Coin Metrics' State of the Network: Issue 71

Tuesday, October 6th, 2020

Weekly Feature

Introducing the CMBI Multi Asset Series

By Ben Celermajer and the Coin Metrics Team

The following is an excerpt from a full-length report which has been truncated due to space limitations. Read the full report here.

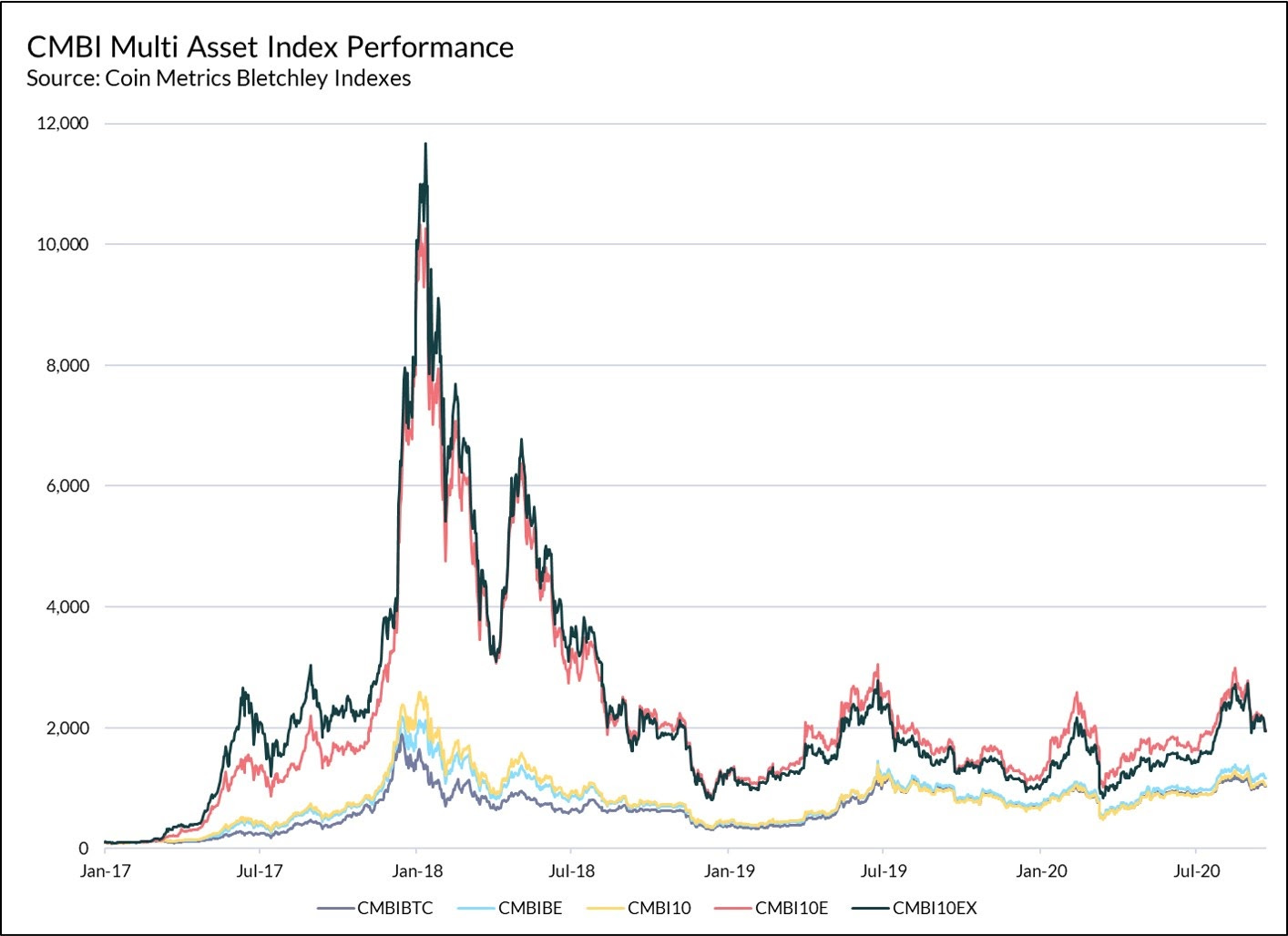

In this week’s State of the Network we are excited to announce the release of the CMBI Multi Asset Series, the first industry indexes that weigh cryptoassets by their Free Float Market Capitalization.

We are particularly excited to bring these indexes to market after almost a year of design and methodology testing, and to share the design considerations and unique data constructs utilized in the index calculations. Cryptoassets are here to last, and as such, Coin Metrics determined it imperative to design a methodology that meets the standards of traditional capital markets and takes the next step towards professionalization of this asset class.

