Coin Metrics' State of the Network: Issue 82

Tuesday, December 22nd, 2020

Get the best data-driven crypto insights and analysis every week:

The State Of The Network 2020 Year In Review

By Nate Maddrey and the Coin Metrics Team

In this special year end edition of State of The Network we review crypto’s tumultuous 2020 run. To explore the data in this piece, check out our free charting tool.

Q1 - A New World

Historically, bitcoin has mostly been divorced from traditional markets. But in the beginning of the year we started to see signs that bitcoin was becoming more intertwined with the external world.

In January, as military tensions between the US and Iran began to escalate, bitcoin’s price showed signs that it was reacting to the increasing chances of conflict. During this time period oil futures and gold futures both experienced immediate positive reactions to events that marked an escalation of tensions and negative reactions to the de-escalation. In a small preview of what was to come, bitcoin reacted similarly.

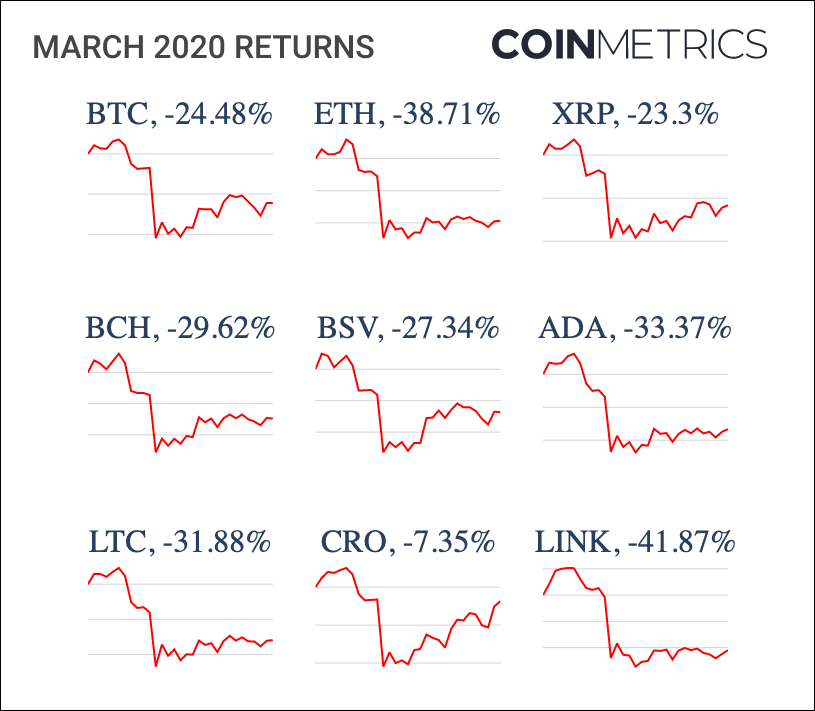

Then, On March 12th, the world abruptly changed. Amidst growing concerns over the COVID-19 pandemic bitcoin suffered one of its largest one-day price drops in history. The rest of crypto followed, with most major assets down over 30% on the week.

Source: Coin Metrics Reference Rates

The crash was exacerbated by a BitMEX liquidation spiral that temporarily sent bitcoin below $4,500. From March 12th 9AM to March 13th 6AM UTC, long positions worth 1.1B contracts (one contract represents a $1 position) were liquidated. As liquidations mounted and liquidity waned BitMEX’s auto-deleveraging engine kicked in, causing bitcoin price to plummet to below $4,500. Price kept dropping until BitMEX suffered a reported DDOS attack that made it nearly impossible to trade on the exchange. In hindsight, March 13th marked the floor for BTC's price in 2020.

Unlike most of the past major crypto crashes, this crash was directly tied to changing global conditions. Markets around the world crashed along with crypto as investors pulled money out in a rapid rush to safety. As a result, the correlation between bitcoin and the S&P 500 shot up to historic highs. The world had changed. Soon, the world’s perception of bitcoin would change as well.

Source: Coin Metrics Correlation Charts

Q2 - The Great Inflation

In the aftermath of the March crash central banks around the world quickly sprung into action.

