Setting the Stage for A Total Return Crypto Index

by Huyette Spring, Ben Celermajer, and the Coin Metrics Team

A Background on Corporate Actions

In traditional capital markets, corporate actions are events that could bring a change to the securities (equity or debt) of a public company. Such events can include mergers and acquisitions, stock splits, dividends and rights issues. Effective handling of such events is standardized and routine, and most investors experience them seamlessly and automatically (the dividend just “shows up” in your brokerage account).

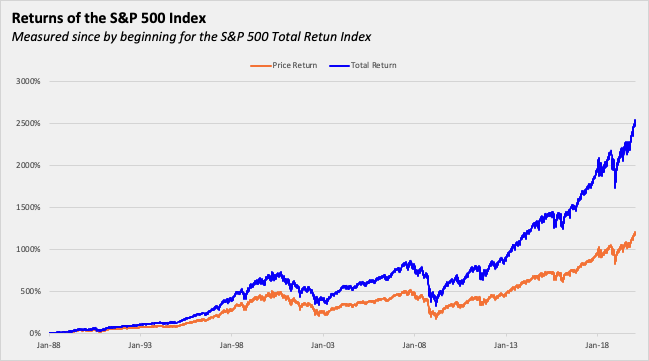

While unglamorous, the significance of accounting for corporate actions is hard to overstate. Imagine that you bought the S&P 500 on the first day of 1988. If you only received the return generated from changes in the prices of the index, you would have earned 1,183%. But if you accounted for the corporate actions of all the companies within the S&P 500, in a so-called Total Return Index, your return was more than double, at over 2,500%.

The key insight here is that financial product creation cannot simply abstract away the economic reality of holding the underlying assets -- asset holders are entitled to those full returns.

Cryptoassets aren’t just an incremental asset class innovation -- they are a first principles re-evaluation of ‘money’. As such, there has yet to be a defined or transparently articulated set of industry standards that dictate how to treat crypto corporate actions or define what an investor will receive under a set of circumstances. The result is that even if cryptoasset holders are credited with the results of any crypto corporate actions there is inconsistency in application and no clarity or certainty around the process.

Such inconsistencies are a gating item for broader adoption. The crypto industry’s nascency has masked the criticality of effective corporate actions handling (along with other market infrastructure components), but this is not a situation that can persist. As the industry grows, both retail and institutional holders of cryptoassets will expect to receive the economic returns of the assets that they hold.

This feature will discuss the methodology and objective eligibility criteria that Coin Metrics has designed to manage corporate actions in crypto, specifically hard forks.

CMBI Corporate Actions Policy

As part of the recent launch of the CMBI Single Asset Index Series, Coin Metrics has developed the CMBI Fork Legitimacy Policy in an attempt to promote standardization, improve transparency and apply institutional rigor to such crypto corporate actions.

Generally speaking, there are currently three main types of crypto corporate actions:

Forks

Airdrops

Staking Yields

The CMBI Fork Legitimacy Policy initially addresses forks, which we consider to be the most significant of the three crypto corporate actions, while the other two (airdrops and staking yields) will be the focus of later iterations.

As noted above, crypto financial products must provide holders with the economic return of underlying assets. With the circumstances under which asset holders should experience a return defined, Coin Metrics can develop two series for every index product:

A Price index, which simply tracks the price

A Total Return index, which tracks to the return investors would experience by holding the underlying assets (i.e. a cryptoasset and all its associated ‘legitimate’ forks)

Deep Dive on CMBI Hard Fork Legitimacy Policy

Unknown to many, there are over 73 forks of Bitcoin alone. But only a handful of the new cryptoassets created by these forks are sufficiently large enough or adopted enough to have an economic impact.

Coin Metrics deems a hard fork to have occurred if:

Two or more distinct blockchains with their own clients are in existence post-fork.

Each blockchain shares the same pre-fork blockchain history.

Native tokens on each chain are distinct assets and are not interchangeable.

Once a hard fork has been identified, the CMBI Fork Legitimacy Policy provides a framework utilizing both market data and network data to answer key questions as to the legitimacy of forked assets.

For CMBI Indexes, the criteria outlined below are observed for up to 12 months after the fork event to determine legitimacy.

