Coin Metrics' State of the Network: Issue 28

Tuesday, December 3rd, 2019

Weekly Feature

The Psychology of Bitcoin Bubbles as Measured by Investor Cost Basis

by Kevin Lu and the Coin Metrics Team

Bubbles and subsequent crashes in financial assets occur with regular frequency in economic history, largely due to deeply-rooted cognitive biases in human psychology. In Bitcoin’s ten year history, at least three complete bubble-and-crash cycles have been observed.

We examine the state of investor psychology at six critical moments in Bitcoin’s history (including its recent state) using the distribution of investor’s estimated cost basis, an extension of the realized capitalization concept.

Understanding Estimated Cost Basis Distribution

Unlike market capitalization, which values each coin at the current price, realized capitalization values each coin at the time of its last on-chain movement. We further extend this concept by using one important assumption: an on-chain transfer represents a trade between a willing buyer and a willing seller, such that the price at the time of the transfer represents the cost basis of the buyer. Thus, realized capitalization can be thought of as the aggregate cost basis of all holders.

This assumption does not always hold in practice -- many transfers do not represent a change in ownership and instead are motivated by wallet maintenance, wallet shuffling, and other reasons. The majority of trading also occurs on centralized exchanges where coins are transferred between parties within an exchange’s internal ledger and do not require on-chain transfers. For these reasons, the idea of realized capitalization as a representation of aggregate cost basis should be taken as an imperfect estimate of the true value.

Despite these important caveats, an analysis of an estimated cost basis for each native unit of a crypto asset allows for rich analysis of investor behavior in a way that is not possible for other financial assets. For example, data regarding the cost basis for each individual share of a company’s stock is not available.

Cost basis data can be valuable because it provides insight into the degree of euphoria or pain that investors are experiencing (due to having either unrealized gains or unrealized losses), two fundamental emotions that affect investment decision-making during asset bubble formations and crashes.

