Coin Metrics' State of the Network: Issue 18

Tuesday, September 24, 2019

Weekly Feature

Stellar Airdrops Are Mostly Transferred to Exchanges or Unclaimed

On November 6th, 2018, Blockchain.com announced it was creating the “largest crypto giveaway in history” in partnership with the Stellar Development Foundation (SDF). The plan was to distribute $125M of Stellar (XLM) among Blockchain’s 30M wallets. Users first needed to complete a KYC process in order to be eligible for the giveaway. Similarly, Keybase.io recently announced a plan to distribute at most 2B Lumens to its users.

Stellar is a crypto-asset created in 2014 whose development is overseen by the SDF. Over its history, the foundation created (or assisted) strategies to distribute Lumens (Stellar’s native token) to many users around the world. At the genesis of Stellar, 100B Lumens were created and granted to the SDF which over time distributed them. Currently, around 20B out of those 100B are outside of SDF control.

An “airdrop” is essentially a cryptocurrency giveaway that is commonly used as a way to distribute new tokens. The sender of the airdrop typically covers all associated transaction fees so there are no costs for the receivers. Airdrops serve as a way to bootstrap new currencies, because they allow the currency creators (or whoever is sponsoring the airdrop) to distribute the currency to a large amount of addresses in a short amount of time. They are often also described as a way to increase a currency’s decentralization, since tokens can be sent to many users who can then do whatever they want with them.

Since airdrop senders cover the fees, they do not even necessarily need the receiver’s permission to airdrop them tokens – the senders simply need a list of addresses that they would like to distribute to. However, this also means that the airdropped currency may never be claimed since some receiving addresses may be inactive or uninterested.

Given our expertise in on-chain data analysis, Coin Metrics decided to analyze the Blockchain and Keybase airdrops and look at the distribution and activity after the initial transfers.

Blockchain.com Airdrop

Our analysis, supported by comments from the airdrop recipients, show that two addresses were used to airdrop XLM on Blockchain.com’s users. First, GARAR5 was used from Nov 6th 2018 to Jan 9th 2019, then GDNWRV from Jan 9th 2019 onward. On July, 15th 2019, Blockchain.com announced that the airdrop was over.

Between Nov 6th 2018 and July 15th 2019, those two accounts created 1.2M accounts and credited them with around 400M XLM (worth $27M at current prices, $100M at the announcement of the airdrop). When valuing the XLM at the time it was credited, we find that overall, Blockchain.com airdrop claimants received $45.7M.

As of Sept 23rd, only 804,309 of those accounts still held more than 1 XLM (minimum balance requirement) and held a combined 101M XLM. Only 8,465 accounts that received Stellar from Blockchain.com during the airdrop period still own more than initial amount they received when they were created.

The vast majority of the airdropped XLM that was sent to users was then sent to various exchanges. This implies that many recipients of the airdrop sold their XLM in exchange for fiat or other cryptocurrencies.

Keybase.io Airdrop

On September 9th, 2019, Keybase.io announced a “surprise gift” to its 300K users from the Stellar foundation in the form of a 100M XLM airdrop (worth $5M at the time). Furthermore, it was supposed to be the first of a series of airdrops to Keybase users, for a total of 2B XLM (roughly 2% of the total XLM supply) to be airdropped to Keybase users in monthly tranches over the next 20 months.

In order to analyze the Keybase.io airdrop, we first looked into how the XLM was distributed to users. It turns out that all the 100M XLM were pre-distributed to 274,864 accounts between Sept 9th and Sept 14th. This is visible when looking at the sharp increase in the number of XLM accounts owning between $10 and $100 (the airdropped amount was ~$20) during that period.

Looking deeper into the chain, we identified GDV4KE as the creator of all those accounts. Furthermore, this account was the biggest account creator by far during the airdrop period ruling out other accounts being used.

The initial balances of the accounts created by GDV4KE are consistent with the amounts received by Keybase airdrop beneficiaries and the number of accounts created is consistent with the number of users claimed by Keybase (280-300K).

Furthermore, we identified two distinct categories of accounts created for this airdrop:

A minority (8.8K) received 356.3817276 XLM

The majority (266K) received 356.2904939 XLM

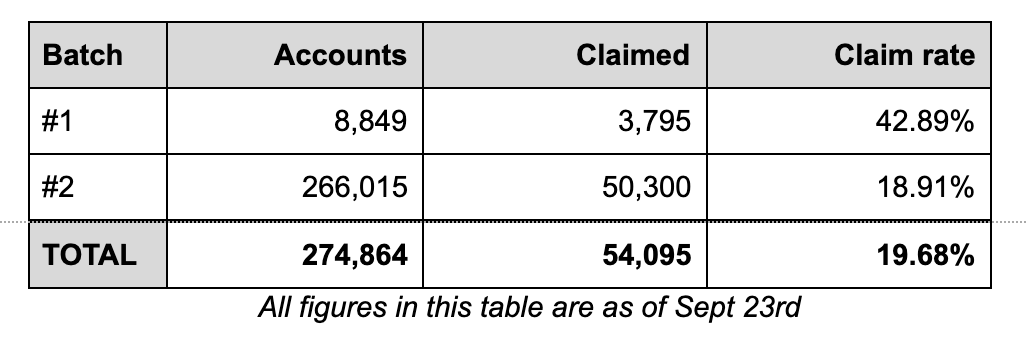

The first batch was created on Sept 9th. The latter batch was created from Sept 10th to 14th. The difference in start dates probably explains the small difference in value given out to users.

