Coin Metrics' State of the Network: Issue 90

Tuesday, February 16th, 2021

Get the best data-driven crypto insights and analysis every week:

Weekly Research Focus

Crypto Trust Supply Sinks

By Nate Maddrey and the Coin Metrics Team

Late last week BNY Mellon, the world’s largest custodian bank with over $2 trillion in assets under management, became the latest institution to announce support for digital currencies. According to the report, BNY Mellon will “eventually allow digital currencies to pass through the same financial network it currently uses for more traditional holdings like U.S. Treasury bonds and equities.”

As institutions continue to embrace Bitcoin (BTC) they are looking for new ways to get exposure to crypto without necessarily having to hold it themselves. Trusts are emerging as one of the most popular options for institutional investors to gain access to BTC and other cryptoassets.

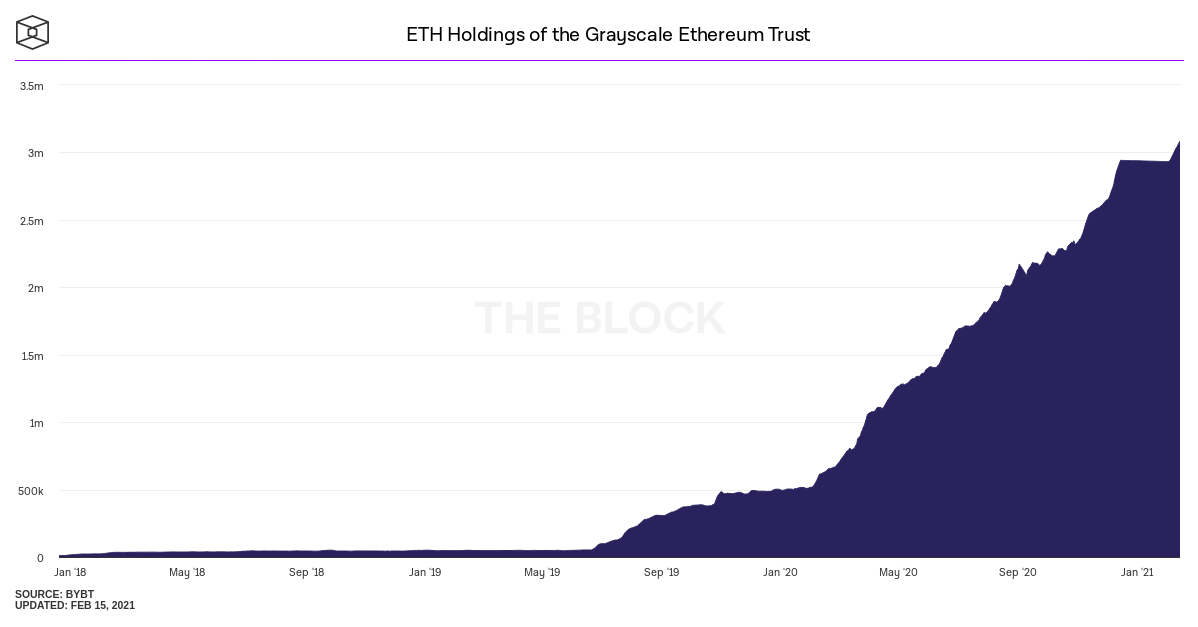

To date, the largest Bitcoin and Ethereum (ETH) trusts are operated by Grayscale and have over $31B and $5.6B AUM, respectively. Grayscale’s trusts allow investors to get exposure to crypto through a traditional investment vehicle by buying publicly quoted shares. Grayscale’s Bitcoin Trust trades as GBTC and its Ethereum Trust trust trades as ETHE.

The trusts are structured to hold the underlying crypto and the value of each share is dependent on the amount of crypto under management. For example, Grayscale’s Bitcoin trust currently holds about 650K BTC valued at around $31.1B. With 689,769,300 shares outstanding each share represents 0.00094789 BTC, or about $45. Current market price of a GBTC share (as of February 12th) is $48.91, a slight premium compared to the amount of BTC held per share.

Additionally, trusts are eligible for tax benefitted accounts like IRAs, and provide a familiar structure for accounting and taxation. High demand from institutional investors has led to the high premium on Grayscale’s BTC and ETH trusts.

A key feature of Grayscale trusts is that there is no way to redeem the underlying crypto, at least for now. So when BTC or ETH is deposited into the trusts it stays there indefinitely. The lack of redemption options plus high institutional demand has created an interesting side effect: crypto trusts are becoming large supply sinks that lock up cryptoassets and effectively take them out of circulation, reducing the overall liquid supply.

Although BTC’s supply is commonly considered to be about 18.63M the actual amount of free float, liquid supply is significantly lower. The following chart shows BTC’s free float supply, which is about 14.55M, compared to the total supply. Trusts are not currently excluded from free float supply but the Grayscale Bitcoin Trust alone effectively removes an additional 650K BTC from circulating supply.

