Coin Metrics' State of the Network: Issue 76

Tuesday, November 10th, 2020

Weekly Feature

Bitcoin: An Unprecedented Experiment in Fair Distribution

By Lucas Nuzzi and the Coin Metrics Team

The following is an excerpt from a full-length report which has been truncated due to space limitations. Read the full report here.

Much has been written about the fundamental differences between Bitcoin and other asset classes. In fact, juxtapositions of Bitcoin and established commodities such as gold continue to lure swarms of newcomers into this industry, institutional and retail-alike.

But are there factors that make Bitcoin fundamentally different than other cryptoassets?

As the first-ever successful implementation of a digital currency, it’s common to see Bitcoin serve as a punching bag for technologists. To many of them, Bitcoin is a first-generation technology and, as such, it is plagued by a lack of transactional throughput and feature richness. But make no mistake: Bitcoin’s uniqueness goes far beyond the scope of technology. It is an unprecedented experiment in wealth distribution.

In bull markets, the proverbial comparisons of Bitcoin and the likes of dial-up internet, or email in the 1980s, are vast and plentiful. Too often, these are part of deliberate marketing strategies pushed by proponents of emerging cryptoassets that reportedly succeed where Bitcoin has failed. Tragically, newcomers confronted by a strictly technological comparison framework are ultimately pushed to the margins, especially as debates turn hyper-technical.

While it is undeniable that technology plays a role in evaluating the merits of any cryptoasset, there’s certainly more to the story. What technologists and, by extension, most newcomers often overlook is the fact that cryptoassets function as digital economies. And just like real-world economies, the technology through which currency is accounted for (governments, banks, payment networks) is often far less important than how that currency was and is effectively distributed (monetary policy and wealth distribution).

On-chain data provides a new paradigm for this type of economic analysis, as it makes possible the identification of inequitable wealth distributions at the asset level. After all, blockchains at their core provide a full history of ownership structures, and that history often speaks volumes. Cronyism, amongst other unfair supply distribution models, inescapably result in incredibly centralized monetary bases. Through on-chain data, we can identify ownership structures antithetical to Bitcoin’s and quantify the degree of wealth centralization within their digital economies.

To paint a full picture of the factors that drive fair supply distribution, we will begin this post by reviewing Bitcoin’s early history. Then, we will take a closer look at distribution through mining and the impact of industrialization. Lastly, we will showcase two novel supply dispersion metrics to evaluate the wealth distribution of dozens of assets relative to Bitcoin.

The Genesis of Magical Internet Money

Bitcoin’s early history is an attestation to the novelty of a purely digital currency. Its earliest transactors were likely enticed by Satoshi’s post on the P2P foundation forum, where he first introduced the system. Back then, only the technically savvy were able or willing to continuously run a network node. Even fewer participants were able to properly custody their wallets, as that would require some understanding of PGP encryption as well as a ton of patience to deal with the inevitable bugs in Bitcoin’s first wallet (if you can even call it that). There wasn’t even an exchange rate for the earliest of adopters to begin to fathom valuing their Bitcoins.

Coupled with the aforementioned technical complexity, the results of early experiments on Bitcoin were disastrous: there is an exorbitant amount of BTC that is believed to have been permanently lost during that period. Transactors, after all, treated Bitcoin as it was back then: a curious experiment of digital monopoly money.

Perhaps no other time series better showcases the unserious nature of early Bitcoin than the chart below. It demonstrates how it took until nearly 2011 for Bitcoin transactors to start using decimals (green line) when sending BTC. Until then, all transactions used full units of BTC (purple line) as users experimented with sending full bitcoins to one another.

This is evidence of the stark difference between Bitcoin and all cryptoassets that followed. Bitcoin set a precedent for the convertibility of a digital asset and fiat currencies, like the US dollar. As a result, early adopters of other cryptoassets assumed value from day one, as opposed to carelessly experimenting. Although it is obviously better for end users to have reliable custody and some idea of asset valuation from the get-go, that experimentation in Bitcoin ultimately led to an unmatched level of supply turnover.

A direct way to measure supply turnover is through supply velocity metrics. As covered in previous SOTN issues, velocity measures the amount of times an average unit of supply has been transferred. It is generally calculated by dividing supply transferred by the total monetary base. In order to provide a better representation of short-term turnover, the particular variation of velocity showcased below filters activity by supply that was active in the trailing 1yr (instead of using total supply).

A key element of Bitcoin’s unmatched distribution are the clear periods of high supply turnover, showcased as cycles of increased velocity. Such cycles depict early adopters making way to new adopters who, when the time comes, make way to even newer adopters. In the past, Bitcoin’s ferocious price rallies have been a considerable driving force for supply turnover.

Again, precedents are important. The lack of a successful precedent for Bitcoin made it so that Fear, Uncertainty and Doubt constantly tormented the minds of early adopters, and newer adopters provided a way out through the markets.