Six Critical Moments in Bitcoin’s History

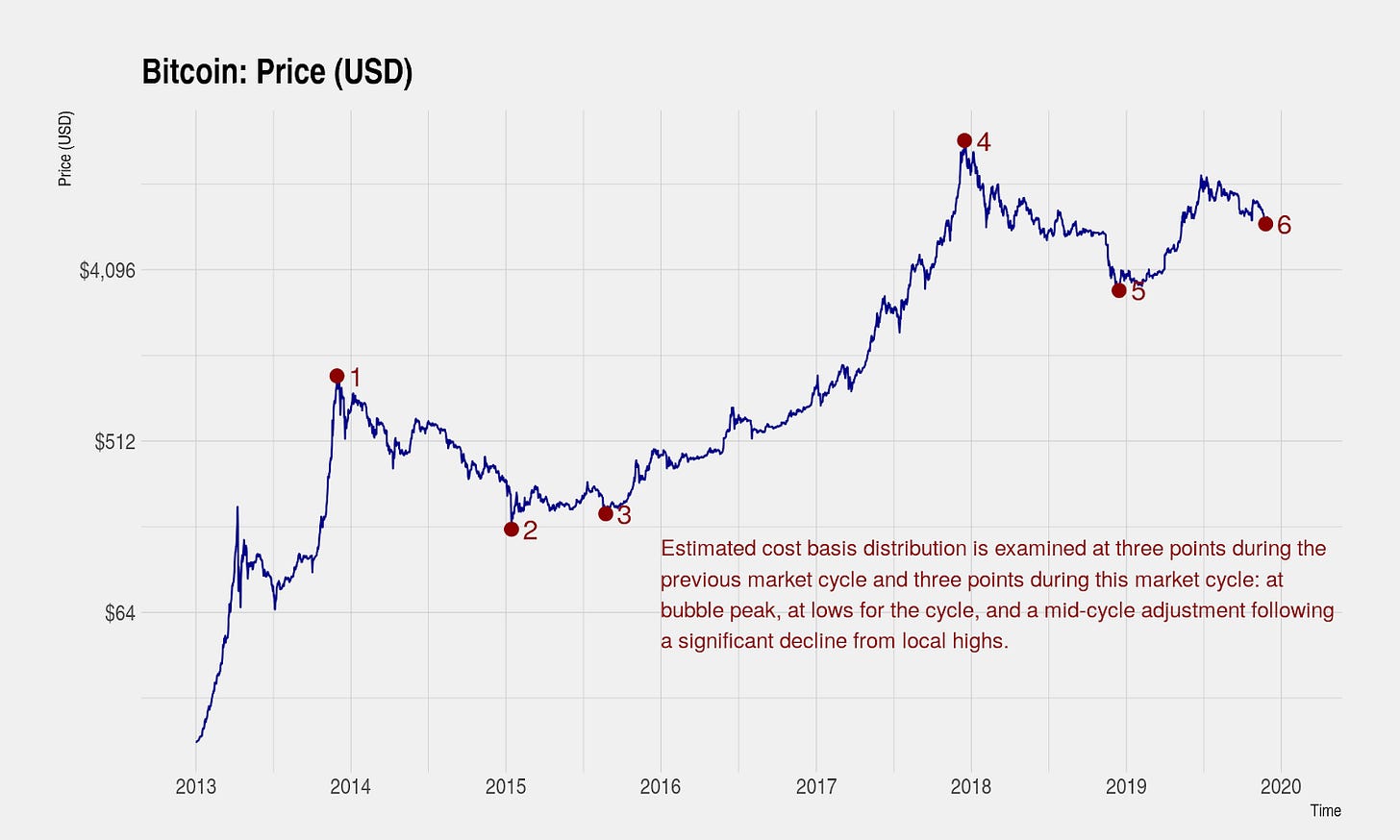

We examine the state of investor psychology through snapshots of estimated cost basis distribution during the previous cycle and during the current market cycle. For each market cycle, three points are chosen: at bubble peak, at lows for the cycle after the bubble has been completely deflated, and at a mid-cycle correction that involved a significant decline in prices after a recovery. All six moments are annotated on the chart below.

A brief description of each moment is described in this table and more fully explored in the sections below.

Peak of the Previous Cycle on November 29, 2013

We first examine the distribution of estimated cost basis distribution on November 29, 2913, the peak of the previous cycle where prices increased from roughly $100 to $1,100 in the span of two months. Below we introduce a visualization that contains a snapshot of the estimated cost basis for each native unit of Bitcoin at this time. Units of Bitcoin are assigned to bins where each bin is segmented into a $50 price interval.

For instance, almost 5.5 million Bitcoin had a cost basis between $0 and $50 (although some of these Bitcoin are presumed to be lost) and almost 400,000 Bitcoin were bought at bubble peak with a cost basis between $1,100 and $1,150. At the time this snapshot was taken, prices were at a new all-time high, such that 100% of the Bitcoin held had unrealized gains.

Despite the explosive price growth observed at this stage in Bitcoin’s development, holdings of Bitcoin remained heavily concentrated in the hands of early adopters with approximately 6.4 million of the 12 million Bitcoin in existence at the time having a cost basis between $0 and $100. As prices exceeded the previous all-time high of $200, all holders sat on unrealized gains and investor sentiment reached its most positive phase. Although there was likely interest in buying more at this phase from new adopters, existing holders find few reasons to sell, leading to constricted available supply and few net transfers of Bitcoin into the $200 to $700 price intervals.

As prices rapidly exceed $800, however, existing holders begin to be incentivized to sell some of their holdings as they experience a several hundred percent return in less than two months. Compared to the $200 to $700 price intervals, many more Bitcoin was transferred from early adopters into the $800 to $1,150 price intervals as prices peaked at approximately $1,129 on November 29, 2013. This indicates that for Bitcoin, bubbles exhaust themselves not from a lack of buying interest but because the large cohort of early adopters are incentivized to bring their previously dormant holdings to market.

Lows of the Previous Cycle on January 14, 2015

Following the peak of the previous cycle on November 29, 2013, Bitcoin experienced an 84% decline over the course of slightly more than a year. Here we show the distribution of estimated cost basis on January 14, 2015 when Bitcoin prices reached a low of $176. On this date, 43% of Bitcoin held had unrealized gains and 57% had unrealized losses.

The shape of the distribution of estimated cost basis changed substantially over the course of slightly more than one year. In contrast to the distribution seen at bubble peak, there are few holdings above $800 and the holdings of early adopters are significantly reduced.

Here we introduce another visualization that shows the change in the distribution between two points in time instead of a snapshot of the distribution at one point in time. For instance, almost 1.5 million Bitcoin that was originally in the $0 to $50 price interval was sold between November 29, 2013 and January 14, 2015.

