Get the best data-driven crypto insights and analysis every week:

Coin Metrics is hiring Research Analysts, Data Scientists, and many other positions. Check out our open roles here.

Stablecoins Shine as Safe Haven Crypto Assets

By Kyle Waters and Nate Maddrey

With the crisis in Ukraine entering its third week, crypto markets and the broader financial markets across the globe remain unsettled. Although crypto prices have faced some selling pressure in recent weeks, crypto infrastructure has continued to empower the flow of millions of dollars worth of donations to Ukraine and its people (see network highlights at the end of this issue for an update on the Ukrainian government’s crypto address holdings).

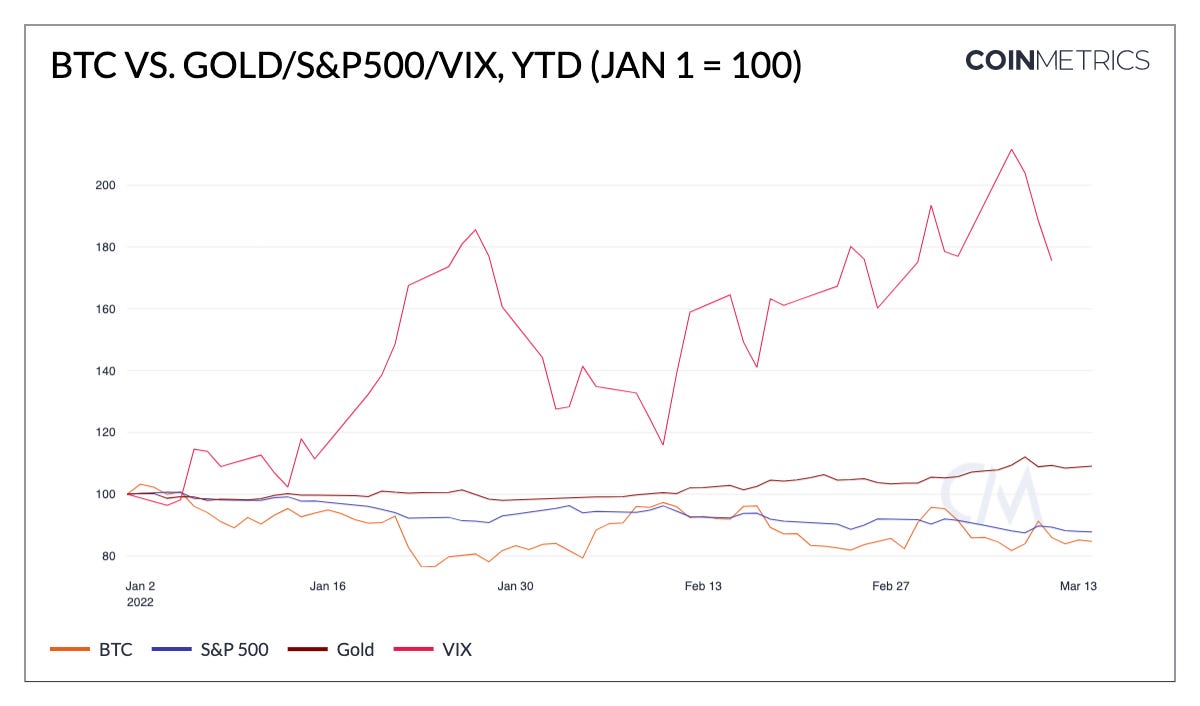

Heightened geopolitical uncertainty has reshaped the macro landscape. The CBOE Volatility Index (VIX), which is a proxy for the market’s short-term expectations of stock market volatility, has risen sharply in the last few weeks. Over the last two years, bitcoin (BTC) has tracked the returns of U.S. equities more closely and the last few weeks have followed a similar pattern: both U.S. equities (S&P 500 index) and BTC have declined in an increasingly risk-off environment.

Source: Coin Metrics’ Formula Builder

In times of market distress, investors often seek safe-haven assets that offer reliable stability and security as a store of value. Due to its properties of scarcity, non-sovereignty, and ubiquity, Gold is often viewed as an exemplar of haven assets, and its price has responded accordingly in recent weeks rising to near record highs in dollar terms.

Although BTC shares many of these intrinsic characteristics with Gold, recent data are inconclusive to BTC’s mutual acceptance as a safe haven asset; BTC has tracked more closely with risk-on assets, like tech stocks and other growth equities. But as crypto continues to mature as an asset class, BTC’s safe haven status might evolve.

However, today it is increasingly clear that public blockchains already serve a critical role for safe haven assets, hosting billions of dollars worth of stablecoins circulating on-chain. Adoption of US-dollar backed stablecoins has continued to accelerate with the total number of addresses holding at least $1 worth of the major stablecoins recently surpassing 12M – roughly three times the value from one-year ago.