Early Q2 saw a rash of new responses to the growing COVID crisis. The US’s primary response, the CARES Act, devoted $2 trillion to COVID response, including stimulus checks which were paid directly to US households. As a result, the US M2 money stock grew from about $15 trillion to about $19 trillion over the course of 2020.

Quantitative easing and growth of the M2 money stock does not necessarily directly lead to increased inflation since newly printed money typically stays in bank reserves. But even though the inflation rate remained around 2%, uncertainty about future inflation levels increased dramatically in March and April. Additionally, real interest rates plummeted, making non-cash flow producing assets like gold and bitcoin more attractive.

For most of its existence institutions have stayed away from investing in bitcoin, typically citing it as a risky, speculative asset. But in Q2 there began to be signs that the tides were turning. In early May billionaire hedge fund manager Paul Tudor Jones announced that he had over 1% of his assets in bitcoin. He explained that he viewed it as a hedge against inflation, saying “we are witnessing the Great Monetary Inflation -- an unprecedented expansion of every form of money unlike anything the developed world has ever seen.” By the end of the year, many more institutional investors would follow suit.

Q2 also saw the start of a big rise in stablecoin supply and activity. Between March 12th and December 12th total stablecoin supply increased by close to 20 billion. For context, before March 2020 it had taken over three years for total supply to grow to about 6 billion.

Many factors contributed to the staggering stablecoins growth. Initially, following the March 12th crash, there was a rush to safety - as crypto prices dropped, investors moved their funds into stable assets. Moving into stablecoins allowed investors to effectively keep money parked on the sideline without having to completely cash out into fiat currency and incurring fees. Stablecoins are also used extensively in trading against bitcoin and many other cryptos. Additionally, stablecoins (especially Tether) are reportedly used to move money across borders, especially in places with relatively strict restrictions. All of these use cases gained steam following the March crash.

Source: Coin Metrics Network Data Charts

In May Bitcoin underwent its third halving. The timing could not have been better. After fiat currencies started undergoing the “great inflation” Bitcoin’s supply issuance started decreasing, towards less annual inflation. But the halving was not some response decided on by the Bitcoin community, or a central bank. The wheels were set into motion many years earlier and built into Bitcoin’s core.

Source: Coin Metrics Network Data Charts

Q3 - DeFi Mania

Fresh off of stimulus check money and with the weather turning warmer, crypto’s attention began to shift to a new front: decentralized finance (DeFi).

Although it may seem like it popped up overnight DeFi has been around for years. During 2018 early projects like MakerDAO (MKR) and 0x (ZRX) pushed the total DeFi market cap to over $5B, as Ether (ETH) price reached all-time highs. But the initial DeFi surge was dwarfed by this summer’s run, which saw the launch of many new tokens.

DeFi’s recent rise began in earnest in June with the launch of Compound protocol’s COMP governance token. Out of 10M total COMP tokens about 4M were set aside to be distributed as a reward for serving as a borrower or lender on the Compound protocol. This meant that lenders could earn interest on their locked crypto plus an additional reward of COMP tokens on top of their regular yield. Within a week after the COMP distribution began, the total value locked in Compound grew from under $100M to over $600M. In hindsight, COMP’s distribution model marked the beginning of “yield farming” and the endless pursuit of higher and higher yields. Soon after, many new DeFi tokens began to launch, mimicking COMP’s distribution model and pushing ETH’s price to its highest levels in years.

Uniswap, the Ethereum-based decentralized exchange, was the engine behind DeFi mania. Uniswap represents a new breed of automated marker maker (AMM) - decentralized exchanges that do not have order books or traditional buy and sell orders. Uniswap trading occurs entirely on-chain, as opposed to centralized exchanges where it occurs off-chain. It also allows anyone to create a new token pair and immediately begin trading, which helped new DeFi tokens launch and scale quickly.

Total trading volume on Uniswap increased from about $1M a day in early June to close to $1B a day in the beginning of September. The big increase in on-chain trading brought on by Uniswap helped push Ethereum transaction fees to new all-time highs in August. Bitcoin’s mean transaction fee soon followed and briefly shot past ETH’s mean fee.