The change in distribution illustrates a picture of complete capitulation, a state of investor psychology that is necessary for prices to completely bottom. Early in the price declines, both investors that bought at bubble peak (above $800) and large numbers of early adopters (below $150) reach the point of maximum pain and sell massive existing holdings to investors who buy the dip.

Although not easily seen in this visualization, subsequent waves of dip buyers are also seen to sell as prices continue to decline. Significant transfers are observed -- a total of 5.7 million Bitcoin out of the 13.7 million Bitcoin in existence moved from one price interval to another. Using this market cycle as a study of deeply-rooted investor psychology, prices do not bottom until capitulation is seen from investors that bought at the peak, large portions of early adopters (although not all), and from early dip buyers who represent investors with the most conviction but also reach a point of maximum pain as prices continue to decline.

Mid-Cycle Correction of the Previous Cycle on August 24, 2015

Although usually not seen as a critical event in Bitcoin’s bubble-and-crash cycles, we examine a mid-cycle correction where prices declined significantly from recent highs. This market environment most closely resembles the current state of Bitcoin as prices have declined from around $13,000 during the summer to a low of $6,500 in late November of this year. During the previous cycle (November 2013 to January 2015), after bottoming at $176, prices recovered to around $310 over the next few months before correcting 35% to $200 over the course of two months. Here we show the snapshot of the distribution of estimated cost basis on August 24, 2015, immediately following the 35% correction.

We also show the change in distribution between the lows of the cycle and immediately following the mid-cycle correction. Over the course of eight months, a significant change in the shape of the distribution is observed. We see some limited selling from early adopters with cost basis below $200, although the magnitude of selling is much less than was observed in the previous section, suggesting that capitulation of early adopters is near complete and even a 35% drawdown is not enough to cause this cohort of investors to bring more supply to market.

Importantly, we see nearly zero selling pressure from investors who bought at bubble peak (above $800) indicating that capitulation for this cohort of investors is complete. Instead, we see most selling pressure coming from investors who bought the dip as prices declined from bubble peak and from recent investors who bought as prices increased off the bottom. This cohort of investors had not yet reached the point of maximum pain prior to the sharp decline in prices.

A study of investor psychology suggests that prices cannot truly bottom until all investors have reached the point of maximum pain and capitulation is complete. An examination of the mid-cycle correction that occurred during the previous cycle indicates that selling pressure from investors who bought at the peak and most early adopters is complete. Significant capitulation was also observed from dip buyers and recent investors who had not yet reached the point of maximum pain. After this mid-cycle correction was complete, prices never declined to these levels again as the state of investor psychology had reached the point where most investors who wanted to sell had already sold.

Peak of the Current Cycle on December 17, 2017

Over the course of one year, prices passed the previous all-time high of around $1,100 and peaked at near $20,000 on December 16, 2017. Here we show again a snapshot of the distribution of estimated cost basis on this date but assign each native unit of Bitcoin to $500 bins. At this point in time, about 7.4 million out of the 16.75 million Bitcoin are held by early adopters with an estimated cost basis of between $0 and $1,000 and 98% of Bitcoin held have unrealized gains.

The shape of the distribution at bubble peak of the current cycle looks similar to the distribution at bubble peak of the previous cycle with some important differences. A large amount of transfers were observed at prices between $1,000 and $7,000 whereas transfers at intermediate prices in the previous cycle were much lower. This caused the price appreciation to occur at a slower pace over a period of about 8 months, with many significant corrections along the way.

On the other hand, we see very few transfers of Bitcoin into the $8,000 to $16,000 price intervals, not because of a lack of buying interest but because existing holders saw few reasons to sell. This coincided with an extremely rapid uninterrupted ascent in prices -- prices increased by $8,000 in only two weeks. We see increased transfers as the prices exceeded $16,000 as the high prices again incentivized early adopters to bring more supply to market. Several hundred percent increases in price in a short amount of time seem to draw early adopters, who hold significant amounts of Bitcoin, to sell their long-held Bitcoins.

Lows of the Current Cycle on December 15, 2018

The speed and magnitude of drawdown during the current market cycle are remarkably similar to the previous cycle -- both experienced a drawdown of around 84% and required about one year for the bubble to completely deflate. At the lows of the current cycle, 39% of Bitcoin held had unrealized gains, also similar in magnitude to the 43% of Bitcoin that had unrealized gains during the previous cycle. This suggests that following a bubble, maximum pain and capitulation can only be reached when prices decline to a point where only roughly 40% of Bitcoin held have unrealized gains.