Source: Coin Metrics’ Network Data Charts (note the chart above may include a small amount of double counting if an Ethereum address holds more than one of the above stablecoins)

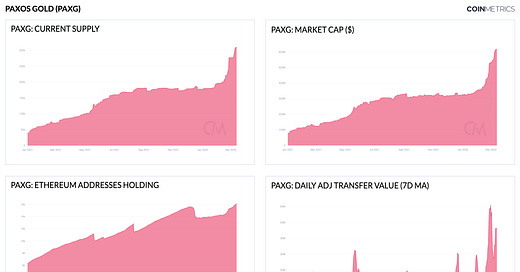

Although most of the largest stablecoins are pegged to the dollar, not all stablecoins are US-dollar backed. There also exist gold-backed stablecoins such as Paxos’ PAX Gold (PAXG) which is an ERC-20 token on Ethereum (note Tether also issues a gold-backed stablecoin, Tether Gold). Each PAXG token is backed by one troy ounce of 400 oz gold bars held in custody by Paxos. Given its 1:1 redeemability, the market price of PAXG closely tracks the $/oz price of spot gold. As market activity in gold has increased in recent weeks, PAXG adoption on Ethereum has been rising.

The charts below show PAXG supply, market cap ($), Ethereum addresses holding PAXG, and daily value settled.

Source: Coin Metrics’ Dashboards

PAXG supply is currently ~310K which corresponds to a market cap of ~$620M at a gold price of ~$2K/oz. As one token is equal to one ounce, this token supply figure is equivalent to 775 gold bars (310K tokens/400oz bars) that are held to back the stablecoin (a very small portion of gold supply though compared to the 771K gold bars held in London vaults worth about $600B as of Feb. 2022, for example). But for comparison to other stablecoins, USDP, Paxos’ US dollar stablecoin, has a market cap of around $1B. Against other stablecoins Coin Metrics tracks, PAXG supply has increased most YTD (in % terms).

Source: Coin Metrics’ Formula Builder

The number of ETH addresses holding PAXG is also up 15% since the beginning of February while PAXG trading volume has also increased on centralized exchanges.

Source: Coin Metrics’ Market Data Feed

Whether it is gold or US dollars, tokenized digital assets continue to proliferate across public blockchains. Distinct benefits such as near-instant settlement, constant network uptime, shared infrastructure, and ease of creating crypto addresses all point to this trend continuing.

To follow the data used in this piece and explore our other on-chain metrics check out our free charting tool, formula builder, correlation tool, and mobile apps.

Network Data Insights

Summary Metrics

We’re excited to introduce a new summary metrics table for State of the Network! The fresh layout covers core network data fundamentals across the dimensions of adoption, economics, and usage for 39 assets grouped by layer one blockchains (L1s), stablecoins, and ERC-20 tokens. Note that you can click on the image to view it in a browser and zoom in for more detail, which might be especially helpful for our mobile readers.

Source: Coin Metrics Network Data Pro

Here are a few important things to keep in mind when reading this table.

Readers should be especially careful when comparing UTXO based (e.g. BTC, BCH) to Account based (e.g. ETH, ETC) blockchains. Addresses are frequently re-used in account-based models whereas UTXO models that uniquely reference each coin encourage new address generation (see here for more).

Heuristics (sets of rules & assumptions based on a priori knowledge of the system) applied to one chain might not translate directly to another. This is most pertinent for daily adjusted transfer value figures in the table above (see more on our adj. transfer value metric here). Transfer value figures can also be especially volatile week-to-week for smaller assets like ERC-20 tokens if there are large one-off transactions.

Coin Metrics’ free float supply aims to measure the liquid supply of each crypto asset available to the market. Free float supply removes items like supply held by foundations and team members, as well as dormant supply untouched for more than 5 years. This metric can be especially helpful for analyzing DAOs/DeFi tokens with significant team/foundation supplies. It can also lead to better approximations of market capitalizations. See more on CM’s free float supply measure here or check out our quarterly supply transparency report for more crypto asset supply analysis.

Coin Metrics is continually evaluating and onboarding new crypto assets so expect more additions for comparison and analysis in the near future. If you have questions or feedback please let us know at info@coinmetrics.io or @coinmetrics on Twitter.

Update on Ukrainian Crypto Donations

Cumulative bitcoin donated to Ukraine’s government-held address crossed 300 BTC (~$12M) on March 14th. In dollar terms, the cumulative value sent has slowed. However, on Monday government officials announced a partnership with FTX and Everstake to facilitate more donations through a designated website. On Monday, total ETH donations also topped 75K with about 8K total ETH sent (~$20M).

Sources: Coin Metrics ATLAS and Coin Metrics Reference Rates

The Ukrainian government has continued to put these received funds to use: the government’s Bitcoin address held only about 2 BTC as of Monday afternoon ET.

Network Highlights

Weekly Summary Video

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Check out our market-data focused newsletter State of the Market, featuring weekly updates on market conditions.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.

© 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.