Coin Metrics' State of the Network: Issue 96

Tuesday, March 30th, 2021

Get the best data-driven crypto insights and analysis every week:

The State of the Network Q1 Wrap-Up

By Nate Maddrey and the Coin Metrics Team

Crypto has already undergone rapid expansion in 2021. We’ve seen new all-time highs and a new wave of adoption and excitement. In this special issue of State of the Network we look back at Q1 2021 and analyze the data behind the trends.

Institutional Growth

Institutional investors have continued to enter crypto in Q1 2021, although many have done so relatively quietly compared to Q4 2020. The new wave of institutional interest helped push bitcoin’s (BTC) price past $50K in February, then past $60K in March.

Source: Coin Metrics Reference Rates

The biggest news came in early February when Tesla announced a $1.5B purchase of BTC. The announcement sent BTC to a new all-time high of over $46K. In March Tesla followed up by saying that they will also accept BTC as payment and operate their own Bitcoin nodes, a signal that they are likely invested for the long-term. In addition to Tesla, Square and MicroStrategy announced purchases of more BTC in Q1 2021, adding to their growing reserves.

Banks also began to get in on the act. On February 11th BNY Mellon became the first global bank to announce integrated services for BTC and other cryptoassets. On March 17th news came out that Morgan Stanley is planning to launch three funds that enable BTC ownership for their high-end clients.

New crypto investment vehicles are emerging and bitcoin ETFs are finally gaining real momentum. On March 25th Fidelity announced a new filing for a bitcoin ETF which they’ve named “Wise Origin” as a nod to Satoshi Nakomoto. Although we are still waiting on the first United States approved bitcoin ETF several have already launched in Canada.

And on February 25th Coinbase filed their S1 in anticipation of their upcoming IPO. Other crypto exchanges may follow in Coinbase’ footsteps with Kraken’s CEO announcing that they may go public next year.

There have been some bump points along the way, including selloffs after price reached $58K on February 21st and when it topped $61K on March 13th. With new money pouring into the market BTC futures open interest levels hit all-time highs preceding both major selloffs. Although painful in the short-term, these sell-offs helped close out some over-leveraged positions, clearing the path for further growth.

Source: Coin Metrics Market Data

Despite the entrance of traditional investors, BTC’s correlation with traditional markets has dropped in Q1 2021.

The following chart shows BTC’s correlation with the S&P 500, using SPY as a proxy. BTC-SPY correlation shot up to new all-time highs following the March 2020 crash as both markets sold off in unison. But BTC has historically had low correlation with the S&P 500. After increasing throughout 2020, in Q1 2021 BTC-SPY correlation has dropped back down closer to historic levels.