It is worth noting that individually, each of the criteria defined below has limitations. To mitigate this, Coin Metrics have taken the following approach:

Criteria are evaluated over a 30 day time period. Price, volume, and on-chain transaction activity can be manipulated, but often at a cost. By requiring criteria to be met over 30 consecutive days, it becomes increasingly unlikely that the economic benefits of this manipulation exceed the costs.

Creating a set of market and network data criteria, which together represent a comprehensive and manipulation-resistant test. As such, a fork is deemed legitimate only once it meets all criteria outlined below.

In the section below, we will demonstrate how two forks were analyzed against the the legitimacy criteria by reviewing one fork which passed, Bitcoin Cash, and one fork which failed, Bitcoin Gold. The results are summarized in the table below.

Market Data Criteria

Exchange Support

The adoption of a fork by exchanges plays a critical role in its investability. Only with support from multiple large exchanges can investors have liquidity to buy and sell the forked token and process large transactions. Liquidity and presence on multiple exchanges also indicates that there is enough trading taking place to determine a fair price for the forked asset.

As such, newly forked tokens will pass the Coin Metrics exchange support criteria if there is support from:

At least one market with a quote currency in U.S. dollars, Bitcoin, or Ethereum on three different exchanges in Coin Metrics’ exchange coverage universe.

At least one exchange that is headquartered and incorporated in the United States and is registered as a Money Services Business with FinCEN or a New York BitLicense.

Bitcoin Cash and Bitcoin Gold both passed this test.

Price

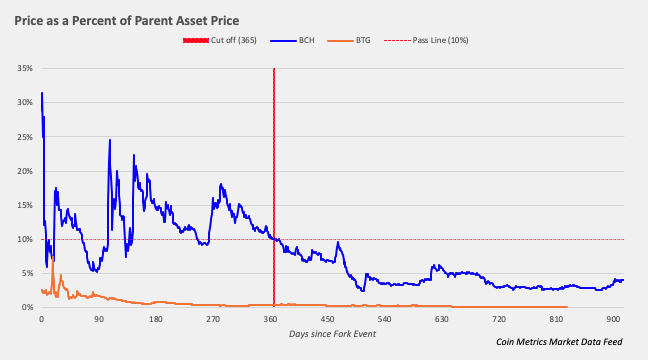

Along with the actions of exchanges, Coin Metrics deems it important to gauge the perception of a forked token by investors and trading market participants. Under the assumption that markets are at least semi-efficient, the price and market capitalization of forked tokens are proxies for investor/trader acceptance. Since forks can happen during various market regimes and the size of cryptocurrency assets continues to grow, the price of the forked asset as a percent of the price of the parent chain asset is examined.

Considering all of this, newly forked tokens will pass the Coin Metrics price criteria if the token trades on whitelisted exchanges with the following characteristics:

A new native token will only be considered eligible once its 7-day price volatility (where the price is quoted in units of the parent chain) remains less than 7.5% for 30 consecutive days. Low volatility might indicate that price discovery has occurred and the manipulative price practices that sometimes occur around fork time have subdued. Since cryptoassets are inherently volatile, the test measures volatility against the parent asset (and not against USD) so that volatile movements that are in line with the market are acceptable.

The price of the new native token must remain at least 10% of the price of the native token on the parent chain for 30 consecutive days. This assumes that the fork resulted in a 1:1 issuance. If another ratio is observed, the criteria is adjusted accordingly (e.g. 1:2 would require a 5% ratio between new token price and previous chain token price).

Bitcoin Cash passed both of these tests. Bitcoin Gold passed the Volatility test but failed the Price test, thus failing the test overall.

