Coin Metrics' State of the Network: Issue 175

Tuesday, October 4th, 2022

Get the best data-driven crypto insights and analysis every week:

The State of the Network Q3 2022 Wrap-Up

By Kyle Waters, Matías Andrade, and Nate Maddrey

In this special edition of State of the Network we take a data-driven look at the most important stories from the crypto ecosystem in Q3, 2022.

Before we jump to a review of Q3, we’re excited to share a new research report on DeFi’s biggest – yet seldom understood – risk: admin keys. In this new report, the Coin Metrics Labs team walks through the rise of admin key use in DeFi development and showcases past instances where these keys have been compromised, shedding light on historical exploits. You can download the full report for free below.

Merged: Ethereum completes its transition to Proof-of-Stake

At the start of 2022, it was clear that Ethereum was finally inching closer to what would likely be one of the biggest storylines of the year in crypto: The Merge – the name given to Ethereum’s ambitious change from a system of miners securing the network under Proof-of-Work to a set of validators under an alternative mechanism called Proof-of-Stake. After years of research, testing, and anticipation Ethereum successfully completed The Merge on September 15th.

Over the last few weeks we’ve covered The Merge extensively, including leading up to and after the event. For a full collection of our research, be sure to check out this page.

The Merge was successfully completed without any network downtime, and the moments right after The Merge were captured in on-chain data. One immediate change was noticeable in the time between blocks, which went from a probabilistic process under PoW to more predictable 12-second slots under PoS (occasionally 24 or 36 seconds when there are missed slots). The chart below shows the time between blocks for all Ethereum blocks one week before and one week after The Merge. Each dot in the chart represents an individual block.

Source: Coin Metrics Network Data Pro

Ethereum continues to hum along with blocks being produced and attested to by validators. With the execution risk of The Merge behind us, attention has now turned to Ethereum’s next steps in its roadmap.

Core developers are starting to scope out Ethereum’s next upgrade, dubbed Shanghai, that will likely allow partial and full withdrawals of ETH from the consensus layer (aka the Beacon Chain). In the meantime, liquid staking derivatives continue to be a popular mechanism for staking ETH as they effectively allow users to benefit from rewards locked on the CL today. After flatlining for a few months, ETH staked through the Lido protocol has started to pick up a bit, helping push the total amount of staked ETH over 14M.

Source: Coin Metrics Network Data Pro

The Shanghai upgrade may also include improvements to boost layer-2 (L2) scaling technologies. It’s clear that Ethereum is still an ever-changing protocol, and the concentration of staked ETH as well as maximal extractable value (MEV) are areas of intense discussion post-Merge.

But despite the success of The Merge, ETH price has fallen about 10% since September 15th as the macroeconomic environment continues to anchor crypto-asset returns, including ETH and other tokens.

