Coin Metrics' State of the Network: Issue 128

Tuesday, November 9th, 2021

Get the best data-driven crypto insights and analysis every week:

Smart Contract Platforms Lead the Market to New All-Time Highs

By Nate Maddrey and Kyle Waters

The Coin Metrics CMBI10 index hit new all-time highs this past week as bullishness picks up across the market. The CMBI10 index (Coin Metrics Bletchley Indexes) consists of the 10 largest cryptoassets weighted by their free float market-cap.

ETH has led the way during the recent surge, breaking its previous all-time high several times over the past week including a surge past $4,800 on Monday. Other smart contract platforms have also remained hot with Avalanche (AVAX) and Solana (SOL) both breaking new highs.

Following Facebook’s recent name change metaverse assets have been surging over the last week - Decentraland (MANA), Sandbox (SAND), and Axie Infinity (AXS) are all at or near all-time highs. Comparatively, top decentralized finance (DeFi) tokens like Uniswap (UNI), Aave (AAVE), and Compound (COMP) have been lagging, but are still on the rise.

The following chart shows how close the major cryptoassets are to their all-time high price (current price divided by all-time high price) as of Monday, November 8th. For example, 100% indicates that they are currently at an all-time high, while 50% indicates that they are at 50% of their previous all-time high price.

Source: Coin Metrics Reference Rates

While some smaller-cap assets will undoubtedly outperform during the bull run, many will likely not stand the test of time. Historically, most cryptoassets have fallen off over the long-run compared to BTC and ETH.

Source: Coin Metrics Reference Rates

ETH Gas Fees Back on the Rise

Amidst ETH’s fresh all-time high, ETH gas fees are rising as network activity picks up. Daily active addresses have averaged ~650K over the last week, the highest level since August of this year.

The mean Ethereum transaction fee over the last week averaged roughly $50, with a median of $26. Even after adjusting for the rise in ETH’s price in USD terms, fees are still increasing in native units. The high fees are starting to price out certain economic activity such as small transfers under $100 in value that have dropped off with the increase in fees.

Source: Coin Metrics Formula Builder

Despite being responsible for a gas surge over the summer, NFT activity is likely not the main factor behind the recent jump in gas fees. Daily ERC-721 transfers averaged 67K over the last week, down from a peak of ~200K per day in early September.

Activity that might be less cost sensitive such as trading is likely the biggest contributing factor to the rise in fees. Daily Uniswap trades and unique buyers have picked up in recent weeks to the highest levels since early summer.

Source: Coin Metrics Network Data

Part of the recent uptick in activity and fees might also be attributed to the latest meme coin mania surrounding Shiba Inu (SHIB), which is an ERC-20 token on Ethereum. For example, on October 28th over 100K ETH addresses interacted with SHIB while 133K transactions involved the token that day, ~9% of the 1.5M ETH transactions that day.

High network use has ultimately been a double-edged sword for Ethereum: it is a sure sign there is high demand for Ethereum block space from users, but the limits to scalability on layer-1 Ethereum quickly begins pricing out activity.

But there is progress being made towards scalability via layer-2 (L2) scaling solutions that promise lower fees and full alignment with Ethereum. This Thursday (November 11th) the L2 solution Optimism is set to release one of its biggest upgrades which will, among other things, greatly improve the developer experience building on Optimism.

President’s Working Group on Financial Markets Releases Report on Stablecoins

Last week, the President’s Working Group on Financial Markets released its highly anticipated report on stablecoins. The report identified the key use cases today for stablecoins as trading, lending, and borrowing of other digital assets. On-chain data is consistent with this: most stablecoin transfers today are generally high in value to facilitate these financial activities, and they are used relatively less for small transactions and payments.

Using payment size metrics launched in Coin Metrics’ Network Data Pro 5.0 release, the charts below show the percentage breakdown of daily transfers of USDC and USDT (Tether, on Ethereum) by transfer size, as well as the average transfer size by day.

For USDC, over one-third of all daily transfers are at least $10K or more in value and the average transfer per day was ~$100K over the last week. The daily median transfer size has typically been around $2.5K. Just ~7% of all transfers are under $100. Given the typical fees on the Ethereum base layer, transfers of this size are generally not economical.

Source: Coin Metrics Formula Builder

The breakdown is very similar for Tether on ETH. The daily average transfer size has been ~$55K over the last week while over half of all transfers are greater than $1K in size.

Source: Coin Metrics Formula Builder

To follow the data used in this piece and explore our other on-chain metrics check out our free charting tool, formula builder, correlation tool, and mobile apps.

Network Data Insights

Summary Metrics

Source: Coin Metrics Network Data Pro

Despite a price surge, BTC and ETH activity was relatively flat over the past week - BTC active addresses dropped by 0.7% week-over-week, while ETH active addresses grew by ~2%. The total number of transactions and transfers also dipped slightly for both assets. Stablecoin on-chain activity, on the other hand, is picking up, with USDC active addresses growing by 8.9% on the week.