Source: Coin Metrics Network Data Charts

Furthermore, a large portion of BTC supply is held for the relatively long-term. Only about 42% of total BTC supply has been moved on-chain within the last year. The percent of supply moved on-chain has been increasing since October 2020 but is still near all-time lows.

Source: Coin Metrics Network Data Charts

The trust supply sink becomes especially potent when mixed with Chicago Mercantile Exchange (CME) futures. CME futures give institutional investors another way to get exposure to crypto derivatives, both long and short.

Institutional investors can take advantage of the Grayscale Bitcoin Trust premium by simultaneously depositing BTC into the trust (in exchange for GBTC shares priced at NAV) while shorting BTC on CME. This allows them to remain market neutral and pocket the premium on GBTC. This dynamic has created a vortex that has drawn a large amount of BTC into the Grayscale Trust supply sink.

CME just launched ETH futures on February 8th, 2021. Since then over 90K ETH has flowed into the Grayscale Ethereum Trust with an inflow of over 53K ETH on February 11th alone.

The Grayscale Trusts have been dominant to date but other trusts are starting to emerge. Bitwise is a competitor that offers both Bitcoin and Ethereum funds. Bitwise currently offers weekly redemptions but plans to terminate redemptions before the start of quotations of shares on the OTC Market.

Additionally, Coin Metrics is serving as the Index Provider for two newer crypto trust entries. On February 9th BlockFi announced the launch of their new Bitcoin Trust which already has over $50M worth of BTC under management. Similar to Grayscale, BlockFi does not currently have an option to redeem BTC from the trust after it’s been deposited. And the Osprey Bitcoin Trust, which reopened for private placement in November 2020, offers a low-cost alternative. The Osprey Bitcoin Trust offers 0.49% management fee compared to Grayscale’s 2% annual fee.

As trusts grow more popular and a larger and larger percentage of supply will be locked up and held indefinitely. Amid an already hot market, this is adding more fuel to the fire for crypto’s 2021 bull run.

Network Data Insights

Summary Metrics

Source: Coin Metrics Network Data Pro

BTC, ETH, and the rest of crypto had a strong week following Tesla’s announcement of a large BTC purchase on Monday. BTC led the way in most categories, with market cap growing 26.5% week-over-week compared to a 12.1% growth for ETH. BTC fees gained ground on ETH fees, growing 56.8% week-over-week for a daily average of $7.7M. But ETH fees still remain at all-time highs with an average of $27M worth of total fees per day. Despite the uptick in market cap usage remained relatively flat on the week. Active addresses dropped by 0.2% and 3.1% for BTC and ETH, respectively.

Network Highlights

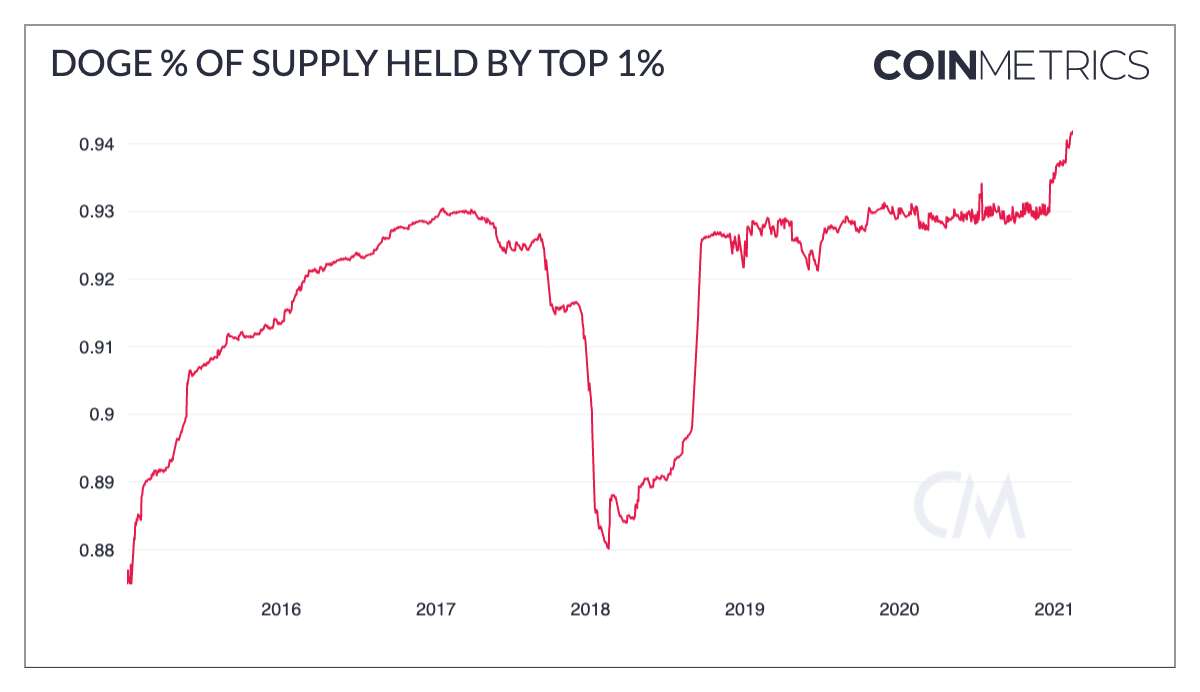

After pumping up Dogecoin (DOGE) over the last few months, Elon Musk shared some concerns on Sunday. Implying that a small group of whales controlled a large part of the supply, he tweeted that “too much concentration is the only real issue” with DOGE.