Both a snapshot of the distribution of estimated cost basis and the change in the distribution also show strong similarities to the previous cycle, providing support for the assertion that bubbles-and-crashes in Bitcoin (and other financial assets) are driven by deeply-rooted cognitive biases which lead to repeating cycles.

Here we show the change in the distribution between the peak of the bubble and the lows of the current cycle. Similar to the previous cycle, strong capitulation is observed by investors who bought near the bubble peak (with cost basis above $16,000) and early adopters (with cost basis below $1,000). Few holdings remain with cost basis above $12,000 so investors belonging to this cohort are not likely to be a source of selling pressure going forward.

A total of 5.4 million Bitcoin (out of 17.4 million Bitcoin in existence) moved price intervals over the course of this year. Although not clearly seen in this visualization, investors who bought near the bubble peak and early adopters were the first group of investors to capitulate. During the final decline between $6,000 and $3,000, selling pressure was observed from investors who bought the drip as prices declined. They represent the final group to experience maximum pain and reach the point of capitulation.

One important caveat when looking at the change in distribution at this time is that Coinbase in early December 2018 migrated its holdings to an alternative set of cold wallets. According to their statements, they migrated 5% of all Bitcoin in existence, or almost 900,000 Bitcoin, most of which likely had a low cost basis.

Mid-Cycle Correction of the Current Cycle on November 25, 2019

The current state of the distribution illustrates that holdings are becoming less concentrated over time and at an increasingly higher cost basis. Whereas at bubble peak, early adopters held 7.4 million Bitcoin with cost basis between $0 and $1,000, these holdings have been gradually reduced to 5.0 million Bitcoin today. Excluding early adopters, cost basis now appears to be roughly normally distributed around $8,000, with a noticeable spike at $3,500 which coincides with the lows of the current cycle. Consistent with the lows of this cycle, holdings with a cost basis above $12,000 are at a very low level and represent a cohort of investors that have completely capitulated.

Below we show the change in the distribution between June 26, 2019 (where prices reached a local peak of $12,863) and November 25, 2019 (where prices recently bottomed at $7,139). The complete peak-to-trough drawdown during this time period has approached 50%, a very steep decline for a bull market, which has caused many market observers to question the current market regime.

Analysis of the sources of selling pressure reveals that investor concern is warranted. Unlike the mid-cycle correction observed in the previous cycle, selling pressure is broad-based and originates from many cohorts of investors. Investors that bought at the local peak with cost basis of around $12,000 to $12,500 have been heavy sellers. Dip buyers have also seen signs of capitulation with heavy selling observed from Bitcoin with cost basis between $7,500 and $8,000. Recent investors that bought after prices bottomed with cost basis between $3,000 and $6,000 also have sold significant amounts. And early adopters have been a source of small but not negligible selling pressure.

Compared to the previous changes in distribution, the current change in distribution is most similar to when prices were reaching a bottom of the cycle. This interpretation may be bullish if the types of sellers have fully reached capitulation and are likely not to be a source of selling pressure going forward. Analysis of the current distribution supports this theory. However, seeing this broad-based selling pressure may reveal that capitulation, originally thought to be complete when prices bottomed in December 2018, may actually require more time or further price declines.

Network Data Insights

Summary Metrics

BTC and ETH mining revenue are down significantly for the second straight week, mostly due to the large price decreases. Similarly, ETH fees came back down to earth, dropping 14.4% after growing by over 20% the week before (likely due to the launch of the Gods Unchained marketplace).

After dipping to a six month low of 1.23 last week, BTC market value to realized value (MVRV) ratio, calculated by dividing market cap by realized cap, started to increase again over the past week. As of Sunday, December 1st, BTC MVRV was 1.32.

XRP transactions jumped by over 50% this past week, after being up over 121% the week before. Ripple recently completed a $50M investment in MoneyGram. However, it is unclear whether this directly led to the increased activity. Despite the increased usage, XRP’s market cap dropped by 6.8% over the past week, which is a larger decrease than both BTC and ETH.

Network Highlights

After reaching all-time highs in May, the amount of Bitcoin that has not moved in over one year has since been declining. As of Nov. 31st, 3,174,760 Bitcoin had not been moved in at least one year. Comparatively, there was 4,500,526 Bitcoin that had not been moved for at least a year on May 18th, 2019.