Throughout this feature, we will discuss the key and unique data components used in the determination of CMBI products, elaborate on the importance of each design consideration, and share the performance of the methodology relative to current standard practices.

The initial indexes that form part of the Coin Metrics Bletchley Index (CMBI) Multi Asset Series include:

CMBI Bitcoin and Ethereum (CMBIBE)

CMBI 10 (CMBI10)

CMBI 10 Excluding Bitcoin (CMBI10EX)

CMBI 10 Even (CMBI10E)

These new indexes broaden Coin Metrics’ Index services, and join the already live CMBI Single Asset Series (CMBI Bitcoin and CMBI Ethereum) and CMBI Mining Series (CMBI Bitcoin Hash Rate and CMBI Bitcoin Observed Work).

The Need for Crypto Indexes

Well-designed and independently administered indexes are an important aspect of capital markets. They help to bring transparency and clarity to markets that investors wish to better understand and potentially invest in. This particularly rings true in the cryptoasset industry which can be confusing to new investors given its nascent form. The spot price of cryptoassets can vary globally, the on-chain characteristics of cryptoassets can be opaque, the market’s trading activity can be misrepresented, and many trading venues still operate in loosely regulated environments.

The Coin Metrics Bletchley Indexes (CMBI), administered by Coin Metrics, have been designed to provide the cryptoasset market with a formalized, transparent and robust set of benchmarks on which to conduct research, measure performance, or create institutional quality financial products. The CMBI Principles outline the ethos and act as a guideline that informs the design of all CMBI products.

The most common path for many new retail and institutional investors looking to allocate to crypto is to first acquire Bitcoin and maybe Ethereum. As such, Coin Metrics’ first fore into indexes was to develop robust Bitcoin and Ethereum Indexes that were:

Designed in line with traditional capital markets best practices, such as the IOSCO Financial Benchmarking Principles.

Manipulation resistant to severe and outlier market conditions.

Transparent and rules based to enhance investor comfort.

Aligned with current regulatory concerns such as the potential for market close manipulative practices.

However, as investors become more familiar with cryptoassets, there is an increasing desire to broaden their exposure to multiple cryptoassets. This was most recently evidenced in Fidelity’s 2020 Institutional Digital Asset Investor Survey, which suggests as many as 2/3 institutional survey respondents indicated interest in diverse cryptoasset exposure.

Granted this, the logical next step for Coin Metrics was to explore designing and developing a series of multi asset indexes for these investors to back-test strategies and allocate capital as and when they are ready to do so.

Continue reading Introducing the CMBI Multi Asset Series...

Network Data Insights

Summary Metrics

Source: Coin Metrics Network Data Pro

After initial panic following the announcement of the BitMEX arrests, Bitcoin (BTC) and the other major cryptoassets have stabilized and started to recover. BTC managed to finish the week in the green (week-over-week) for most network metrics, buoyed by a strong start to the week.

Ethereum (ETH) activity continued to tumble following the deflation of end-of-summer DeFi hype. Active addresses fell another 5.1% week-over-week and dipped as low as 412.9K on September 30th.

