Coin Metrics' State of the Network: Issue 110

Wednesday, July 7th, 2021

Get the best data-driven crypto insights and analysis every week:

Ethereum Gas Update

By Nate Maddrey and the Coin Metrics Team

Ethereum gas price has dropped down to its lowest levels since March, 2020. While a few months ago average gas price regularly reached 150-200 GWEI, average gas price has decreased to the 15-30 GWEI range since the end of May.

Source: Coin Metrics Formula Builder

Although it may seem like the drop in gas price corresponded with ETH’s price crash, gas price actually started trending downward in late April, well before the crash. Average gas price reached as low as 40 GWEI on May 1st.

Gas then temporarily spiked back up to 250-300 GWEI on May 12th and 19th, two of the worst days of the crash. But upon closer examination the large price spikes were caused by extreme circumstances and were relatively short lived.

Around 11:00 UTC on May 19th, average gas price suddenly spiked from under 100 GWEI to over 2,000 GWEI in less than two hours. It then dropped down to about 300 GWEI a few hours later.

Source: Coin Metrics Network Data Pro

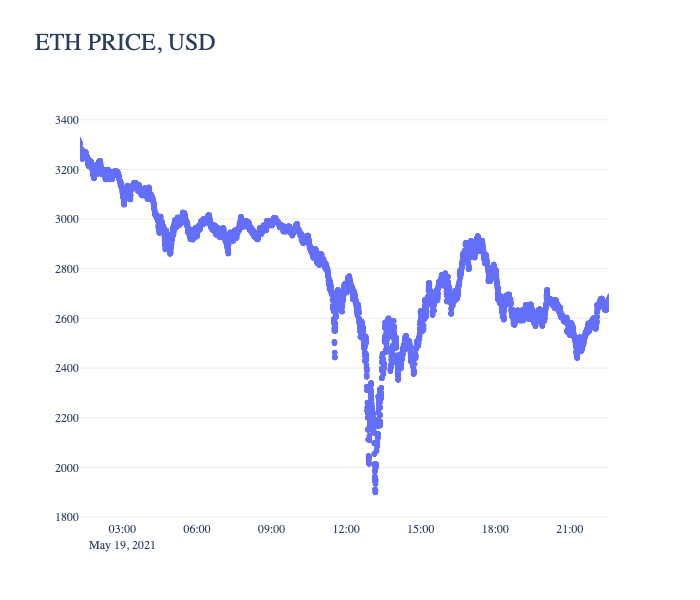

The extreme gas spike occurred during one of the worst flash crashes in ETH’s history, as price dropped from about $3,400 to under $1,900. The sudden crash led to a DeFi liquidation spiral, which caused escalating gas prices as investors desperately tried to avoid liquidation. According to a report from AAVE, May 19th was the largest single-day liquidation total in the history of AAVE and Compound.

Source: Coin Metrics Network Data Pro

But outside of the relatively extreme circumstances of May 12th and May 19th, gas prices have mostly been trending downwards.

Several factors have combined to contribute to the drop in average gas prices. First, the Ethereum gas limit was raised to about 15M on April 22nd. The gas limit raise allows more operations to fit into each block, and has helped ease congestion.

Source: Coin Metrics Formula Builder

Additionally, Ethereum scalability solutions have started to take off since late April. Polygon, a sidechain scalability protocol for Ethereum, has gained momentum over the last few months, including adoption by AAVE and other DeFi protocols. Arbitrum, which uses optimistic rollups for scalability, launched in late May. More and more transactions are moving over to these scalability solutions, which helps remove more congestion from Ethereum and further ease gas prices.

Lastly, flashbots is helping to move DeFi arbitrage bots off the Ethereum blockchain. With the rise of decentralized exchanges (DEXs) like Uniswap, arbitrage bots have been a major contributor to high gas prices. Since DEX trades are viewable in the mempool and on-chain, bots will monitor incoming trades and then try to front-run them for arbitrage or other profit making opportunities. The timing of these types of trades are critical so these bots are typically willing to pay extremely high gas prices to try to outbid each other and get their transaction confirmed first. But flashbots has started to move this bidding process to a parallel chain, off of the Ethereum main chain. This has helped to reduce gas wars on ETH and bring down the overall gas price.

Lower gas prices have contributed to a drop in overall ETH fees over the last two months. But with EIP-1559 set to go live in early August, there’s another potential consequence of lower gas prices: less transaction fees burned after the onset of EIP-1559.

The following chart shows what ETH’s estimated annual inflation rate (30-day average) would look like if EIP-1559 results in 75% of fees being burned. There’s no way to know exactly what percent of fees will be burned compared to what percent will go towards tips once EIP-1559 goes live - this is just a historical estimate calculated by subtracting 75% of daily fees from the amount of ETH issued daily.

While estimated annual inflation rate would have dropped to less than 2% while there were high fees in March and early April, it’s now increased to above 3.5% following the fee drop in May. This would still be significantly below ETH’s current annual inflation, but it would not be as low as previously estimated. However, fees will likely continue to fluctuate over time. If the amount of total fees eventually goes back up ETH’s annual inflation will decrease thanks to EIP-1559’s fee burn mechanism.

Source: Coin Metrics Formula Builder

For a detailed explanation of Ethereum’s gas mechanism and how it will change following EIP-1559 see the Ethereum Gas Report. And to follow the data used in this piece and explore our other on-chain metrics check out our free charting tool, formula builder, correlation tool, and mobile apps.

Network Data Insights

Summary Metrics

Source: Coin Metrics Network Data Pro

BTC active addresses are up 11.6% week-over-week, while ETH active addresses dropped by 6.5%. BTC now once again has more daily active addresses than ETH after ETH briefly topped BTC last week. BTC usage was down last week as the average time between blocks spiked, which caused less blocks than normal to get added to the blockchain. The increase in block time was likely due to a drop in hash rate, which can lead to less blocks getting mined. BTC hash rate stabilized over the last week after dropping to its lowest level since 2019 on June 27th.

Network Highlights

Bitcoin difficulty decreased by about 28% on July 3rd, which is the largest downward difficulty adjustment in Bitcoin’s history. Although it has undergone a relatively large drop in hash rate over the past month, Bitcoin was designed to be able to adjust to sudden changes and remain secure.

Source: Coin Metrics Network Data Charts

The difficulty adjustment comes after the time between Bitcoin blocks briefly topped over 23 minutes last week, its highest level since 2010. Bitcoin’s average block time increased during June, likely because of the ongoing miner migration out of China due to new stricter regulations.

Average block time has decreased to about 658 seconds since the difficulty adjustment, much closer to the 10 minute target.

Source: Coin Metrics Network Data Charts

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

State of the Network was published on a Wednesday this week due to the observance of the July 4th holiday. We will move back to our regular publication time of Tuesday at 8AM EDT for next week’s issue.

We’re excited to announce the new Coin Metrics mobile app. View real-time cryptoasset pricing and relevant on-chain data in a single app! Download for free here: https://coinmetrics.io/mobile-app/

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.