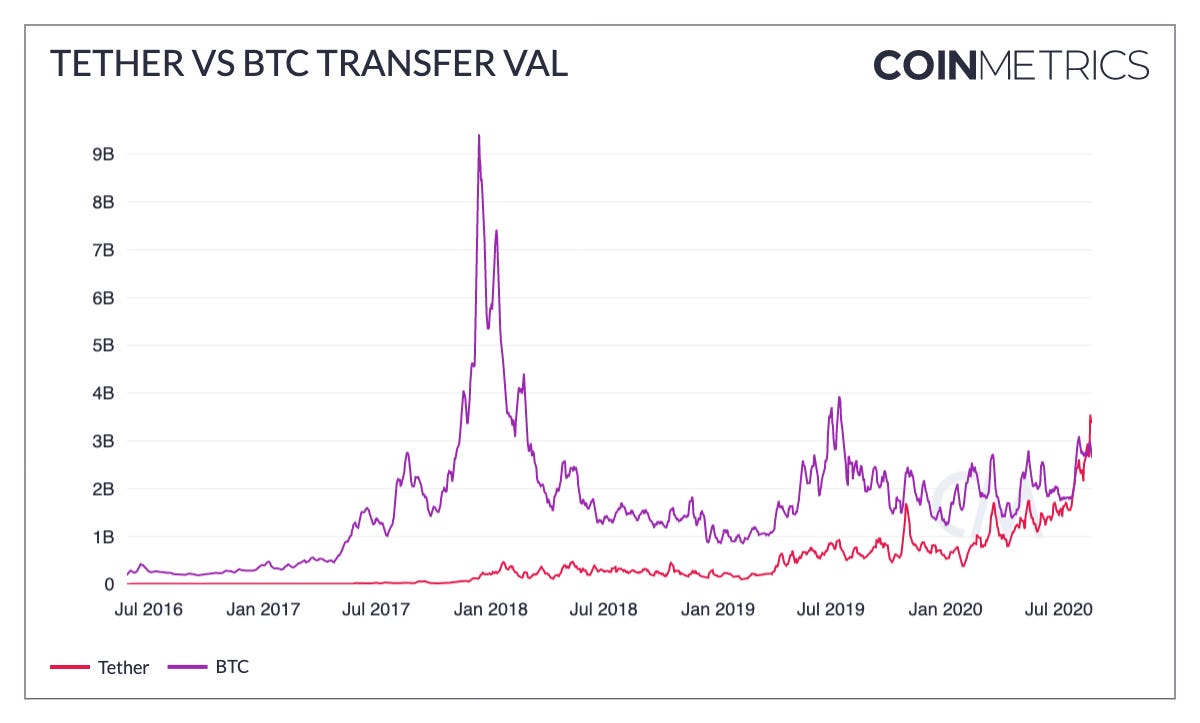

After months of rapid growth, Tether’s 7-day average adjusted transfer value has finally flipped Bitcoin’s.

On August 20th, Tether’s 7-day average adjusted transfer value reached over $3.55B compared to Bitcoin’s $2.94B. This is a big milestone for stablecoins as Tether continues to take more and more of the market share of on-chain transfers. Stablecoins are increasingly being used in popular DeFi applications like Uniswap and Curve, both of which likely played a role in Tether’s recent surge.

Source: Coin Metrics Formula Builder

Simultaneously, total Tether supply crossed another milestone reaching over 13B on August 21st. Tether’s supply has grown at a rapid rate - it was less than 10B on June 1st, 2020, and less than 5B on March 1st. The following chart shows the total supply of the Ethereum, Tron, and Omni versions of USDT.

Source: Coin Metrics Formula Builder

And Tether continues to expand to more networks. Tether recently announced that USDT would be expanding to yet another platform in addition to Ethereum, Tron, the Omni protocol, and others. On August 19th a new USDT integration went live on the OMG Network, an Ethereum-based layer 2 protocol. As a result OMG’s daily active addresses have already shot up to their highest levels since August 2018.

Source: Coin Metrics Network Data Charts

Market Data Insights

Current market sentiment surrounding certain DeFi projects evokes memories of the ICO-fueled market of late 2017. In light of this situation, we examine where the crypto market is in its current market cycle compared to previous cycles.