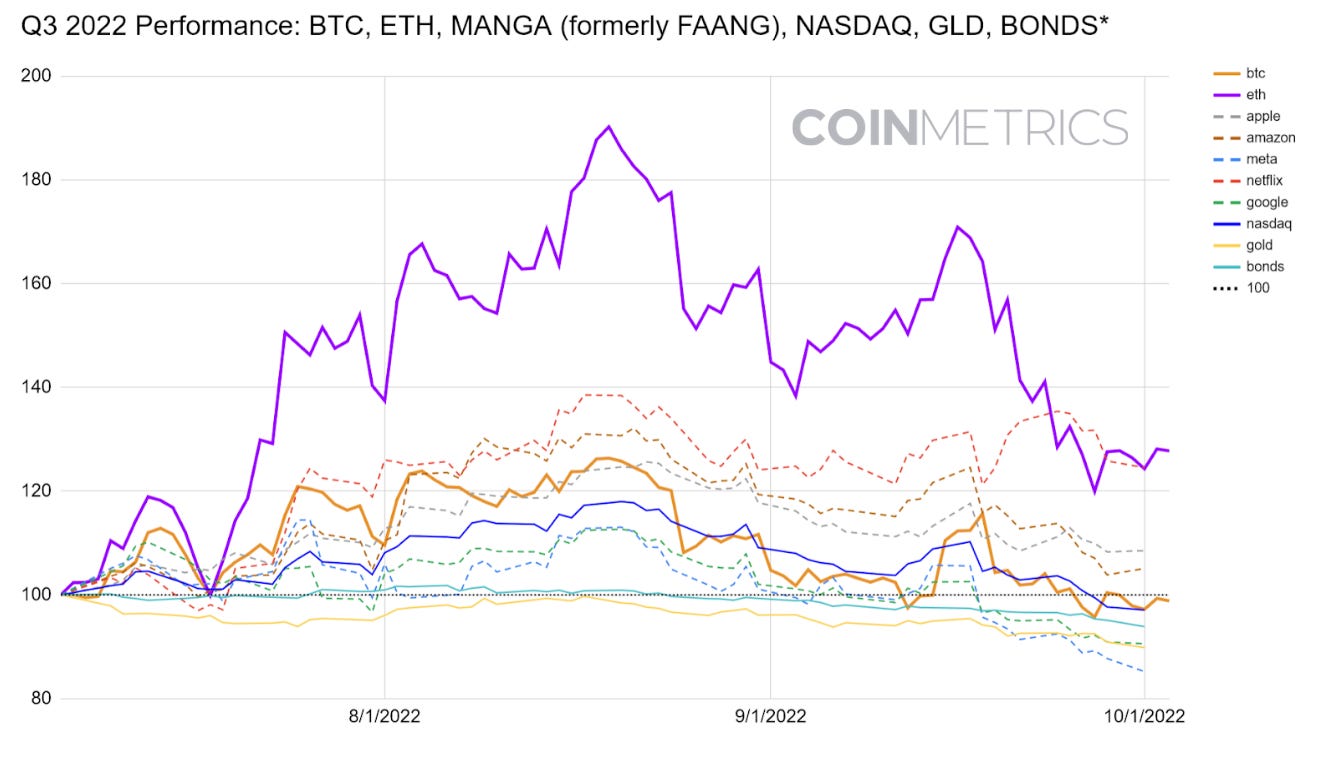

Macro Remains Dominant Factor

A wide sell-off of risky assets has ensued as the market reprices their expectations in accordance with interest rates and economic conditions around the world. The US Federal Reserve has hiked the Federal Funds Rate by 75 bps on three separate occasions since June 16, 2022, with a target rate of 3.25%. The ECB is turning hawkish and has raised rates by a total of 1.25%, with expectations of further hikes to tame high inflation rates in Europe. Meanwhile, Japan’s Ministry of Finance has spent around $20 billion to prop up a rapidly devaluing yen, which recently reached a 24-year low. The Bank of England’s hand was similarly forced to intervene as price rapidly fell in the gilt market (the name given to the UK’s sovereign debt) that threatened local pension funds, willing to commit up to £65 billion.