Examining the data, DOGE is indeed relatively concentrated. The top 1% of addresses collectively hold 94.2% of the total supply.

Source: Coin Metrics Formula Builder

Drilling down further, the top 100 largest DOGE addresses hold 68.1% of total supply. Comparatively, the top 100 largest BTC addresses only hold 13.7% of total supply.

Source: Coin Metrics Formula Builder

It’s important to note that some of these large addresses are exchanges. Exchanges typically hold large amounts of crypto and show up at the top of whale lists. Many owners of DOGE are likely holding their coins on centralized exchanges and brokers.

But considering there are over 2.7M addresses holding at least 1 DOGE, the supply is still top heavy.

Source: Coin Metrics Network Data Charts

Overall, DOGE supply is relatively concentrated towards large holders. The following chart shows the percent of total supply that different sized addresses collectively hold.

Starting from the bottom of the chart, the pink band represents the amount of supply collectively held by addresses that each hold between 0 and 0.0001% of total supply. The light blue band represents the percent of supply held by addresses that each hold 0.0001% - 0.001% of supply, and so on.

Source: Coin Metrics Formula Builder

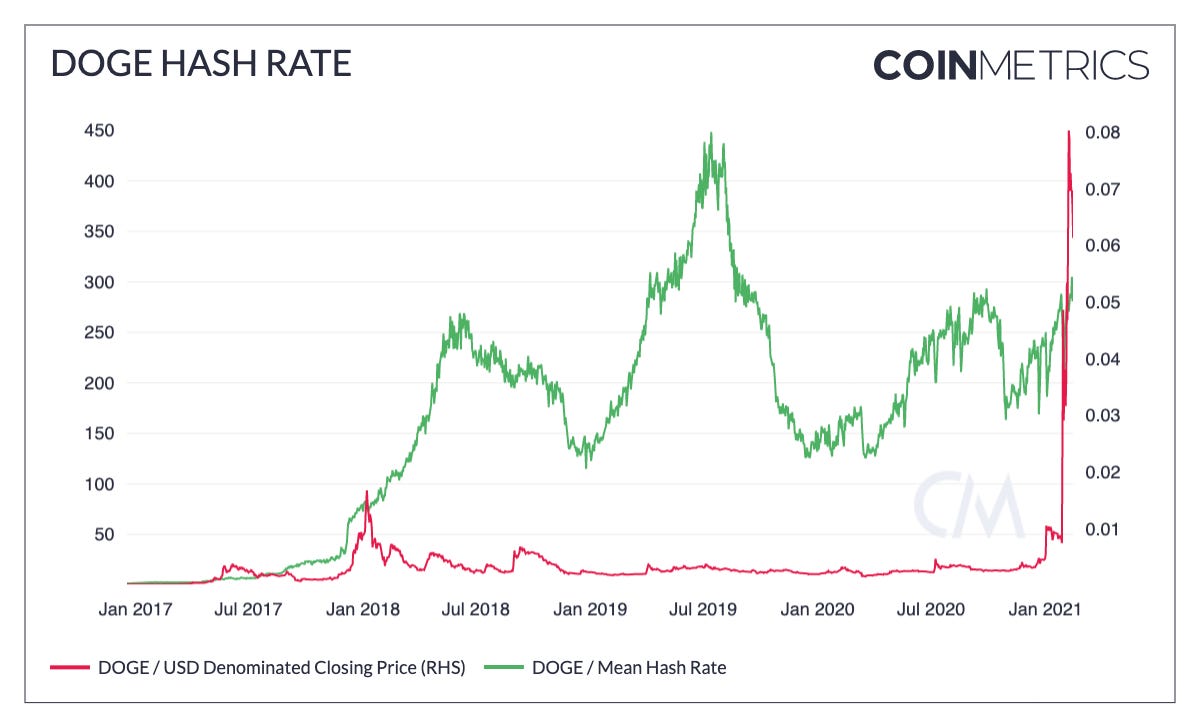

It’s also important to note that supply concentration is far from the only problem with DOGE, as pointed out in a thread by Lucas Nuzzi.

DOGE hash rate, which is a proxy for network security, is still far below all-time highs despite price skyrocketing. The price of DOGE is up 1200% YTD while hash rate grew only 15% YTD. This potentially makes DOGE an attractive target for an attack.

Source: Coin Metrics Network Data Charts

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

We’re excited to announce the new Coin Metrics mobile app. View real-time cryptoasset pricing and relevant on-chain data in a single app! Download for free here: https://coinmetrics.io/mobile-app/

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.