Fair Distribution by Design

As mentioned in the introduction, a cryptoasset’s underlying technology is most definitely not the sole determinant of its intrinsic value. However, it is still an important factor to consider as it often plays an enormous role in the distribution of supply. Bitcoin solved a decades-long problem in distributed computing dubbed the “Byzantine’s General Problem”, which has to do with reaching consensus on the validity of a statement amongst untrusted parties. What is truly remarkable is that Satoshi’s solution not only addressed the issue of distributed consensus, but did so with an activity that intrinsically fosters monetary decentralization: mining.

By design, Bitcoin mining is an activity that pushes the forces of fair distribution. In order to be profitable, miners must operate on long time horizons as they have fixed operational costs. However, the BTC reward issued for this activity widely fluctuates as Bitcoin’s price carries high volatility. This nudges miners to carefully manage their treasuries and constantly sell their holdings for operational purposes like paying for electricity, as well as strategic requirements like upgrading their hardware to remain competitive. This ultimately increases supply turnover.

Apart from the effective validation of Bitcoin transactions, this activity strengthens the network by increasing the cost to attack it. By its very nature, Bitcoin’s underlying monetary policy fosters competition as its inflation rate decreases over time with every halvening. Even though miners have consolidated and fully industrialized as time progressed, the sheer size of existing operations leaves less room for them to speculate, which pushes new supply to change hands.

Crypto Assets and Wealth Inequality

Thus far, we have covered the fundamental factors that have affected Bitcoin’s supply distribution. Now it is time to assess the extent to which these factors differentiate Bitcoin from other assets. In economics, there is extensive literature on wealth inequality and supply dispersion metrics. Unfortunately, the cryptoasset industry has not converged on an equivalent set of metrics. We hope to change that, and have devised a new set of metrics to quantify wealth inequality across many cryptoassets.

Continue reading “Bitcoin: An Unprecedented Experiment in Fair Distribution” here…

Network Data Insights

Summary Metrics

Source: Coin Metrics Network Data Pro

It was a big week for Bitcoin (BTC) with market cap surging past $260B for the first time since January 2018. In addition to price, network usage was also up across the board. BTC active addresses grew by 17.9% week-over-week and averaged over 1M a day, after averaging only about 861K a day the previous week. Hash rate rebounded and grew 10.1% week-over-week after a precipitous drop likely caused by changing weather conditions in China. Daily transaction fees also continued to climb, averaging about $3M a day. Overall, the surge in usage and fundamental metrics is a positive sign that BTC is in a good position to continue its price growth.

Ethereum (ETH) also had a big week, with release of the Ethereum 2.0 deposit contract which allows users to start locking up ETH in anticipation of Ethereum’s upcoming transition to proof-of-stake. The deposit contract will serve as a one-way bridge - once the funds are committed to the contract they cannot be subsequently unlocked and used on the main (Ethereum 1.0) chain. Therefore the supply locked into the contract is effectively taken out of circulation, at least until the launch of Ethereum 2.0. Once 524,288 ETH is locked into the contract Ethereum will launch Phase 0 of Ethereum 2.0, which will be a multi-year process aimed at exponentially increasing Ethereum’s scalability. At time of writing, the deposit contract already holds about 49,500 ETH.

Network Highlights

On November 3rd an old Bitcoin address that had been dormant since 2013 suddenly came to life and transferred 69,369 BTC to an initially unknown destination. The transfer of almost 70K BTC was one of the largest single-day movements of dormant supply in Bitcoin’s history. The below chart shows the daily amount of BTC supply that has been revived after remaining inactive for at least five years. Since the initial transaction, it's been revealed that the address was tied to early darknet marketplace Silk Road, and that the BTC was seized by the United States Department of Justice.

Source: Coin Metrics Network Data Charts

On November 4th the percent of BTC unspent transaction outputs (UTXOs) in profit topped 98% for the first time since December 2017. Every time a Bitcoin transaction occurs at least one UTXO is created. UTXOs represent coins that can be spent as inputs to future transactions. We consider a UTXO “in profit” if BTC’s price at the time of the UTXO creation was lower than BTC’s current price. Theoretically, this means that the UTXO’s owner can sell their BTC at a profit (assuming that their initial transaction represented a purchase price). A high percentage of UTXOs in profit potentially signals that there is relatively low sell pressure, since there’s low risk of capitulation. But conversely it could signal that some investors may soon start taking profits if the potential gains become too good to pass up.

Source: Coin Metrics Network Data Charts

Decentralized finance (DeFi) is showing signs of life. After declining over the last few months, yearn.finance (YFI) transaction count hit a new all-time high of 11.3K on November 7th. With ETH pumping, DeFi could be in store for a resurgence, although it remains to be seen whether we will ever return to the days of peak DeFi mania.

Source: Coin Metrics Network Data Charts

Market Data Insights

We have rapidly reached levels over the past month not seen since late 2018 and are closing in on all-time highs. Bitcoin moved ~$2,000 week-over-week with a close of $15,483. The high for the week reached over $16,000 on some exchanges.

Source: Coin Metrics Reference Rates

But the macroeconomic backdrop shifted a bit over the weekend. With the recent results from a Pfizer vaccine for COVID-19 and the “blue wave” not coming to fruition, the magnitude of future fiscal stimulus via central bank policy appears to have decreased. On Monday the markets reacted by punishing inflation hedges when money moved from safe havens to risk-on assets, sending gold down 5% for its worst day since August. Bitcoin ended the day down roughly 1%.