Bitcoin has experienced multiple bubble-and-crash cycles in its history and here we identify three major cycles with cycle tops and cycle bottoms. With the benefit of hindsight, we identify the beginning of our current cycle when the price of Bitcoin briefly fell to the low $3,000s in late 2018.

We are currently over 600 days in the current cycle and are closely tracking the performance of the previous cycle which began in 2015. Although there is no guarantee that the market will follow the patterns established by previous cycles, financial history has shown us that the formation of asset bubbles appear to be linked to deeply rooted aspects of human behavior.

The market has significantly changed over the past several years, particularly with respect to the ability for market participants to express short market views. The market has also grown to a point where further increases are more difficult than before, so there are good arguments to be made that this cycle will be different. Nonetheless, if this cycle evolves similarly to the previous cycles, there appears to be at least several hundred days remaining.

In DeFi news, the $BASED (based.money) project reached some major milestones. The protocol is the product of an anonymous group and follows a distribution mechanism similar to Ampleforth where the supply is rebased periodically in an attempt to have 1 $BASED equal $1.

Following the release of its Pool 1 on Uniswap it had over $38m of staked liquidity in less than 24 hours and had traded at an all time high price of $941.13. It currently trades at $152.72 as of the time of writing. The creators state it is designed as “game of chicken designed to shake out weak hands and yield the highest gains for those who understand the rules”. The activity surrounding it so far makes it appear an interesting aspect of the DeFi ecosystem to watch over the next few weeks

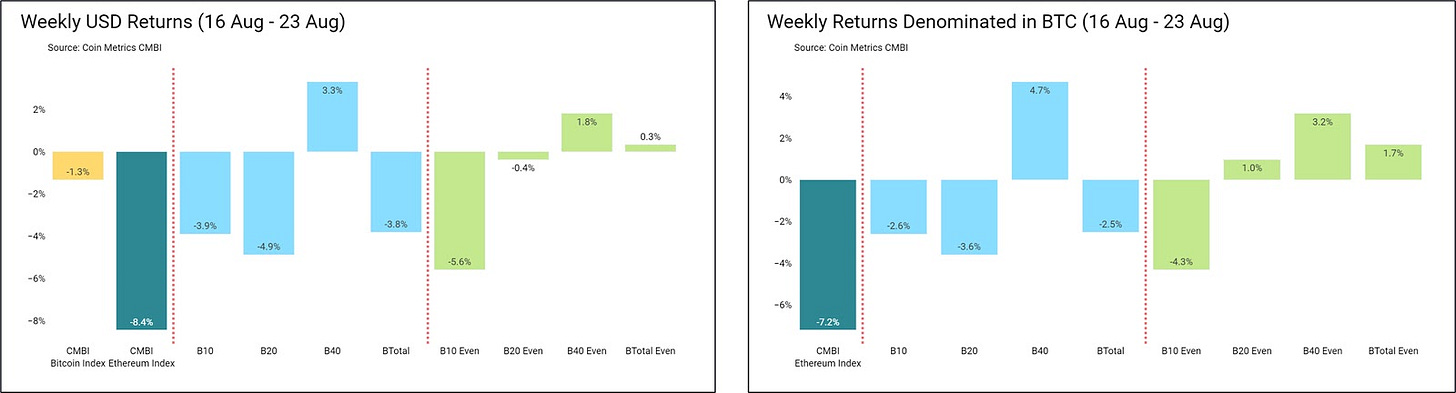

CM Bletchley Indexes (CMBI) Insights

Update to the Bletchley Indexes: As of the 1st of September, Coin Metrics will take the next step to integrate the Bletchley Indexes into Coin Metrics, transitioning all infrastructure over to Coin Metrics owned systems and updating all pricing sources to Coin Metrics Reference Rates. As part of the transition, Coin Metrics will be updating the history of the Bletchley Indexes to reflect Coin Metrics historical reference rates. Further, going forward, we will also be expanding the universe of assets available for selection which will result in a significant turnover in the index during the September Rebalance.

This is an exciting step for Coin Metrics that allows the company to wholly own, manage and have transparency into the current and historical pricing data as well as overcoming anomalies that currently existed from methodologies that are not administered and calculated by Coin Metrics.