The below chart shows the amount of Bitcoin not moved in over X years, where X ranges from one month to 5 years.

Decred daily active addresses are approaching new all-time highs. On November 16th, Decred had 25,315 active addresses, which is its highest daily total since April 23rd, 2016. The below chart shows Decred active addresses smoothed using a seven day rolling average.

Note: November’s active addresses appear to be all-time highs in the below chart because the all-time highs in April 2016 were outliers, surrounded by days with low relatively low active addresses.

Zcash, on the other hand, is trending in the opposite direction. Zcash active addresses are approaching all-time lows. As of December 1st, Zcash had 11,218 daily active addresses, which is the lowest since October, 2016. The below chart shows Zcash active addresses smoothed using a seven day rolling average.

Market Data Insights

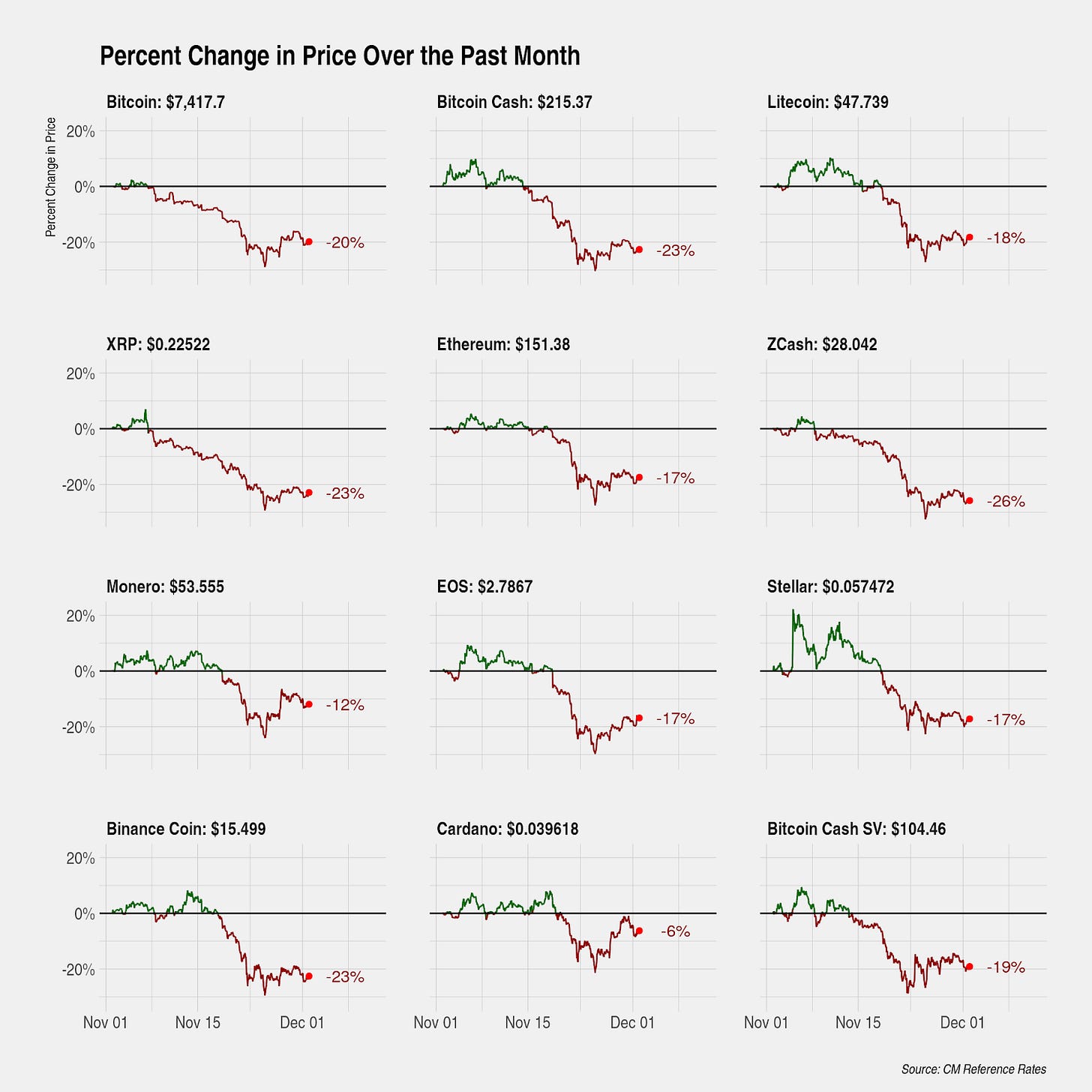

As November concludes, we examine indexed prices over the past month. Bitcoin is down 20% for the month, although slightly higher than the lows that occurred on November 25. Most other major assets are down a similar magnitude. Over the past week, Monero, EOS, and Cardano have staged decent recoveries although all assets are down for the month.