Source: TradingView.com

CM Bletchley Indexes (CMBI) Insights

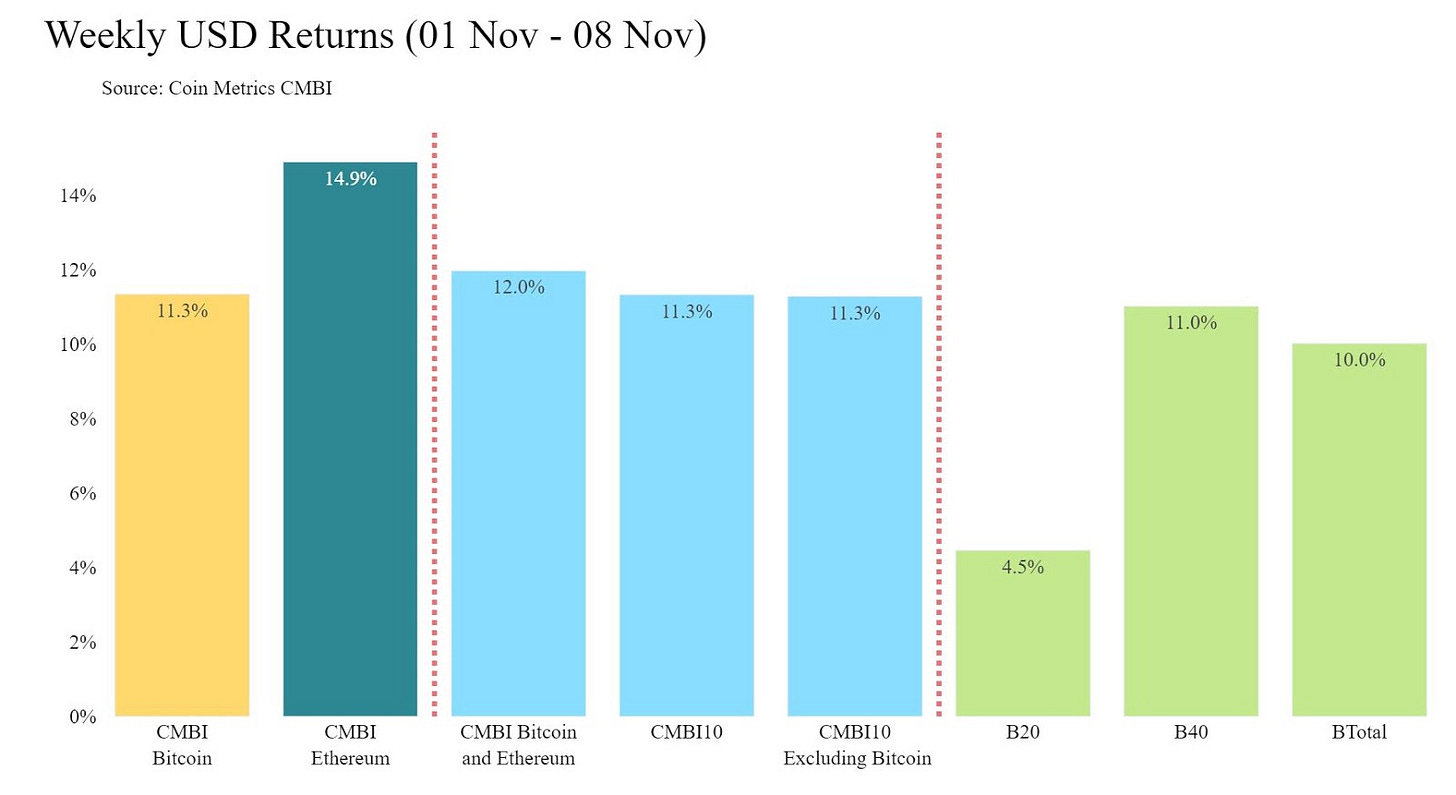

It was an incredible week for all CMBI and Bletchley Indexes with most indexes returning above 10%. The CMBI Ethereum was the strongest performer, gaining momentum after the announcement of the Ethereum 2.0 staking contracts and closing the week at $451.79, up 14.9%. The CMBI Bitcoin also performed strongly, adding to its impressive run of 5 consecutive positive weekly returns, up 11.3% to $15,400.29.

The small cap assets showed a strong reversal after several weeks of negative returns, increasing 11% for the week. The mid caps performed well against the USD, increasing 4.5%, but underperformed the rest of the market.

The CMBI Bitcoin Hash Rate reversed its consecutive down weeks after a difficulty adjustment last week. The index closed the week up 13%, spending most of the week in the 115-130 exahashes per second range.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

We’re excited to announce the new Coin Metrics mobile app. View real-time cryptoasset pricing and relevant on-chain data in a single app! Download for free here: https://coinmetrics.io/mobile-app/

As always, if you have any feedback or requests, don’t hesitate to reach out at info@coinmetrics.io.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.