Network Highlights

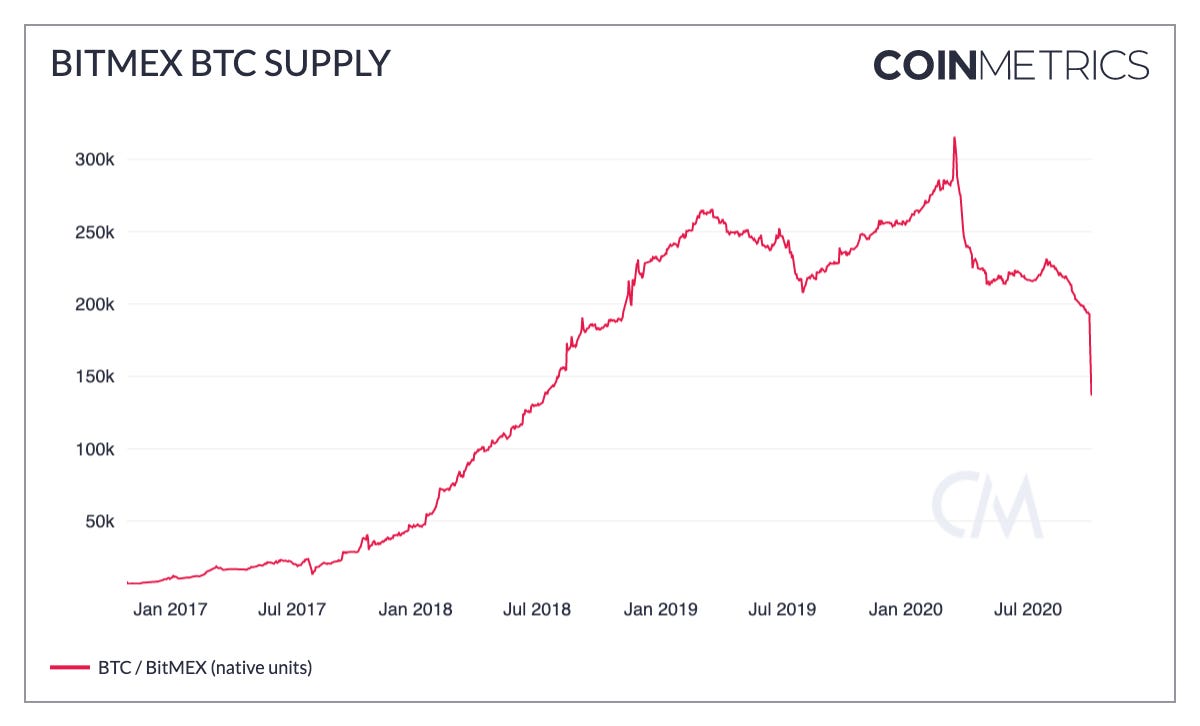

On October 1st news broke that BitMEX executives had been charged with violating the Bank Secrecy Act, as well as willfully failing to establish and implement an adequate anti-money laundering program. BitMEX CTO Samuel Reed was arrested while the rest of the BitMEX executive team remains at large.

Crucially, BitMEX’s funds are held in multisig wallets that require a signature from multiple private keys in order to be unlocked. BitMEX’s three founders each hold a key, and two of three partners must sign each withdrawal. So the funds may have been unobtainable if multiple founders were arrested.

The market reacted quickly. BitMEX had its largest daily BTC outflow ever, as investors rushed to remove their funds from the exchange. At least for now, there have been no issues with withdrawing funds.

Source: Coin Metrics Network Data Charts

Zooming in, BitMEX had a net outflow of over 20K BTC on October 1st and an outflow of over 34K BTC on October 2nd. However, by October 3rd, as it became apparent that funds would not be locked on BitMEX (at least temporarily), things began to stabilize. BitMEX actually had a positive net inflow of about 472 BTC on October 4th.

Source: Coin Metrics Network Data Charts

As a result of the large outflows BitMEX’s BTC supply plummeted to its lowest levels since July 2018. In total, over $500M worth of BTC was withdrawn from the exchange between September 30th and October 3rd. But despite the drop, there is still close to $1.5B worth of BTC held on BitMEX.

Source: Coin Metrics Network Data Charts

Market Data Insights

Last Thursday we saw a bit of a selloff following the arrest of Samuel Reed of BitMEX. Bitcoin fell roughly 5% in as the news broke but has retraced two-thirds of that decline in the time following.

Source: Coin Metrics Reference Rates

What has not recovered as quickly is the open interest in the XBT Perpetual contract on BitMEX. In parallel to the price drop roughly $130M in open interest on the contract was closed, falling from ~$590M to ~$460M.

Source: Coin Metrics Market Data Feed

Other exchanges with similar contracts saw temporary declines in open interest as well, however most of them gained it back in the period following. This may be traders that intend to keep the position on and remove some risk by either moving some size to other exchanges or off of BitMEX entirely.

CM Bletchley Indexes (CMBI) Insights

With the launch of our CMBI Indexes announced in this week’s feature we underwent our first rebalance for the CMBI Multi Asset Series. During the rebalance the CMBI10 added Polkadot and Binance and removed Cardano and Tezos.

A relatively quiet week for cryptoasset markets that saw all CMBI and Bletchley Indexes finish the week slightly down. The CMBI Ethereum was least impacted by the week's movements, closing 0.2% down at $352.36. The CMBI Bitcoin also finished the week slightly down, falling 0.4% to close at $10,678.54. All Bletchley Indexes finished the week between 0.9% and 1.4% down, with the large caps (Bletchley 10) being the least impacted by this down week.

More performance information on each of the CMBI products can be found in our factsheets:

CMBI Bitcoin and CMBI Ethereum can be found in the September CMBI Single Asset Series Factsheet.

CMBI Bitcoin and Ethereum, CMBI 10, CMBI 10 Excluding Bitcoin, CMBI 10 Even can be found in the September CMBI Multi Asset Series Factsheet.

CMBI Bitcoin Hash Rate and CMBI Bitcoin Observed Work can be found in the September CMBI Mining Series Factsheet.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

We’re excited to announce the new Coin Metrics mobile app. View real-time cryptoasset pricing and relevant on-chain data in a single app! Download for free here: https://coinmetrics.io/mobile-app/

As always, if you have any feedback or requests, don’t hesitate to reach out at info@coinmetrics.io.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.