After a few weeks of across the board growth, this week most CMBI and Bletchley Indexes experience a pull back. The CMBI Bitcoin Index fell a modest 1.7%, ending the week at $11,680.64 after twice closing the daily above $12,000 for the first time since July 2019. The CMBI Ethereum Index, which has recently been more volatile on the up and downside, closed the week at $393.49 (down 8.4%) after reaching intra-week highs of $437.78. The only Index to close the week higher was the Bletchley 40 (small caps) which grew 3.3%.

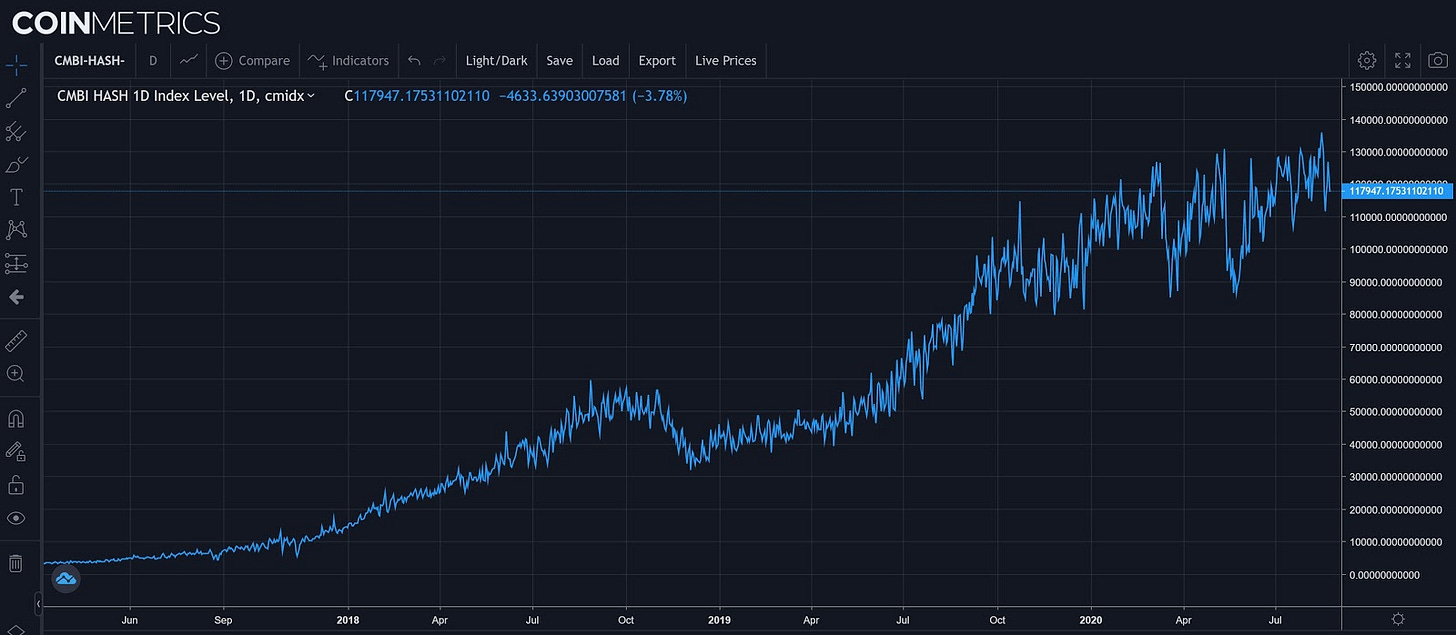

The CMBI Bitcoin Hash Rate Index reached all time highs of 136,060 terahashes during the week, but ended closing at 117,947 terahashes, remaining in the range it has been in since the start of June (100,000 TH - 140,000 TH).

More performance information can be found here:

CMBI Bitcoin Index and CMBI Ethereum Index can be found in the July CMBI Single Asset Index Factsheet.

CMBI Mining Indexes can be found in the July CMBI Mining Index Factsheet.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

We’re excited to announce the new Coin Metrics mobile app. View real-time cryptoasset pricing and relevant on-chain data in a single app! Download for free here: https://coinmetrics.io/mobile-app/

As always, if you have any feedback or requests, don’t hesitate to reach out at info@coinmetrics.io.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.