Volume

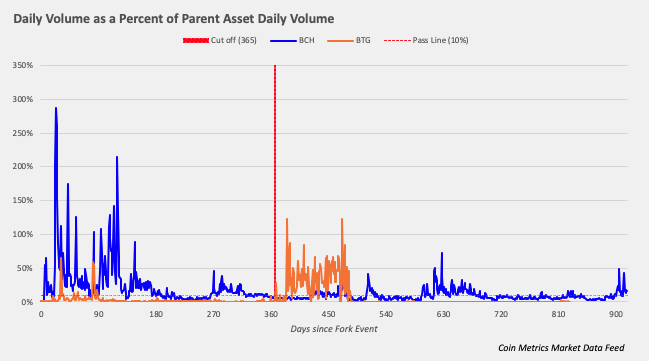

In order for financial institutions and large asset managers to liquidate forked tokens, there must be the presence of significant volume in the market. Volume acts as a further measure to ensure that the exchange, investor and trading community adopt the newly forked token. As such, newly forked tokens will pass the Coin Metrics volume criteria if the native token trades on an exchange in Coin Metrics’ exchange coverage universe, with the following characteristics:

The volume of the new native token must remain at least 10% of the volume of the native token from the parent chain for 30 consecutive days.

Bitcoin Cash passed this test while Bitcoin Gold failed.

Network Data Criteria

Fork Uptake

Fork uptake is a measure of the number of native units that appear active on the newly forked blockchain from the time of the fork. Here, activated is defined as being sent to an address post a fork event.

This measure provides an indication of how many owners of the parent chain are choosing to “activate” their newly forked native units to either unlock their utility or to sell them (i.e. how much of the supply gets transacted at least once, as opposed to staying indefinitely dormant). This measure is relatively resistant to manipulation as long as the parent asset’s supply is reasonably distributed. If the parent asset is decentralized, it would take coordination amongst many different holders to fake fork uptake.

Newly forked tokens will pass the Coin Metrics fork update criteria if it meets the following definition:

The fork uptake of the new native token must exceed 10% of the supply of the native token from the parent chain at the time of the fork.

Bitcoin Cash and Bitcoin Gold both passed this test.

Hash Rate

Miners are another important stakeholder in the cryptoasset ecosystem. As such, hash rate is an important metric to examine because it reflects the consensus of miners. Hash rate is also relatively resistant to manipulation because mining equipment is a scarce asset that incurs high variable costs in the form of electricity.

Newly forked tokens will pass the Coin Metrics hash rate criteria if it meets the following definition:

If the forked asset shares the same consensus algorithm as the parent chain, the hash rate of the forked chain must exceed 10% of the hash rate of the parent chain for 30 consecutive days. If the forked asset uses a different consensus algorithm, this criterion cannot be applied and is ignored.

Bitcoin Cash passed this test. Bitcoin Gold has a different consensus algorithm than Bitcoin, thus this criteria is ignored.

Active Addresses

Active addresses are the number of unique addresses that were either the recipient or originator of a ledger change and can reflect the estimated amount of activity on a blockchain.

Newly forked tokens will pass the Coin Metrics active addresses criteria if it meets the following definition:

The active addresses of the forked asset must exceed 3% of the active addresses of the parent chain for 30 consecutive days.

Bitcoin Cash passed this test while Bitcoin Gold failed.

Conclusion

Broader adoption of cryptoassets requires clarity, transparency and consistency. Nowhere is this more important than in determining the economic returns entitled to cryptoasset holders.

While it will undoubtedly change over time, the CMBI Fork Legitimacy Policy aims to bring standardization, transparency and institutional rigor to crypto corporate actions. Hopefully the handling of corporate actions for cryptoassets will become as routine and automatic as traditional assets. Standardization around events like forks sets the stage for a crypto Total Return index, which is an important step for the continuing maturation of the crypto industry.

Network Data Insights

Summary Metrics

Crypto markets rallied this past week, as Bitcoin (BTC) passed $9,000. There is growing evidence that BTC is beginning to predictably react to geopolitical events, and this past week’s cryptoasset rally may have (at least partially) been a reaction to the recent drop in the Chinese stock market. We explore this more in today’s Market Data Insights section.

Adjusted transfer value increased by at least 20% for all five cryptoassets in our sample, outpacing the increases in market cap. Bitcoin Cash’s (BCH) adjusted transfer value is relatively even with Ethereum’s (ETH) -- over the past week, BCH had a daily average of $217M adjusted transfer value while ETH had $234M. BTC still dwarfs them both, with a daily average of $1.9B.

Network Highlights

Tether continues to gain market share versus all other non-Tether stablecoins.