Network Highlights

Three months have now passed since the implementation of EIP-1559, the overhaul to Ethereum’s fee mechanism. In that time span just over 800K ETH has been burnt, ~40% of the roughly 2M ETH issued in that period.

Daily net ETH issuance has dipped below zero (i.e. deflationary) in 10 days. This has significantly dropped ETH’s expected rate of net annual inflation. Looking at a 30-day moving average, ETH’s net annual inflation is now under 1%. The number of transactions implementing EIP-1559 type fees is still just around 60%, though.

Source: Coin Metrics Dashboards

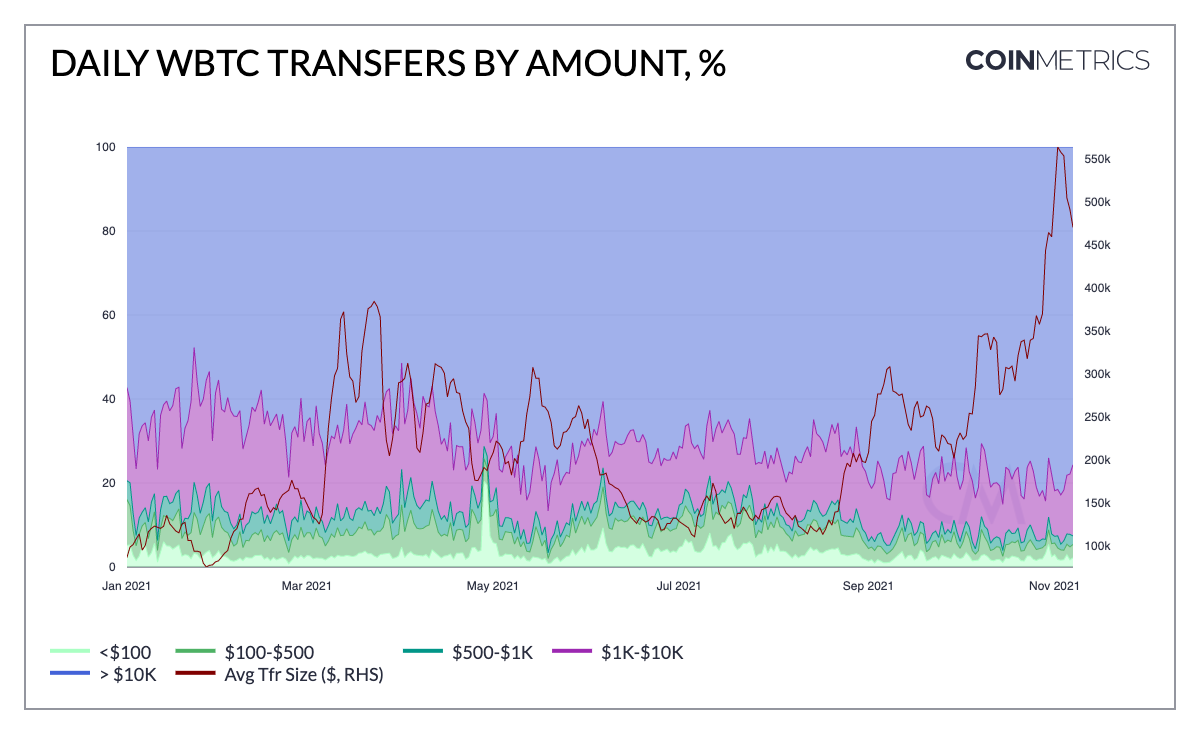

The total supply of wrapped Bitcoin (the ERC-20 tokenized version of bitcoin on Ethereum) has risen to 235K, or 1.2% of the total bitcoin supply today. Breaking down transfers by size helps to show how WBTC is generally used vs. BTC on the Bitcoin network itself.

The average transfer size for WBTC was about $500K over the last week, while over 90% of all transfers were greater than $1K in value.

Source: Coin Metrics Formula Builder

While most transfers on Bitcoin itself also tend to be large in value, there are relatively more smaller-sized transfers. Just around 15% of all transfers are under $500 in value on a typical day today while the average transfer size has been around $50K over the last week, 1/10 the size of the average transfer of WBTC on Ethereum.

This likely suggests that WBTC is mostly used on Ethereum today in DeFi protocols for trading and other financial activity. For example, the 0.05% fee WBTC / ETH Uniswap V3 pool recorded $150M in volume on November 8th. Additionally, WBTC’s share of the total collateral in the Maker system has also increased to over 14%.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Coin Metrics turns three years old!

Check out our market-data focused newsletter State of the Market, featuring weekly updates on market conditions.

Also check out the Coin Metrics mobile app. View real-time cryptoasset pricing and relevant on-chain data in a single app! Download for free here: https://coinmetrics.io/mobile-app/

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.

© 2021 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is’ and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.