Source: Coin Metrics Network Data Pro

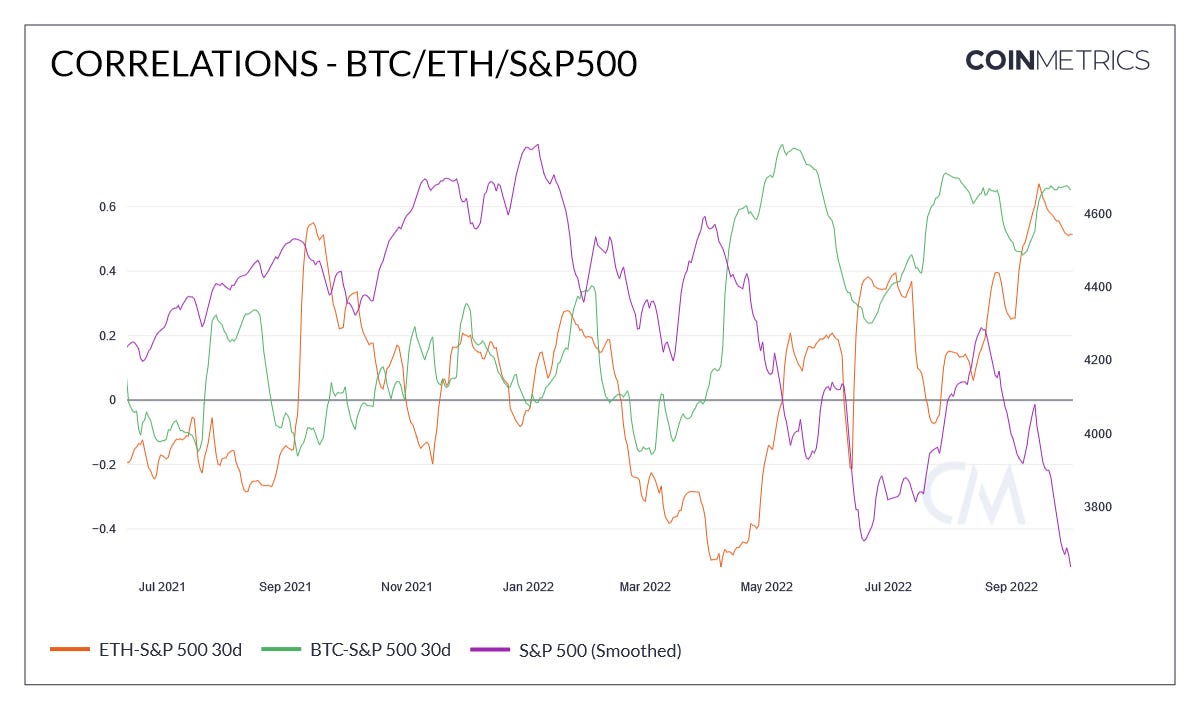

Fear of protracted worldwide central bank action to control inflation, rising interest rates and deteriorating economic conditions are suppressing economic expectations in the near future, and this has impacted many financial assets and cryptocurrencies alike. This corresponds to the third consecutive quarterly loss in the S&P 500. Correlations among BTC, ETH and with the S&P 500 have increased recently as the benchmark index fell in price to 3600, which had not been breached since December of 2020.

Sources: Coin Metrics Reference Rates & Google Finance

The Evolving Regulatory Backdrop

The quarter was also impactful from a regulatory and enforcement perspective.