Source: Coin Metrics Network Data Charts

In September, Uniswap announced a surprise launch of their governance token: UNI. UNI was distributed as an airdrop that rewarded previous Uniswap users and liquidity providers. Because of its sudden launch, UNI almost immediately catapulted DeFi market cap to a new all-time high. But soon after the bubble began to burst. New UNI recipients started to sell their tokens en masse, causing UNI’s price to drop from a high of close to $7 to a low of less than $2.

Additionally, a series of exploits and hacks led to large losses which took more air out of the sector. Yam Finance launched in August and gained over $500M locked in about 24 hours, only to collapse a few days later. In September SushiSwap had a rapid rise as a potential Uniswap competitor until its anonymous founder abruptly sold funds from the project’s dev pool, sending SUSHI’s price into a tailspin.

After bottoming out in October DeFi has started to rebound and is back at similar levels to September. Overall, DeFi continues to grow and mutate as experimentation continues. With new money flowing into BTC and ETH, new DeFi tokens and applications may be soon to follow.

Source: Coin Metrics Network Data Charts

Q4 - The Return of Bitcoin

By Q4 the flood gates began to open. After a tumultuous beginning of the year, institutional investors had finally arrived.

On October 8th, Square announced a $50M investment into bitcoin, stating “we believe that bitcoin has the potential to be a more ubiquitous currency in the future.” Square joined MicroStrategy and others in allocating part of their corporate treasury to bitcoin. On October 21st, PayPal made an official announcement that it was introducing “a way for customers to buy, hold, and sell certain cryptocurrencies within the PayPal wallet.”

Soon after, Bitcoin’s price began to rise. It would keep on rising for most of Q4. As institutions continued to join, the narratives around bitcoin started to shift. In a quickly changing world, bitcoin is increasingly being endorsed as a hedge against inflation and form of digital gold.

Note: Q4 returns calculated from October 1st-December 20th

In November, billionaire investors Bill Miller and Stanley Druckenmiller joined in, publicly stating that they held and recommended bitcoin. Both compared bitcoin to gold, with Miller adding that he thinks “inflation is coming back due to the Federal Reserve gunning the money supply.” A few weeks later a Citibank senior analyst predicted bitcoin could reach over $300K and called it “21st century gold” in a leaked note to institutional clients.

November brought more signs of a growing institutional investor base. Throughout the month, bitcoin price moved upward more during hours that US markets were open than during hours where US markets were closed. This was not the case during bitcoin’s 2017 bull run, which was more retail driven.

The below charts highlight bitcoin’s price during the hours that the New York Stock Exchange was open, shown in green. Hours where the stock market was closed, like nights, weekends, and the Thanksgiving holiday, are left blank (i.e. not highlighted).

Interestingly, while price moved sideways over the first three weekends of the month, the last weekend of November saw significant upward movement. This followed a large drop on the night of Wednesday the 25th and over Thanksgiving, and is potentially related to a large CME bitcoin futures gap to close the month.

Adding to crypto’s growing momentum, Ethereum hit a big milestone on December 1st. After years in the making the first phase of Ethereum 2.0 was successfully launched. Over the upcoming years Ethereum will continue its transition to Ethereum 2.0, which will introduce Proof-of-Stake and allow investors to earn yield by staking their ETH to secure the network. With over $1B already locked in the Ethereum 2.0 deposit contract, Ethereum may start attracting more institutional attention going into 2021.

On December 10th, in another sign of institutional adoption, insurance company MassMutual announced a $100 million purchase of bitcoin. Less than a week later, on December 16th, bitcoin surged past $20,000, three years to the day after it reached its 2017 peak of $19,640.

Over the course of 2020 bitcoin added over $300B to its market cap. The amount of daily active addresses doubled, and the number of addresses holding at least 0.01 BTC grew by over 700k. While adoption grew, bitcoin veterans continued to hold strong. Bitcoin’s velocity dropped by close to 10% on the year, and the amount of supply active within the last 2 years decreased by about 11%.

In many respects, bitcoin is in its strongest position yet closing out 2020. As momentum continues to build, bitcoin is on the verge of reaching unprecedented heights in 2021.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.