Coin Metrics' State of the Network: Issue 112

Tuesday, July 20th, 2021

Get the best data-driven crypto insights and analysis every week:

Crypto Google Search Trends Analysis

By Nate Maddrey and Kyle Waters

Google search data is often used to analyze a wide-variety of trends. Although a Google search doesn’t necessarily translate into a crypto purchase, analyzing search data for crypto-related keywords can help shed light on retail interest in a variety of cryptoassets.

In this week’s State of the Network we compare Google Search Trend data to our network and market data to analyze how Google search interest relates to price and usage changes.

Bitcoin Search Trends

Worldwide Google search volume for Bitcoin shows that interest levels closely followed BTC’s rapid price movements this year and tend to track major changes in price historically. While Google Trends data is not absolute search volume for Bitcoin, it does show the relative level of popularity for Bitcoin searches over time.

Sources: Coin Metrics Reference Rates, Google Trends

Relative search interest this year for Bitcoin has not yet surpassed levels achieved in late 2017. This might be a sign that many retail investors and the general public were already aware of Bitcoin prior to the recent price movements this year. Institutional adoption is a big reason for Bitcoin’s recent successes in 2020/2021 which will not be captured easily from Google search interest.

Ethereum Search Trends

While Bitcoin’s search interest did not surpass levels of popularity in 2017, Ethereum reached a new peak in worldwide Google search popularity earlier this year. Supported by mass interest in NFTs and the continued adoption of DeFi, global interest in Ethereum has been at an all time high in 2021.

Sources: Coin Metrics Reference Rates, Google Trends

With retail investors likely playing a large role in Ethereum’s success in 2021, it is unsurprising to see such high interest via Google search. Surging Google search interest for MetaMask, an ETH wallet that counted five million monthly active users in April, is also consistent with higher ETH usage. Institutional adoption of ETH is in its early stages but might accelerate like Bitcoin following this recent burst of interest.

Dogecoin Search Trends

Dogecoin (DOGE) had very little relative Google search interest before 2021. Then in January DOGE suddenly started to skyrocket. DOGE searches surged the week of January 24th, as DOGE price climbed from under a penny to close to 5 cents. DOGE search volume peaked the week of May 9th, right before the crypto-wide market crash.

Sources: Coin Metrics Reference Rates, Google Trends

Interestingly, Dogecoin searches initially spiked the same week that popular meme stocks GME (Gamestop) and AMC (AMC Entertainment Holdings) did. This coincided with GME’s sudden surge and Robinhood’s subsequent halting of GME and AMC trading on January 28th. Robinhood is also a popular platform for DOGE trading - according to Robinhood’s latest S-1, DOGE trading accounted for “34% of our cryptocurrency transaction-based revenue” in Q1 2021, up from 4% in Q4 2020.