Coin Metrics now tracks the amount of Tether that has been issued on Tron, in addition to Ethereum and Omni. The below chart shows how the combined market cap of Tether issued on Tron, Ethereum, and Omni compares to the combined market cap for all of the other stablecoins we track (DAI, USDC, GUSD, PAX, and TUSD). Tether currently accounts for about 85% of the total stablecoin market cap. Comparatively, Tether made up about 77% of the market cap on January 1st, 2019.

Bitcoin SV (BSV) OP_RETURN transaction count has been increasing over the past week, after falling over the past two months. OP_RETURN transactions are often used to write arbitrary data onto a blockchain and are therefore often used for on-chain data storage.

BSV OP_RETURN transaction count passed BTC and Bitcoin Cash (BCH) OP_RETURN transaction count in mid-2019, and has been mostly trending upwards since. Check out State of the Network Issue 8 for more of our coverage on how Bitcoin SV is being used for data storage.

Market Data Insights

Recent events such as the U.S.-Iran military conflict demonstrate that under certain circumstances, BTC reacts to geopolitical events. If this cause-and-effect relationship continues to strengthen, the narrative that BTC is uncorrelated to financial assets may need to be re-examined. BTC’s reaction to China’s equity market reopening after the Lunar New Year holiday adds to the growing body of evidence that BTC reacts to global events. As China’s equity markets re-opened, most shares fell by the daily limit within minutes, and a small but significant increase in BTC price was observed.

Volatility exhibits mean-reverting behavior partially because low levels of volatility encourage higher levels of leverage and risk taking by market participants. BTC realized volatility, measured on a three month rolling basis, is now at 52% and approaching levels that it has historically bounced off of.

In addition to this, BitMEX’s XBTUSD perpetual swap contract’s open interest has recently exceeded $1 billion dollars, a level that also has historical significance. During the summer of last year, market sell-offs were closely associated with open interest breaching this level.

Nearly all major assets saw strong gains this week with high dispersion in returns. While BTC outperformed most assets for the majority of 2019, a trend of certain assets significantly outperforming BTC has been recently established. Strong performers this week include Litecoin (+26%), Tezos (+24%), and Cardano (+26%).