Source: Coin Metrics Correlation Charts

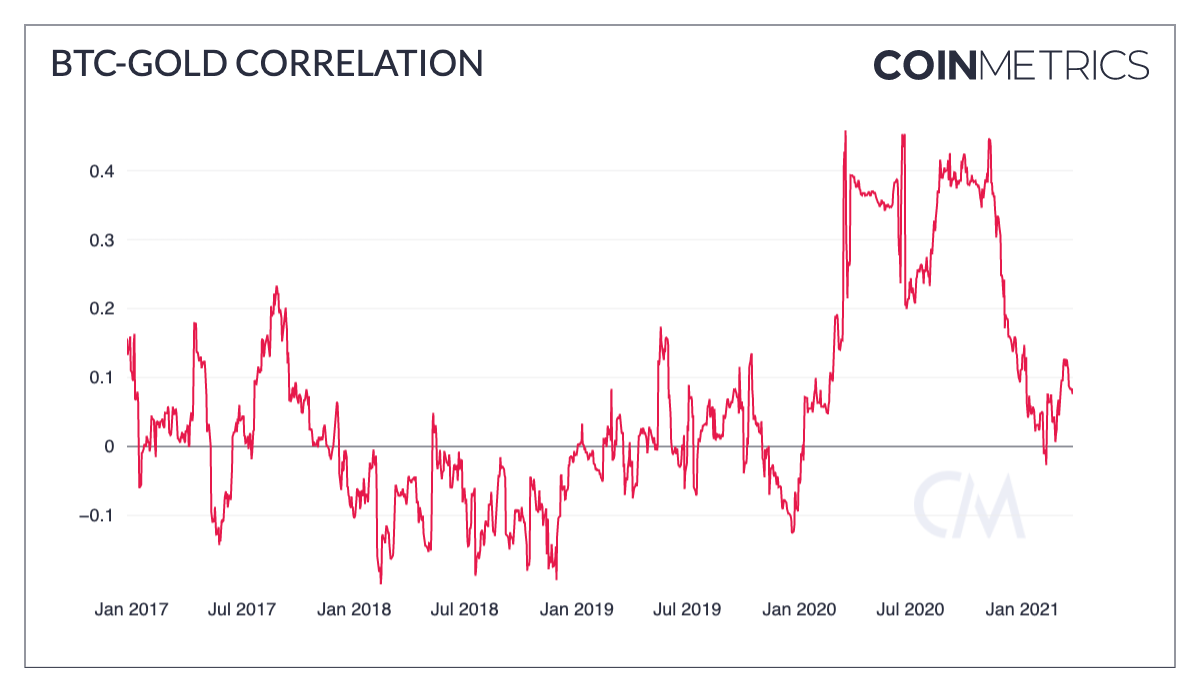

The change in BTC’s correlation with gold (using GLD as a proxy) has had an even steeper decline, although it rebounded a bit in March. This has led to commentary that BTC is eating into gold’s market share as the “bitcoin is digital gold” narrative gains momentum.

Source: Coin Metrics Correlation Charts

Ethereum’s Surge

Ethereum (ETH) is also off to a strong start to 2021 with a frenzy of new activity. ETH price also broke new all-time highs in Q1 2021, peaking at over $2k on February 20th.

Source: Coin Metrics Reference Rates

Decentralized finance (DeFi) surged back into the spotlight in early 2021 following its initial rise in summer 2020. All of the major DeFi tokens had a great first quarter, with most up at least 100%.

Uniswap (UNI) led the way amongst the large-cap DeFi tokens, rising 486% since January 1st, 2021. With Uniswap V3 and the introduction of concentrated liquidity officially scheduled for launch on May 5th it's shaping up to be a big year for Uniswap and decentralized exchanges (DEXs) in general. Other DEX tokens such as SUSHI, CRV, BAL, 1INCH, and ZRX were also up big this quarter, each growing by at least 250% since the start of the year.

Source: Coin Metrics Reference Rates

But Ethereum’s biggest Q1 storyline was undoubtedly the explosion of non-fungible tokens (NFTs). Ethereum has hit the mainstream media more than ever before thanks to huge cryptoart sales headlined by Beeple’s Christie’s auction, celebrity attention from Mark Cuban, Elon Musk, and others, and the explosion of digital collectibles like CryptoPunks and Hashmasks.

Driven by this new interest, there are about 800,000 more addresses holding at least 0.1 ETH than there were at the beginning of the year.

Source: Coin Metrics Network Data Charts

The flurry of activity is great for Ethereum’s long-term prospects. But it has brought some short-term growing pains.

Ethereum transaction fees have shot up to new highs in early 2021. For context, at the peak of the 2017/2018 bull run, average Ethereum transaction fee reached $5.70. Ethereum average transaction fee has been more than $5.70 every day since January 18th, 2021. The median transaction fee has been above $10 for most of the year.

Part of the growth in transaction fees has been due to the sharp increase in ETH price. As ETH gets more valuable, transaction fees get more and more expensive when measured in USD. But it's also due to a large increase in gas prices caused by network congestion.

Further complicating things, Ethereum’s fee structure is set to change this July now that Ethereum Improvement Proposal (EIP) 1559 is officially set for inclusion in the upcoming London hard fork.

For a detailed overview of what’s causing Ethereum’s current high gas prices and how things will change with the launch of EIP-1559, check out our latest in-depth research report: The Ethereum Gas Report.

