Coin Metrics' State of the Network: Issue 86

Tuesday, January 19th, 2021

Get the best data-driven crypto insights and analysis every week:

Weekly Research Focus

Altseason Watch

By Nate Maddrey and the Coin Metrics Team

It’s starting to feel a lot like altseason. That magical time of year when people you went to high school with start messaging you out of the blue to ask if a coin you thought had died in 2017 is a good investment.

“Altcoins” is a term typically used to describe cryptocurrencies other than BTC and ETH (or other than just BTC, depending on who you ask). They’re the smaller cap cryptoassets that can lead to huge gains or unexpectedly go bust.

Many altcoins have come and gone over the years. Most notably, during the ICO boom during 2017 hundreds of new tokens were launched at ridiculously lofty valuations, many of which are now dead and gone. But amidst the many scams and busts there are also plenty of legitimate, innovative projects. Especially with the rise of DeFi, more investors are looking to diversify into smaller holdings.

With new capital flowing into BTC and ETH, some of that money may start flowing into altcoins. While that largely held true in the retail driven 2017 rally, this current run is a little different: signs point to it being driven by institutional investors, rather than retail. Altcoin investing is largely considered a retail phenomenon. Similar to penny stocks, it’s often driven by individual investors looking for outsized gains. Institutions mostly stick to BTC and potentially ETH given their liquidity requirements and risk profiles. But as crypto prices keep going up more and more retail investors are starting to get back on board.

Since the beginning of December 2020 BTC and ETH have outperformed most other Layer 1 (L1) blockchains. Many of the assets that were launched as competitors to either Ethereum or Bitcoin have not been able to keep up during the current rally. BCH, BSV, and LTC are all down compared to BTC since December 1st. ETC, TRX, EOS, and XTZ are all down compared to ETH.

Source: Coin Metrics Reference Rates

However, there are a few notable exceptions. Decred (DCR) is up 126.59% since December 1st, outpacing both BTC and ETH. Decred fundamentals look relatively strong compared to most other L1 altcoins. DCR active addresses are reaching new all-time highs, while most other blockchains other than Bitcoin and Ethereum are well below 2017 levels. DCR staking is also reaching all-time high levels, which locks DCR and removes it from circulating supply. The Decred Project also recently launched a decentralized exchange, rivaling some of the innovation being built on Ethereum.

Source: Coin Metrics Network Data Charts

Cardano (ADA) has also outperformed. Similar to DCR, ADA active addresses have spiked to all-time highs in early 2021. Cardano’s Shelley mainnet launched in 2020, which helped renew hype around the platform. However, Caradano has still not deployed functional smart contracts, which means the large price movements are still likely anchored around future expectations.

Lastly, Dogecoin (DOGE) has outperformed BTC, ETH, ADA, DCR, and pretty much every other L1 cryptoasset. DOGE is a long time favorite of altcoin investors and is regaining steam after being hyped on TikTok and by Elon Musk. While DOGE may simply be an outlier, it may also be a canary in a coal mine - an early indicator of an oncoming altcoin wave.

Although most L1 assets are underperforming, the story changes when we look at tokens for applications built on top of Ethereum. After surging over the summer and crashing in September, decentralized finance (DeFi) tokens are back on the rise. Since December 1st 2020 Uniswap (UNI), Aave (AAVE), Synthetix (SNX), MakerDAO (MKR), SushiSwap (SUSHI), and Curve (CRV) have all outperformed ETH and BTC.

Source: Coin Metrics Reference Rates

DeFi development has been progressing rapidly since Q4 2020. Synthetic recently announced the initial steps of an integration with the Optimistic Virtual Machine (OVM), a new solution to help with scalability and reduce Ethereum transaction fees. Yearn.finance (YFI) is working on V2 of their platform and recently released an updated version of their vaults. And the Uniswap team is hard at work on Uniswap V3, which is rumored to improve slippage and potentially address high transaction fees. Uniswap trading volume has surged in early 2021 (as seen in the below chart) to similar levels as September 2020.

Although institutions likely aren’t wading into DeFi at this stage, there may be growing interest from traditional finance investors drawn in by the technology. We also might finally be starting to see some of the capital flow from L1 assets to more promising application layer projects. With older projects falling out of favor and new money continuing to flow in, 2021 is gearing up to be a potential turning point for altcoins. Check out our free charting tool and mobile apps to keep up with the ongoing altcoin watch and explore the data from this piece.

Network Data Insights

Summary Metrics

Source: Coin Metrics Network Data Pro

On-chain activity quieted down over the past week after a frenetic stretch. Transfers and adjusted transfer value decline week-over-week for both BTC and ETH. BTC regained some ground in ETH in terms of fees, gaining 5.2% on the week compared to a 27.3% drop for ETH. But ETH’s transaction fee drop comes after a stretch of new all-time highs. The daily average of ETH transaction fees still remains about twice as much as BTC.