Among smaller assets, Tezos leads with a +44% return for the month of November, driven in part by the announcement that Coinbase would be offering staking rewards. Cosmos also had a positive return of +18%, but all other assets are down. Curiously, although almost all assets displayed high correlation to Bitcoin, UNUS SED LEO has exhibited unusually low correlation for an unknown reason.

CM Bletchley Indexes (CMBI) Insights

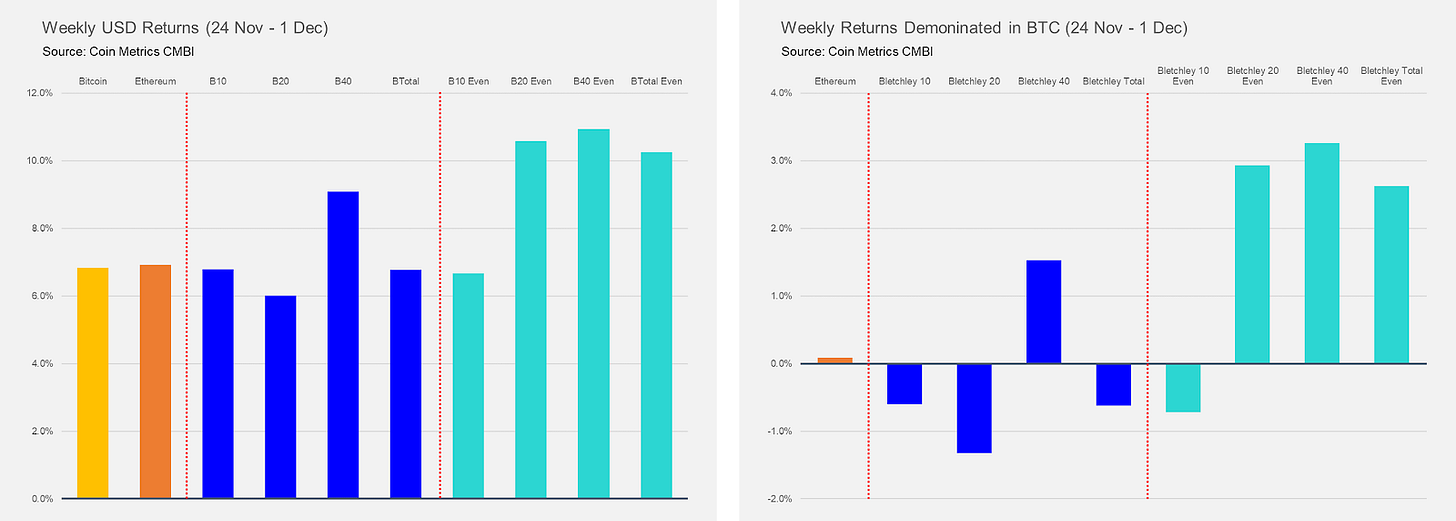

This week crypto assets experienced a slight market wide recovery, with all Bletchley Indexes returning 6-9%, after the ~20% market wide drop in the prior week. Coincidentally the even indexes outperformed the market cap weighted indexes this week, indicating that the best weekly performers within each index were the lower market cap constituents.

Despite strong weekly performance of all indexes, it was not enough to overcome a bad November against the USD, with all indexes experiencing significant losses. The Bletchley 20 and Bletchley 40 performed best over the month, indicating that mid and small-cap crypto assets outperformed large-cap crypto assets for the second month in a row.

Large-cap assets seem to have largely moved in tandem with Bitcoin over November, evidenced by the negligible returns of the Bletchley 10 in BTC terms, whereas the Bletchley 20 and Bletchley 40 both had positive returns, 10% and 7.5% respectively, against a BTC pairing.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Coin Metrics is hiring! We recently opened up 6 new roles, including Blockchain Data Engineer and Data Quality and Operations Lead. Please check out our Careers page to view the openings.

As always, if you have any feedback or requests, don’t hesitate to reach out at info@coinmetrics.io.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.