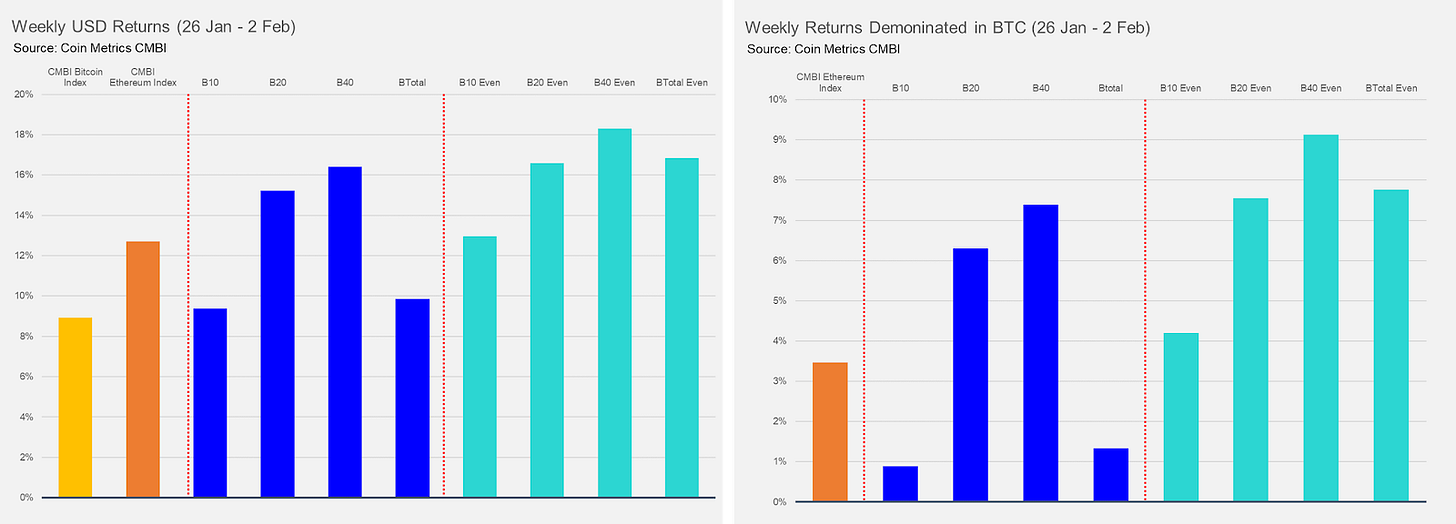

CM Bletchley Indexes (CMBI) Insights

All Bletchley Indexes performed strongly throughout the week, finishing the week between 9% and 19% up. Despite a strong week for the CMBI Bitcoin Index, returning 9%, it was the weakest performer of all indexes. It was the small-cap assets that had the best week, with the Bletchley 40 increasing a staggering 16% for the week, after constituents MonaCoin, ZCoin and BitShares all returned over 50% and Siacoin, Ziliqa and Nano all returned over 20%.

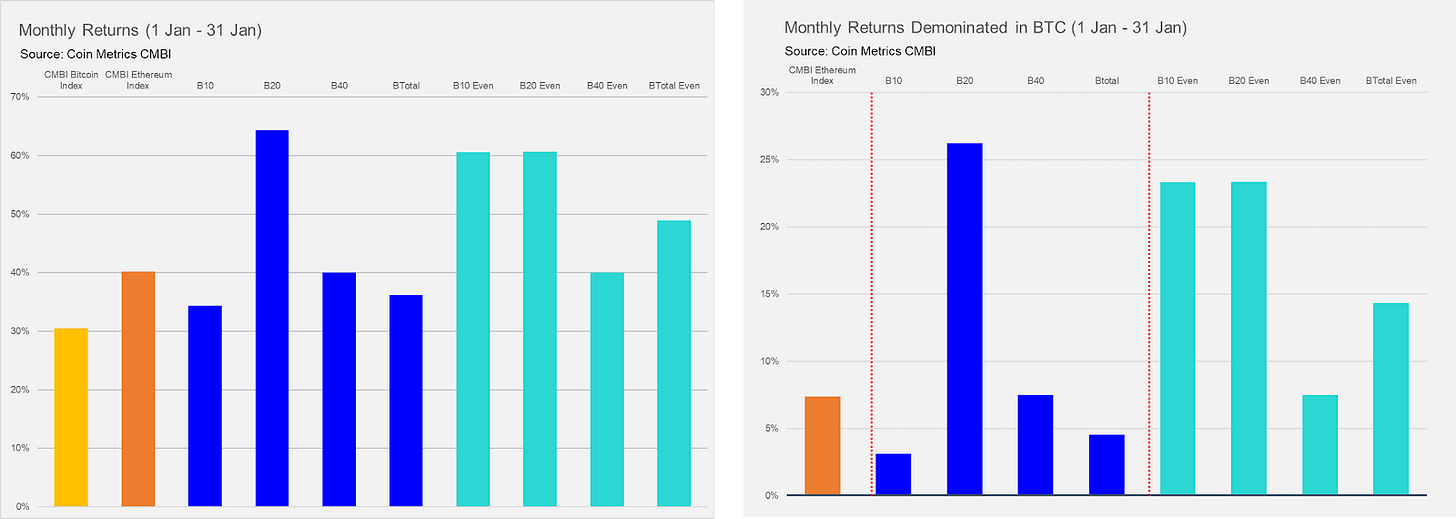

The weekly returns above added what was already a very positive month for cryptoassets. Over the month it was the Bletchley 20 (mid-cap assets) that performed the best, returning 70% in just 31 days. Large-cap and small-cap assets both performed in line with each other, returning ~35% for the month.

A trend that has been discussed a bit through the January is the performance of the even indexes. This has been no truer than for the Bletchley 10, where the performance of the even index was almost double the performance of the market cap weighted index. Index design and construction in traditional capital markets can result in very interesting return profiles during different market conditions, something that Coin Metrics hopes to emulate within the cryptoasset market.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Coin Metrics is hiring! We recently opened up 5 new roles, including Blockchain Data Engineer and Data Quality and Operations Lead. Please check out our Careers page to view the openings.

As always, if you have any feedback or requests, don’t hesitate to reach out at info@coinmetrics.io.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.