UNI’s on-chain activity is heating up with a 55.4% increase in adjusted transfer value. On January 16th UNI’s adjusted transfer value reached its highest level since September 24th, 2020.

Network Highlights

Spent Output Profit Ratio (SOPR) is a ratio of bitcoin’s price at the time UTXOs are spent to its price at the time they were created. In other words, it’s a proxy for price sold divided by price paid. SOPR can act as a way to approximate whether holders are selling at a profit or at a loss.

Theoretically, a high SOPR signals that a relatively high amount of bitcoin is being sold for a profit. Historically, a high SOPR has signalled that bitcoin price is reaching a local maximum and that a decline is coming. Conversely, a low SOPR theoretically signals that holders are selling at a loss, which has historically indicated a good time to buy. A SOPR of 1 is also particularly important to watch as it signals the tipping point from selling in profit to selling at a loss.

On January 9th BTC’s 7-day average SOPR approached 1.05, a level that has typically signalled an incoming correction in the past. The following day BTC’s price dropped from over $41K to under $31K. SOPR has since recovered to about 1.017, a healthier range.

For more information about SOPR and other on-chain metrics that can be used to gauge bitcoin market cycles see our “Bitcoin On-chain Indicators Primer” research report.

Source: Coin Metrics Network Data Pro

The amount of ETH transferred by smart contracts has spiked in early 2021 and is approaching all-time highs set in mid-September 2020. September was the height of the summer’s DeFi mania, with the launch of UNI sending on-chain activity and transaction fees to new all-time highs. This is more evidence that DeFi and other decentralized applications built on top of Ethereum are gaining momentum.

Source: Coin Metrics Network Data Charts

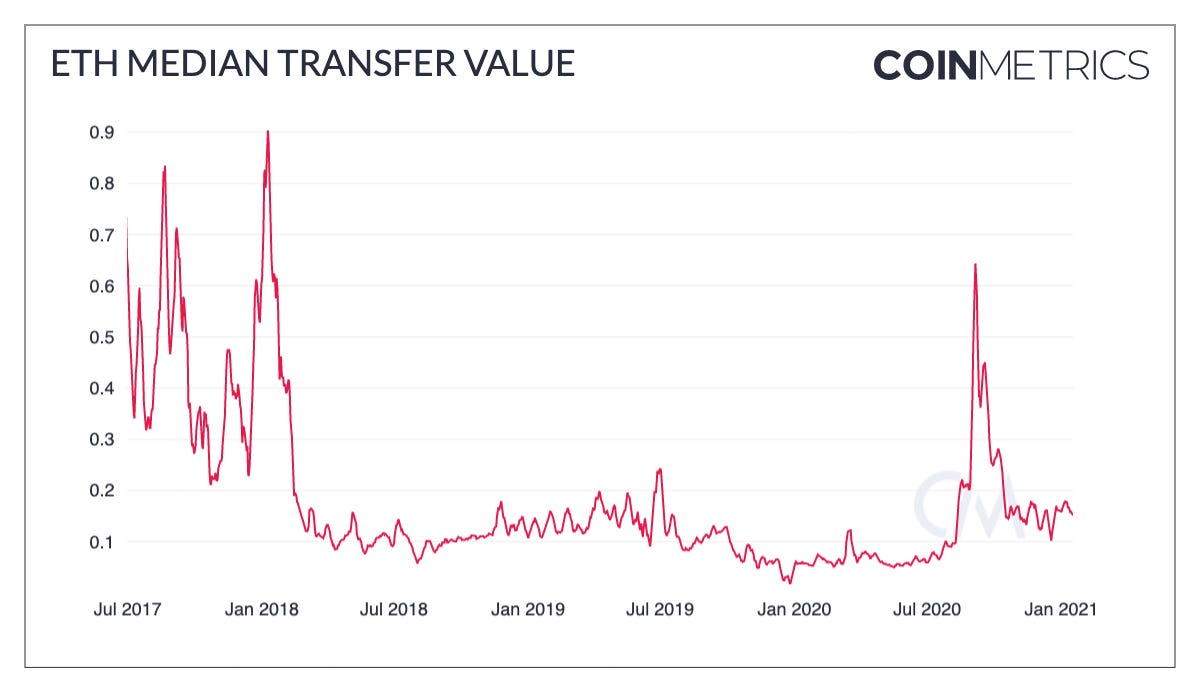

But despite the increase in ETH transferred by smart contracts, ETH’s median transfer value remains well below the highs of August and September.

Source: Coin Metrics Network Data Charts

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

We’re excited to announce the new Coin Metrics mobile app. View real-time cryptoasset pricing and relevant on-chain data in a single app! Download for free here: https://coinmetrics.io/mobile-app/

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.