Source: Google Trends

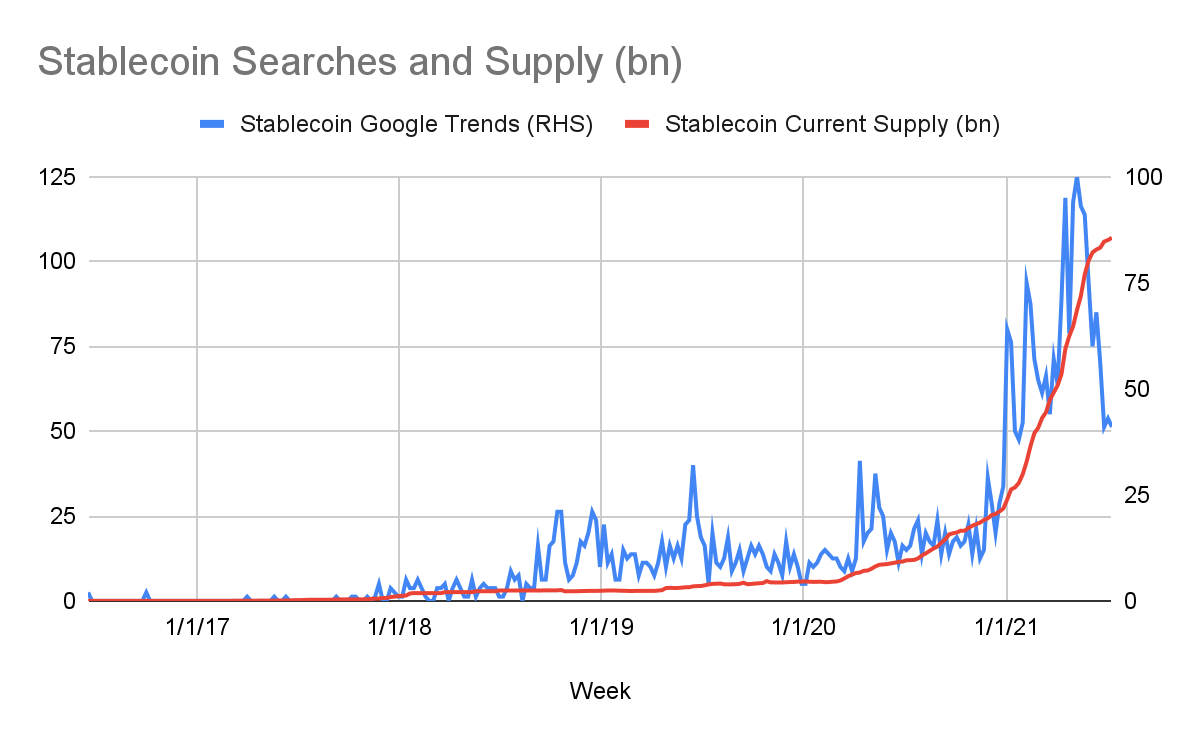

Stablecoin Search Trends

A big development in the crypto ecosystem over the last year has been the continued issuance and adoption of stablecoins. Search interest for stablecoins has surged like never before in 2021, eclipsing the fall 2018 launch of USDC and the June 2019 announcement of Facebook’s Libra (rebranded to Diem) project and subsequent update in April 2020. This search popularity is consistent with the growth in the supply of these tokens including Tether, USDC, DAI, BUSD, HUSD, and PAX.

Sources: Coin Metrics Network Data Charts, Google Trends

This topic is likely to remain a popular one, especially in the US, with the Federal Reserve expected to release a report in early September on the potential for a digital version of the US dollar (CBDC), stablecoins, and cryptoassets in general. Ahead of this paper, Secretary of the Treasury Janet Yellen has also convened the President’s Working Group on Financial Markets (PWG) and other agencies to discuss stablecoins, a sign they are top of mind for US authorities. Finally, the expected public listing of USDC operator Circle via a SPAC merger will likely drive new conversations around stablecoin transparency.

Geographic Insights

While global search interest for Bitcoin is relatively lower compared to earlier years, there are geographic pockets where interest in Bitcoin has never been higher. Search interest for Bitcoin in El Salvador boomed following the June announcement that bitcoin would be accepted as legal tender.

Source: Google Trends

Note that because Trends data is a relative measure to max popularity, the small interest levels prior to this announcement do not necessarily mean Bitcoin was unpopular or unheard of in El Salvador. More likely, the spike just reflects an exceptional increase in search volume for Bitcoin in the country.

In fact, El Salvador is ranked first among all regions with the highest proportion of Google search interest in Bitcoin over the last 90 days ended July 18, 2021.

Source: Google Trends

Interestingly, the top countries are fairly constant across different time windows. Future analysis of global Bitcoin adoption would help identify the local forces driving interest in these individual countries and others.

To follow the data used in this piece and explore our other on-chain metrics check out our free charting tool, formula builder, correlation tool, and mobile apps.

Network Data Insights

Summary Metrics

Source: Coin Metrics Network Data Pro

The total supply of Tether (USDT) was again stagnant over the last week and hasn’t grown since the end of May. Because USDT is mostly used during Asian and European market hours, this might signal weaker demand in Asia, likely due to ongoing regulatory pressure.

Meanwhile, USDC supply continues to expand, growing another 2.5% in the last week. While USDT supply has been flat since June 1, USDC supply has grown by roughly 4B from ~22B to ~26B. This may point to changing dynamics in stablecoin use and supply.