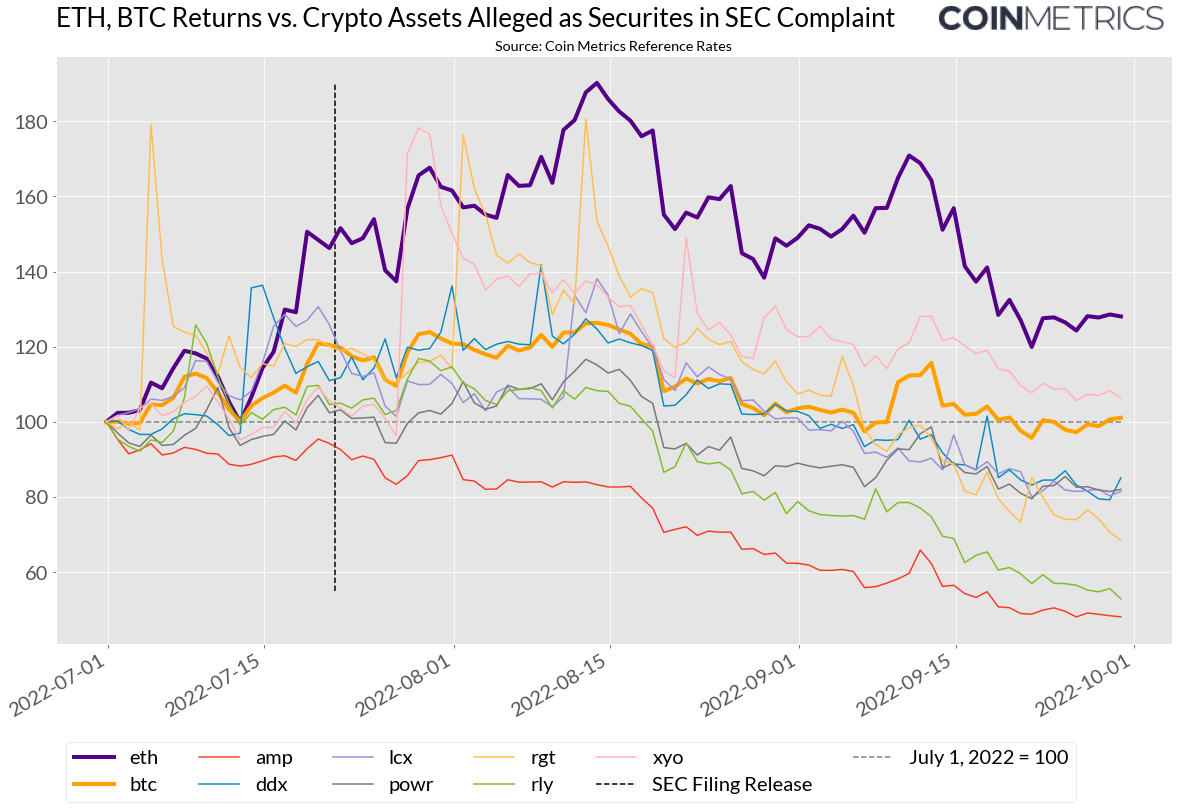

In July, the US Securities and Exchange Commission filed a complaint against a former Coinbase employee alleging he traded on insider information regarding which crypto assets were soon to be listed on the exchange. The SEC also alleged that some of the tokens involved were crypto asset securities under US securities laws.

As shown in the chart below, the release of the allegations did not appear to have an immediate impact on the prices of the tokens alleged as securities, however, most did underperform in the quarter vs. ETH and BTC.

Source: Coin Metrics Reference Rates

Then in August, the US Treasury took an unprecedented step in sanctioning the open source smart contracts behind Tornado Cash, a privacy-enabling decentralized application running on Ethereum.

Some block producers (miners in PoW pre-Merge, validators in PoS post-Merge) have been filtering for Tornado Cash transactions as a result of the sanctions.

The actions quickly led to a renewed conversation surrounding blockchain censorship resistance, open source software, and the limits to sanctioning code that is not controlled by a central entity or individual.

Coinbase announced in early September that it would be funding a lawsuit challenging the US Treasury’s sanctions, arguing that “Sanctioning open source software is like permanently shutting down a highway because robbers used it to flee a crime scene.” Later in September, some aspects of the ban were rescinded, with the Tornado Cash GitHub repository coming back online.

Looking to Q4, the conversation around crypto regulation is set to be an important ongoing area of development.

Conclusion

This quarter was beset by the same trends that we witnessed in the previous quarter: a broad decrease in asset value in crypto and in many other markets. Although many of the events we mention concern everyone equally, this quarter has also given us reason to be optimistic, such as Ethereum’s successful transition to Proof-of-Stake. Many great financial institutions, such as Blackrock, labor in the background to offer crypto assets to their clients and to build important infrastructure to push the ecosystem forward.

Q3 Summary Metrics

BITCOIN IN Q3 2022

$408B: Realized cap on 9/30

$851B: Total value settled on-chain (adj.)

$1.2T: Total BTC spot volume across Coin Metrics trusted exchanges

$1.8B: Total miner revenue

ETHEREUM IN Q3 2022

$2.6T: Total value settled on-chain (ETH + Stablecoins + Major ERC-20s, adj.)

$74M: Total Priority Fees paid by users (to miners before 9/15, validators after)

$468B: Total ETH spot volume across Coin Metrics trusted exchanges

1.1M: new ETH staked

Coin Metrics’ Q3 Updates

This quarter’s updates from the Coin Metrics team:

We covered Ethereum’s Merge extensively including a 40-page report and a live stream ‘Merge Day’ event.

We announced a partnership with Two Sigma to provide institutional-grade crypto asset data to Venn, Two Sigma’s multi-asset portfolio analytics and investment platform.

Coin Metrics joined the Pyth network to provide real-time reference rates to promote the functioning of efficient markets.

We launched new PoS metrics alongside The Merge.

We released version 2.6 of Coin Metrics’ market data feed.

The CM team also made a few media appearances:

Research Analyst Kyle Waters spoke with Nic Carter about The Merge on Castle Island Ventures’ On The Brink podcast.

Head of R&D Lucas Nuzzi appeared on CoinDesk TV to talk about The Merge.

CM weighed in on the end of GPU mining on Ethereum in a Wall Street Journal article.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.

© 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.