Given that the airdropped amounts were pre-credited to users, we looked at the airdrop’s uptake among Keybase users to see if they were actually claiming their free tokens. We define an airdrop as “claimed” if the account created by Keybase/Stellar had any activity.

Given the low size of the first batch, its high claim rate and the fact that it was first, we assume it was a test batch given to active Keybase users.

So far, around 19M XLM ($1.3M at current prices) has been claimed out of the 100M XLM currently distributed and 2B maximum distributable. Compared to the Blockchain.com airdrop, so far only a small fraction of the airdrop (around 1M XLM) has ended up on exchanges so far.

Conclusion

Airdrops have been touted as ways to improve an asset’s decentralization, popularity, or usage by fairly distributing some of its supply among individuals which can then use it as they see fit.

Our analysis shows that despite it being literally free money, only a minority of the targeted population actually claim their airdrop money (1.2M addresses out of 30-40M wallets for Blockchain.com, around 20% of Keybase users).

Furthermore, most people decide to exchange this new money for another one (either fiat, a stablecoin or Bitcoin) and only a few of them keep using the cryptoasset by getting more of it on open markets or through other means. These findings call into question the efficacy of airdrops, as most of the coins are sold immediately

Network Data Insights

Summary Metrics

The major crypto assets rebounded this past week and had positive gains in most metrics. ETH’s market cap grew by 15% week over week, leading all five of the major assets.

ETH’s daily transaction fees also continued to rise (as we covered in State of the Network Issue 17), growing by over 53%. BTC fees grew by 4.2% over the same period. Average BTC fees were still higher, however, than ETH fees over the last seven days. BTC’s average daily fees were $307k over the past week, compared to $254k for ETH.

Network security for both BTC and ETH also continues to grow stronger. BTC’s average difficulty and hash rate grew by 6.9% and 6.5%, respectively. Similarly, ETH’s difficulty and hash rate grew by 6.1% and 6.4%.

Network Highlights

After reaching all-time highs in gas usage last week, as we reported in State of the Network Issue 17, the ETH block gas limit has increased. On September 20th, the ETH block gas limit increased to a new high of 6.42B gas.

But despite the block gas limit increase, blocks are still at historically high rates of utilization. As of September 22nd, ETH blocks were 93.86% full, which is relatively close to the all-time high of 96.90%.

This is because ETH gas usage continued to rise after the gas limit was increased. ETH gas usage hit new all-time highs this past week, reaching 60.1B gas used on September 20th.

Market Data Insights

The trend of smaller assets outperforming Bitcoin continued this past week. This phenomenon has been rarely observed since the market peaked starting in January 2018. Notable performers over the past week include Ethereum (+11%), XRP (+8%), and Stellar (+17%), while Bitcoin declined by 3%. The sustained and concentrated nature of these price increases, in combination with a growing narrative of healthier than expected on-chain metrics for Ethereum, has presented market participants with perhaps the first credible instance this year that altcoins may be back on the rise.

Impact of Binance U.S. Trader Restriction Announcement Has Been Priced In But Restriction Still Not in Effect

The general trend of Bitcoin outperformance this year is at least partially attributable to exchange operators delisting small, illiquid assets and restricting U.S. investors from trading in certain assets. Bittrex and Poloniex both took aggressive steps this year to restrict several assets from U.S. traders. Most other major exchanges which have already banned U.S. users in policy but allowed them to trade in practice have stepped up their KYC and geofencing measures and cracked down on users using means to circumvent their restrictions.

Most notably, Binance announced in June of this year that all U.S. traders would be restricted from trading on their platform which coincides with the start of a period of extremely strong Bitcoin outperformance. As one of the only remaining trading venues available to U.S. traders and the primary trading venue for several altcoins, the announcement of this restriction served as a catalyst for some traders to liquidate their altcoin holdings into Bitcoin or Tether (the primary quote currencies for most markets on Binance).

Trading volume supports this theory as Binance's volume has been declining sharply after achieving a local peak in June. According to Binance's updated terms of service, the ban of U.S. traders was supposed to go into effect on September 12, although several individuals have reported that this ban is not currently being enforced.

Nonetheless, the impact of lowered demand for these smaller assets due to the heightened regulatory environment appear to be mostly priced in, and most traders who anticipated the September 12 deadline have already sold their positions. The reversal we have seen in these smaller assets' prices may just be a slight normalization in prices following a period of liquidations. Future trends in Bitcoin-altcoin price movements may depend on how the regulatory environment develops relative to current market expectations.

CM Bletchley Indexes (CMBI) Insights

Is the elusive and ever evasive alt-season finally nearing? Weekly CMBI returns indicate that there is renewed interest in mid and small cap crypto assets, which produced weekly returns against BTC of 6% and 5% respectively. However, perhaps the best weekly performer was Ethereum, which lead the large cap assets, returning 14% against the US Dollar and 18% against BTC.

Medium and small cap crypto assets still have a long way to go before any meaningful recovery takes place. However, as highlighted in last week’s SOTN (Issue 17), increased on-chain activity for Ethereum coupled with a few consecutive weeks of strong performance, such as the below, could indicate a change in investor sentiment.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Coin Metrics is hiring! We recently opened up 7 new roles, including Blockchain Data Engineer and Data Quality and Operations Lead. Please check out our Careers page to view the openings.

As always, if you have any feedback or requests, don’t hesitate to reach out at info@coinmetrics.io.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.