Network Highlights

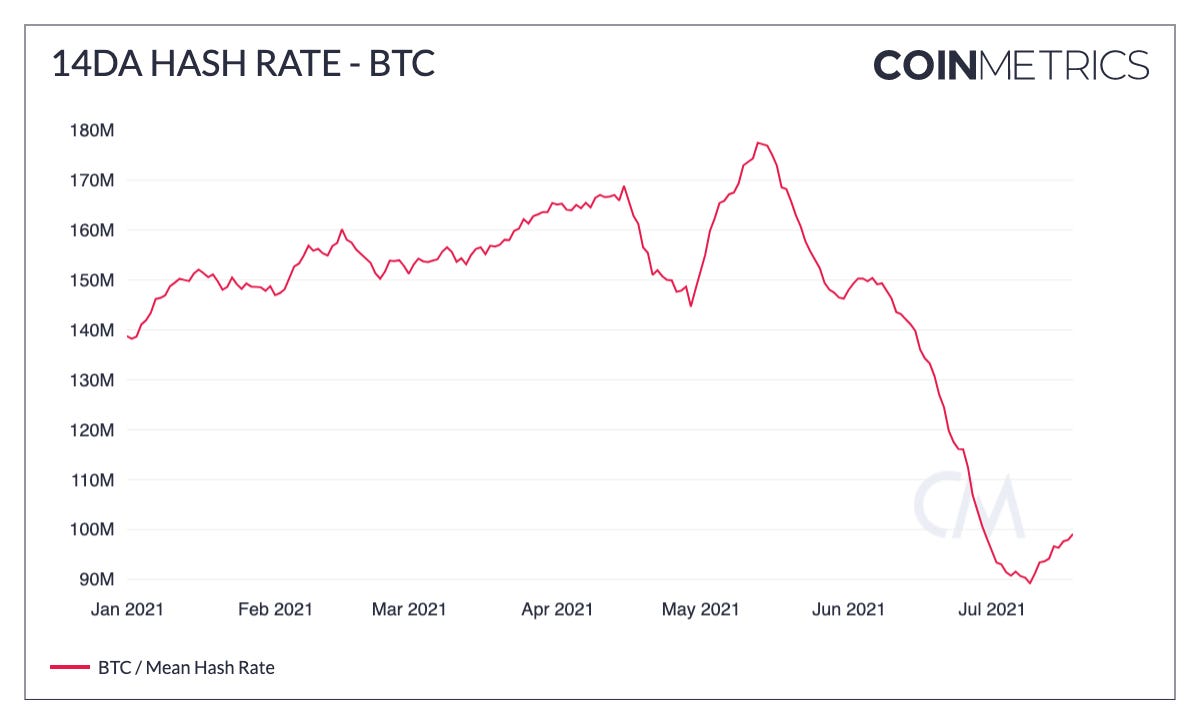

China’s sudden crackdown on Bitcoin mining in Q2 2021 (see our Q2 recap here) left miners with no choice but to shut down operations and move resources elsewhere. Bitcoin’s hash rate fell by ~50% as a result, but appears to be rebounding (2-week moving average).

Source: Coin Metrics Network Data Charts

This might suggest that some Chinese miners have successfully relocated and restarted their mining rigs. In addition, Ethereum’s hash rate has also started to bounce back.

Source: Coin Metrics Network Data Charts

Interestingly, new data from the Cambridge Bitcoin Electricity Consumption Index (CBECI) show that China’s share of total Bitcoin hash rate was declining prior to the government’s mining shutdown. This indicates that China was already becoming a less popular destination for new mining operations. The data also imply that the US and Kazakhstan have been gaining most in the share of hash rate up to April 2021. It’s still unclear where Chinese miners will relocate after the recent ban, but gains in hash rate share for these two locations might be a good signal to follow.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Check out our market-data focused newsletter State of the Market, featuring weekly updates on market conditions.

We’re excited to announce the Coin Metrics mobile app. View real-time cryptoasset pricing and relevant on-chain data in a single app! Download for free here: https://coinmetrics.io/mobile-app/

Coin Metrics is actively hiring for many positions including in engineering and data science. If you are interested in learning more about our open roles please visit our careers page.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.