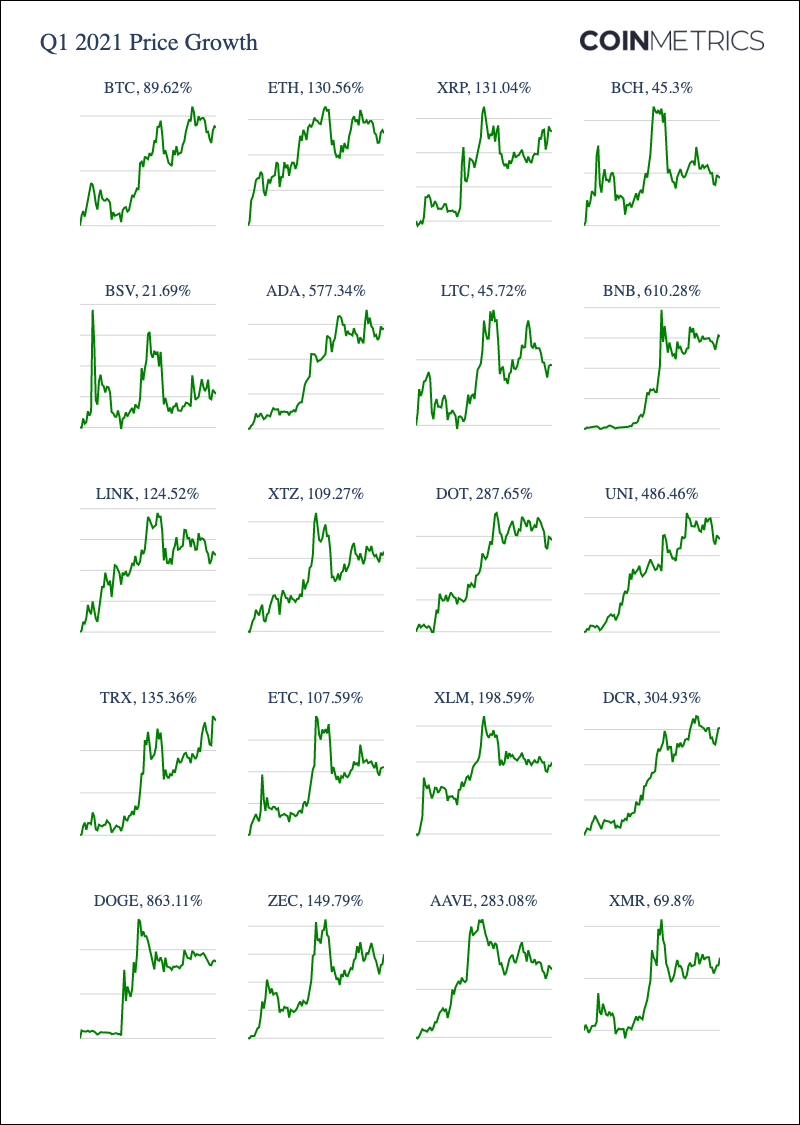

Rising Tide

Q1 2021 also saw the rise of many other projects and protocols, both old and new. Notably, potential Ethereum competitors had a big quarter as some investors grew concerned about Ethereum’s high transaction fees. This differs from Q4 2020, when BTC and ETH outperformed compared to most other major cryptoassets.

Binance Coin (BNB) grew 610% since the start of the year with a big leg up in mid-February. Cardano (ADA) was also up over 500% in Q1 after new protocol updates and a Coinbase listing. And Polkadot (DOT) came bursting onto the scene to become the largest market-cap interoperability platform, growing 287% since January 1st.

Source: Coin Metrics Reference Rates

But outdoing them all was Dogecoin (DOGE), which in a lot of ways captured the spirit of Q1 2021. Amidst GameStop (GME) mania and repeated Elon Musk Tweets, DOGE price rose over 10X in a 24 hour period from January 28th to 29th. It crashed soon after, but then climbed to another new all-time high on February 8th.

Coin Metrics Q1 Wrap-Up

Q1 2021 has also been a big quarter for Coin Metrics. We’ve released several new metrics and updates to our data offerings:

New network data metrics include supply dispersion ratios, new hashrate estimates by ASIC types, and next-generation miner flow data that can be used to analyze the transfer of funds from miners to exchanges.

Eleven new assets added to our reference rates coverage including 1INCH, GRT, and ALPHA.

We also released our trusted volume metric which aggregates the reported volume from exchanges that we consider to be the most trustworthy.

Over the last several months we’ve published multiple in-depth research reports including:

A series of reports on on-chain miner activity: Following Flows II: Where do Miners Sell and Following Flows III: Measuring Ethereum Miner Activity.

And our data and analysis has been featured in the following:

Bitcoin: At The Tipping Point by Citi GPS

Understanding Bitcoin by Fidelity

Our Thoughts on Bitcoin by Bridgewater

Lastly, we’ve partnered with industry leaders to launch new products:

A combined offering with KPMG & BitGo to enable BitGo's existing and future clients to actively monitor and manage public blockchain network risks.

To explore the data used in this piece and our other on-chain metrics check out our free charting tools and mobile apps, and view our full suite of products at coinmetrics.io.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

We’re hiring! Check out our open positions on our careers page.

Check out our new market-data focused newsletter State of the Market, featuring weekly updates on market conditions.

As always, if you have any feedback or requests please let us know here.